Deng Tong, Golden Finance

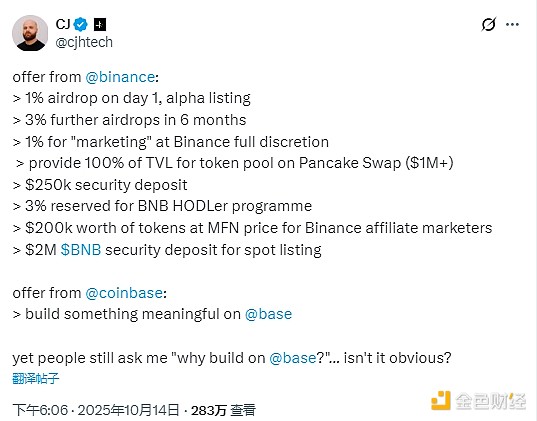

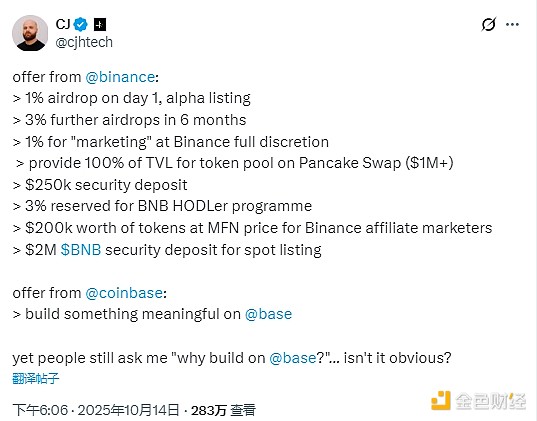

On October 14th, CJ Hetherington, CEO of Limitless Labs (backed by Coinbase Ventures), posted on X, directly criticizing Binance's high listing fees.

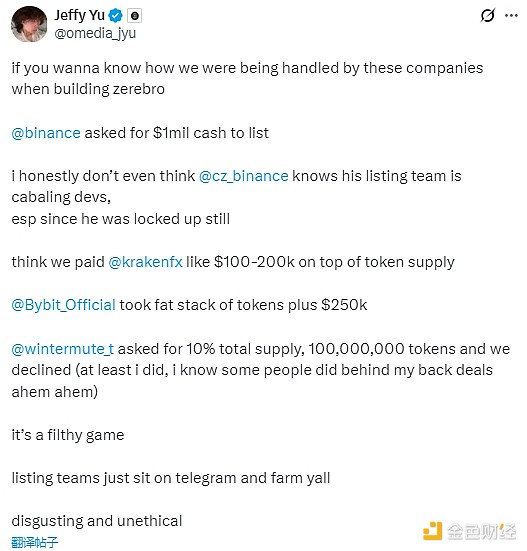

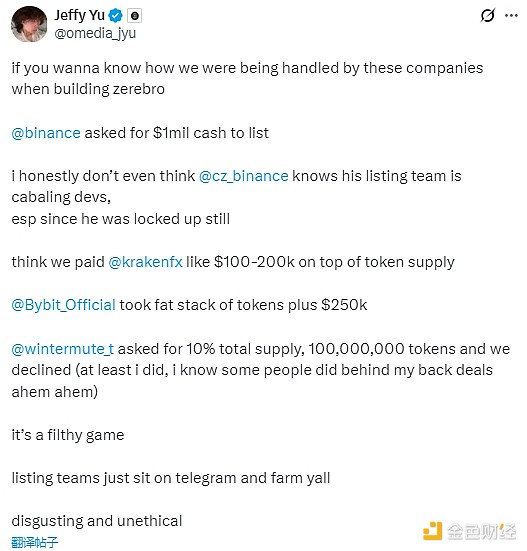

On October 11th, Jeffy Yu, co-founder of Zerebro, posted on X, exposing the issue of exchange listing fees, calling it a dirty game, disgusting, and unethical. He also listed the listing requirements of several exchanges.

Once the news on the 14th was released, it quickly gained traction within the industry, with leading exchanges like Binance, Hyperliquiquit, and Uniswap responding to the "listing fee" issue. Back in mid-September, Coinbase also addressed the "listing fee" issue in a post on X.

One or Two Tweets Sparked a "Listing Fee" Controversy

On October 11, 2025, Zerebro co-founder Jeffy Yu first exposed the exchange listing fee issue in a post on X:

If you want to know how we were treated by these companies when we started Zerebro, @binance demanded $1 million in cash for listing.

Honestly, I don't even think @cz_binance knew their listing team was secretly manipulating developers... I even think we paid @krakenfx $100,000-200,000 in addition to the token supply.

@Bybit_Official took a bunch of tokens, plus $250,000. @wintermute_t asked for 10% of the total supply, or 100M tokens, but we refused (at least I did, I know some people did it behind my back, ahem). This is such a dirty game, listing teams are just sitting on Telegram pumping money, you guys are disgusting and unethical.

Under this tweet, Binance officially responded:

Hello, after checking with our coin listing team, we confirm that we currently have no communication record regarding your coin's listing. We recommend that you proceed with caution and confirm whether the person you are contacting is a scammer.

Other netizens commented:

Many projects have been killed due to listing fees and lock-up fees. Exchanges hold all the power, and unfortunately, it's a one-way relationship. This needs to change. Why are you lying, haha. Kraken and Binance are free, idiot. Subsequently, the "listing fee" issue continued to ferment, and leading exchanges were caught up in the "listing fee" controversy. On October 14th, Limitless Labs CEO CJ Hetherington posted again on X, directly criticizing Binance's high listing fees.

· Airdrop 1% of tokens on the first day (Alpha launch phase)

· Airdrop an additional 3% over 6 months

· Allocate 1% of tokens for “marketing”, determined by Coin Security Rights

· Provide 100% of TVL (total liquidity, over $1 million) for the token pool on PancakeSwap

· Post a $250,000 margin

· Reserve 3% of tokens for the BNB Holder Program

· Provide $200,000 worth of tokens to Binance affiliates at the best price

· Post an additional $2 million worth of BNB as margin for spot listings

II. Responses from Leading Exchanges

1. Binance

On October 15, Binance Customer Support, the official account of Binance, posted on the X platform:

“We have noticed the post published by CJ on the X platform on October 14, 2025, which contains false and defamatory accusations against Binance. These accusations are clearly intended to mislead the community and undermine the fairness of Binance’s listing process.

3. Uniswap

On October 15th, Uniswap founder Hayden Adams stated:

"Decentralized exchanges (DEXs) and automated market makers (AMMs) have achieved the ability to provide free listing, trading, and liquidity support for any asset. If a project is willing to pay high listing fees, its purpose is marketing and promotion, not to meet market structural needs. We are proud to play a role in achieving this goal."

4. Coinbase

As early as September 14th, Coinbase CEO Brian Armstrong wrote on the X platform about the listing fee issue:

Coinbase has received numerous questions regarding how and why assets are listed. We have developed a guide to provide greater transparency on how this works. Listing is free and metrics-based, with all assets evaluated according to a unified standard.

According to the Coinbase Digital Asset Listing Process Guide, listing application times can vary significantly, from a few hours to several months, depending on factors such as the complexity of the asset and the completeness of the submission. A complete and well-prepared application is crucial for an efficient review, which typically follows the following steps: application submission, business evaluation, core review, communication with the issuer, and approval. Shortly after Jesse Pollak, head of Coinbase's Base Network, stated that exchange listing fees should be "0%," calls arose for Coinbase to "lead by example" by listing BNB. In response, on October 16th, Coinbase added BNB to its listing roadmap. Later, CZ responded to Justin Sun regarding Coinbase listing BNB: "Thank you to all our colleagues for your support. Listing the third-largest cryptocurrency by market capitalization should be a no-brainer. It has excellent liquidity, trading volume, and an ecosystem. Not listing it would be a loss for the exchange itself." He also suggested that Coinbase list more BNB Chain project tokens. CZ stated that Binance has already listed multiple Base Chain project tokens, while Coinbase appears to have not yet listed any BNB Chain project coins, and BNB Chain is a public chain with a more active ecosystem.

III. Industry Discussions on "Listing Fees"

1. "CEXs Have Too Much Power"

Some industry insiders believe this phenomenon demonstrates that centralized exchanges (CEXs) have too much power over new projects.

Animoca Brands' Mo Ezeldin once stated, "Exchanges have too much power." He believes that listing fees and token demand create an unhealthy cycle that ultimately harms projects and erodes positive momentum.

Mavryck Network founder Alex Davis expressed support for DEXs, believing they can provide a more sustainable model for the future. Davis stated, "All this drama surrounding CEXs highlights the need for decentralized exchanges (DEXs) and further transparency. Clarify listing rules and ensure reasonable listing practices. The point of cryptocurrency is to eliminate third-party intermediaries, not create new ones to earn fees." 2. "Who is fairer and more transparent?" Some CEXs charge "listing fees" to meet operational costs. While this can help generate initial publicity for projects and attract new users, it has also drawn criticism for transparency and fairness. Unlike CEXs, DEXs allow projects to list directly without intermediaries or large token distributions, potentially providing a path to fairer entry. Crypto.com CEO Kris Marszalek previously urged global regulators to investigate major cryptocurrency exchanges following the market crash. While not directly related to listing fees, his call for increased auditability, public disclosure of clearing mechanisms, and regulatory oversight reflects the broader industry demand for greater transparency among CEXs.

3. Is "Zero Listing Fees" Really Achievable?

Can the "zero listing fees" advocated by Coinbase, Hyperliquiqui, and Uniswap truly be achieved across the entire industry? Clearly, under this model, listing offers advantages such as transparency, openness, and fairness. However, there are also issues such as junk coins and unrealized tokens, and a lack of risk control may pose greater risks to users. Therefore, for most exchanges, while "listing fees" have been criticized, they are, to a certain extent, a screening mechanism and will not be universally implemented in the short term.

Weatherly

Weatherly