Author: Liu Jiaolian

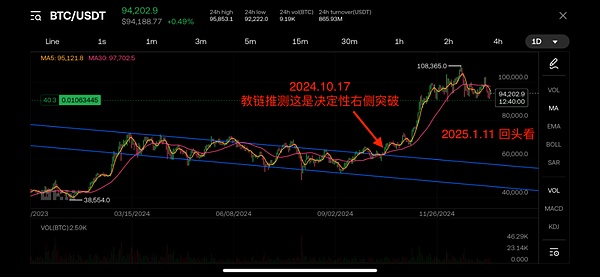

The overnight BTC rebound failed, and the bulls failed to hold 95k. In the morning, it was still waiting at 94k. The 30-day line has been bent and the upward trend has been interrupted.

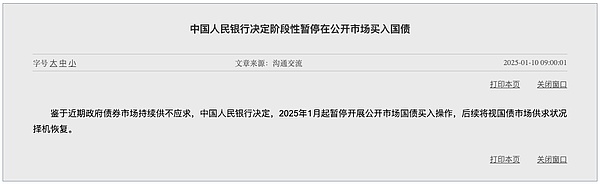

Yesterday, the central bank announced that it decided to temporarily suspend the purchase of treasury bonds in the open market.

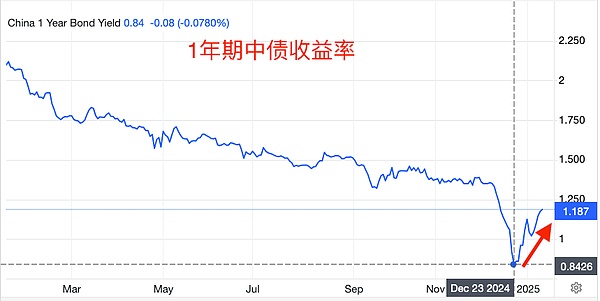

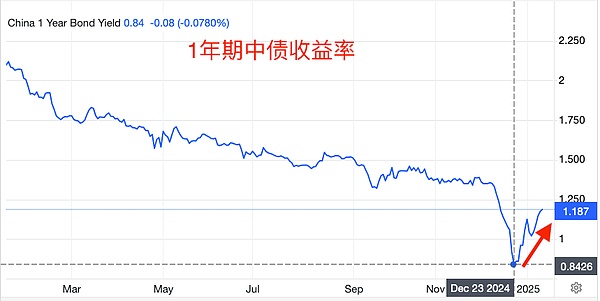

The yield of one-year medium-term bonds has already bottomed out and rebounded as early as Christmas Eve in December 2024.

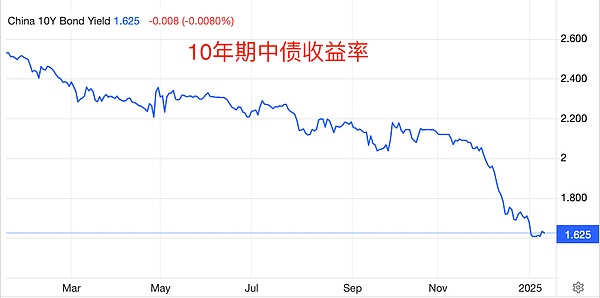

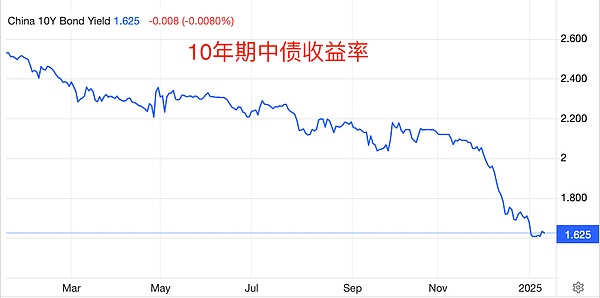

Now, the yield of 10-year medium-term bonds has also shown a bottoming trend.

Jiao Lian said that bond yields are inversely proportional to their prices.

The bottoming of yields, or the rebound from the bottom, indicates that bond prices are falling.

Why it fell is easy to understand. Without a big buyer, according to the market supply and demand relationship, the price will naturally fall back to a new equilibrium price.

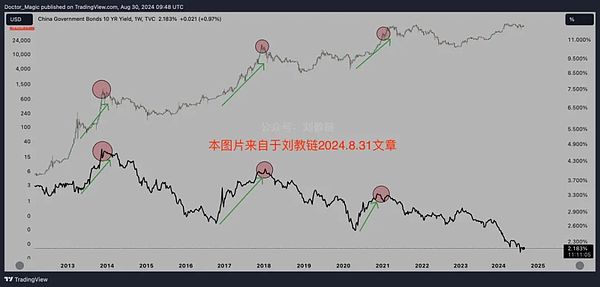

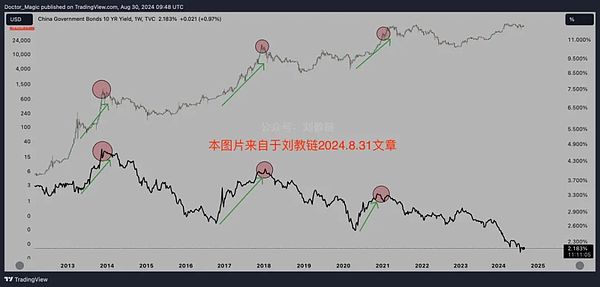

Not long ago, in the article The Strange Correlation between China's Long-term Bond Yield and BTC published on August 31, 2024, the 10-year medium-term bond and the BTC bull market resonated in the past three BTC bull market cycles.

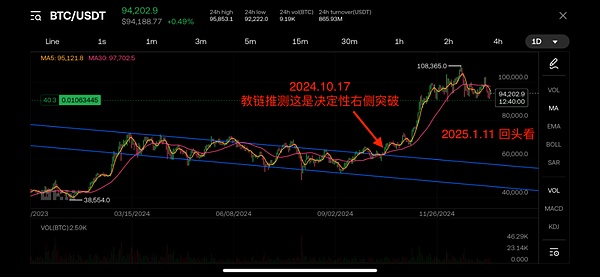

When did BTC make a decisive right-side breakthrough? Probably in October 2024. Let’s look back at the speculation in the article Big Breakthrough: Another Conjecture of BTC’s Anti-Power Law Growth published by Jiaolian on October 17, 2024: “This fundamental weekly K-line opened on October 14 has a good chance of becoming a decisive upward breakthrough of the downward channel built since the beginning of this year. Zoom out a little and expand your vision, and you will see it more clearly. … At present, we may be on the eve of the launch of this round of fast bull cycle. It’s just a matter of time.”

Looking back now, it is very clear. It was indeed a decisive right-side breakthrough at that time. The two blue straight lines that squeeze the channel in the figure are still the two that Jiaolian drew at the beginning, and they have not changed. Using this as a reference, we can also clearly see the shape of the right-side breakthrough.

From the last bottoming out before BTC broke through on the right side, roughly in September 2024, to the one-year medium-term bond yield bottoming out in December, there was a difference of about 3 months.

Financial issues always bring us a lot of myths. Or, at least, they bring a lot of strange things to the teaching chain.

Are mainstream financial propositions really so natural? The teaching chain believes that it is not necessarily so.

For example, the decline in treasury bond yields indicates that the economy is in the risk of deflation. But the decline in yields is clearly the market's pursuit of treasury bonds. Doesn't this show that the market recognizes the country's credit?

Why do we say that? It is because of a common idea that capital will only chase after government bonds when there are no better investment opportunities in the market.

But isn't the economic development of the entire country created by the market players?

So if the government bond yield goes up, it is a reflection of economic activity.

This dualistic concept really puts the state and the market in opposition to each other. This opposing dualism is not suitable for the Chinese economy, because China is a model of national complementarity with the state-owned economy as the main body and the private economy as the supplement.

Therefore, what the Chinese bond yield indicates may only represent the activity of some economic players.

When will the correlation between the rebound of the Chinese bond yield and the BTC bull market disappear? Perhaps when the state begins to participate in it, the correlation pattern will change.

At least before then, if the correlation pattern is expected to continue, then holding BTC should not be bearish on China's economic recovery in 2025. Because it is very likely that without the latter, there will be no BTC bull market in 2025.

Brian

Brian