Author: Song Song

At the beginning of 2025, Justin Sun and Li Lin, two big names in the currency circle, once again exchanged fire over "30 million US dollars". This dispute is also the latest chapter in the dispute between the two for many years.

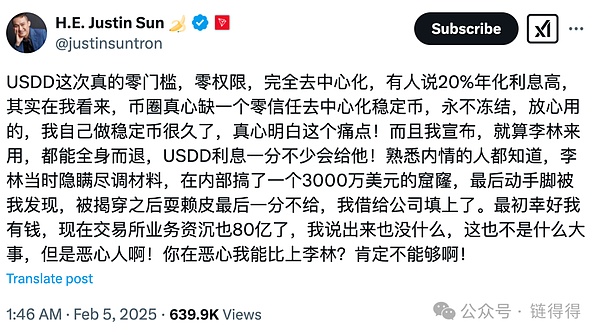

The cause of the incident is that Justin Sun has been constantly promoting his own "high-interest" stable currency product USDD on the community and X recently, and acted as a customer service to answer people's questions. In order to ensure the reliability of USDD and let users use it with confidence, Justin Sun posted on X on February 5 that even if "Li Lin comes to use it, he can get out of it unscathed, and the USDD interest will be given to him!" This broke out the big melon of "30 million US dollars hole".

Sun Yuchen said that Li Lin concealed the due diligence materials when he sold Huobi (now HTX) to him in 2022. The financial situation at the time of delivery was very different from expectations, and there was a $30 million hole that had not been resolved, which forced him to provide emergency financial support to the company and fill it with his own money.

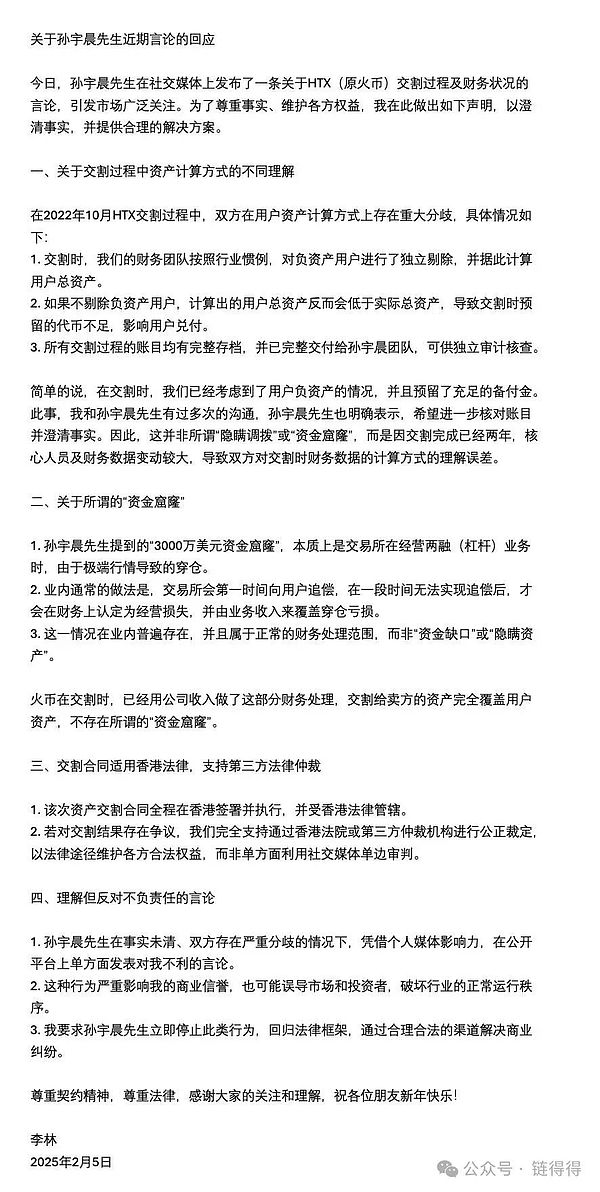

Li Lin responded with a long article saying that the two parties had differences in the calculation method of user assets when HTX was delivered in October 2022. The "$30 million funding hole" mentioned by Sun Yuchen was actually a position-breaking due to extreme market conditions when the exchange operated margin trading, and the financial processing had been completed by the company's income, so it should not be regarded as an undisclosed "financial loophole."

The delivery contract is subject to Hong Kong law. Li Lin expressed his willingness to make a fair ruling through the Hong Kong court or a third-party arbitration institution, rather than unilaterally judging on social media, which would "mislead the market and investors."

Sun Yuchen then responded again that he had filed a lawsuit in Hong Kong and "the money owed will continue to be recovered." So far, Li Lin has not responded.

In fact, this is not the first confrontation between the two. The grievances between Sun and Li began shortly after Huobi was sold.

In October 2022, Li Lin's sale of his Huobi shares caused controversy. In May 2023, Sun accused Li Lin's brother Li Wei in a now-deleted post on X of allegedly obtaining a large number of Huobi's native HT tokens through improper means without paying for them and having sold them. Sun vowed to recover and destroy these HT tokens.

In June 2023, Li Lin filed a legal action against Huobi Global in Hong Kong, claiming that his company X-Spot owned the trademark rights to Huobi. The court ultimately ruled that the exchange could not use the Huobi name.

Now, with the heat raised by the two again, Sun Yuchen launched a two-hour Space on X, with a maximum number of viewers reaching 12,000. Although everyone went to watch it with the mentality of eating melons, Sun Yuchen did not mention much about the feud between him and Li Lin, but instead promoted and introduced USDD.

This also makes many people suspect that Sun Yuchen's revelation this time may just be to attract a wave of traffic to his own products and increase the attention of USDD.

But in any case, Sun Yuchen's revelation has once again made people doubt Huobi's financial and operating conditions. Not long ago, Binance Labs (now renamed Yzi labs and independently operated) under Binance was just accused by industry insiders of suspected major "internal corruption" and had problems such as "currency listing interest transfer" and "nepotism-related transactions".

The problems exposed by these two large exchanges have made people increasingly distrustful of the current industry in terms of risk management and corporate governance. After all, as large head exchanges, their financial transparency and internal operations should be subject to strict scrutiny. This is the case, let alone other small exchanges and companies?

Joy

Joy