以太坊基金会研究员辞去 EigenLayer 顾问职,聚焦保持中立与推进以太坊主链发展

今年 5 月出任 EigenLayer 顾问的以太坊基金会研究员 Justin Drake 和 Dankrad Feist 于 10 月 2 日宣布辞去顾问职位,原因是为了避免与以太坊产生潜在利益冲突,并维护以太坊基金会的中立性。

Miyuki

Miyuki

On the occasion of Circle's successful listing, Arthur Hayes, the "godfather" of the cryptocurrency field, published a heavy blog post warning investors about Circle and the risks of a possible stablecoin bubble. Arthur Hayes has greatly promoted the development of cryptocurrency derivatives trading through BitMEX's innovative products. From his perspective, he pointed out that although Circle is seriously overvalued, its stock price may continue to rise, and this listing is just the beginning of the stablecoin frenzy cycle.

This article compiles it, and the article reviews the history of the birth of the USDT stablecoin, analyzes the process of the evolution of the ecosystem, and how USDT finds and consolidates its product-market fit. In contrast, Circle is still in the payment fee promotion stage, and there is a huge gap with USDT's market share. Then it is almost impossible for new entrants to replicate their success.

However, what Arthur Hayes did not tell you is that stablecoins are penetrating every corner of the global economy in the form of "payments" rather than "transactions". After the US Stablecoin Genuis Act, "payment stablecoins" will drive the flow of funds in real-world scenarios, and then the flow of value. Then in this future world: Stablecoin Payments + On-Chain Finance, emerging stablecoins can throw away the shackles of encrypted transactions and rush into the blue ocean of scenarios.

In the capital markets, professional cryptocurrency traders are unique because they need to survive and thrive in the crypto space while also having a deep understanding of how funds flow in the international fiat currency banking system. This is very different from stock or foreign exchange investors, who do not need to know how funds are settled and transferred behind the scenes, because brokers will quietly provide this service in the background.

Arthur Hayes is one of these cryptocurrency traders, and because of the risks of transferring fiat currency in the crypto market, it is necessary to have a detailed understanding of the cash flow operations of their trading partners. He received a crash course in global payments in his early days of moving money around the banking systems of Hong Kong, mainland China, and Taiwan (Arthur Hayes referred to this region as Greater China). It was in this context that Tether USDC was born and developed.

Early understanding the flow of funds in Greater China helped Arthur Hayes understand how major Chinese-operated exchanges and international exchanges (such as Bitfinex) conduct business. This is important because all real crypto market innovation occurs in Greater China. This is even more true for early stablecoins. 1.1 The Original Path to the Market In the early days of Bitcoin, it was not easy to buy your first Bitcoin because it was not clear which was the best and safest way to do it. For most people, at least when Arthur Hayes started to get involved in cryptocurrency trading in 2013, the first step was to buy Bitcoin from another person, by sending them a fiat bank wire directly, or paying with cash, and then you would start trading on an exchange. But it was not easy to deposit fiat currency into an exchange, and many exchanges did not have a solid banking relationship or were in a regulatory gray area in their country, which meant that you could not transfer money directly to them. Exchanges come up with workarounds, such as directing users to transfer fiat directly to local agents who hand out cash vouchers at the exchange, or setting up a seemingly unrelated crypto-related subsidiary business to obtain a bank account and direct users to transfer funds there.

This friction allows scammers to thrive and steal fiat through a variety of means. The exchange itself may lie about where the funds are going, and then one day…boom—the website is gone, along with your hard-earned fiat. If you use third-party intermediaries to transfer fiat into and out of the crypto capital markets, these individuals can disappear with your funds at any time.

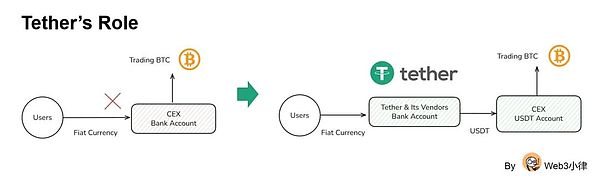

1.2 Bank restrictions give rise to the demand for digital dollars

Therefore, transferring funds through banks is the safest path and the blood transfusion line of the crypto market. Once the capital link is cut off, the business conducted around crypto exchanges will be unsustainable. Unfortunately: Due to the notoriety of cryptocurrencies in the early days, this forced banks to cut off ties with crypto exchanges. Similarly, this has also given rise to people's rigid demand for on-chain bank accounts and digital dollars.

The most successful crypto exchange story in the West belongs to Coinbase, which opened in 2012. Coinbase’s innovation, however, was to: get and keep a banking relationship in the United States, the market most hostile to financial innovation. Otherwise, Coinbase is just a very expensive cryptocurrency brokerage account, and that’s all it took to make its early shareholders billionaires.

(Ideal and Reality: Bitcoin’s “Wild West” and Legal Challenges)

Initially, cryptocurrency trading was ignored. For example, from 2014 to 2017, Bitfinex was the largest non-Chinese global exchange. At the time, Bitfinex was a company operating out of Hong Kong, which had multiple local bank accounts. Arthur Hayes’ apartment was in Sai Ying Pun, Hong Kong, and across the street from almost every local bank was stationed. This was very important for arbitrage traders like Arthur Hayes, who needed to turn over capital once every business day, so that funds could be transferred to exchanges almost instantly to reduce fees and the time required to receive funds.

Meanwhile, in mainland China, the three major exchanges OKCoin, Huobi, and BTC China all had multiple bank accounts in large state-owned banks. It only takes 45 minutes to travel by bus to Shenzhen, and with a passport and basic Chinese language skills, it is possible to open various local bank accounts. As a trader in China and Hong Kong, having banking relationships means you have access to global liquidity. These banking relationships gave Arthur Hayes great comfort, knowing his fiat money wouldn't be lost. Instead, he was terrified every time he sent a wire to some Eastern European exchange.

But as cryptocurrencies became more popular/riskier, banks began closing accounts. Arthur Hayes had to check the operational status of each bank-exchange relationship every day. This was very bad for traders, the slower the money moved between exchanges, the less money there was to make through arbitrage.

But what if you could move dollars through a crypto blockchain instead of through traditional banking channels? Then these digital dollars, as the important blood of the crypto market at that time and now, can flow between exchanges 24/7 almost for free.

USDT was born in this context: People need to bypass the banking system to create a digital dollar that can flow freely, free of charge, and 24/7. To this day, there are still many crypto exchanges around the world that cannot obtain bank accounts.

So the Tether team worked with the founding team of Bitfinex to create such a product - USDT. In 2015, Bitfinex allowed the use of USDT on its platform. At the time, Tether used the Omni protocol as an additional layer on the Bitcoin blockchain to send USDT between addresses. This is a primitive smart contract layer built on top of Bitcoin.

Tether would allow certain entities to transfer dollars to their bank accounts, and in exchange, Tether would mint USDT. USDT could be sent to Bitfinex and used to buy cryptocurrencies. What was so exciting about this? Just because a random exchange offered this product?

1.3 USDT distributed in Bitfinex & Chinese market

Stablecoins, like all payment systems, only become valuable when a large number of economically meaningful participants become nodes in the network. For USDT to really solve any real problems, cryptocurrency traders and other large exchanges besides Bitfinex need to use USDT.

Everyone in Greater China is in the same predicament, banks are closing accounts of traders and exchanges. Plus Asians are eager to get dollars because their national currencies are vulnerable to shock devaluations, high inflation and low domestic bank deposit rates. For most Chinese, access to U.S. dollars and access to U.S. financial markets is extremely difficult.

Therefore, the USDT stablecoin created by Tether, as a digital version of the U.S. dollar that anyone with an internet connection can use, was very attractive.

The Bitfinex/Tether team jumped at the opportunity, as the largest exchanges at the time were all controlled by Chinese. Bitfinex’s CEO since 2013 has been Jean-Louis van der Velde, who previously worked for a Chinese automaker, understood Greater China, and worked hard to make USDT the preferred on-chain U.S. dollar bank account for Chinese using cryptocurrencies. Although Bitfinex has never had any executives of Chinese descent, it has built tremendous trust between Tether and the Chinese crypto trading community.

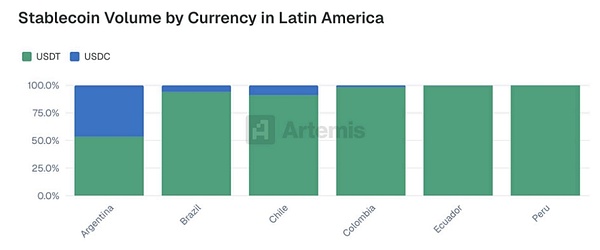

So you can believe that the Chinese trust USDT. And in the Global South, the overseas Chinese control everything. As the citizens of the Empire have discovered in this unfortunate trade war, the Global South is therefore backed by USDT.

( Artemis: Stablecoin Payments from the Ground Up)

However, just because USDT had a large exchange as its founding distributor, it did not ensure success. The market structure changed to the point where trading altcoins against USD was only possible by using USDT. Let’s fast forward to 2017, when the ICO craze was at its peak and USDT really solidified its product-market fit. 1.4 USD Trading Pair Demand During the ICO Boom August 2015 was a very important month as the People’s Bank of China (PBOC) shocked the market by devaluing the RMB against the USD and Ethereum’s native currency Ether started trading. The macro and micro levels aligned at this time. This became legendary and fueled the bull run from then until December 2017. Bitcoin soared from $135 to $20,000; Ether soared from $0.33 to $1,410.

When the printing presses are on, the macro environment is always favorable. Since Chinese traders are marginal buyers of all cryptocurrencies (at the time, only Bitcoin). If they get nervous about the RMB, Bitcoin will soar. At least that was the narrative at the time. The shocking devaluation of the PBOC exacerbated capital outflows. The RMB was abandoned, and the US dollar, cryptocurrencies, gold, overseas real estate, etc. were in demand.

The micro level is always the most interesting. After the Ethereum mainnet and its native currency Ether went online on July 30, 2015, a large number of altcoins began to flood. Poloniex was the first exchange to allow Ether trading, and it was this foresight that made them a protagonist in 2017. Interestingly, Circle almost went bankrupt at the height of the ICO market because they acquired Poloniex. Years later, they sold the exchange to Justin Sun at a huge loss. Poloniex and other Chinese exchanges took advantage of the emerging altcoin market by launching crypto-only trading platforms. Unlike Bitfinex, they didn't have to interface with the fiat banking system. You could only deposit and withdraw crypto, and then trade it for other cryptocurrencies. But this was not ideal, because traders instinctively wanted to trade altcoin/USD pairs. Without the ability to accept deposits and withdrawals in fiat currencies, how do exchanges like Poloniex and Yunbi (the largest ICO platform in China until it was blocked by the PBOC in the fall of 2017) offer these trading pairs?

Tether's USDT is officially on the scene!

After the Ethereum mainnet is launched, USDT can be transferred through the ERC-20 standard smart contract on the Ethereum network. Any exchange that supports Ethereum can easily support USDT. Therefore, pure cryptocurrency trading platforms can provide altcoin/USDT trading pairs to meet market demand. This also means that digital dollars, USDT, can flow seamlessly between major exchanges like Bitfinex, OKCoin, Huobi, BTC China, which are the entry points for money into the ecosystem, and more fun, speculative venues like Poloniex and Yunbi, where speculators can have fun.

The ICO mania gave birth to the behemoth that would become Binance. CZ (Changpeng Zhao) angrily resigned from his position as OKCoin CTO a few years ago due to a personal dispute with OKCoin CEO Mingxing Xu. After CZ left, he founded Binance with the goal of becoming the world's largest altcoin exchange. Binance has no bank account, and to this day it is not known whether fiat can be deposited directly into Binance without going through some kind of payment service provider. Binance uses USDT as its on-chain banking channel and quickly became the preferred place to trade altcoins.

1.5 USDT consolidates its Product Market Fit

From 2015 to 2017, USDT achieved product market fit and built a moat against future competitors. Due to the trust of the Chinese trading community in USDT, USDT was accepted by all major trading venues. At this time, it was not used for payments, but was the most efficient way to move digital dollars in, out, and within the crypto market.

Until 2020, it was difficult for exchanges to maintain bank accounts. Taiwan once became the cryptocurrency banking center for all the largest non-Western exchanges, which controlled most of the liquidity in global cryptocurrency trading. This was because some Taiwanese banks allowed exchanges to open USD accounts and were somehow able to maintain correspondent banking relationships with large US money center banks such as Wells Fargo.

However, this arrangement began to break down as correspondent banks demanded that these Taiwanese banks expel all crypto customers or lose access to global USD markets. As a result, by the end of the decade, USDT became the only way to transfer USD on a large scale in the crypto capital markets. This solidified its position as the dominant stablecoin.

Western players, many of whom raised funds under the crypto payments narrative, rushed to try to create competitors to USDT. The only one that survived on a large scale was Circle’s USDC. However, Circle was at a distinct disadvantage as it was a US company based in Boston with no ties to the crypto trading and usage hubs of Greater China. Circle’s unspoken message is: China = Scary; America = Safe. This message is interesting because Tether has never had an executive of Chinese descent, but it has always been associated with Northeast Asian markets and now the Global South.

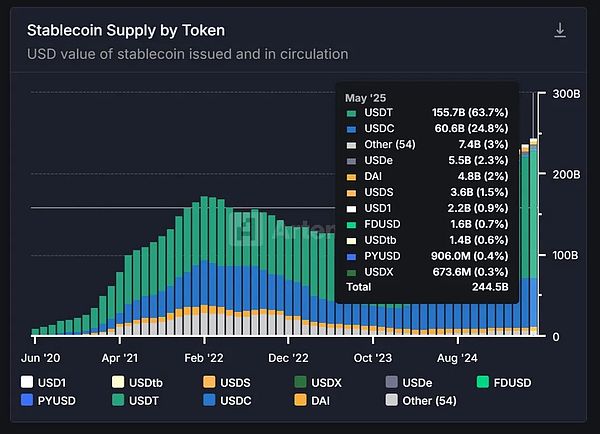

(As of June 20, 2025, the proportion of stablecoin supply. Data source: artemis.xyz)

02 Sexy Stablecoin Narrative

We can see Tether The status it has developed to today is not something that can be achieved overnight through the accumulation of capital and the promotion of political will. Apart from issuance, the distribution of stablecoins is of utmost importance. Without the restrictions on bank accounts at that time that gave rise to the digital dollar, without the support of the macro background, and without the ICO boom that drove the demand for US dollar trading pairs, USDT at that time would have been difficult to maintain.

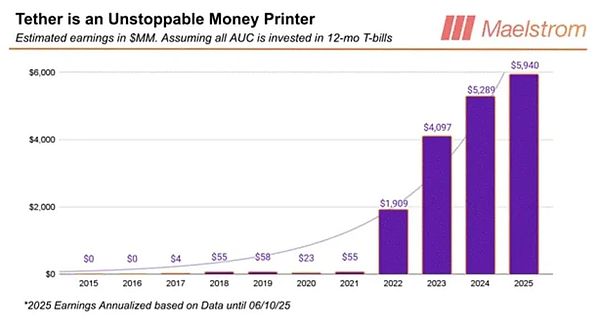

Given the difficulties faced in the large-scale distribution of stablecoins, there are still many emerging stablecoin issuers rushing to try this impossible thing. The reason here is: the profits of stablecoin issuers are too high. 2.1 Huge Profitability The profitability of stablecoin issuers depends on the amount of their Net Interest Income (NIM). The cost basis of the issuer is the fees paid to holders, and the income comes from the cash investment returns of Treasury bonds (such as Tether and Circle) or arbitrage activities in some cryptocurrency markets (such as Ethena). As the most profitable issuer, Tether does not pay any fees to USDT holders or depositors, but earns all NIM based on the yield level of Treasury bills (T-bill).

Tether is able to keep all the NIM because it has the strongest network effect and its customers have no choice but to open an on-chain USD bank account. Potential customers will not choose other USD stablecoins, but USDT because USDT is accepted throughout the southern hemisphere.

For example, how Arthur Hayes paid during the Argentine ski season:

I spend a few weeks every year skiing in the Argentine countryside. When I first went to Argentina in 2018, it was difficult to pay if the merchant did not accept foreign credit cards. But by 2023, USDT has taken over as my guide, driver, and chef all accept payment in USDT. This is awesome because even if I wanted to pay in pesos, I couldn’t; bank ATMs would only take out $30 in pesos per transaction and charge a 30% fee. What a criminal – long live Tether! It’s awesome for my employees to be able to receive digital dollars stored on crypto exchanges or mobile wallets and easily purchase goods and services at home and abroad.

Tether’s profitability is the best advertisement for social media companies and banks to create stablecoins. Neither of these two giants has to pay deposit fees because they already have a solid distribution network, which means they can capture the entire net interest yield (NIM). Therefore, this could become a huge source of profit for them.

( Arthur Hayes, Assume The Position)

Tether's annual earnings far exceed this chart's estimates. This chart assumes that all stablecoins are invested in 12-month Treasury bills, and its purpose is to show that Tether's earnings are highly correlated with US interest rates. You can see that Tether's earnings jumped significantly between 2021 and 2022 as the Federal Reserve raised interest rates at the fastest pace since the early 1980s.

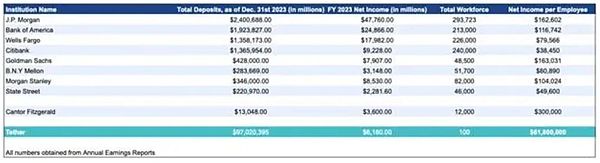

Below is a table published by Arthur Hayes in the article Dust on Crust Part Deux, which uses data from 2023 to prove that Tether is the bank with the highest per capita profit in the world.

( Arthur Hayes, Assume The Position)

2.2 The political pushers behind

Let’s take a deeper look at why investors’ judgments are blinded by the huge profit potential of stablecoins.

In addition to simply holding Bitcoin and other altcoins, there are currently three business models that can create cryptocurrency wealth. They are mining, exchange operations, and stablecoin issuance. Take Arthur Hayes, for example, whose wealth comes from ownership of BitMEX (a derivatives exchange), Maelstrom’s (his family office) largest position, and the largest source of absolute returns is Ethena, the stablecoin issuer of USDE. In less than a year, Ethena has gone from nothing to the third largest stablecoin in 2024.

Stablecoins are unique in that they have the largest and most obvious target market for laymen in traditional finance. USDT has proven that an on-chain bank that only holds user funds and allows them to move freely can become the most profitable financial institution per capita in history.

USDT has succeeded in the face of legal battles launched by various levels of the US government. What if US authorities were at least not hostile to stablecoins and allowed them to operate somewhat freely, competing with traditional banks for deposits? The profit potential is simply incredible.

Now let's consider the current situation: US Treasury staff believe that the total stablecoin supply could grow to $2 trillion. They also believe that US dollar stablecoins could be the vanguard of advancing/maintaining US dollar hegemony and serve as buyers that are insensitive to Treasury prices. This is a major macro positive.

As an added bonus, don't forget that Trump has a deep grudge against big banks because they kicked him and his family off the platform after his first presidential term. He is in no mood to prevent the free market from providing a better, faster, and safer way to hold and transfer digital dollars. Even his sons have joined the stablecoin game.

These are the reasons why investors are salivating over investable stablecoin projects.

3.1 The difficult mountain of distribution

Unless your stablecoin has a huge use case, such as being exclusively owned by exchanges, large Internet companies, or traditional banks, the cost of issuing a stablecoin may be very high. Bitfinex and Tether were founded by the same people, Bitfinex has millions of customers, so Tether has millions of customers from the beginning, and all altcoins are traded against USDT. Tether does not have to pay issuance fees because it is partially owned by Bitfinex. Circle, and any other stablecoin that comes after it, must somehow pay issuance and distribution fees to the crypto exchanges where stablecoins are currently used most widely. Large Internet companies and banks will never work with third parties to build and operate their stablecoins, so crypto exchanges are the only choice. Crypto exchanges can also build their own stablecoins, just like Binance tried to launch BUSD, but ultimately many exchanges believe that building a payment network is too difficult and distracts from their core business. Therefore, exchanges require issuers to hold their equity or a portion of the issuer's net proceeds (NIM) in order to trade their stablecoins. Even so, all altcoin/USD pairs will likely be pegged to USDT, meaning Tether will still dominate.

This is Tether's original accumulation, which continues to accumulate and contributes to Tether's huge moat.

Remember, stablecoins are delivered over the Internet, and the Internet has network effects.

Because of this, Circle had to woo Coinbase to compete. Coinbase is the only major exchange not in Tether's orbit because Coinbase's customers are mainly from Americans and Western Europeans. Tether had been slammed by Western media as some kind of foreign-made scam before U.S. Commerce Secretary Howard Lutnik took a fancy to Tether and provided financial support for it through his law firm Cantor Fitzgerald. Coinbase's existence depends on its favor in the U.S. political circles, so it has to find another way.

So Jeremy Allaire took over the condition and accepted Brian Armstrong's "deed of sale." The deal is: Circle will pay 50% of its net interest income to Coinbase, and Coinbase will distribute it through the Coinbase network.

Seeing this, I believe everyone is familiar with Arthur Hayes's reason for saying that investors will go bankrupt on almost all publicly listed stablecoin issuers or technology providers at the end of the cycle, but this cannot stop the carnival.

3.2 Risk Warning for Circle

The issuer that had the most dazzling IPO and opened the party is Circle. It is a US company and the second largest stablecoin issuer by trading volume. Circle's current valuation is ridiculously high. You know, Circle will give 50% of its interest income to Coinbase. However, Circle's market value is 59% of Coinbase (as of June 20). Coinbase is a one-stop crypto financial services company with multiple profitable business lines and tens of millions of customers worldwide. Circle is good at public relations, and although this is a very valuable skill, they still need to improve their skills and take care of those businesses that are not valued.

If you want to short Circle, absolutely not! If you think Circle's ratio to Coinbase is wrong, you should buy Coinbase. Although Circle is overvalued, in a few years when we look back on the stablecoin craze, many investors will wish they had owned Circle instead of some "copycat" stablecoin issuer. At least they will have some money left.

The next wave of IPOs will be Circle copycats. In relative terms, these stocks will be more overvalued than Circle on a price/float ratio. In absolute terms, they will never surpass Circle in terms of revenue. The promoters will tout some meaningless traditional financial credentials, trying to convince investors that they have the connections and the ability to disrupt the traditional banks in the global dollar payments space by partnering with them or leveraging their distribution channels.

The scam will work; the issuers will raise huge amounts of money.For those of us who have been in this business, it will be hilarious to watch the fools in suits and ties coax the investing public into investing in their junk companies.

After the first wave, the scale of the fraud depends entirely on the strength of US regulation of stablecoins: the more freedom the stablecoin issuers are given in terms of the assets that underpin the stablecoins and whether they can pay out returns to holders, the more financial engineering and leverage they can use to cover up the scam.

If we assume that stablecoins are lightly regulated or even non-regulated, then we could have a situation like Terra/Luna where the issuer issues some sort of fake algorithmic stablecoin Ponzi scheme. The issuer can pay holders high yields that come from leveraged positions in certain assets.

As you can tell, I have nothing to say about the future. There is no real future because the distribution channels for new entrants have been closed.

But don't short. These new stocks will make the short sellers look bad.

The macro and micro picture is consistent. As Chuck Prince, former CEO of Citibank, said when asked whether Citigroup was involved in subprime mortgages: "When the music stops, things get complicated in terms of liquidity. But as long as the music is playing, you have to stand up and dance. We are still dancing." 04 Dilemma faced by emerging stablecoins As we talked about before, even Circle USDC, which ranks second in market share, needs to rely heavily on a single Coinbase crypto exchange, so the situation of emerging stablecoin issuers is even more severe, and there is no visible open distribution channel. Currently, all major crypto exchanges either embrace existing Tether, Circle and Ethena, or cooperate with them, while large Internet companies and banks will build their own solutions. Even if new issuers want to transfer their large amounts of net interest income (NIM) to depositors to pull them out of other stablecoins with higher adoption rates, they will inevitably encounter regulatory restrictions.

4.1 Internet giants' attempts at stablecoins

The stablecoin craze is not new. In 2019, Facebook (now renamed Meta) decided to launch its own stablecoin, Libra. The appeal is that Facebook can provide on-chain US dollar bank accounts to the world (except China) through Instagram and WhatsApp.

( Facebook’s Libra Coin: What It Is, What It’s Not, and Should You Care)

Arthur Hayes wrote about Libra in June 2019:

The event horizon has passed. With Libra, Facebook has entered the digital asset industry. Before I start my analysis, let’s make one thing clear: Libra is not decentralized or censorship-resistant. Libra is not a cryptocurrency, Libra will destroy all stablecoins, but no one cares. I have no sympathy for those who inexplicably believe that a project by an unknown issuer to create a fiat money market fund on a blockchain has any value.

Libra's existence could put commercial banks and central banks in a difficult position, as Libra could reduce their role to a regulated digital fiat custodian. And in the digital age, these institutions should indeed be treated as such. And Libra and other stablecoins offered by other large Internet companies could have stolen the show, as they have the most customers and almost complete information about their preferences and behaviors.

Finally, the US political establishment has activated the protection mechanism to protect traditional banks from the threat of real competition in the payment and foreign exchange fields. Arthur Hayes’ comment at the time was:

I have no regard for the foolish comments and actions of Representative Maxine Waters of the U.S. House Financial Services Committee. But her and other government officials’ concerns are not motivated by goodwill toward the public, but by fear of disruption of the financial services industry that finances them and keeps them re-elected. The speed with which government officials have condemned Libra suggests that the project does have some potential positive value for human society.

That was then, but now the Trump administration will allow competition in financial markets. A second term for Trump has no regard for the banks that removed his entire family from their platforms during the Biden administration. Therefore, large Internet companies are reviving stablecoin projects or embedding stablecoin technology natively into their platforms, as reported in the news now, such as Meta, Uber, Amazon, Walmart, and various large Internet companies that are preparing stablecoins.

This is good news for shareholders of social media companies, which can completely devour traditional banking systems, payment and foreign exchange revenue streams. However, it is bad news for any emerging stablecoin issuer trying to create a new one from scratch. Because large Internet companies will build everything they need to drive the development of their stablecoin business.

Therefore, investors must be vigilant about those emerging stablecoin issuers!

Other tech companies are also jumping on the stablecoin bandwagon. Social media platform X, Airbnb and Google are all in preliminary discussions about integrating stablecoins into their business operations. In May, Fortune reported that Mark Zuckerberg’s Meta, which has unsuccessfully experimented with blockchain technology in the past, has held discussions with crypto firms to introduce stablecoins for payments.

—— Fortune

4.2 Traditional banking will be on the verge of extinction

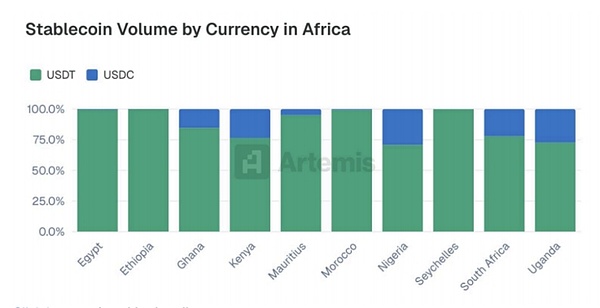

Whether banks like it or not, they will no longer be able to continue to earn billions of dollars a year by holding and transferring digital fiat currencies, nor will they be able to earn the same fees by conducting foreign exchange transactions. Arthur Hayes recently talked to the board members of a large bank about stablecoins: they said "we are finished". They believe that stablecoins are unstoppable and use the situation in Nigeria as an example. Arthur Hayes is not sure about the penetration of USDT in Nigeria, but they told him that even after the Nigerian central bank tried very seriously to ban cryptocurrencies, one-third of Nigeria's GDP was still settled in USDT.

They go on to point out that because cryptocurrency adoption is bottom-up, not top-down, regulators are powerless to stop it. By the time regulators notice and try to act, it is too late because adoption is already widespread among the local population.

Even though every large traditional bank has people like them in their executive ranks, the banking system doesn’t want to change because it would mean the departure of many employees. Tether has no more than 100 employees, but it can scale to perform critical functions for the entire global banking system by leveraging blockchain technology. By comparison, JP Morgan, the world’s best-run commercial bank, has a little over 300,000 employees.

Stablecoins will eventually be adopted in limited forms within the traditional banking system. They will be running two systems at once: the old slow and expensive one and the new fast and cheap one. The extent to which they are actually allowed to adopt stablecoins will be determined by the prudential regulators in each office. Remember, JPMorgan is not a single institution, but its branches in various countries are regulated differently. Data and people are often not shared across branches, making firm-wide technology-driven rationalization difficult to achieve.

Good luck to you, bankers, regulations protect you from Web2 but will stifle you from Web3.

These banks will certainly not work with third parties on the technical development or distribution of stablecoins. They will do all of this in-house. In fact, regulators may explicitly prohibit this. Therefore, this distribution channel is closed to entrepreneurs who build their own stablecoin technology.

Arthur Hayes doesn't care how many proofs of concept an issuer claims to have run for a traditional bank, they will never lead to bank-wide adoption. So if you are an investor, if a stablecoin issuer claims to be working with traditional banks to bring the product to market, run.

The above is what Arthur Hayes told you about the development path of the crypto-native market that gave birth to the large-scale adoption of USDT, but it is difficult to follow. Even Circle, which was pushed to the climax by capital, still had to bow to Coinbase according to the "sale contract". From the development path of Tether, they are not at the same starting line. Tether is already far ahead, and Circle is still paying dividends everywhere to promote more continuous adoption of USDC.

However, what Arthur Hayes did not tell you is that stablecoins are and will penetrate every corner of the global economy in the form of "payment".

With the US Stablecoin Act, the Geunis Act, which is very likely to be passed this year, we will see several obvious trends:

The Geunis Act's definition of "payment stablecoin" will exclude most stablecoin projects established through DeFi because they find it difficult to meet compliance requirements.

The compliant stablecoins that remain will pry open the door to banks again.

The opening of the bank's door means that "payment stablecoins" can access payment and settlement scenarios in the real world.

Stablecoins will start with payments and then gradually build a new financial system based on blockchain.

Combined with these trends, it is actually a huge scenario for introducing compliant stablecoins into the Web2 traditional financial payment system.

The essence is: Stablecoin Payments + On-Chain Finance.

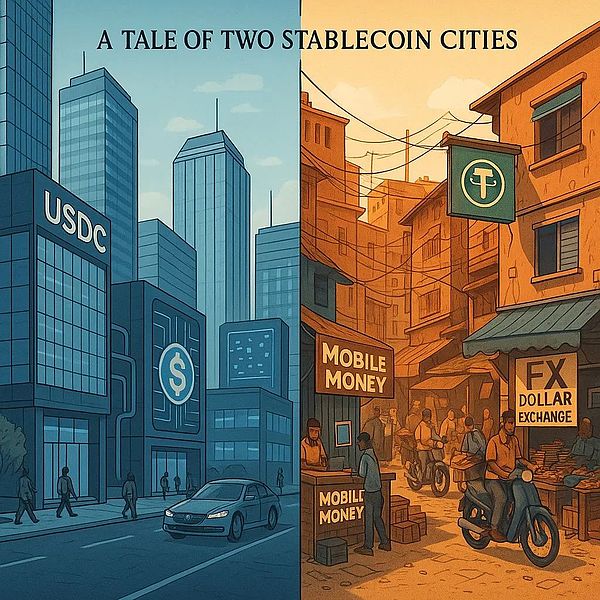

5.2 Stablecoin “A Tale of Two Cities” in the Payment Context

From the perspective of facilitating the circulation of funds, USDC and USDT are not real competitors, but each occupies a dominant position in two completely different financial realities.

In this world in the northern hemisphere, the US dollar stablecoin is compliant, programmable, and ready to enter the institutional field. It is the future of banking and financial services. Large institutions (such as JP Morgan, Worldpay, Fiserv, Revolut) are preparing to launch custody, wallet, payment and peer-to-peer fund flow services. All of this is built on the blockchain, aiming to improve efficiency, programmability and optimize returns, and maximize cost reduction and efficiency, rather than achieving financial inclusion and financial equality.

This is the next generation of technology's transformation of finance, which is full of huge structural opportunities. Blockchain will serve as a new financial infrastructure, starting with payment, and gradually building a financial market on the chain.

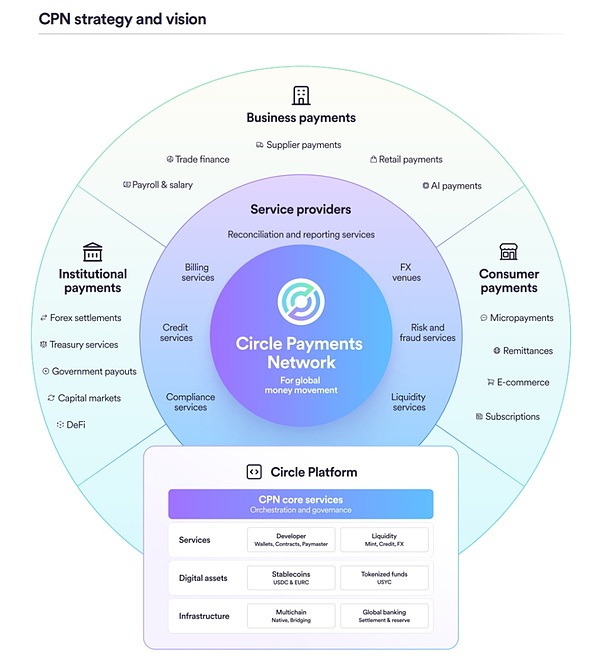

Circle has taken the lead and has established the Circle Payment Network, and is trying to gain incremental growth beyond cryptocurrency transactions. The Circle Payments Network is a Circle that uses its strong compliance background to bring together financial institutions (USDC services) in a compliant, seamless and programmable framework to coordinate global payments of fiat currencies, USDC and other payment stablecoins. As a result, fiat currencies no longer need to circulate through the old traditional SWIFT system, and the digital dollar using blockchain as the settlement layer will be its new channel.

(Circle Stablecoin Payment Network White Paper)

Similarly, Shopify Checkout, jointly launched by Circle, Stripe, and Coinbase, enables e-commerce websites to support a whole payment chain of stablecoins for the first time. Shopify supports millions of online stores around the world - 2.6 million merchants in more than 150 countries, from individual entrepreneurs to Fortune 500 companies.

This is not a simple marketing promotion, but unlocks many possibilities for e-commerce. For example, a scenario where an Argentinian merchant sells products on Shopify to American buyers:

When the buyer chooses to pay with USDC, Privy creates a temporary or permanent embedded wallet for them that can be linked to their email or mobile phone without requiring them to download MetaMask or manage keys.

The buyer completes the payment with USDC on the Base platform, and the merchant receives payment in local currency (Bridge/CPN) without touching cryptocurrencies. The entire process has zero foreign exchange fees, does not rely on credit card networks, and can achieve almost instant and final settlement.

Not only that, merchants can now program discounts, membership rewards or dynamic pricing functions into payment logic.

This is where the real value lies - a real-time, programmable global e-commerce infrastructure. Coinbase built the protocol track, Stripe provided support as a payment channel, and Shopify was responsible for distribution, all built on the value layer of USDC. Most importantly, most users will never know that all this is actually running on the blockchain, just like users use 5G to surf the Internet and don’t need to know the communication logic behind it.

( Chuk, Stablecoins are a tale of two cities)

We can see that for the northern hemisphere, stablecoins built on the blockchain can construct a new business model for each scenario, with the focus on: cost reduction, efficiency improvement and programmability. In the world of the southern hemisphere, there is a completely different story. Here, stablecoins help people get rid of currency collapse, capital controls and political instability.

The digital dollar is permissionless and often in conflict with politics. It is replacing banks that have failed. A 4% yield is not nearly as important as avoiding a 50% loss in purchasing power. USDT is not the "future" but the "present" for those whose currencies have collapsed and who have no other options. No KYC requirements, no yields, and no trust in financial institutions. Just a working dollar, permissionless, to power a wide range of ethical use cases.

“In Africa, it’s not a choice between stablecoins and other financial instruments. It’s stablecoins, or nothing.”

——Samora Kariuki, Frontier Fintech

Across Africa, stablecoins are solving real problems. From preserving assets to facilitating trade, the adoption of stablecoins is out of necessity, not out of trading and speculation. For users facing foreign exchange rationing and 30% inflation, the most important thing is that it can work. Stablecoins help users preserve assets in marginal areas and save in stable currencies. According to the World Bank, as of 2021, only 49% of people in Africa have bank accounts, but 400 million people use mobile payments, and stablecoins can meet user needs in places where banks cannot cover.

And in South America, Tether has just acquired a 70% controlling stake in South America's leading sustainable production company, Adecoagro S.A. (NYSE: AGRO), an agribusiness group operating in Argentina, Brazil and Uruguay. For Tether, this is an opportunity to realize its ambitions: to back its tokens with real assets (such as crops or land) and support a productive economy while expanding the use of blockchain to the real world.

Why Latin America? Tether has made no secret of its geographical goals. Latin America is both a testing ground for cryptocurrencies, especially in countries affected by inflation or currency instability (such as Argentina and Venezuela), and a cradle for global agriculture and energy, but traditional markets still do not provide enough funding. By building profitable vertically integrated businesses in these countries, Tether is able to support stablecoin payment settlement under bulk trade of agricultural products, while expanding its alternative financial services (such as trade finance, supply chain finance, etc.), accelerating the tokenization of physical assets (which can be used for transaction settlement of tokenized assets), and providing green energy for future projects.

These two worlds have completely different logics. One world craves better infrastructure and relies on policies and partnerships; the other world simply craves access to financial services, relies on chaos, and wins when the system collapses. However, most builders are chasing these two aspects without thinking about why stablecoins are important.

If you don't choose the logic you serve, you can't achieve global scale. Do you choose regulated programmability or the necessity of permissionlessness? Two systems, two leaders, one determines your strategic direction. 5.3 The next stage of stablecoins Regulatory clarity is opening the door for participants in traditional finance. The next stage of stablecoins is not only about who has scale, but also about the business model of all participants in the stablecoin supply chain, including issuers, distributors and holders. In the next 12-24 months, we will definitely see changes and challenges in the value chain and value capture. As more and more issuers with similar capabilities enter the market, the importance of the issuer itself gradually decreases. What matters is what users can do with stablecoins. Therefore, the dominance of stablecoins is shifting from issuers to distributors.

Distributors integrate stablecoins into their own real use cases, such as e-wallets or Web2 applications. They now have both influence and leverage. They control user relationships, shape user experience, and increasingly determine which stablecoins get attention.

Stablecoins, through their penetration into Web2 scenarios, are the future of entry and exit. From virtual to real, to reshape the user experience.

(Artemis: First-line data from stablecoin payment adoption)

Artemis gave the adoption data of first-line stablecoin payment companies in its article Stablecoin Payments from the Ground Up. It should be made clear that these data are all from outside of crypto exchanges and from data on real-world capital flows. Among them: B2B payments (reaching $36 billion on an annualized basis) are the most active, followed by P2P (operating at a rate of $18 billion), card-linked payments ($13.2 billion), and B2C ($3.3 billion). This data is just the tip of the iceberg that has not yet been fully rolled out. Once stablecoins gradually come to the fore, more scenarios can be built, and the efficiency of capital/asset circulation will be higher. How to import stablecoins into the massive scenarios of Web2, whose scenarios to import, who will import, and whose stablecoins to use. These are issues that every stablecoin issuer needs to think about urgently.

Of course, you must remember what I said, the future is:

Stablecoin Payments + On-Chain Finance.

今年 5 月出任 EigenLayer 顾问的以太坊基金会研究员 Justin Drake 和 Dankrad Feist 于 10 月 2 日宣布辞去顾问职位,原因是为了避免与以太坊产生潜在利益冲突,并维护以太坊基金会的中立性。

Miyuki

MiyukiMeta plans to launch an AI tool on Instagram called the ‘adult classifier’ to verify users' ages by analysing their profiles and interactions. If the tool suspects a user is under 18, they will be switched to a more restrictive version of the app, even if they claim to be older.

Anais

Anais近期,加密货币交易所币安(Binance)被 Moonrock Capital CEO Simon Dedic 指控,称其向项目方索取高达 15% 的代币作为上币费用。币安联合创始人何一迅速回应,重申上币流程透明,任何项目方即使支付大量代币,仍需通过严格的筛选才能在币安上市。此事引发市场热议,Coinbase 和 Fantom 等平台纷纷表态,激起了中心化交易所(CEX)与去中心化交易所(DEX)上币策略的讨论。

Miyuki

MiyukiSkyBridge Capital创始人安东尼·斯卡拉穆奇对美国经济风险及比特币潜力持乐观态度,指出了债务、通胀和政策的不确定性。

Alex

Alex英国退休金咨询公司Cartwright透露,一家规模达5000万英镑的退休基金已通过其协助,将3%资产直接投入比特币,成为英国首个不通过ETF间接持有比特币的退休基金。

Miyuki

Miyuki2024年美国总统大选正式拉开序幕,比特币与狗狗币短线急涨。宾夕法尼亚州法官允许马斯克每日赠送100万美元的做法继续执行,而马斯克也在选前发表了激烈言论,为特朗普辩护,这一举动推动了特朗普选情升温。

Weiliang

WeiliangThe crypto industry has invested heavily in the 2024 US election, with companies like Coinbase and a16z donating millions to support pro-crypto candidates. In total, the sector has contributed over $133 million to super PACs backing crypto-friendly policies.

Anais

Anais在美国总统大选即将投票之际,加密市场波动加剧,曾破产的加密货币交易所 Mt. Gox 于今晨转移了 32,371 枚比特币,价值约 22 亿美元。此举疑似为向债权人支付赔款的准备,市场担忧可能加剧比特币的抛售压力,进而影响币价走势。

Alex

AlexBinance and its former CEO, Changpeng Zhao, are pushing to dismiss the SEC’s amended complaint, arguing that the regulator’s approach to crypto lacks clarity and consistency. Binance claims the SEC's broad interpretation of crypto assets as securities is confusing and unfairly applied.

Weatherly

WeatherlyBitcoin is outpacing traditional assets like gold due to increasing adoption by individuals and institutions. With political backing and a surge in value, it’s gaining traction as a reliable store of value, alongside stablecoins for everyday transactions.

Joy

Joy