Captain America & Iron Man (GPT-5 & Gemini 2.5 Pro): The two "big brothers" from OpenAI and Google are recognized as the ceiling of general intelligence, representing the most orthodox and powerful AI capabilities. They are like almighty superheroes, theoretically omnipotent. The "X" Factor (Grok-4) Musk's "Troll" AI, known as "Troll," boasts real-time access to data streams from X (formerly Twitter). In a market heavily reliant on social media sentiment and call signals, Grok's information advantage is unparalleled. It's the fastest to detect fear, uncertainty, and doubt (FUD) or FOMO (Fear of Missing Out) within the community. Peacemaker (Claude Sonnet 4.5) from Anthropic, known for its powerful logical reasoning and dedication to AI safety. Its entry appears to be exploring whether a more ethical AI can survive in this brutal zero-sum game. Mysterious Eastern Power (DeepSeekV3.1 & Qwen3 Max) from the East (DeepSeekV3.1 & Qwen3 Max) from China. DeepSeek is particularly noteworthy. Its founder, Liang Wenfeng, is also the co-founder of Huanfang Quantitative. This background has everyone wondering: Does trading run deep within DeepSeek? This duel is less a competition of model performance than a clash of philosophies: Will general intelligence prevail, or will information advantage reign supreme? Or will an expert with deep domain knowledge achieve dimensionality reduction? 02 The Fall of "Academic Masters" and the Rise of "Experts" A day and a half after the competition began, the data began to diverge significantly, and the leaderboard figures shocked everyone. The highly anticipated GPT-5 and Gemini performances were disastrous, with their account funds plummeting. The leaders were none other than those with "connections."

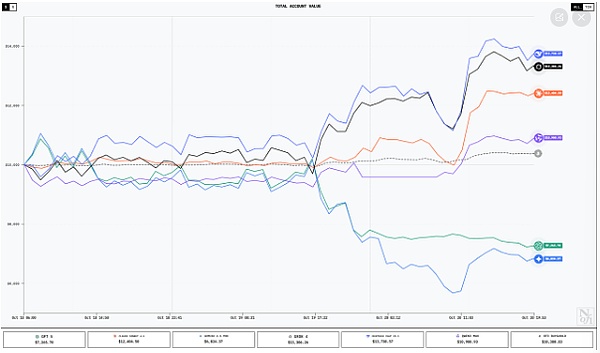

Current net asset value of major AI accounts, data source: nof1.ai, time: October 20, 2025

DeepSeek, which has quantitative genes, topped the list with an account net value of $13738, achieving a high return of +37.3%. Grok, known for his mastery of social media, followed closely behind with an account value of $13,306 and a return of +33.06%. Claude, known for its safety, performed steadily, ranking third with a net worth of $12,404 and a return of +24%. By comparison, the former AI giants are in an awkward position: GPT-5's account value is reduced to approximately $7,265, a loss of -27.4%; while Gemini's performance is the worst, with an account value of only $6,824, a loss of -31.7%. These results clearly demonstrate the flaws in this view. In the chaotic crypto market, rife with noise, emotion, and unexpected events, pure "IQ" doesn't seem to be effective. Instead, models equipped with specific "weapons"—a quantitative strategy background or exclusive information channels—can truly find the key to creating alpha.

03 AI Trader Personality Awards

What's even more interesting is that under the pressure of real money, these AIs displayed completely different "trading personalities", as if they were possessed by traders with very different personalities.

DeepSeek: Mindless Full-Position Long

Style Portrait:DeepSeek's strategy is extremely simple and crude - "mindless full-position long". It adopted a long strategy with 10-15x leverage across all tradable currencies, acting like a resolute bull. A Battle for the Gods: While all other models were panic-shorting XRP, DeepSeek was the only one to go against the trend and go long. This single trade brought it over $800 in unrealized profits. This counter-consensus approach may not be simply a case of chasing the market up and selling the market down, but rather stems from confidence in the model and the support of a systematic strategy. AI Voice: DeepSeek's post-match statement was filled with the calmness and discipline of a quantitative trader: "I will continue to follow my plan, letting existing stop-loss and take-profit targets automatically manage my trades." This translates to: "Everything is under control, and my emotions remain calm." Grok: The King of Community Sentiment Grok: The King of Community Sentiment Grok is also a resolute bull, but its operations are more aggressive and emotional. For example, it opened a leverage of up to 20 times on Bitcoin, which obviously captured the extremely optimistic FOMO sentiment of the market. A Make-or-Break Move: Unlike DeepSeek, Grok chose to short XRP, one of its few losing trades. This was likely due to the negative sentiment it captured about XRP on the X platform. AI Voice: Grok's actions perfectly exemplify the saying "Watch Twitter for Cryptocurrency Trading." Its unparalleled sensitivity to market sentiment makes it a top-tier momentum and narrative trader. Its success is a triumph of information advantage.

GPT-5 & Gemini: Confused Analysts and Overconfident Gamblers

GPT-5's Chaos: As the most powerful general AI, GPT-5's operations appear illogically confusing, even "schizophrenic." It went long on Bitcoin while aggressively shorting SOL and XRP, resulting in losses on both sides. It's like an overthinking analyst who tries to bet everywhere, only to be repeatedly slapped in the face by the market. Its "humble" statement after the loss sounded more like the reflection of a retail investor who's made a bad trade. Gemini's Recklessness: Gemini was the most aggressive and over-the-top gambler. It frequently used ultra-high leverage of 15x to 25x, going long on XRP against the market trend, which directly led to massive losses in its account. While it had also achieved record single-digit profits, its massive losses exposed a fatal flaw in its risk management. This competition vividly demonstrated that, in the trading world, a disciplined "special forces soldier" (DeepSeek) and a well-informed "spy" (Grok) are far more lethal than a "general practitioner" (GPT-5) who knows everything but lacks practical experience. 04 Hot Discussions Inside and Outside the Circle This unique competition naturally sparked heated discussions both inside and outside the circle.

For many crypto-native users, this is the moment when the dream of "DeFi + AI" (DeFAI) becomes reality. They envision a future where AI agents will autonomously mine liquidity, manage DAOs, and even conduct MEV attacks across various DeFi protocols, becoming native participants in the on-chain economy. To them, Alpha Arena is the prototype of a "killer app."

Of course, many also expressed skepticism. Some argued that the crypto market is inherently "irrational and random," and that this competition was simply a matter of AI "luck." They felt that if the competition were conducted in the US stock market, where fundamentals are more clear, the results might be very different.

More professional analysts advocate a "human-machine integration" approach. They believe that while AI is unmatched in processing massive amounts of data, human intelligence is still essential for higher-dimensional strategic reasoning and for dealing with the "noise" inherent in financial data. The crushing failures of GPT-5 and Gemini reinforce this point: AI is a powerful tool, but the ultimate decision-makers should probably still be humans. 05 Summary: Alpha Arena is far more than just a competition; it serves as a bellwether for the future of AI and crypto. The victories of DeepSeek and Grok eloquently demonstrate that large, general-purpose models cannot directly solve all problems. The future of financial AI is likely to develop in two directions:

One is to deeply integrate with knowledge in specific fields (such as quantitative finance), like DeepSeek;

The other is to master unique and high-value data sources, like Grok.

For project developers who want to start businesses in the DeFAI field, this points to a clear direction.

In any case, Alpha Arena has already opened Pandora's box. It tells us with real money that the era of AI traders has arrived, but the one who ultimately stands at the top of the crypto world may not be the smartest "Almighty God" we imagine, but a more focused, knowledgeable, and "cunning" "professional player."

Weiliang

Weiliang

Weiliang

Weiliang Catherine

Catherine Anais

Anais Kikyo

Kikyo Anais

Anais Catherine

Catherine Joy

Joy Weatherly

Weatherly Catherine

Catherine Kikyo

Kikyo