Author: Liu Jiaolian

The minutes of the Federal Reserve's September interest rate meeting were released in the early hours of the night, which made the world gasp. Bitcoin (BTC) fell suddenly, retreating from the 30-day line of 62k to the 60,000-dollar line.

To be a banker, you must have the awareness of being a banker, and don't treat the Federal Reserve as a cadre. In the financial game of intrigue and deception, you must believe in these three points: First, the banker must know that he is a banker, but the banker will definitely disguise himself; second, the banker can definitely think of what you can think of, and the banker can also think of what you can't think of; third, in the cruel game of life and death, conspiracy theories may not necessarily die, but naive people will definitely die.

From the official minutes of the Federal Reserve meeting, we can see that there were internal differences in the September meeting. Director Bowman voted against it. There are quite a few voting committee members who actually support a 25bp cut first. The original text of the minutes reads: "However, some participants noted that inflation remains slightly elevated, while economic growth remains solid and unemployment remains low, and they said they would prefer to lower the target range by 25 basis points at this meeting, and some participants said they might support this decision. Several participants noted that a 25 basis point rate cut is consistent with the path of gradual policy normalization, which will give policymakers time to assess the extent of policy constraints as the economy develops. Some participants also added that a 25 basis point rate cut may indicate a more predictable path to policy normalization. "Finally, the conclusion of the meeting on September 18 was released, with a sharp drop of 50bp. (See the article "The Fed's rate cut has landed, and half of the people are wrong" on the teaching chain on September 19, 2024) Obviously, this is the result of the efforts of Fed Chairman Powell to persuade.

This leaves room for "repentance" during the National Day holiday.

On October 1, the report "10.1 Teaching Chain Internal Reference: No War on the Eastern Front, Unrest on the Western Front" was published. Powell denied that a 50bp interest rate cut would become the norm, conveying to the market the tone of not rushing to cut interest rates too quickly, and hitting the market's fantasy of rapid liquidity easing.

On October 5, the report "10.5 Teaching Chain Internal Reference: Non-agricultural Employment, a Thunderbolt" was published. The seasonally adjusted non-agricultural employment population in the United States in September was 254,000, which was expected to be 140,000 (is it outrageous? The actual number is more than 80% higher than expected!), and the accelerated employment growth in September further reduced the need for the Federal Reserve to maintain a large interest rate cut in the remaining two meetings this year.

Soon after, the predicted probability of a 50bp rate cut in November dropped rapidly from over 50% to 0%.

On October 10, today, the Fed released the minutes, which completely nailed the lid of the coffin of the fantasy of a rapid rate cut. Even the probability of a 25bp rate cut is decreasing, while the probability of a pause in rate cuts is increasing.

Some people say that the Fed has predicted China's actions and tricked us through Tai Chi techniques.

On September 18, the signal of a 50bp cut was released to "lure the snake out of its hole." On September 24, we really began to launch a heavy stimulus policy (see the article Hot Thinking After the Central Bank's Big Move on September 25, 2024 in Jiaolian). Soon, on September 27, "A-shares return to 3,000 points, BTC returns to 65,000". Overseas institutions have raised the ratings of A-shares, A-shares have skyrocketed, and retail investors have entered the market crazily.

Then, taking advantage of the fact that A-shares were closed during the National Day holiday and retail investors had nowhere to escape, the sun began to turn to the moon. On October 1, Powell's speech set the tone, and on October 5, the ridiculously high employment data was released to show support.

On October 8, the National Day holiday ended, A-shares opened, and it rose to the daily limit at the opening, then opened high and went low. The next day, on the 9th, it continued to fall sharply, stepping back on the 5-day line. A large number of new leeks were harvested. The minutes were released on October 10, revealing the true face.

In fact, the Fed's "dragon tail swing" not only cut the leeks chasing the A-share market, but also the bond speculators with perfect logic.

If the interest rate is cut, the bond yield will fall, so the bond will rise. This is correct. However, the correct sutra is misrepresented by the mouths of Internet celebrities. When the Fed's interest rate cut landed on September 18, Internet celebrities began to advocate rushing for US bonds. In fact, whoever believed it was a fool. See the picture:

See it? When the Fed's interest rate cut landed, the US bond yield had passed the low point and began to rebound. In just half a month, it soared from 3.7% to 4%, which means that friends who were fooled into rushing for US bonds at that time have lost more than 7% of their principal. When did Wall Street buy in? It started in May - 4 months in advance!

When retail investors play with the dealer, think about why you can win? If you are not sure that you will win, then you will definitely lose, at least nine times out of ten.

If the Fed's interest rate meeting is a performance packaged with professionalism and seriousness, then the leeks are the big fools who are too deep into the performance and take the performance seriously!

The best way to deal with this kind of teasing is what the teaching chain summarized in the 10.9 internal reference yesterday, "Have your own rhythm, not be led by the market", which is what the teacher said, "You play yours, I play mine."

To be able to do this, two prerequisites are required: one is to have the insight to see through the opponent's tricks, which was dismantled by Jiaolian in "10.8 Jiaolian Internal Reference: The Smokescreen of the Fed's Regret". The second is to be fearless of the opponent's true strength, such as Dongfeng Express (see Jiaolian's 2024.9.28 article "Three Super Variables About the United States, China and BTC"), such as BTC's unparalleled super computing power in the world.

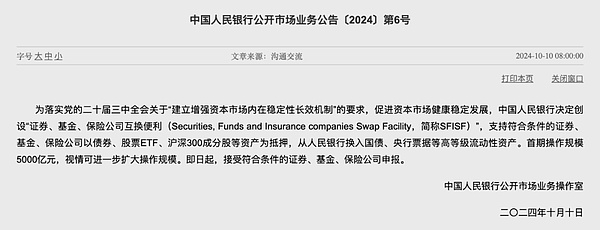

So, no matter what Tai Chi the Fed plays, we will still unswervingly move forward steadily in accordance with the established principles and policies. At 8 am on October 10, the central bank officially announced the [2024] No. 6 Announcement on the launch and implementation of the "swap facility" announced before the holiday.

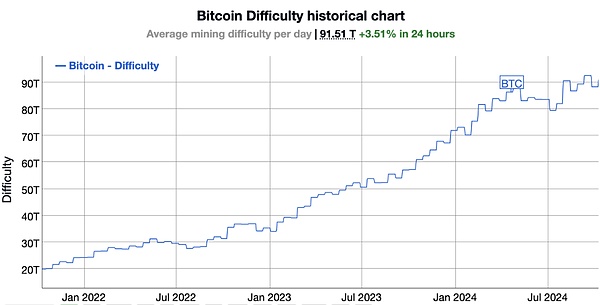

As a result, the difficulty of BTC mining continues to rise, and has now exceeded 90T.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance MarsBit

MarsBit Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph