Since Trump won the US election, the crypto market has seen explosive growth. Bitcoin, as the leader, rose by more than 37% in November, with an increase of more than $26,000, pushing the entire cryptocurrency market value to more than $1 trillion, an increase of about 45%. This wave of gains not only made Bitcoin the focus of investors again, but also brought a long-awaited rise in altcoins, and market sentiment was high.

Bitcoin sideways, altcoins soared

After setting a continuous price ATH, Bitcoin encountered resistance at the $100,000 mark and showed a volatile trend. Market funds began to turn their breakthrough points to altcoins. In the past week, the market share of altcoins has risen from 8.91% to 11.0%, and the daily trading share has also risen from 23% to 37%. New and old altcoins have started sector rotation, with amazing gains. In November, the total market value of altcoins rose unilaterally by nearly 70%.

Among them, the performance of the old altcoin XRP is particularly outstanding. Driven by the sharp reduction in litigation pressure from the resignation of the SEC chairman, the application for XRP spot ETF, and the Korean whale, XRP rose 400% in a single month, reaching a historical high. Its market value surpassed USDT and Solana, ranking third in the cryptocurrency market value list, and even surpassed Pinduoduo, rising to 138th in the world's mainstream assets.

In the crypto market, the value of altcoins is often difficult to quantify, and can only be roughly valued by benchmarking the top projects in the track. XRP's FDV surged to over $260 billion, which reshaped the value reference system of most altcoins on the market, released the valuation potential of many altcoins, and demonstrated a strong money-making effect. The arrival of the altcoin season has made the market lively.

Can Bitcoin reach new heights in December?

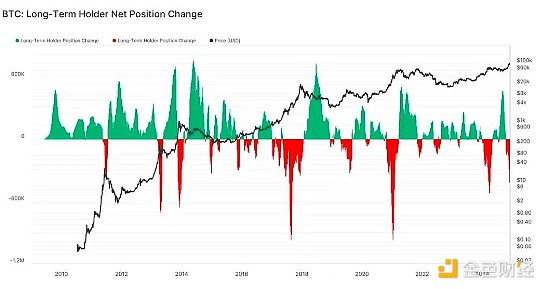

Bitcoin's rapid rise in November has led to a large number of profit-taking transactions in the market. The $100,000 mark, which is just a step away, has never been broken. Data also shows that the net position change of long-term Bitcoin holders is declining, approaching the level near March 2024. Many investors are beginning to worry about whether the current crypto market is overheated. However, from many perspectives, Bitcoin still has great potential for growth in December.

1. The Santa Claus market in the US stock market boosts market optimism

As the holiday season approaches, the US stock market often sees a Santa Claus market, that is, stock prices often rise around Christmas. This rise is often affected by holiday optimism, increased holiday consumption, and investors' year-end transactions. Since 1950, the average increase of the S&P 500 during the Santa Claus rally was about 1.3%.

Due to the high correlation between the U.S. stock market and the crypto market, the positive sentiment of the U.S. stock market is expected to provide a stable external environment for the crypto market.

2. Bitcoin has a significant average increase in December after each halving

Data shows that after the halving of Bitcoin in 2012, 2016 and 2020, the average increase in December was significant, with a success rate of 100%. Among them, it rose from US$12.57 to US$13.45 in December 2012, with a return rate of 7%, a return rate of 30.8% in December 2016, and a return rate of 46.92% in December 2020. The return this month is still worth looking forward to. It is worth noting that Bitcoin closed up 7.35% in September this year, setting a record high performance in history. Historically, every time Bitcoin closed up in September, it could rise to the end of the year. Learning from history, the historical rise of the same cycle is very consistent with the consensus, which also makes Bitcoin have a considerable chance to have a larger upside this month.

3. The Federal Reserve is likely to continue to cut interest rates in December

The interest rate cut is a hot topic in the market for a long time. The Federal Reserve announced a 0.5% interest rate cut in September, and then further cut interest rates by 0.25% in November, which accelerated the pace of global interest rate cuts and boosted global market sentiment. Recent US economic data shows that inflation is stubborn, but the downward trend has not changed. Unless the employment or inflation report in November is unexpectedly strong, the Federal Reserve will most likely continue to cut interest rates in December, which will make funds that were originally on the sidelines or bound in low-yield investment areas seek higher-yield investment channels, accelerating the transfer of global funds to risky assets. Bitcoin, as a highly anticipated asset with great appreciation potential, will take over part of the liquidity.

4. Trump's inauguration is a big hype period

Last week, Trump's cabinet was basically formed, and almost all of them are cryptocurrency fans, including Trump's own cabinet, which collectively has configuration exposure to cryptocurrency, an emerging asset. This "all-member cryptocurrency" attitude has greatly increased the market's expectations for the implementation of future crypto-friendly policies, and has also become an important support for the continuation of the December market.

And referring to the 2016 election, many Trump transactions peaked at the inauguration in January. From historical experience, whether Trump was shot or his campaign was successful, the currency circle has shown an extremely intense market reaction. Although the inauguration ceremony on January 20 is seen as a potential peak, the accumulation of market sentiment often manifests itself in advance. From the current perspective, December may become a key window for investors to make arrangements.

5. ETFs and on-chain funds continue to flow in

The continued inflow of ETFs and on-chain funds also provides strong support for the popularity of the crypto market. Thanks to Trump's promise to implement policies that are favorable to the crypto industry, Bitcoin and Ethereum ETFs set new records for net inflows in November, reaching $6.5 billion and $1.1 billion respectively. This increase shows that the market has a strong demand for these two crypto assets.

Net inflows of ETF funds for Bitcoin and Ethereum in November

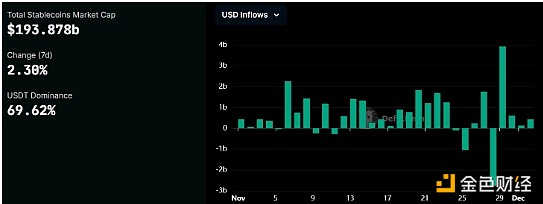

On the other hand, the issuance of USDT is also accelerating, with an increase of more than US$13 billion in November, the fastest issuance rate since 2021. At present, the total market value of the stablecoin market has exceeded US$193 billion, a record high, with an increase of 2.3% in the past week.

Stablecoin market value

In addition, the sudden rise of Phantom Wallet also provides an observation window for the market. On November 21, in just half a month, Phantom Wallet's ranking in the Apple App Store jumped from obscurity to the top of the tool category, and its overall ranking reached the sixth place. According to data analysis from similarweb, Phantom's recent US user traffic accounted for 27.38%, and achieved a significant increase of 24.82% in the past month, showing that the crypto market is attracting more and more people to enter.

Summary

Although Bitcoin has encountered some resistance after its rapid rise in November, many positive factors are working together in the cryptocurrency market, laying an optimistic tone for the December market of Bitcoin and even the entire altcoin sector. Bitcoin may end with an overwhelming positive momentum in 2024. As the official partner of the Argentine national team, 4E supports spot and contract transactions of more than 200 crypto assets such as Bitcoin, Ethereum, SOL, XRP, etc., covering all sectors, with high liquidity and low fees.

At the same time, 4E has also integrated traditional financial assets into the platform, and established a comprehensive one-stop trading system covering everything from deposits to encrypted assets, to US stocks, indexes, foreign exchange, bulk gold, etc., with more than 600 assets of different risk levels. You can invest at any time with one click by holding USDT. In addition, the 4E platform has a $100 million risk protection fund, which adds another layer of protection for the safety of users' funds. With 4E, investors can keep up with market trends, flexibly adjust strategies and capital allocation, and seize every potential opportunity.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance ZeZheng

ZeZheng JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian JinseFinance

JinseFinance Cointelegraph

Cointelegraph