Author: AI Soros Scott Source: X, @0xScottBTC

Why are cross-border payments sometimes fast and sometimes slow? Where is the innovation of stablecoins, and what challenges are constraining them? This article will dismantle the scenarios of cross-border payments and stablecoin payments, and based on this, make an estimate of the penetration of stablecoin cross-border payments.

Introduction

In a coffee shop, scanning a QR code will "come in seconds"; but when a Shenzhen assembly plant wants to pay $50,000 to a Brazilian supplier, it is often told by the bank: "Expect T+2 to T+3." This is not because the bank's computers can't run, but because three institutional chains - ledger fragmentation, liquidity inertia, and compliance review - have turned technical potential into real resistance. This article first explains how chains slow down cross-border payments, then sees why stablecoins speed up, and in which scenarios they are truly implemented, and finally dismantles the high walls and potential market space that it still needs to climb.

1. Traditional cross-border payment: three institutional chains

1.1 Account book fragmentation

Term explanation|Correspondent Bank: When two banks have no account transactions with each other, a third-party bank will take over the bookkeeping and settlement.

There is no "world central bank account book" internationally. If Kasikorn Bank in Thailand wants to pay US dollars to Banco do Brasil in Brazil, it must first transfer the money to the correspondent bank in New York or London, and the correspondent bank will then transfer it to the receiving bank. Every additional hop means an additional message, an account reconciliation and a transfer fee.

A quick look at the “ledger fragments”

Multi-level correspondent banks → Message encryption and decryption

Different operating time zones → Approval nodes are difficult to synchronize

Charge fees at each level → Final cost increases

1.2 Liquidity inertia

Term explanation|Nostro: The foreign currency account I opened in your bank is used to pre-deposit clearing funds.

Banks must pre-deposit US dollars in correspondent banks to prevent “insufficient balance” from causing clearing failures - this part of the money is lying in the account all day and cannot be invested.

New York cuts off accounts at 15:00 p.m.;

Weekends and holidays are closed for 48 hours;

Instructions from Friday night in Asia often "sleep" until the following Monday.

Two major side effects of liquidity inertia

Idle capital: The company clearly has money in its account, but it cannot be circulated because it is "cross-border in transit."

Implicit costs: opportunity cost of pre-deposited dead money + cross-day interest rate difference.

1.3 Compliance Review

Term Explanation|FATF 40: Global Anti-Money Laundering and Counter-Terrorist Financing Standards.

Term Explanation|OFAC: Office of Foreign Assets Control of the U.S. Treasury Department (Sanctions List).

In cross-border links, each hop must independently perform KYC, AML and sanctions list screening.

The risk control model triggers manual review if there is any doubt;

Time zone + holiday misalignment, instructions are often suspended;

If any node is slowed down, the entire chain will be slowed down.

The core pain point of compliance review

2.1 Shared ledger - multiple hops compressed into “one hop”

Term explanation|Shared ledger: a blockchain database that is jointly maintained by multiple parties and cannot be tampered with.

In the USDC network, the paying bank transfers 50,000 USDC to the address of the receiving bank, and confirms it on the other party’s chain a few seconds later. The three steps of the agent bank, message, and reconciliation disappear at the same time.

2.2 Programmable liquidity - dead money becomes live money

Term explanation|Tri-party Repo: A U.S. debt repurchase agreement brokered by a third-party custodian that can lend liquidity overnight. Glossary | Tokenized T-Bill: A short-term U.S. Treasury token mapped on the chain, which can be called by smart contracts.

J.P. Morgan Onyx: Put Tri-party Repo on the chain, repurchase within the group → cash in seconds.

Franklin Templeton BENJI: Issue Tokenized T-Bill, which can be mortgaged for USDC.

2025 Payment Stablecoin Act: Passed by both houses, allows reserves to hold ≤ 90 days of Treasury bonds and disclose them in real time, and is regulated by the OCC.

Current situation: Dead money can already "pledge Treasury bonds → borrow stablecoins in seconds", but to become a global conventional tool, it still needs to expand the capacity of custodian banks, clearing houses, and regulatory sandboxes.

2.3 Payment is asset management - 0% → 4%+

In Europe and the United States, as long as the reserve ratio is 1:1, more than 80% of the funds can be invested in ≤ 90-day government bonds, with an annualized return of about 4%. The original zero-interest customer balance immediately becomes a profit engine.

3.2 Traditional "fast conditions" scenario

During business hours between London and New York, only one hop to the correspondent bank is needed, and the US dollar can be landed at T+0.5. However, the speed will drop on weekends or when the account is cut off, and stablecoins become the "bottom-line solution" with 24×7 on-chain settlement.

3.3 Traditional structurally slow scenario

Long link: Thailand ↔ Brazil, 2-3 level correspondent bank + weak RTGS → T+2~3.

Weak infrastructure: 7-10% wire transfer rate in Africa and Latin America.

Small amount fragmentation: A freelancer’s $200 salary is diluted by a $20 handling fee.

Debit cut-off blind spot: The dollar flow is suspended for 48 hours on weekends.

In the above scenario, the advantages of a stable currency with one-hop on-chain + Gas < 1% + 24×7 are immediately apparent.

Local currency landing - If the dollar on the chain wants to become legal tender, it still needs a legal FX license and quota.

Regulatory fragmentation - The United States calls it "payment stablecoin", the European Union calls it "electronic currency", and Japan requires "bank issuance".

Reserve transparency - USDC is audited monthly, USDT is only certified; the discount rate and frequency are not unified.

On-chain compliance - Travel Rule requires real-name registration, GDPR restricts cross-border data, and companies must "run both ends".

Macro stability - If banks hoard the same stablecoin, once a redemption crisis occurs, it may impact the short-term Treasury market.

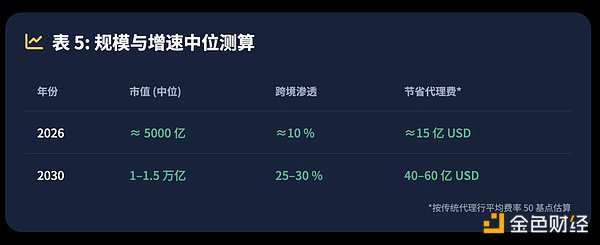

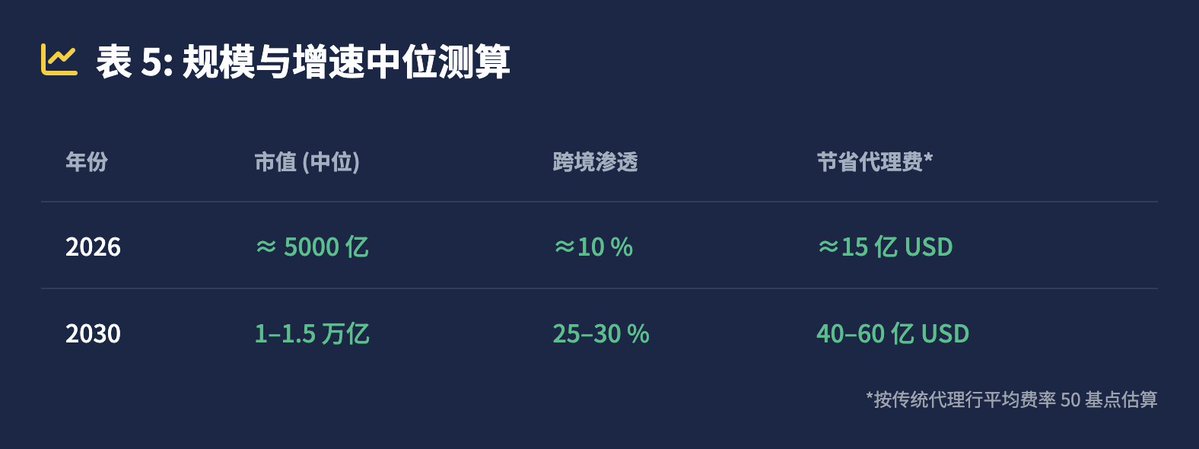

Annual market value (median) Cross-border penetration Savings on agency fees* 2026 ≈ 500 billion ≈ 10 % ≈ 1.5 billion USD 2030 1–1.5 trillion 25–30 % 4–6 billion USD

*Estimated based on the average fee rate of 50 bp for traditional agency banks.

Conclusion

Traditional slowness: ledger fragmentation, dead money account closure, compliance review;

Stablecoin speed: shared ledger + programmable liquidity, and turning zero interest reserve into 4%+ interest rate spread;

Realistic high wall: local currency landing, global regulatory consensus, macro stability still need to be solved.

In a word, stablecoin upgrades cross-border payment from "a long journey of time for space" to "the movement of a pointer on a global shared ledger". The speed is amazing, but what is really subverted is the profit chain of multi-level corresponding banks. As long as regulations, liquidity and governance are finally synchronized on the chain, cross-border payments will no longer be counted by working days, but by "block height".

Jixu

Jixu