Source: xPanse World

For June transactions, it will definitely be very "bloody". The data at 2 a.m. today did not sing bearish, but was positive. At the same time, since today is the 613 delivery day, the price of BTC rose from the lowest $66,051 to $69,999, an increase of 6%. It then fell back from $69,999 to $67,500.

zkSync postponed its launch time due to community dissatisfaction caused by the project party's hoarding of a large number of "rat warehouses". The zkSync witch lost almost 60% of the user addresses, causing abuse in the community. zkSync will decide to postpone the launch time, which may put great pressure on the launch of ZK. The event that the project party created a large number of addresses to build a rat warehouse is a double-edged sword. The question of whether to sell or not has become the most important issue for zkSync traders.

If you sell, the selling pressure on the market is huge. Since the mouse warehouse is too concentrated, the airdrop does not constitute a dispersed address, so the expectation of selling pressure is amplified, resulting in greater panic among traders on the market after the launch.

If you don't sell, the project party will control the market, which will lead to the actual controllers of many addresses having their own will. Once a large amount of chips are controlled and not flow into the market, the trading volume will shrink. Under low liquidity conditions, there will be a stable rise, but the price will still cause panic among traders after it is high.

What is the terminal interest rate?

Terminal Rate refers to the highest (or lowest) level that the Federal Reserve expects interest rates to reach during a round of interest rate hikes or cuts. This interest rate level indicates that the Federal Reserve believes that the monetary policy stance has been reached that is suitable for economic conditions and indicates the end of the interest rate hike or cut cycle.

The determination of the terminal rate is based on the Federal Reserve's comprehensive assessment of the economic situation, including the following key factors:

Inflation:One of the main goals of the Federal Reserve is to maintain price stability, that is, to maintain an inflation rate of around 2%. If the inflation rate is too high, the Federal Reserve may raise interest rates to a certain terminal rate to curb inflation; conversely, if the inflation rate is too low, the terminal rate may be lower.

Economic Growth:The level of economic growth also affects the setting of the terminal rate. Strong economic growth may require higher interest rates to prevent the economy from overheating, while weak economic growth may require lower interest rates to stimulate economic activity.

Employment situation:The Fed also pays attention to the job market. High employment and low unemployment are usually accompanied by higher interest rates, while high unemployment may require lower interest rates to support employment.

Global economic environment:Uncertainty in the global economy and monetary policies of other major economies will also affect the Fed's terminal interest rate decision.

The reason for the market decline this time is also mainly due to several positive data, which led to a temporary gap in the market's expectations of a Fed rate cut.

Since Powell revealed in his last press conference that "the unemployment rate will be considered to cut interest rates when it reaches 4%", in fact, the rate has not exceeded 4% for nearly a year, and the latest data is 4%, which is not seriously higher than expected. The Fed has not focused on cutting interest rates in the current environment.

In addition, the Democratic Party has also expressed its hope to urge the Fed to cut interest rates as soon as possible. This news also revealed that in the short term, the Fed's attitude towards cutting interest rates is not high.

When will the interest rate be cut?

At present, all players in the circle are concerned about the Fed's interest rate cut, which means that economic development is moving in a good direction.

After the release of last week's data, the market speculation on interest rate cuts instantly died out, because the data was stable and there was no major adjustment or optimism.

Then the timing of the interest rate cut is more concerned.

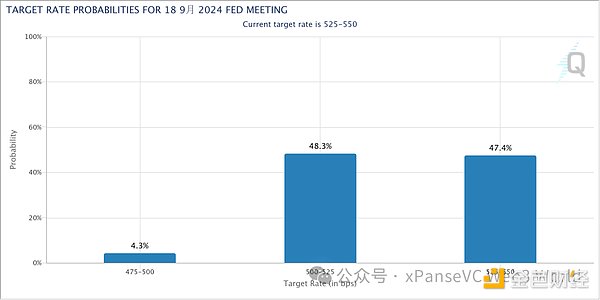

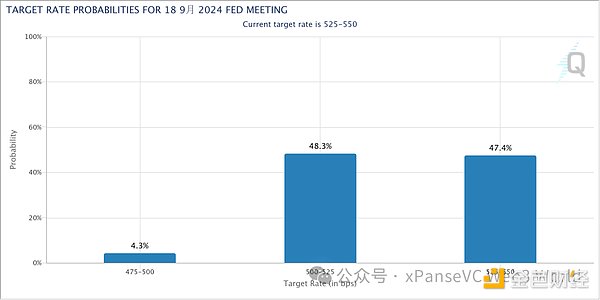

The terminal interest rate is currently displayed on September 18. As of now, the probability of a 25 basis point interest rate cut is 48.3%, which is higher than the probability of 525-550 for no interest rate cut. It is currently the most important turning point.

So for the issue of interest rate cuts, I think the probability of a rate cut in September is the highest.

Will June be a "bloody battle"?

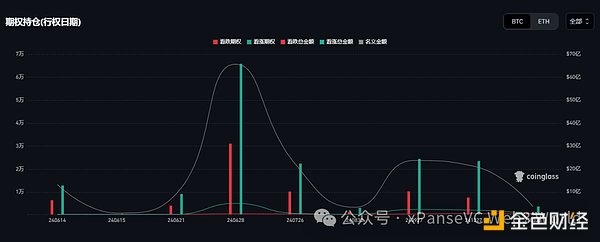

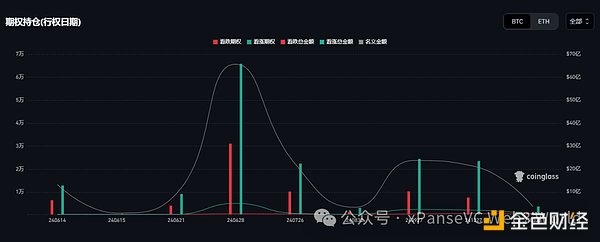

First of all, the market volatility in June may be very large. In the futures market, the main force options market is very bullish, and the current main option position is on the 628 exercise date, and its biggest pain point is $55,000.

Among them, the nominal amount of option positions on June 28 is $6.564 billion, and the number of call options is 65,800, worth $4.454 billion.

Accounting for 67% of the total nominal amount, it shows that the market is strongly bullish on the second half of June. Although the data may show some hawkish views and remarks, the current capital market is optimistic.

The trading in June will definitely be very "bloody". The data at 2 a.m. today did not sing bearish, but was positive. At the same time, since today is the 613 delivery day, the price of BTC rose from the lowest $66051 to $69999, an increase of 6%. Then it fell back from $69999 to $67500.

The weather is too hot now, so everyone should pay more attention to rest. In the end, the market in June will be more volatile, which is a good opportunity for friends who like to play short-term trading.

Miyuki

Miyuki