After two weeks of fluctuations around $60,000, the bulls tried to challenge $65,000 from August 23 to 25. Unfortunately, however, Bitcoin quickly fell after briefly touching $65,000", not only wiping out all the gains of the past three days, but also falling below the key support level of $60,000, causing the bullish sentiment that had just recovered to drop to the freezing point again. From the weekly K-line, Bitcoin's current round of rebound is still suppressed by the downward trend line, and even failed to touch the downward trend line, which also makes more and more people believe that this round of rebound has peaked. In fact, from the technical trend point of view, Bitcoin is currently in a wedge consolidation, waiting for a change. Although the price of the currency has been suppressed by the downward trend line, the support of the upward trend line is still good. This trend of lower highs and higher lows is actually a manifestation of the gradual convergence of the currency price. In addition, since there is no quadruple top in technical analysis, the fourth time the price of the currency touched $70,000 means that the previous three times of inducing more are not true. Therefore, the repeated fluctuations of Bitcoin at high levels may be a wash-out behavior rather than a top.

After the market continued to soar, the market trading volume has risen sharply from an average of $120 billion per day last week to $450 billion this week. The surge in trading volume not only reflects the high sentiment of the market bulls, but also suggests that some funds are quietly withdrawing. From November 10th to November 13th, when the market rose the most violently, institutions such as Paradigm and DWF almost continuously transferred various types of altcoins to the exchange, and the intention of dumping was very obvious. In addition, the ancient ICO address and the high-winning whale also began to reduce their holdings of ETH on a large scale. It is worth noting that during the continuous surge in the market, the futures position continued to grow significantly, indicating that the shorts still chose to fight against the market trend. Obviously, neither the long nor the short sides will give up until the winner is determined. So, which signal is more significant, the trend or the institution?

The formation of a trend is a process from quantitative change to qualitative change, and the same is true for the collapse of the trend. Only when the number of "traitors" in the group team accumulates to a certain level, the trend will change fundamentally. Although the market's rapid rise on November 13 has approached the level of shipments (the previous article mentioned that the shipment volume is usually 5 times the benchmark volume, and the transaction volume of 556 billion US dollars on November 13 is very close to 600 billion US dollars), the first emotional climax is usually not enough to shake the trend (the climax may be the second and third time). Even if 556 billion US dollars has constituted the sky-high volume of this round of rebound, according to the theory of technical analysis, the market still has a chance to reach a sky-high price for a period of time after the sky-high volume. Therefore, for most currencies with strong trends, the high point of November 13 will continue to be refreshed.

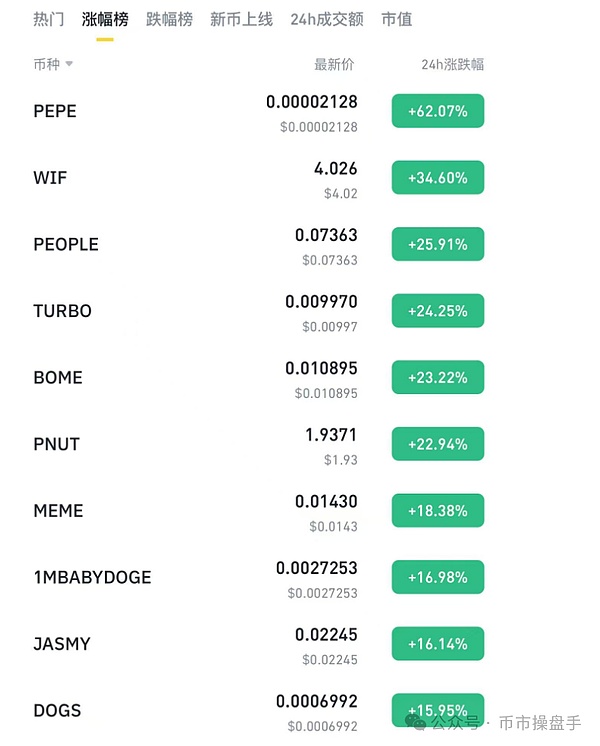

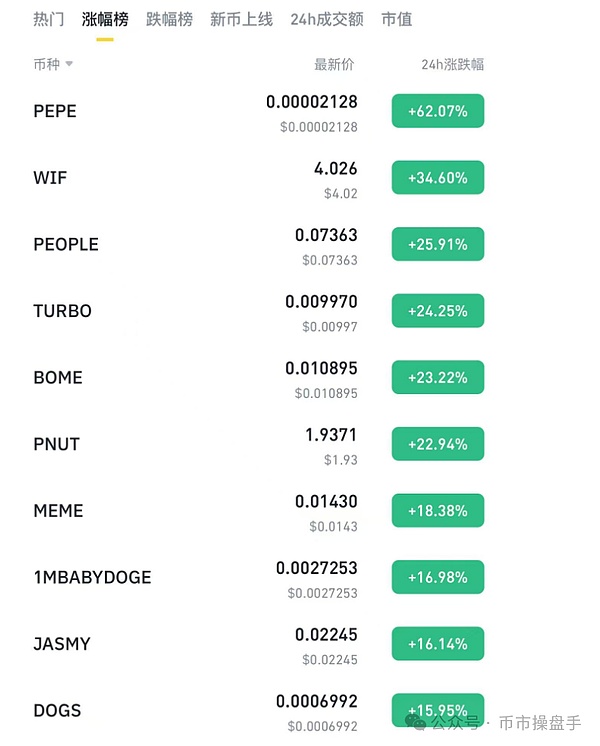

After nearly a year of brewing, the MEME coin market has finally ushered in a concentrated outbreak of FOMO sentiment. On November 14, CoinMarketCap data showed that among the top 100 currencies by market value, the number of MEME coins has reached 15, an increase of nearly 50% from July. What's even more exaggerated is that from November 13 to 14, the top ten currencies on Binance's growth list were all MEME coins.

Driven by FOMO sentiment, the trading volume of the MEME coin sector on the 13th reached an astonishing 37%, which not only far exceeded the 26% at the peak of this year's AI market, but also exceeded the 30% at the peak of the previous bull market DeFi Summer. The trading congestion of the MEME coin track has reached a record level. It is hard to imagine that more than one-third of the funds in the market have been in an extremely speculative state, not to mention that there has never been any hot spot in the history of the crypto market that can maintain a trading share of more than 30% for a long time. Therefore, the author tends to believe that the emotional peak of the MEME market has appeared, and the enthusiasm for speculation will gradually ebb in the future. However, it should be emphasized that since the top hot money from all walks of life has been deeply connected, the MEME market will still be repeatedly hyped, and the money-making effect will continue for a long time.

Many opinions regard the crazy rise of MEME coins as a typical bubble boom. In fact, there are two positive signals behind the rise of MEME coins: First, after being repeatedly harvested by the high FDV model, the awakening forces of the market began to challenge the old order dominated by VC. By voting with their feet on VC coins, they forced the market to re-establish a fair issuance system and strive for more voice and pricing power for the community. Second, the madness of the MEME market means that the funds with the highest risk preference in the market are returning at an accelerated pace, which also shows that funds have shifted from absolute value to price elasticity. According to past experience, the height of the leading sector determines the height of the bull market, and the amazing increase in MEME coins also means that the level and sustainability of the bull market are likely to far exceed expectations.

As for the driving logic of this round of bull market, asset tokenization may become an important breakthrough. Recently, Tether and Visa, two giants, launched Hadron and VTAP, respectively, to launch asset tokenization platforms. The former aims to simplify the tokenization process of everything from stocks to bonds, stablecoins, loyalty points, etc., and open up new ways for a wider audience to issue and invest in emerging technology markets. Its service groups are financial institutions, governments, or private companies. The latter will help banks issue stablecoins and use them in their networks. Spanish bank BBVA is one of the first adopters. In addition, Brian Quintenz, policy director, Michele Korver, regulatory director, and Miles Jennings, general counsel of a16z, also jointly wrote that the channel for constructive engagement with regulators and legislatures has been opened. As the regulatory system becomes clearer, it has become possible for project parties to explore blockchain services and issue coins.

Before the arrival of the asset tokenization trend, Wall Street giants BlackRock and Franklin Templeton were already pioneers in the field of asset tokenization. The former was one of the first institutions to enter the tokenized money market fund, and its asset management scale has reached US$1 billion. The latter also entered the tokenized market fund market by issuing BUIDL tokens and used them as collateral for DeFi transactions. Compared with stablecoins, the advantage of BUIDL tokens is that they can continue to earn returns while serving as collateral. This may reshape the competitive landscape of the stablecoin market. Perhaps after Trump took office, the RWA wave is getting closer and closer to us.

In terms of operation, after the leading sector showed an extremely high valuation premium, the market's latecomers began to enter the market. This week, old altcoins represented by XRP and ADA have continued to surge, driving the entire altcoin sector to recover. As the bull market signal has gradually become clear, if you have missed the front row (BTC+MEME) and the back row (XRP+ADA), then the old kings that are still at the bottom (such as DOT, ATOM, ICP, FIL, etc.) are undoubtedly a good choice to bet on the rebound.

Jasper

Jasper