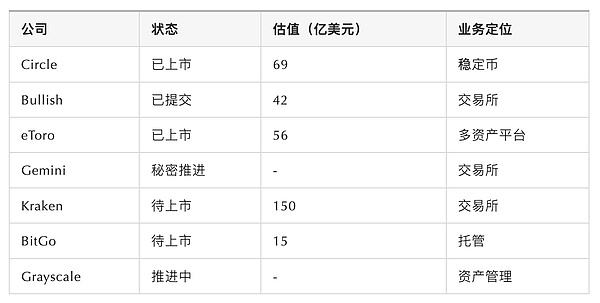

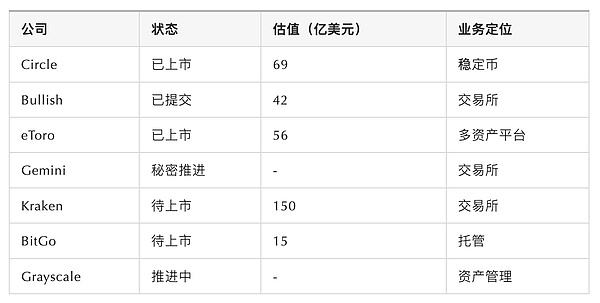

In recent years, the crypto industry has seen a resurgence. Following the crazes surrounding stablecoins, RWAs, and AI+Crypto, the capital market in 2025 is experiencing a surge in the number of crypto exchange IPOs.

Many leading platforms have submitted or are preparing to list on the US stock market, signaling the crypto industry's accelerated integration with traditional finance.

Who is pursuing IPOs? Let’s first look at the hottest Bullish

The Bullish exchange, incubated by Block.one, invested by Peter Thiel and others, and led by former NYSE President Tom Farley, officially submitted an IPO application to the SEC in July 2025. The stock code is BLSH, and it plans to be listed on the New York Stock Exchange.

Amount of funds to be raised: approximately US$629 million

Pricing range: US$28–31 per share

Reserve assets: 24,000 bitcoins

Valuation expectation: up to US$4.2 billion

Gemini twins are also going public

The Gemini exchange, founded by the Winklevoss twins, has also secretly submitted a prospectus to the US SEC IPO documents. Although no public timetable has been announced, the Wall Street Journal reports that its IPO has entered the substantive stages of progress. The founding twins are also legendary in the United States. While studying at Harvard, they created a social networking site and hired a junior to write the code. This junior turned out to be Mark Zuckerberg, who copied the site and renamed it "Facebook." The brothers were also among the earliest Bitcoin whales, publicly stating in 2013 that they held approximately 1% of the total circulating supply of Bitcoin (about 110,000 at the time).

eToro has successfully gone public, with crypto revenue accounting for nearly 40%

In May 2025, eToro was successfully listed on the Nasdaq with the stock code ETOR, and its current market capitalization is approximately US$5.6 billion.

Revenue reached US$192 million in 2024

of which 38% came from crypto trading commissions

Who else is on the road? Kraken, BitGo, and Grayscale are all here

Why are there so many IPOs? Three major driving factors

With the advancement of regulations such as the GENIUS Act, the compliance path for US crypto companies is becoming clear. ETF approval and increased Nasdaq exposure are boosting capital market recognition of crypto assets. With the secondary market warming and revenue growing rapidly, exchanges are entering an ideal window for listing and valuation. In summary, 2025 will be the first "mass IPO" window in crypto industry history. From exchanges to custodians, from stablecoin issuers to asset management companies, a complete "IPO landscape" is emerging. Which crypto platform do you favor to go public next?

Anais

Anais