Jessy, Golden Finance

Recently, a company focusing on investing in Bitcoin, Twenty One Capital, announced its establishment. It is worth noting that the majority of the company's shares will be held by Tether and Bitfinex, the world's largest stablecoin issuers, while SoftBank also holds a minority stake in the company. The company has also completed its listing through Cantor Equity Partners as a special purpose acquisition company.

Twenty One Capital is expected to start with a holding of more than 42,000 bitcoins, making it the world's third largest public company in terms of bitcoin reserves.

How did the third largest public company holding Bitcoin come about?

According to the company's statement on April 23, the company's three major shareholders will invest a large amount of bitcoin or funds to purchase bitcoin. Tether will provide $2 billion worth of Bitcoin investment, while Bitfinex and SoftBank Group, which share the same parent company, will invest $600 million and $900 million in Bitcoin respectively.

According to the agreement with Cantor Equity Partners, the transaction between the two involves a convertible note private placement (convertible note issuance) and an equity private placement (equity PIPE issuance), with a total financing amount of $585 million, including $385 million in convertible debt and $200 million in equity. Part of these funds will also be used to purchase Bitcoin. Once the agreement is reached, Twenty One Capital will trade on the Nasdaq with the stock code XXI.

Based on the estimates of these initial capital investments, Twenty One Capital is expected to start with a holding of more than 42,000 Bitcoins, which will make it the third largest public company in the world in terms of Bitcoin reserves. The first two are MicroStrategy and Marathon Digital Holdings.

The biggest difference between MicroStrategy and the first two is that MicroStrategy is a software company, and buying is just an asset reserve for the company, while Marathon Digital Holdings is a Bitcoin mining company. Twenty One Capital has clearly defined its positioning since its inception - focusing on investing in Bitcoin, and building some Bitcoin native products and services.

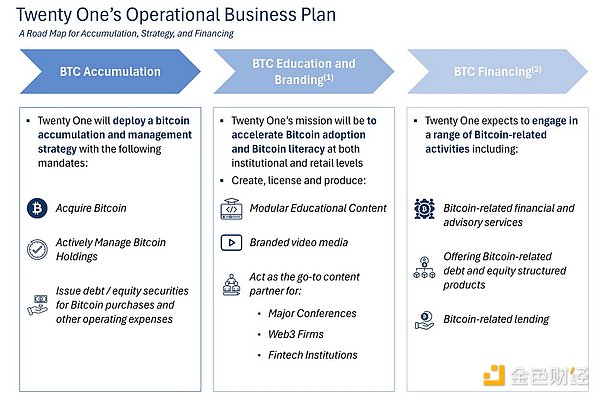

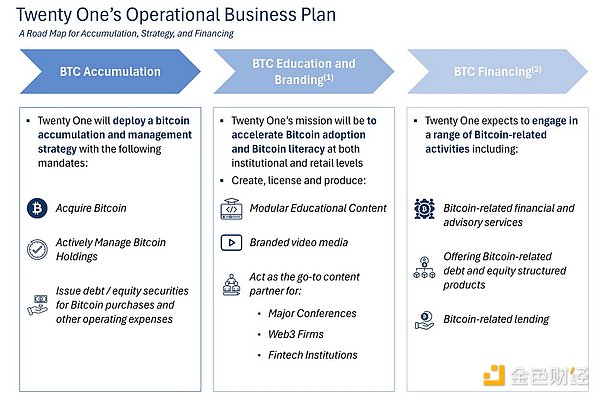

According to its announced three-stage plan, we can see that in the first stage of the company's development, it will focus on purchasing and accumulating the number of Bitcoins. In the second stage, it will focus on popularizing knowledge related to Bitcoin, and creating educational content and video media. In the third stage of development, it will mainly provide financial and consulting services related to Bitcoin, such as providing debt and equity structured products related to Bitcoin. It can be seen that in the future, Bitcoin debt and equity products, consulting services, lending platforms and education platforms will be the key product directions of the platform.

From the company's development plan, it is precisely the various needs that will arise in the current environment where Bitcoin is gradually integrating into the mainstream. The ultimate goal is to be a Bitcoin-related service and financial company so that more individuals and institutions can access Bitcoin-related financial products.

The company's CEO, Strike's founder Jack Mallers, described Twenty One Capital as follows: "Our mission is simple: to become the most successful company in the Bitcoin field and the most valuable financial opportunity of our time. We are not trying to beat the market, but to create a new market."

To challenge MicroStrategy or have greater ambitions?

It is worth noting that MicroStrategy's issuance of convertible bonds to purchase Bitcoin has set off a wave of imitation by a number of companies in this cycle. At present, it has become the listed company with the largest number of Bitcoin holders, and the second is a mining company Marathon Digital Holdings. Part of its Bitcoin is obtained by mining, and the other part is raised by issuing convertible bonds like MicroStrategy.

Twenty One Capital wants to replace MicroStrategy and become "a better tool for investors seeking capital-efficient Bitcoin investment."

According to the company's external disclosure, investors have the opportunity to purchase equity at a price of about 1 times the net asset value of Bitcoin, which is an advantage over other companies that adopt Bitcoin funding strategies. The company was established to accumulate Bitcoin and increase ownership per share, not just track it.

To this end, Twenty One Capital introduced two key indicators to reflect its Bitcoin-denominated capital structure and Bitcoin-centric mindset. The first indicator is Bitcoin per share (BPS), which is the number of Bitcoins represented by each fully diluted share, reflecting the Bitcoin held by shareholders, not the statutory earnings per share. The second indicator is the Bitcoin Return Rate (BRR), the rate at which BPS grows over time, which will measure the company's performance in units of Bitcoin.

At present, it has accumulated a large amount of Bitcoin through the investment and financing of its partners. According to its documents submitted to the SEC, in the next operation of the company, Twenty One Capital plans to raise funds for Bitcoin purchases and other operating expenses by issuing debt or equity securities. As the company conducts Bitcoin-related financial business, such as Bitcoin-related lending, providing Bitcoin-related debt and equity structured products, the proceeds generated may also be used to purchase Bitcoin.

Another thing worth paying attention to is the background of the company.

First of all, Cantor, as a special purpose acquisition company, has a relatively deep background in the US government. The company's former CEO Howard Lutnick was appointed Secretary of Commerce in the Trump administration in February 2025. Howard Lutnick's son Brandon Lutnick was appointed as the chairman of Cantor and became the main promoter of this acquisition.

Both TEDA and SoftBank are companies that play a very important role in the development of global finance.

SoftBank is one of the world's largest venture capital funds, managing huge amounts of funds with a wide range of sources of funds. Masayoshi Son is the founder and largest individual shareholder of SoftBank, holding a considerable proportion of the company's shares. As for institutional investors, internationally renowned investment institutions such as BlackRock, Prudential Financial Asset Management, and Fidelity International, as well as investment funds such as General Atlantic, Advent International, and Alpha Weston Investments, as well as venture capital companies and professional investment institutions such as Kaizi Capital, Sequoia Capital, and Gaorong Capital, all provide funds for SoftBank by holding shares in SoftBank. In addition, sovereign wealth funds or public authorities such as the Canada Pension Plan Fund and the Saudi Arabian Sovereign Fund are also important shareholders of SoftBank, providing it with a large amount of funds. Technology companies such as Amazon, Google, and Alibaba also hold shares in SoftBank.

Tether’s status in the crypto industry is self-evident. As the leader of the US dollar stablecoin, its ties with Cantor have gradually deepened in recent years. Cantor holds convertible bonds issued by Tether and assists in managing Tether’s more than $80 billion in US Treasury reserves.

The cooperation between these three institutions can be described as a strong alliance, with a large enough capital force, the leader of the US dollar stablecoin, and the background of the US government. It is conceivable that in the future, this company will inevitably have an important impact on Bitcoin and even the crypto market itself. This also indicates that Bitcoin has increasingly become a force that cannot be underestimated in the mainstream financial system.

Weiliang

Weiliang