Author: Chu Yan

At present, exchange OTC is the main channel for investors in the currency circle to deposit and withdraw funds. Before the release of the "September 4th Announcement" in 2017 Investors transfer fiat currency directly to exchange accounts to purchase virtual currencies such as Bitcoin. After the "September 4th Announcement" was released, the country increased its supervision of the industry, so the exchange's OTC business was derived. The exchange no longer accepted users' legal currency, but became a platform similar to Taobao that only provides OTC buying and selling order information. Assist users to conduct deposit and withdrawal transactions with merchants, and the exchange does not charge any fees during the entire process.

However, with the popularity of virtual currencies such as USDT and their own advantages, more and more black and gray industries use virtual currencies as a tool for money laundering and e-commerce. As a media tool for illegal and criminal activities such as fraud, OTC exchanges have become the business with the greatest criminal risk in the currency circle. Among the typical cases recently jointly issued by the Supreme People’s Procuratorate and the State Administration of Foreign Exchange to punish foreign exchange-related crimes, there are two cases involving OTC business in the currency circle. Below, the author will analyze the legal risks existing in the OTC business of the currency circle based on cases.

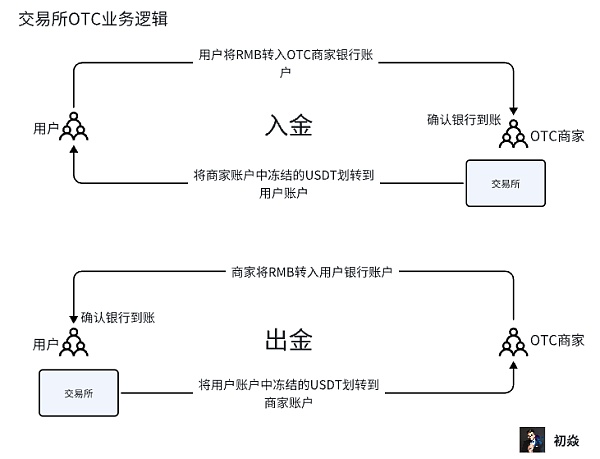

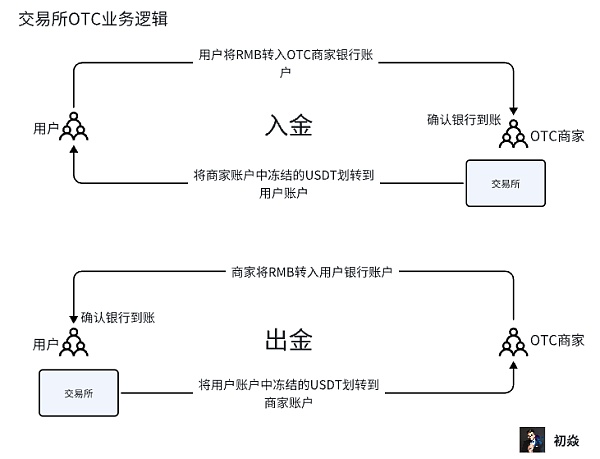

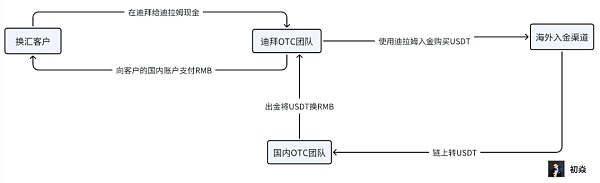

Exchange OTC business logic

In analyzing legal risks Before proceeding, we first need to understand the business logic of the exchange's OTC. From the figure, we can clearly see that the two parties in the entire OTC business are users and OTC merchants. As a platform, the exchange provides transaction matching and ensures transaction security for both parties. Users Merchants can obtain transaction order information on the platform and transfer funds off-site through bank cards, Alipay, WeChat and other channels. The transaction target USDT and other virtual currencies are equivalent to transferring from one account on the platform to another account. How does this transaction model involve illegal and criminal activities?

It can be clearly seen from the above figure that the two parties in the entire OTC business are users and OTC merchants. As a platform, the exchange provides transaction matching and ensures transaction security for both parties. Users and merchants obtain transaction order information within the platform and transfer funds off-site through bank cards, Alipay, WeChat and other channels. The transaction target USDT and other virtual currencies are equivalent to transferring from one account on the platform to another.

Illegal business crimes involving currency OTC business

The two typical currency-related cases released by the Supreme People's Procuratorate and the State Administration of Foreign Exchange both involved the crime of illegal business operations.

Article 225 of the "Criminal Law" stipulates that the crime of illegal business refers to violation of national regulations and one of the following illegal business behaviors: Anyone who disrupts market order and the circumstances are serious shall be sentenced to fixed-term imprisonment of not more than five years or criminal detention, and shall also or solely be fined not less than one time but not more than five times the illegal income; if the circumstances are particularly serious, he shall be sentenced to fixed-term imprisonment of not less than five years and shall be fined not less than one time the illegal income. A fine of not less than five times but not more than five times or confiscation of property:

(1) Operating franchises and specialty items or other restricted sales and purchases stipulated in laws and administrative regulations without permission Articles;

(2) Buying and selling import and export licenses, import and export certificates of origin, and other business licenses or approval documents stipulated in laws and administrative regulations;

(3) Illegal operations of securities, futures, and insurance businesses without approval from relevant state authorities, or illegal fund payment and settlement business;

(4) Other illegal business activities that seriously disrupt market order.

The legal interest protected by the crime of illegal business operations is market order. Article 96 of the "Criminal Law" stipulates that violation of state regulations refers to violation of laws and decisions formulated by the National People's Congress and its Standing Committee, administrative regulations, prescribed administrative measures, decisions and orders issued by the State Council . Currently, industry regulatory documents such as the September 4th Announcement and the September 24th Notice issued by the Supreme People’s Court, the Supreme People’s Procuratorate, the People’s Bank of China and other ministries and commissions do not fall under national regulations.

For the behavior of "illegal engagement in fund payment and settlement business" in paragraph 3, the "Concerning the Handling of Illegal Engagement in Fund Payment and Settlement Business, Illegal Trading of Foreign Exchange" Article 1 of the Interpretation of Several Issues concerning the Application of Law in Criminal Cases stipulates that any person who violates national regulations and falls under any of the following circumstances shall fall under the category of "illegal engagement in fund payment and settlement business" as stipulated in Article 225, Paragraph 3 of the Criminal Law: < /p>

(1) Use acceptance terminals or network payment interfaces to pay monetary funds to designated payers in illegal ways such as fictitious transactions, false prices, transaction refunds, etc.

(2) Illegally providing others with the service of cashing out the company's bank settlement account or transferring the company's bank settlement account to a personal account;

(3) Illegally providing check cashing services to others;

(4) Other situations of illegally engaging in fund payment and settlement business .

In an article published by the Shanghai Rule of Law News, the Pudong New District Prosecutor believed that accepting funds from others through an account under actual control, and then according to customer order requirements Realizing the exchange of virtual currency and legal currency, and making profits from it, acting as an "intermediary", such as using mainstream virtual currencies such as Bitcoin and Tether as stable currencies to achieve cross-border payment and settlement of legal currency, its behavior violates the "Commercial Banking Law" It stipulates that endangering the order and security of the payment market falls under the "other illegal engagement in fund payment and settlement business" in Article 1, Paragraph 4 of the above-mentioned "Interpretation", and can be convicted and punished for the crime of illegal business operations.

But the author believes that users and OTC merchants complete the purchase and sale of USDT through the transaction matching information provided by the exchange, thereby making virtual currency investments. Virtual currencies such as USDT and BTC are virtual commodities, which are essentially equivalent to users purchasing goods on platforms such as Taobao and Pinduoduo. In this process, the RMB between buyers and sellers is transferred through bank cards, Alipay, WeChat and other channels outside the platform, while the purchased virtual commodities such as USDT and BTC are transferred from the seller's platform account to the buyer's account. Regarding this behavior, the author It is believed that it should not be regarded as illegally engaged in fund payment and settlement business in illegal operations.

"Interpretation on Several Issues Concerning the Application of Laws in Criminal Cases of Illegal Fund Payment and Settlement Business and Illegal Trading of Foreign Exchange", which violates the provisions of the national It stipulates that those who engage in illegal foreign exchange buying and selling activities such as buying and selling foreign exchange or buying and selling foreign exchange in disguise, disrupting the order of the financial market, and the circumstances are serious shall be convicted and punished for the crime of illegal business operations in accordance with the provisions of Article 225, Paragraph 4 of the Criminal Law.

Although stablecoins such as USDT and USDC are linked to the U.S. dollar and are minted and issued through the issuer’s collateral in the bank, stablecoins cannot be equated with foreign exchange. . Article 3 of the "Foreign Exchange Management Regulations" gives a clear definition of foreign exchange. Foreign exchange refers to the following means of payment and assets expressed in foreign currencies that can be used for international settlement:

(1) Foreign currency cash, including banknotes and coins;

(2) Foreign currency payment vouchers or payment instruments, including bills, Bank deposit certificates, bank cards, etc.;

(3) Foreign currency securities, including bonds, stocks, etc.;

(4) Special Drawing Rights;

(5) Other foreign exchange assets.

The "Notice on Preventing Bitcoin Risks" issued by the People's Bank of China and other five ministries and commissionsclarifies that Bitcoin is not issued by the monetary authority and does not have legal authority. Monetary attributes such as compensability and compulsoryness are not the real currency, but a specific virtual commodity. Some jurisprudence in judicial practice also clarifies that virtual currency is a virtual commodity. Buying and selling virtual currency through RMB is equivalent to buying and selling virtual goods. After investors obtain investment income, they withdraw the virtual currency and exchange it back for RMB. There is no foreign exchange purchase or sale in the entire process and evasion of foreign exchange supervision. Therefore, it should not constitute illegal foreign exchange trading.

Typical cases constituting the crime of illegal business operations

Although stable currencies such as USDT and USDC are not foreign exchange, in two typical cases from the Supreme People's Procuratorate and the State Administration of Foreign Exchange, the perpetrators committed illegal business crimes for buying and selling foreign exchange in disguise. Why is this? First, let’s sort out the OTC business processes of these two cases.

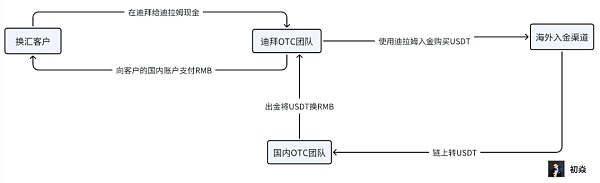

Typical Case 1: Illegal business case of Zhao and others

From the picture above, you can see that Zhao’s team is in Dubai Collect dirham cash from customers, then pay RMB to the customer's domestic account, and then use virtual currency as a medium to realize the return of funds in the form of "Dirham-USDT-RMB", which is equivalent to using virtual currency as an intermediary tool to achieve The exchange of foreign exchange and RMB is a disguised purchase and sale of foreign exchange, and he will ultimately be held criminally responsible for the crime of illegal business operations.

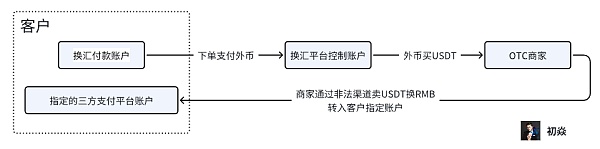

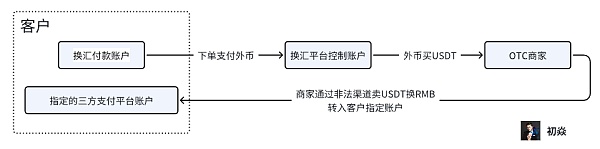

Typical Case 2: Case of Guo Mouzhao and others illegally operating and assisting information network criminal activities

In case 2, Customers place orders through the payment platform and pay foreign currencies to overseas accounts controlled by the platform. The platform uses foreign currencies to purchase USDT, which is converted into RMB through OTC merchants using illegal channels and transferred to the domestic account designated by the customer. The payment exchange platform also uses USDT as an intermediary tool. Helping customers bypass national foreign exchange supervision and indirectly realize the exchange of foreign currencies and RMB is a disguised purchase and sale of foreign exchange.

The above-mentioned typical cases are the same as the huge underground bank case cracked by the police in Qingdao, Shandong some time ago.Criminal gangs all use virtual currency as foreign currency to exchange with RMB. Media, evading state supervision of foreign exchange, transferring funds and converting funds for various upstream crimes and money laundering teams, posing a major threat to the social and economic order and national financial security.

In addition, it can be seen that in several cases, the public security organs cooperated with the foreign exchange management department, and used three-party technology companies to assist in investigating on-chain transaction records. , comparing the on-chain wallet transaction records with off-chain bank account flows, and fixing the evidence of the entire illegal currency exchange, which also reflects the regulatory authorities’ ideas of cracking down on the virtual currency OTC business.

Summary and suggestions

In summary As mentioned above, the author suggests that some entrepreneurial projects under the banner of cross-border payment and payment platforms that support the recharge of virtual currencies such as USDT need to carefully evaluate their own business. If we assist or support users to open various foreign currency debit cards and prepaid cards, users can deposit USDT using RMB, and then exchange it for foreign currency on the platform for payment and consumption. The entire transaction process will realize the exchange of RMB-USDT-foreign currency. This behavior is the same as the above-mentioned typical cases. It uses virtual currency as a media tool to evade foreign exchange supervision. It is very likely to be suspected of buying and selling foreign exchange in disguise, constituting the crime of illegal business operations.

And because these platforms support on-chain recharge of virtual currencies, they need to conduct anti-money laundering compliance reviews on the chain and adopt KYT. The on-chain fund review tool provides advance warning for virtual currencies flowing into the platform and traces the source afterwards, thus minimizing the inflow of illegal and criminal suspects into the platform and increasing the platform's criminal risk.

JinseFinance

JinseFinance