Written by: Oasis, Mia, Claude, KuCoin Ventures

1. Evolution of on-chain trading platforms: from efficiency tools to one-stop asset discovery and trading integration engines

The launch of Pump Fun has greatly simplified the issuance process of new assets on the Solana network and greatly accelerated the creation of Memecoin. Pump-like tools continue to spread to networks such as Base and BNB Chain, becoming the mainstream way to launch on-chain assets. Users' demand for early discovery and rapid purchase of potential Memecoins is growing, driving the continuous evolution of trading tools around trading efficiency and early identification capabilities. Trading tools centered on on-chain assets have roughly undergone three stages of change: from DEX/DEX aggregators for general transactions -> Telegram Bots focused on transaction speed -> All-In-One on-chain trading platforms that integrate fast transactions and multi-dimensional analysis.

During this development process, DEX has always been the party that controls the liquidity of tokens; Telegram Bot and on-chain trading platforms rely on server signing, transaction execution and optimization of transaction routing to significantly improve transaction efficiency, and support users to bribe validators to pack transactions first by presetting Gas priority fees, but in any case, the interaction with the DEX liquidity pool will not be bypassed in the underlying transaction. Therefore, when users use Telegram Bot or on-chain trading platforms to trade tokens, they need to pay two layers of fees, one is the LP fee and protocol fee from DEX, and the other is to pay 1% of the handling fee to Telegram Bot or on-chain trading platforms. For Telegram Bot and on-chain trading platforms, compared with the emergence of a token with a long life span and high market value, more newly launched Memes with a short life cycle but a moderate upper limit can allow the platform to obtain more trading volume and handling fee income.

On-chain trading platforms have gradually become the mainstream of new asset transactions, representing the re-iteration of Telegram Bot, expanding the user group from professional traders to ordinary users and even novices. Telegram Bot is a purely speed-first trading product. Thanks to Telegram's efficient communication architecture, it interacts with users through the Bot API to directly execute commands. It is usually faster than the transaction speed of on-chain trading platforms, and realizes automatic buying and selling functions such as sniping, copying, stop-profit and stop-loss, which is more in line with the habits of degen players who are familiar with on-chain operations. The advantage of on-chain trading platforms is that, on the basis of relatively faster transaction speeds, through multi-dimensional analysis covering on-chain data and social media, ordinary users are also able to discover and identify early Memes, thereby driving more new users into the Meme field. At present, some on-chain trading platforms will not completely abandon Telegram Bot, but make it a branch of platform functions to match the habits of different traders.

2. See the truth from on-chain data: analysis of trading platform traffic migration and user behavior trends

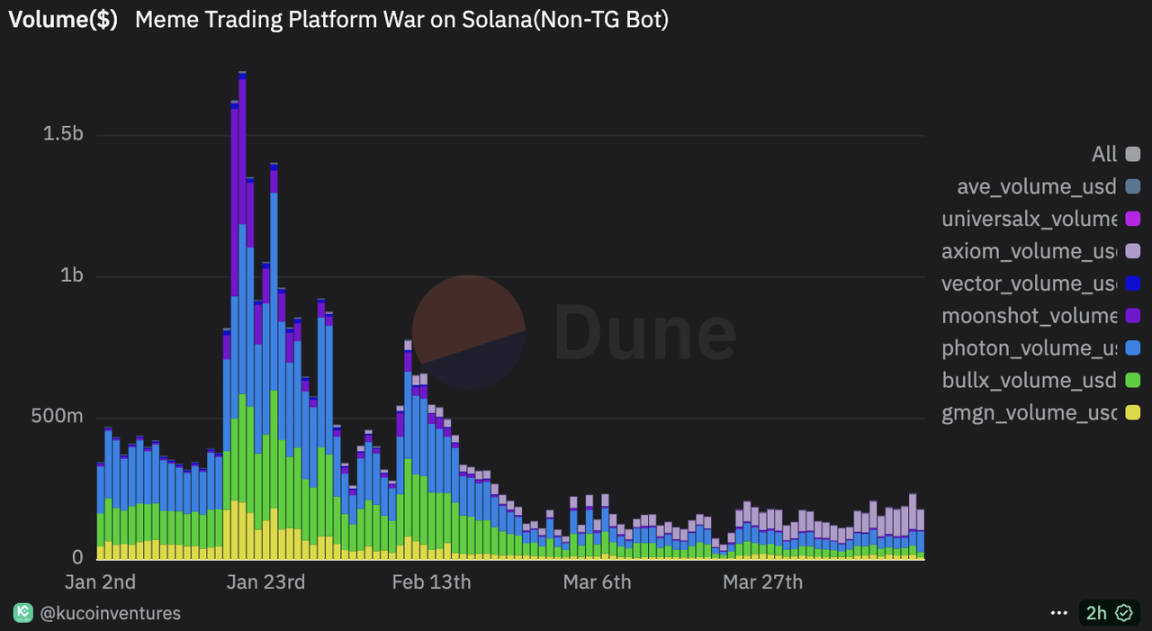

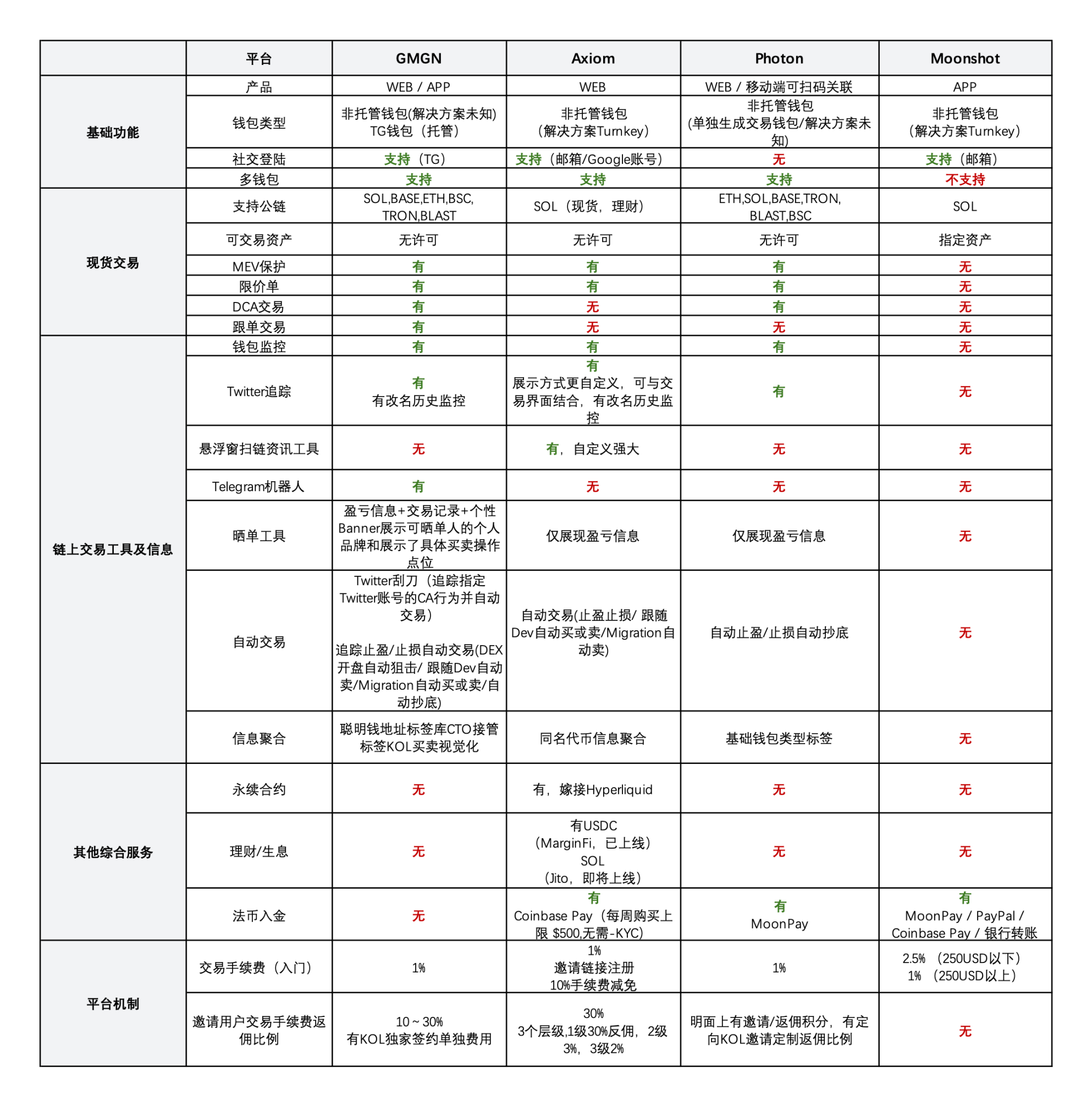

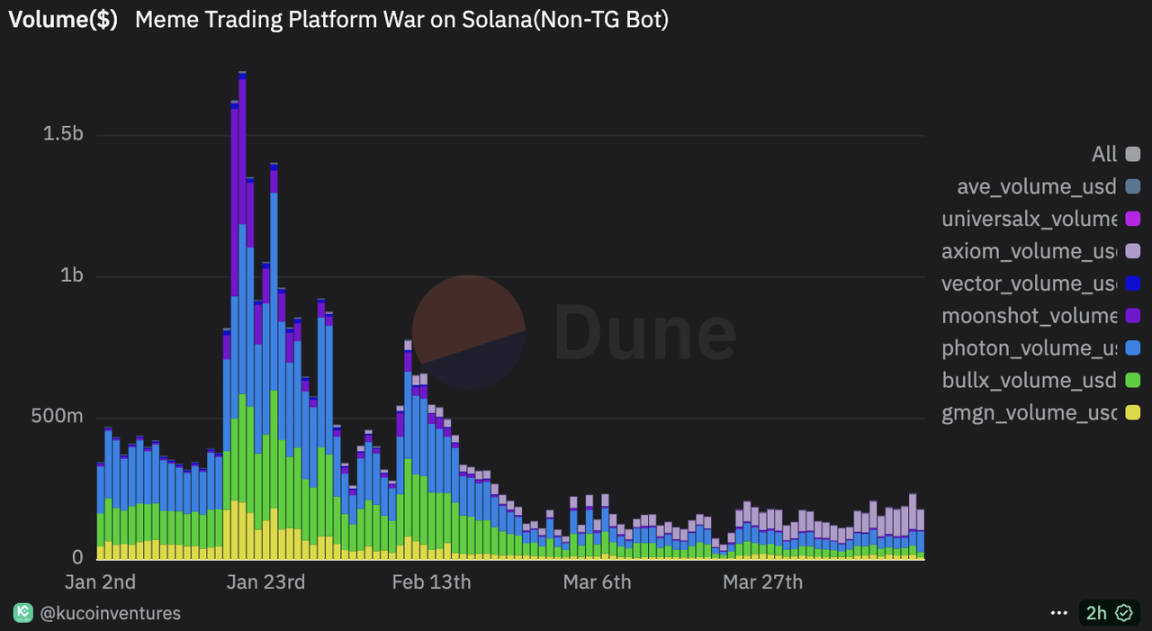

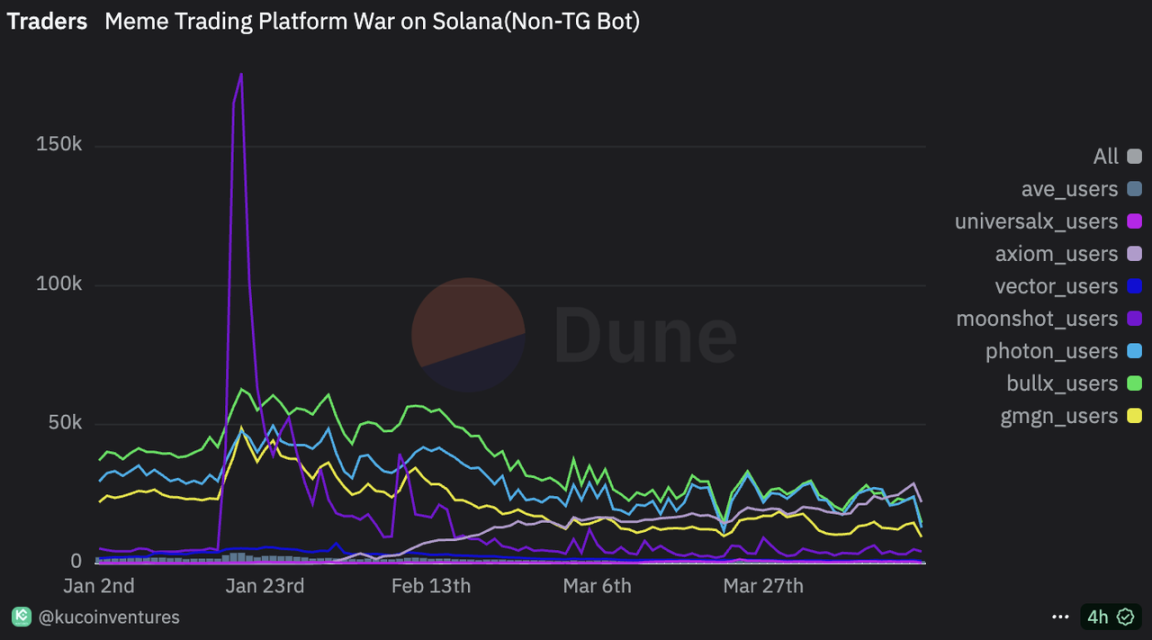

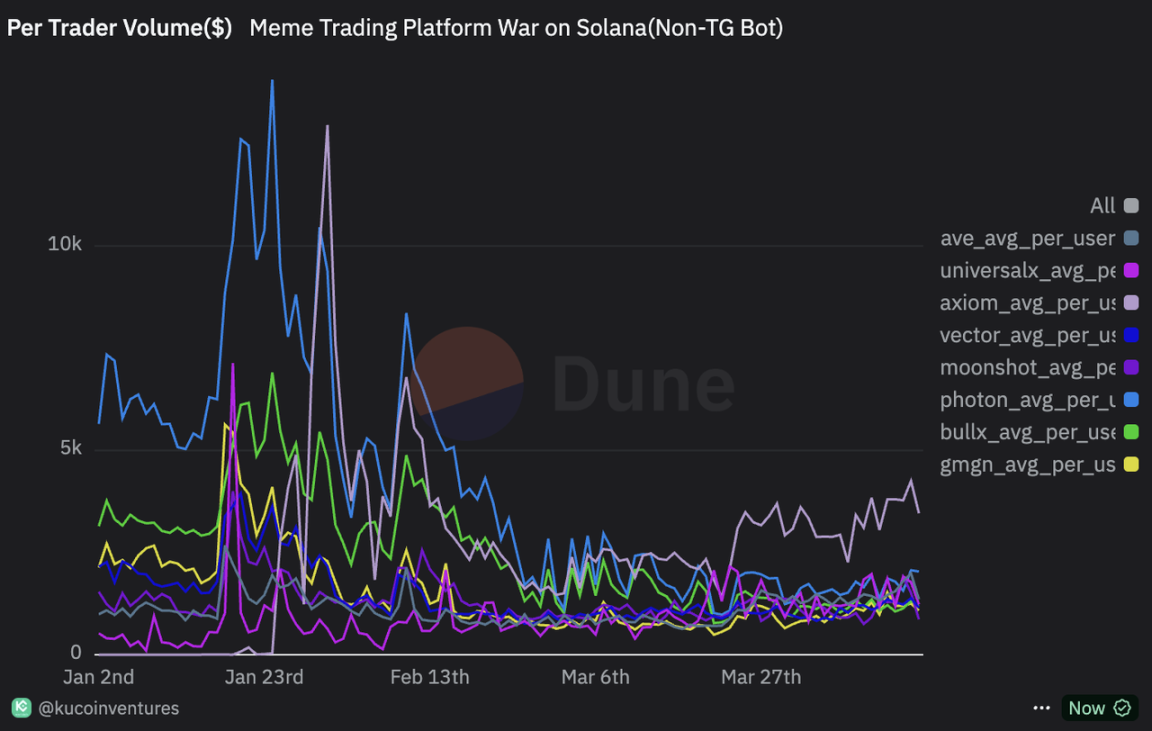

With the incoming president and first lady of the world's most economically powerful country releasing Memecoin on the Solana network, the trading volume of on-chain trading platforms set new historical highs on January 19 and 20. The daily trading volume on January 20 reached a peak of US$1.73 billion. The craze for $TRUMP and $MELANIA swept the world, triggering an unprecedented speculative frenzy. Some early players and community leaders made a lot of money in this speculative feast.

Source: KuCoin Ventures, https://dune.com/kucoinventures/meme-trading-platform-war-on-solanaolana

After the peak, as the huge profits of the leading companies withdrew, the funds began to cool. However, driven by Trump's coin issuance craze, some leaders of small countries successively authorized the issuance of coins, resulting in a mess in the market. The market liquidity is almost exhausted, the transaction volume of the on-chain trading platform has dropped sharply, and the daily transaction volume has shrunk by nearly 90% compared with the peak. The market has officially entered the era of stock competition.

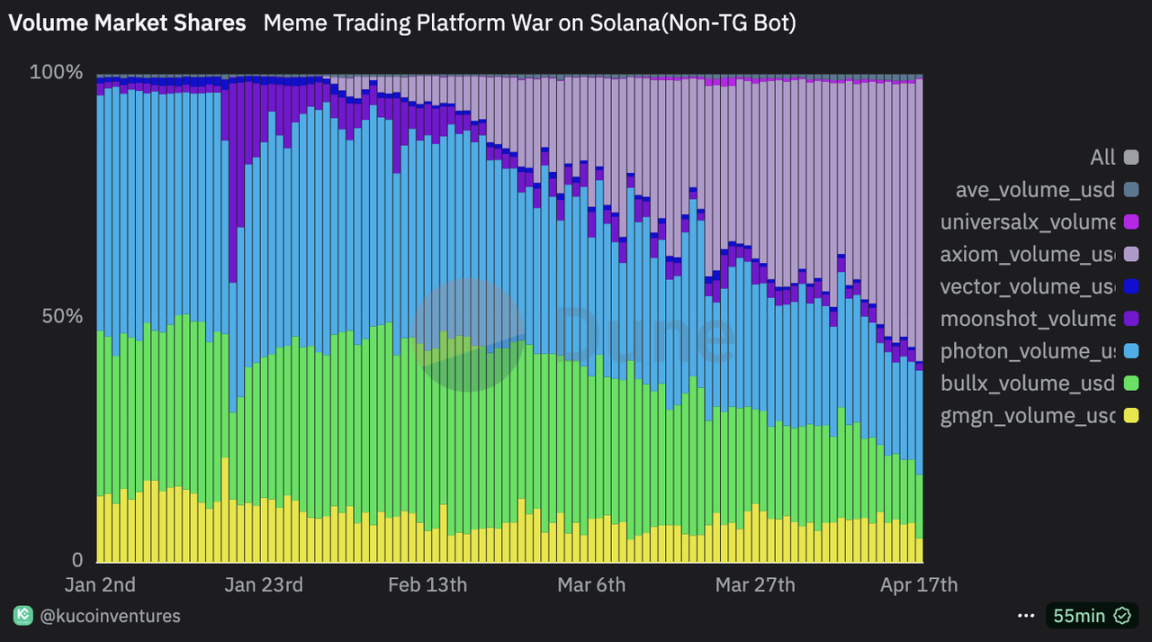

Source: KuCoin Ventures, https://dune.com/kucoinventures/meme-trading-platform-war-on-solana

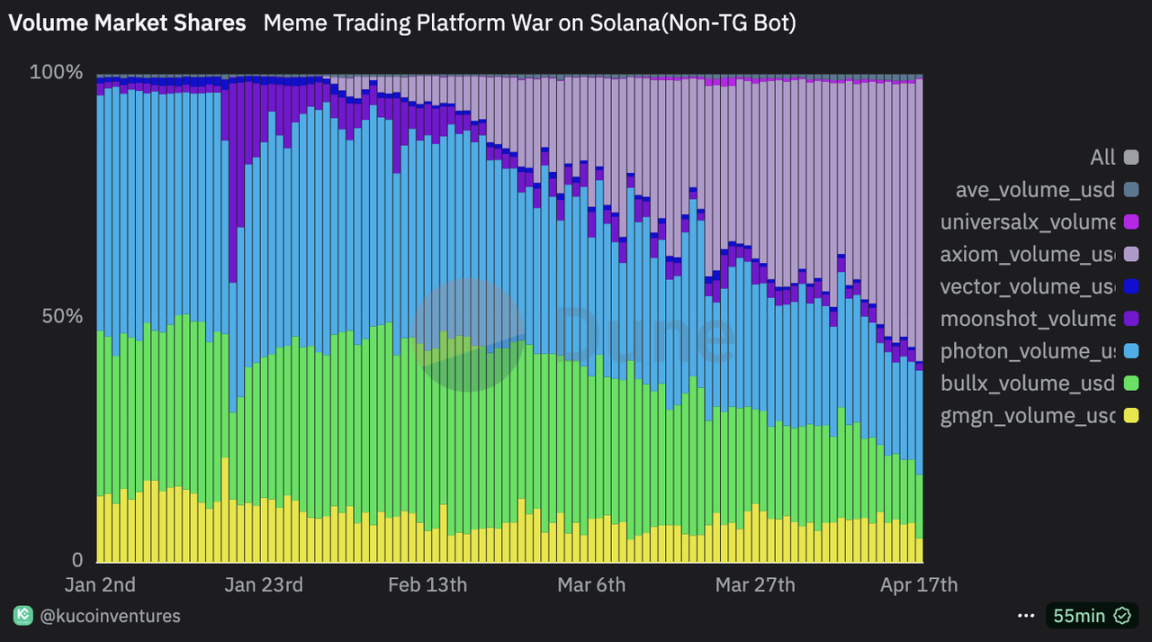

With Trump's coin issuance as a watershed, before $TRUMP, the transaction volume of on-chain trading platforms was mainly occupied by Photon, BullX and GMGN, representing the on-chain degen players in China and the West; Moonshot, which has opened up the fiat currency channel, is the first stop for non-circle users to purchase on-chain Memecoin as a supplement. During the $TRUMP boom, the trading volume represented by the purchasing power of non-circle users represented by Moonshot once exceeded that of any other company, but the funds showed a relative lag. In the post-$TRUMP stock competition era, Axiom has risen rapidly with the support of Y Combinator incubation, points vampire attack and YouTube video live broadcast promotion strategies, and its daily trading volume has reached 50% of the market share.

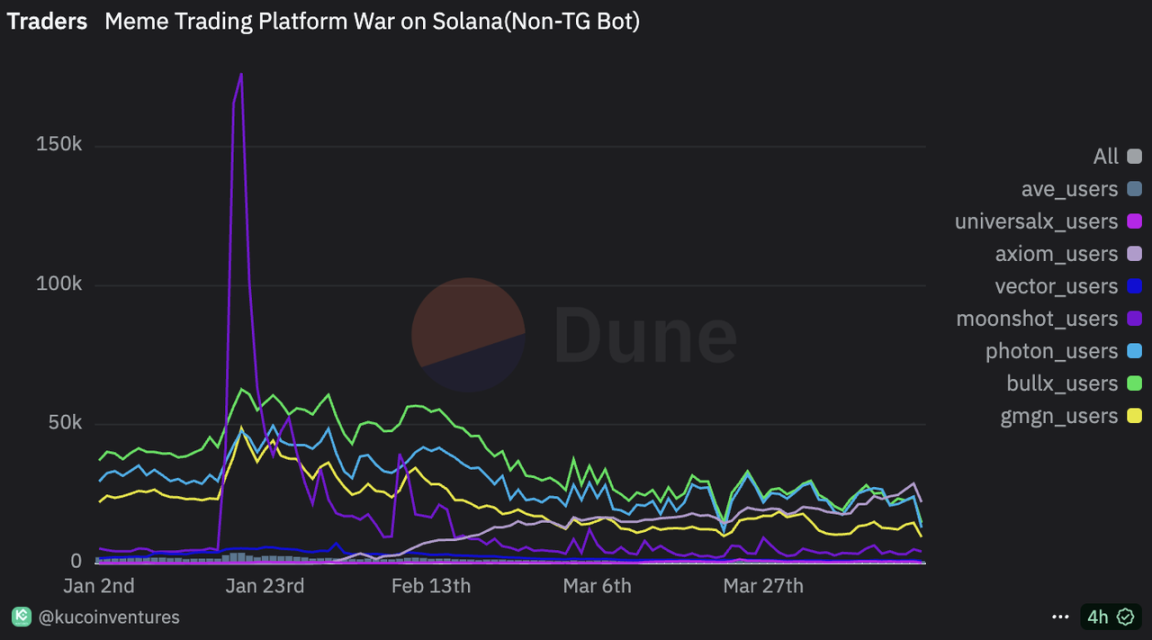

On-chain trading platforms are also PMF products that can continuously attract users without relying on token incentives. The continuous profit potential brought by new assets is the best dopamine. Compared with the general decline of 90% in trading volume from the peak, the decline in the number of active addresses of most on-chain trading platforms is relatively controllable, and user stickiness is resilient in the stock market. For example, Photon, BullX and GMGN, three trading platforms that are not driven by any points or airdrops, can still maintain above 60,000 daily active addresses in the stock market. The average daily active addresses on a single platform is above 20,000, which is very rare in Crypto products that do not rely on token incentives.

Source: KuCoin Ventures, https://dune.com/kucoinventures/meme-trading-platform-war-on-solana

It is worth mentioning that Moonshot may have also created an unprecedented record. Without any token incentives, the number of active addresses for two consecutive days during the $TRUMP $MELANIA craze reached more than 160,000; and due to the Moonshot one account one address model, this can better reflect the real incremental user level brought by the circle Meme. However, users outside the circle are mainly driven by major events and have a poor retention rate.

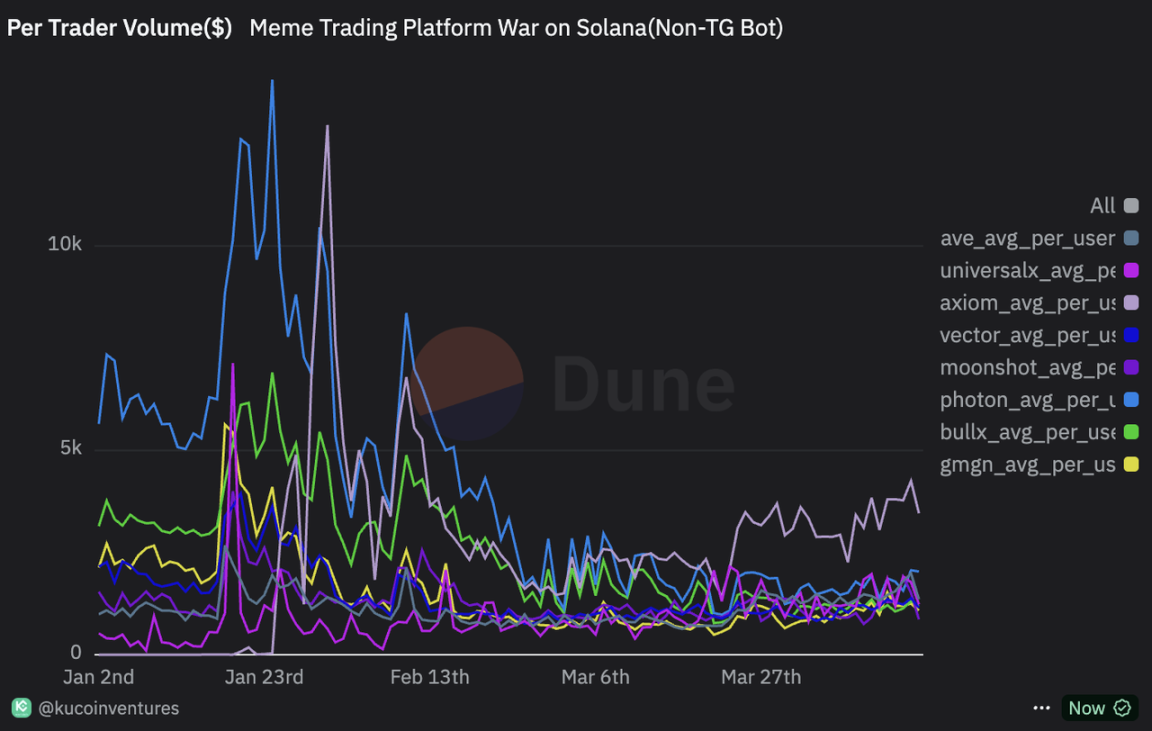

Source: KuCoin Ventures, https://dune.com/kucoinventures/meme-trading-platform-war-on-solana

Of course, the points/airdrop vampire attack is still a powerful means for new entrants to challenge old players. There is nothing new under the sun, and this scene has also happened in tracks such as DEX and NFT Marketplace. As a new entrant who missed $TRUMP $MELANIA, Axiom is one of the first on-chain trading platforms to launch point incentives. In just two months, the number of daily active addresses has increased from 0 to nearly 30,000, slightly higher than Photon. However, a notable feature of the point-driven platform is that in the same period, the average transaction amount per address is significantly higher than that of other platforms without point incentives, which shows that there may be some volume-washing behavior. For example, the recent average daily transaction amount per address of Axiom is almost twice that of Photon.

In addition to the platforms that have already emerged, new entrants are also eyeing them, trying to capture users and funds in the stock market environment with differentiated functions and refined operation strategies, and looking forward to making a difference when the next wave of on-chain bull market comes. On-chain trading platforms do not directly own and provide liquidity, and their moats are weaker than DEX. The core of attracting and retaining users and funds still lies in continuously optimized product functions and efficient operation strategies.

3. How to fight the battle of on-chain trading platforms? A multi-dimensional competition from functional polishing to operational breakthrough

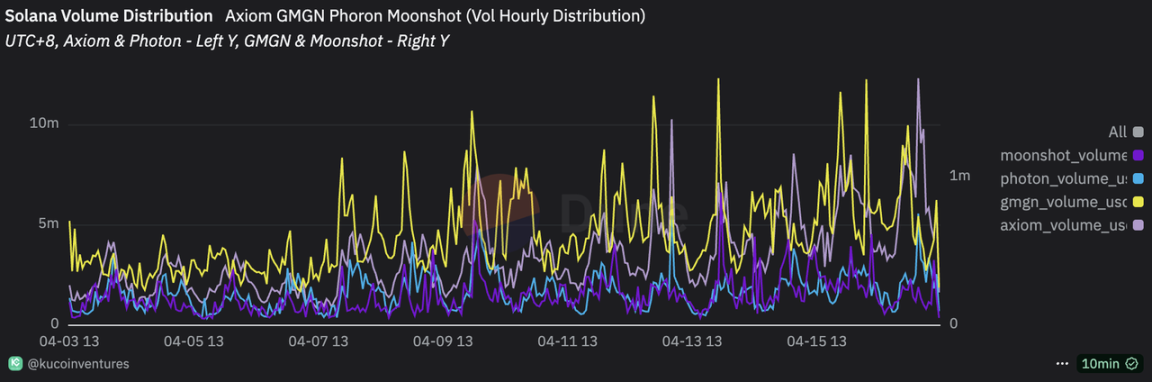

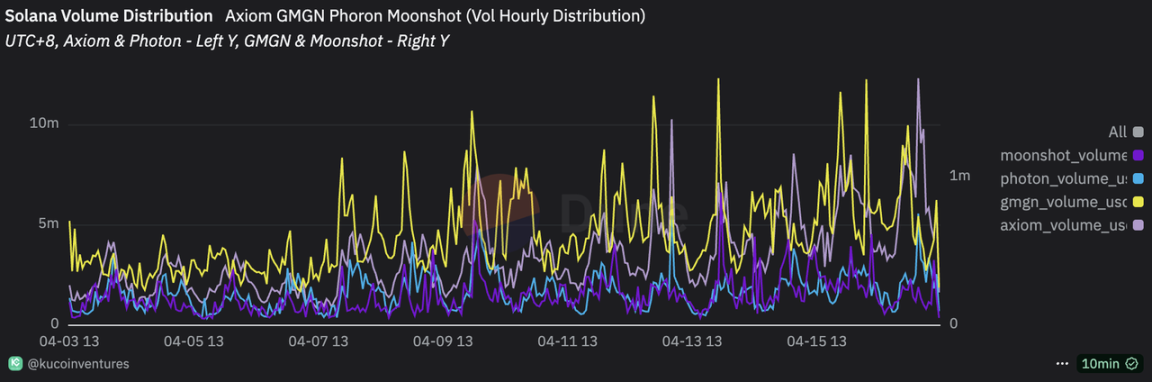

In the preliminary comparison of the monthly/daily trading volume of each on-chain asset trading platform, we observed that GMGN, Axiom, Photon and Moonshot not only have their own advantages in absolute trading volume, but also their growth trends are differentiated. However, a particularly critical and inspiring discovery is the significant difference in the peak trading hours of each platform. This provides us with important clues to understand their potential user portraits and market positioning.

Source: KuCoin Ventures, https://dune.com/queries/4995396/8266684

According to the transaction data statistics in the past half month, the transaction peak of GMGN is mainly concentrated between 22:00 and 00:00 in the UTC+8 time zone. In contrast, the transaction peaks of Axiom and Photon generally appear in the relatively late UTC+8 next day 02:00 to 05:00 interval.

This clear time distribution feature strongly suggests that their core user groups may have a significant focus on geographical regions: GMGN may be more popular among users in the Asian time zone, while Axiom and Photon may have higher activity among European and American user groups.

This basic difference in core users is often not accidental. It is likely to profoundly affect or even determine the platform's specific choices in product function polishing, interactive experience design and even marketing promotion strategy. Next, we will start from the dimensions of each platform's functional characteristics, product design philosophy and market operation strategy, and conduct a more detailed comparative analysis to try to reveal how these differences are formed and how they ultimately affect the flow of users and the overall trading performance of the platform.

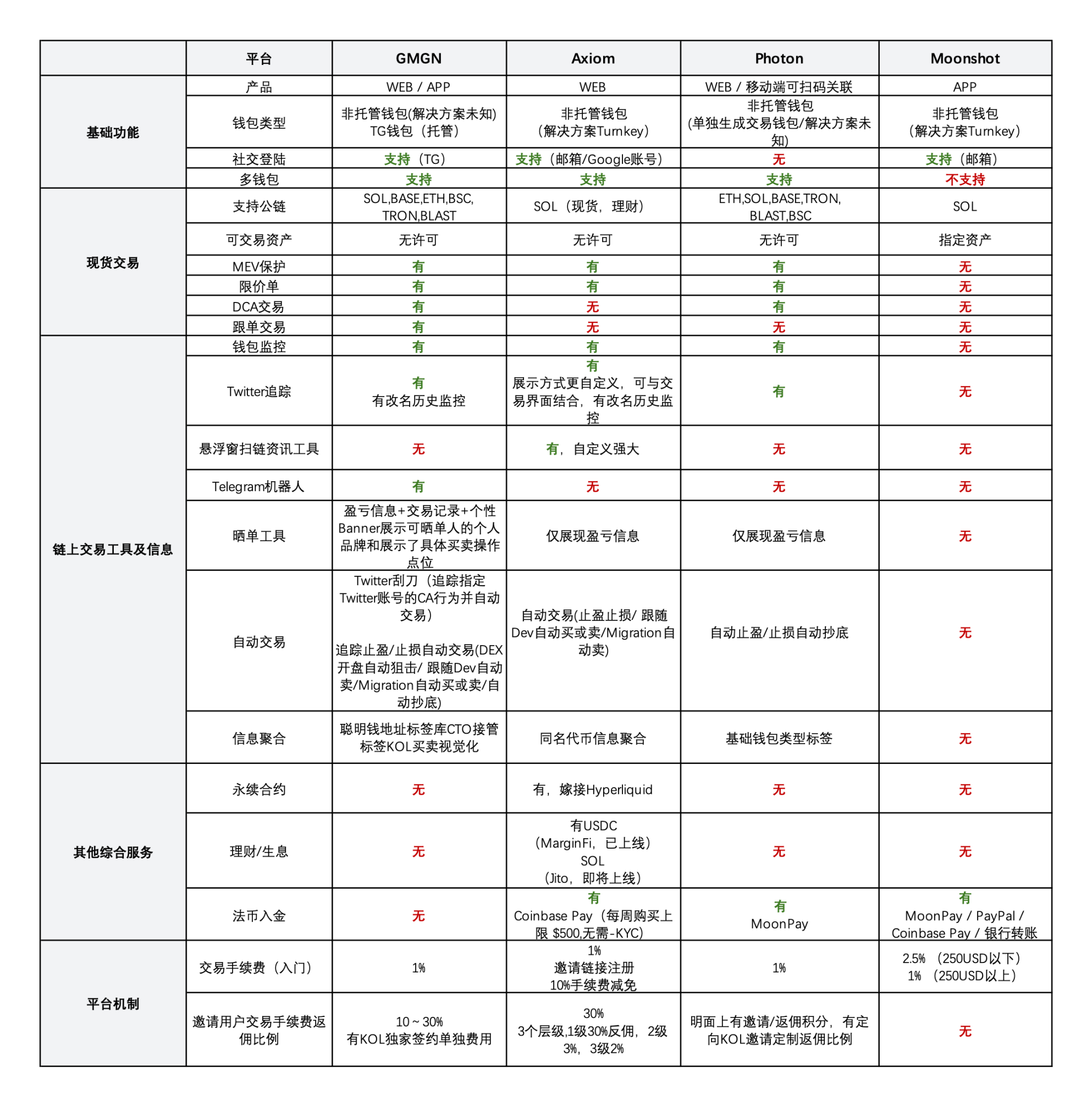

Moonshot: The double-edged sword of low threshold deposit advantage and differentiated market positioning

The biggest advantage of Moonshot is that it supports multiple methods of fiat currency deposits such as credit cards, Apple Pay, and bank transfers, and the $TRUMP official website also mentioned that the App can be used as a trading method. Its no private key concept, pure email registration method and the convenience of fiat currency deposits, as well as the extremely simple operation experience, allow new users to enter the world of encrypted chain assets with a very low threshold. It competes for the latest on-chain assets that Coinbase cannot capture, and the countries and regions that many other offshore CEXs cannot touch. The misalignment of user needs between the two.

Moonshot's core competitive advantage lies in its user-friendly entry mechanism. By supporting multiple fiat deposit methods such as credit cards and Apple Pay, it significantly lowers the threshold for new users to enter the cryptocurrency market. The $TRUMP coin official website even lists Moonshot as a recommended trading channel, which has brought it considerable exposure and users.

The platform uses pure email registration, without the need to understand the complex concept of private keys. The overall operation interface and functions are also very simple, allowing crypto newcomers to quickly get started. This simplified user experience strategy accurately targets two market gaps:

The supply gap caused by the inability of traditional exchanges such as Coinbase to list the latest on-chain assets in a timely manner due to compliance, liquidity and other reasons

Targeting many countries and regions that can quickly list assets on offshore exchanges but cannot be served due to regulatory restrictions

Through this differentiated positioning and sensitive market demand, Moonshot once successfully seized the opportunity of misalignment between market demand and existing services. However, the fiat currency deposit channel provided by the partner is not Moonshot's indestructible moat. As competitors begin to follow up and access, Moonshot will face challenges.

As users on the platform become more professional in trading, their trading needs and desire for new assets may prompt them to look for more professional platforms with more assets, thereby causing the loss of mature users who pursue more professional trading experience and larger trading scale. If Moonshot hopes to retain these users, the development and launch of the MoonShot Pro version must be put on the agenda.

GMGN: Data-driven on-chain trading terminal, building a professional moat for the Meme market

GMGN is a tool platform designed for on-chain Meme coin traders. With its powerful data analysis capabilities and automated trading functions, it stands out in the market.

In terms of trading functions, GMGN has conducted in-depth research on the real usage needs of on-chain users, not only providing a wealth of order visualization functions, but also creating a multi-dimensional trading indicator system, which greatly improves user decision-making efficiency. The platform has launched original functions such as blue chip index, runaway probability, visual tracking of KOL buying and selling behavior, and Twitter scraper, which have formed a clear differentiation in the vertical segment of on-chain transaction intelligence. Its address label system finely labels robots, smart money, whale addresses, etc., and combines comprehensive analysis of on-chain data and social media to enhance the product's appeal to new and fast arbitrage users. It can be said that the rich trading indicators and address labels stored under this data-driven trading product path constitute GMGN's most solid moat. However, this also leads to extremely high information density on the product page, which is less friendly to primary users, and to a certain extent is not conducive to the wide penetration of the user group.

On the other hand, GMGN has opened APIs, allowing whitelisted users and institutions to capture platform data, customize the use of strategy modules, and develop automated trading scripts based on APIs, which further reduces the operating costs of professional users and enhances the platform's infrastructure attributes. However, it should be noted that some strategies rely on Telegram Bot to run, and users need to entrust their private keys to the platform, and there are still risks in terms of security that cannot be ignored. To this end, GMGN has introduced security measures such as Google 2FA verification and whitelist address restrictions to reduce risks.

In terms of operational strategy, GMGN shows a clear difference between Asian development teams and European and American product-oriented projects. It continues to activate community activity and expand user sources by continuously launching on-chain trading competitions, KOL linkage, project cooperation and other activities. So far, the platform has held 6 trading competitions in cooperation with multiple ecological partners such as BNB Chain, 1000X GEM, and X Community. At the same time, it has co-authored popular science books such as "GMGN: From 0 to 1000 Playing US Dollars MEME Operation Guide" with well-known KOLs in the industry to further cultivate market awareness and allow new users to quickly get started and join the on-chain world. Through external cooperation, multilingual communities, and Telegram customer service groups, GMGN has gradually built an operational moat based on communities and activities, as well as meticulous service-driven.

Axiom: Emerging on the Solana Chain with its Ultimate Trading Experience and Community-Driven Strategy

Axiom has risen rapidly on the Solana chain, thanks to its deep understanding of the needs of on-chain traders and its continuous polishing of product experience. Its core scenario Pulse provides functions such as hover preview of project icons, Twitter name change history query, and tweet floating window, helping users to efficiently obtain information in a single interface, reduce the frequency of jumps, and improve the efficiency of chain scanning.

Specifically, Axiom's floating window monitoring interface allows users to track the operations of smart money addresses and the latest developments of Twitter KOLs in real time, further enhancing the convenience of information acquisition. This enables users to monitor and track the latest operations of smart money addresses and follow the latest information of Twitter KOLs on a single screen, which is highly consistent with the current market situation, where on-chain trading hotspots are highly concentrated in the news trading section.

The function of querying the Twitter name change history can help users understand whether the project has issued other coins, and the tweet preview pop-up window can understand the community information without jumping out of the transaction page. These are the pain points that professional chain users have experienced in the process of scanning the chain in the past. The essence of the platform introducing these functions is to reduce the frequency of user jumps out, shorten the user's usage path, facilitate user chain scanning, and continuously optimize and refine product details to pursue the ultimate experience of chain user needs.

In terms of transaction execution, Axiom uses a customized engine and node optimization technology to achieve a transaction speed of "less than one block" (about 0.4 seconds), and supports professional users to use custom RPC nodes, further improving the flexibility and efficiency of transactions. This is especially important for users who pursue the speed of new issuance.

In terms of user incentive mechanism, Axiom has launched a points system and potential token airdrop expectations. Users accumulate points through transactions, invitations, and completion of tasks, and may receive airdrop rewards in the future. In addition, the platform also has a three-level referral reward system, direct referrals can get 30% of the transaction fee share, indirect referrals and extended referrals can get 3% and 2% share respectively, which effectively stimulates the user's enthusiasm for promotion.

Axiom's success is also reflected in its continuous optimization of user experience and keen insight into market demand. Through continuous iteration of product functions, improving transaction speed and enriching incentive mechanisms, Axiom has occupied an important position in the Solana ecosystem and has become one of the preferred platforms for on-chain traders, occupying about 50% of the market share alone.

Fourth, who is the master of the ups and downs? The future of on-chain transactions

We have conducted an in-depth analysis of representative on-chain trading platforms such as GMGN, Axiom, Photon, and Moonshot from the dimensions of data, products, and operations, revealing a current vibrant and competitive track. Looking back at the trading frenzy triggered by hot assets on the chain such as MEME and AI Agent, we not only witnessed the rapid iteration and maturity of on-chain trading platforms under competitive pressure, but also clearly identified several key trends that will shape the future of the industry:

Trend 1: New Paradigm on the Chain - Evolution of Traffic Entrance and Exploration of "Binance"

New Asset Frontier and Value Discovery Center:Given the current market structure and changes in user behavior, DEX has become the first home for new assets such as Meme coins and low-market-cap potential coins, and has been their main source of liquidity for a long time. However, such assets change quickly and are numerous, and there are many inconveniences in simply relying on DEX front-ends or TG Bots for trading. Against this background, on-chain trading platforms have rapidly emerged with better trading experience and powerful data analysis capabilities, effectively meeting users' needs to capture early opportunities and substantially helping many high-quality assets complete initial price discovery. In fact, the leading on-chain trading platforms have replaced some of CEX's early functions of listing coins and guiding liquidity to some extent, becoming the first choice for retail and professional traders to participate in on-chain asset games in the early and mid-term.

"Get rich on the chain" mental reinforcement and user migration: One of the core charms of the crypto industry lies in its high-multiplier wealth effect in a permissionless environment. Traditionally, CEX is the first stop for asset listing and price discovery, where users participate in early games. However, with a large number of assets (especially MEME-type attention assets) directly launched on the chain in this cycle, some pioneers participated in very early projects through on-chain trading platforms and obtained amazing returns, which made a wider user group truly feel the high-multiplier gold mining potential contained in the chain. In addition, on-chain trading platforms are often deeply bound to KOLs, and profit screenshots with platform logos are widely disseminated through social media. The narrative of "getting rich on the chain" is constantly strengthened, deeply associating the wealth effect with these platforms. As a result, even CEX leaders such as Binance are beginning to face significant challenges in the wealth effect that their newly launched spot assets can bring.

CEX's transformation pressure and the challenge of "deconstructing" on-chain tools:Although CEX still dominates the overall transaction with its strong fiat currency channel, integrated functions, liquidity advantages and position in institutional compliance, emerging on-chain tools such as Moonshot (simplified deposit), GMGN (professional data), and Axiom (one-stop investment research and trading) are gradually eroding CEX's functional territory, providing users with more convenient (often without KYC), more timely, and more native on-chain trading options. The evolution of on-chain trading platforms from single tools to comprehensive trading terminals that integrate security, data, copy trading and other functions has directly impacted CEX's one-stop service model. Even if CEX still retains user stickiness and liquidity barriers, it is forced to accelerate strategic adjustments and product innovations to cope with the severe situation of user demand diversion to the chain.

Trend 2: Two-way rush - Boundary blurring and integration exploration between CEX and on-chain scenarios

OKX's early exploration and path division: In fact, OKX launched MetaX (later renamed OKX Web3 Wallet), which combines NFT market and multi-chain non-custodial wallet functions, as early as 2022. It is one of the first exchanges to try to deeply integrate wallets with CEX. Although the NFT market performed mediocre, its wallet business seized the opportunity in the inscription boom in 2023 with its first-mover advantage and technological accumulation, and became the focus of the market. OKX's previous strategic intention to build a Web3 super app was clear, aiming to connect the on-chain and internal ecosystems through a single application. However, subsequent industry events and regulatory compliance pressure forced it to split the exchange app and Web3 wallet. This also reveals the inherent tension between non-KYC/non-custodial wallets and strong KYC/strongly regulated CEX businesses in the current compliance environment, highlighting the practical challenges faced by the deep integration of the two.

Binance/Bitget's alternative integration and model innovation: However, exchanges have not stopped exploring the integration of CEX and on-chain. This year, Binance Web3 Wallet launched the Alpha function and iterated rapidly, allowing users to directly use exchange accounts to trade specific on-chain tokens without the need for external wallets. Unlike OKX, which emphasizes non-custodial and strict scene division, Binance has adopted a bolder and relatively centralized integration approach. Through the product combination of "KYC wallet + exchange account direct to chain", it has taken the lead in breaking the traditional barriers of CEX and on-chain asset interaction. Following closely, Bitget also launched Bitget Onchain to achieve similar functions, while retaining the Bitget Wallet, a fully self-custodial decentralized option, to meet the preferences of different users. This shows that CEX and on-chain trading scenarios are undergoing two-way penetration and reference, and the boundaries between the two at the product level are expected to become more blurred in the future.

Trend 3: Experience is king - the continuous revolution and intelligent wave of user experience

Underlying technology drives the leap in ease of use: In the past few years, the concepts of high-performance public chains, account abstraction, chain abstraction, and intent-driven have been proposed and developed, with the core goal of continuously simplifying user operations, shielding the complexity of underlying technologies, and significantly lowering the threshold for Web2 users to enter Web3. With the popularity of mobile apps on on-chain trading platforms and the continuous pursuit of low-threshold experience, it is not difficult to foresee that in the future crypto boom, these tools will enable a wider range of user groups to seamlessly access on-chain assets and diversified gameplay.

Deep integration of intelligent trading and socialization:This round of market has clearly demonstrated the strong market demand for social trading and comprehensive decision-making assistance tools based on news/on-chain data, and on-chain trading platforms have shown their leading advantages in this regard. In addition to conventional KOL copy trading, functions such as "smart money" tracking and automated trading strategies based on off-chain community signals/key events are becoming increasingly mature. In the future, combining AI-driven sentiment analysis, pattern recognition and other advanced tools will be an inevitable trend, which is expected to further lower the threshold for professional trading.

The broad prospects of AI empowerment:We also look forward to more powerful AI capabilities to deeply empower on-chain trading platforms. At present, AI has shown great potential in strategy recommendation and generation, natural language interactive operations, etc. In time, AI may enable users to achieve highly personalized and professional-level trading automation without programming knowledge, completely revolutionizing the on-chain trading experience.

In summary, as an important bridge connecting new asset discovery and user trading behavior, on-chain trading platforms are completing the transition from "tools" to "entry" at a very fast speed. They not only make continuous breakthroughs in product functions, user experience, and operational strategies, but also play an increasingly critical role in the structural transformation of crypto trading. From CEX's transfer of some early liquidity dominance to on-chain trading platforms actively absorbing asset discovery, social trading and user minds, the underlying logic of this round of competition is no longer just a competition of speed and efficiency, but an exploration of the "next generation of trading infrastructure."

In the future, driven by the evolution of high-performance chain infrastructure, account abstraction and AI empowerment, the boundaries of on-chain trading platforms will continue to expand. On the one hand, they will further challenge CEX's monopoly on liquidity, entry and user mind; on the other hand, they may also form a deeper integration relationship with CEX, pushing the entire trading system from centralization to a more flexible and diversified hybrid structure.

This is not only a product innovation, but also a reshuffle of the power structure, user behavior path and value distribution method of the crypto market. Before the next cycle really arrives, this "entry battle" will continue to evolve, and the story of the on-chain trading platform has just begun.

Alex

Alex