Author: NingNing

In early February, altcoins in CEX and AI Agent/MeMe coins on the chain experienced a terrible retracement. Everyone has a question in mind: where did the liquidity (AKA, money) go?

The answer may be simpler than you think - chasing certain returns.

When high FDV/low market value altcoins in CEX are constantly unlocked and dumped or OTC shipped, and when the P-boys on the chain are rolled into a red ocean, funds have become tired of the high odds and low winning rate fool game, and began to look for passive returns with certainty and compound interest effects.

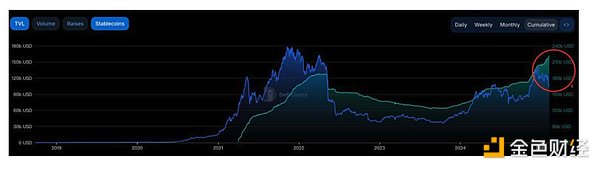

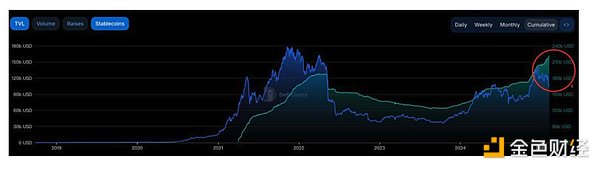

Over the past 25 years, the growth rate of stablecoins has become steeper, while the TVL of the entire market has been declining

Thus, the PayFi track has raised its head in the winter mute.

Like other cutting-edge narratives, the concept extension of PayFi is in the process of evolution and iteration, from the initial "Buy First, Never Pay" payment process paradigm innovation to the solution for payment and financing scenarios defined by Messari. Behind this change is the evolution of the industry's thinking from narrative maximalism to cost reduction and efficiency improvement pragmatism.

Let's first look at a set of cross-border payment industry data:

Global prepaid account locked funds: $4 trillion

Cross-border payment fees: average 7%

Settlement cycle: 2-3 days

Unbanked population: 1.4 billion

It can be seen that the cross-border payment industry has serious problems of high cost and low efficiency. The root cause of the problem is the structural defects of the traditional financial system.

In the past decade, we have witnessed three waves of decentralized financial innovation, including ICO, DeFi, and http://Pump.fun paradigm launch platform, each of which is subverting the asset issuance and trading paradigm of traditional finance.

PayFi is doing something similar, it is trying to reconstruct the entire payment financing infrastructure. This includes:

Real-time settlement (T+0) instead of T+2

Programmed credit instead of manual review

Composability instead of closed system

How can PayFi achieve the above goals?

As a pioneer in the PayFi track, Huma Finance provides a standard paradigm consisting of a transaction layer, currency layer, custody layer, compliance layer, financing layer, and application layer:

1. Transaction Layer

This is the foundation of the entire system. Mainly dominated by two public chains:

Solana: 65,000 TPS, sub-second confirmation, fees as low as $0.0024

Stellar: 5 seconds confirmation, fees about $0.00005

Why can these two chains dominate PayFi? Because they solve the three core requirements of payment: high throughput, low latency, and controllable costs.

2. Currency Layer

This layer is mainly composed of stablecoins. USDC plays a core role here. Interestingly, USDC accounts for 22% of the market value and 55% of the transaction volume. USDC is becoming a "payment-level" stablecoin, while USDT is more of a "store-of-value" stablecoin.

3. Custody Layer

This may be the most underestimated layer. It solves a key problem: how to safely manage large amounts of funds.

Major players include: Fireblocks, Copper, Cobo.

They provide not only "custody", but a complete framework for fund operations.

4. Compliance Layer

Talking about compliance in the crypto world seems a bit out of place, but this is precisely the key to distinguishing PayFi from traditional DeFi. The core functions include: KYC/AML integration, transaction monitoring, risk assessment, and compliance reporting.

5. Financing Layer

This is the most innovative part of the entire architecture. It achieves things that are impossible in traditional finance:

Huma's innovations in this layer are particularly worthy of attention:

6. Application Layer

This is a layer directly facing users, including:

Payment applications (Helio, etc.)

Cross-border remittances (Bitso x Felix)

Corporate payments (Rain)

Micro-credit (Jia)

The market value of stablecoins increased by 57% to $204 billion in 2024. At the same time, Huma and Arf's monthly payment financing increased from $63 million to $136 million, showing a strong growth trend that is de-correlated with market fluctuations.

I personally hold an optimistic accelerationist attitude towards PayFi. It is neither the End Game of finance nor a short-lived narrative, but an ongoing "disruptive innovation" experiment.

History tells us that those who bet on "disruptive innovation" and adhere to long-termism often win more than swing masters and on-chain gamblers.

According to the information I have learned, Huma Finance will hold TGE in Q2 this year. Before that, the only way for ordinary investors to bet on PayFi, a "disruptive innovation", was to deposit money into the payment financing and lending pool deployed by Huma Finance on the Solana chain.

In order to lower the threshold for user participation, Huma Finance reduced the minimum deposit amount from 1000U to 100U and introduced a 7x points Boost mechanism. At present, the stablecoin yield in the second phase of the activity is 13% to 20%. With the potential points airdrop reward, the APY will be higher. If you participate now, you can get an OG LP Status reward and enjoy permanent APY Boost rights.

Currently, the pool with a lock-up period of 6 months is full, and there are still a few vacancies for the lock-up period of 3 months. If you miss this wealth train, don't worry, Huma Finance will open new quotas in late February.

In the current market environment full of uncertainty, there are still $10 billion worth of Bitcoin options (the biggest pain point is $85,000) expiring on March 28. Embracing stablecoin wealth management with real income + investment opportunities with potential airdrops to increase the rate of crit may be one of the best strategies.

Kikyo

Kikyo