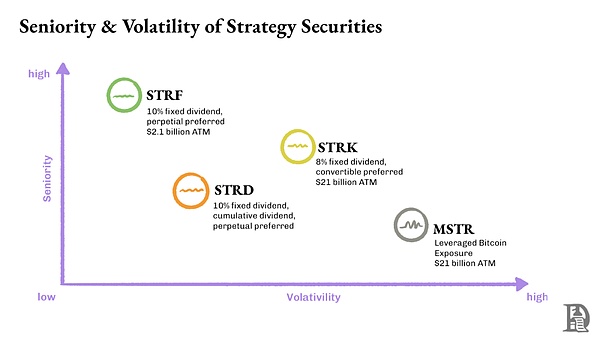

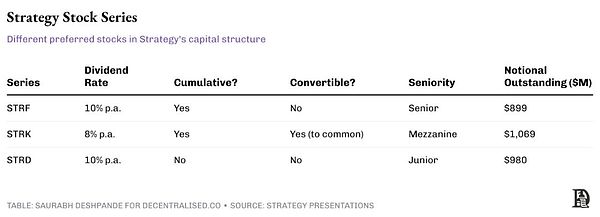

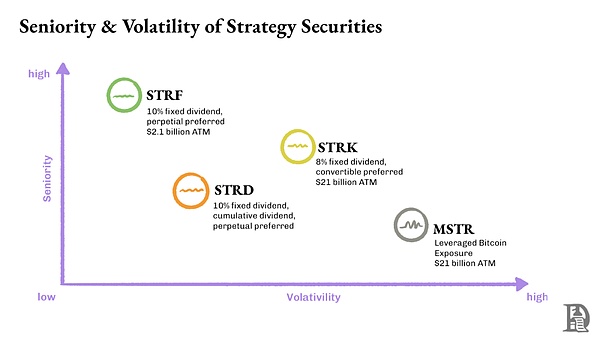

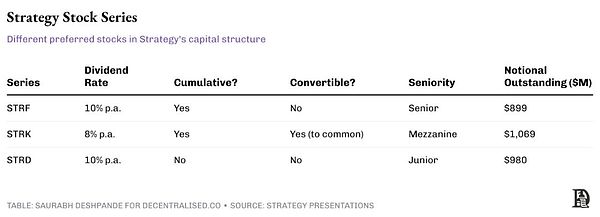

STRF

STRK:Perpetual Preferred Stock, 8% Cumulative Dividends, Medium Priority. Unpaid dividends accumulate and must be paid in full before common shareholders receive any return. Also includes the right to convert to common stock.

STRD:Perpetual Preferred Stock, 10% non-cumulative dividends, lowest priority. The higher dividend yield compensates for the higher risk - if Strategy skips a payment, these dividends are lost forever, without the need to make up later.

Perpetual Preferred Stock enables Strategy to raise equity-like capital while paying bond-like dividends forever, with each series customized to different investors' risk preferences. The accumulation feature protects STRF and STRK holders, ensuring that all dividends are eventually paid, while STRD provides higher current income but no security for unpaid dividends.

Strategy Scorecard

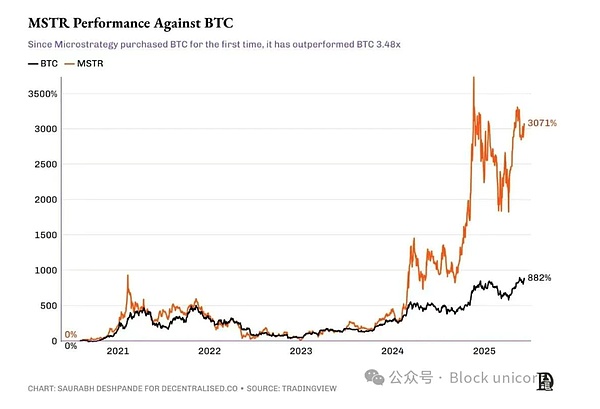

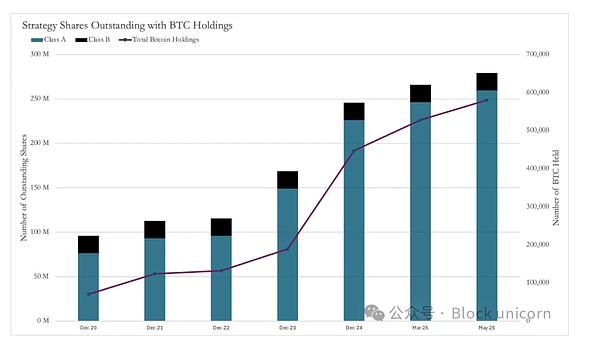

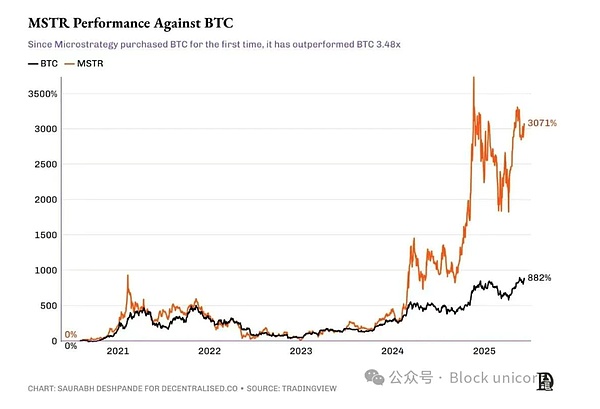

Strategy began raising funds to buy Bitcoin (BTC) in August 2020. Since then, the price of Bitcoin has soared from $11,500 to $108,000, an increase of about 9 times. At the same time, the price of Strategy's stock has surged from $13 to $370, an increase of nearly 30 times.

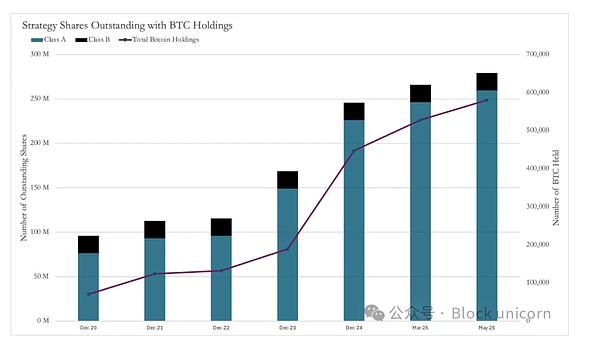

Strategy s regular business has not grown, and its quarterly revenue remains at $100 million to $135 million. The only change is that they borrowed money to buy Bitcoin. Currently, they hold 582,000 Bitcoins, worth about $63 billion. And their stock market value is about $109 billion, 73% higher than the actual value of their Bitcoin. Investors paid an additional premium to hold Bitcoin through Strategy s stock. As previously mentioned, Strategy issued new shares to finance its Bitcoin purchases. Since starting to buy Bitcoin, they have nearly tripled the number of shares they own, from 95.8 million to 279.5 million shares (a 191% increase).

Usually, issuing so many new shares would hurt existing shareholders because each person's ownership percentage of the company would become smaller. But despite a 191% increase in the number of shares, the share price soared 2,900%. This means that even though shareholders hold a smaller percentage of the company, the value of each share has increased significantly, and shareholders still profit.

Strategy's model is popular

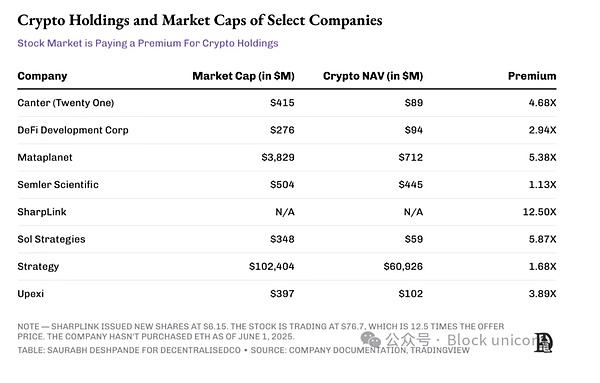

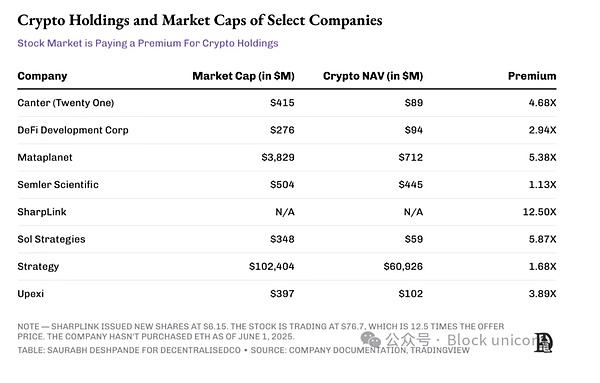

A number of companies holding Bitcoin have emerged, trying to replicate Strategy's success. One recent example is Twenty One (XXI), a special purpose acquisition company (SPAC) led by Jack Mallers and backed by Brandon Lutnick's Cantor Fitzgerald, son of the U.S. Secretary of Commerce, Tether, and SoftBank. Unlike Strategy, Twenty One is not publicly traded. The only public investment is through Canter Equity Partners (CEP), which invested $100 million in XXI for a 2.7% stake.

Twenty One holds 37,230 bitcoins. Since CEP owns 2.7% of Twenty One, they effectively control about 1,005 bitcoins (worth about $108.5 million at $108,000 per bitcoin).

CEP’s stock market value is $486 million, 4.8 times its Bitcoin holdings! When its Bitcoin connection was announced, CEP shares soared from $10 to about $60.

This huge premium means that investors paid $433 million to gain exposure to $92 million worth of Bitcoin. As more similar companies emerge and their Bitcoin holdings grow, market forces will eventually pull these premiums back to more reasonable levels, although no one knows when this will happen or what a “reasonable” level will look like.

The obvious question is, why are these companies trading at a premium? Why not just buy Bitcoin from the market to gain exposure? I think the answer lies in options. Who is funding Strategy’s Bitcoin purchases? Mainly hedge funds pursuing delta-neutral strategies by trading bonds. If you think about it, this trade is similar to Grayscale’s Bitcoin Trust (GBTC). The trust used to trade at a premium because it was closed (there was no way to withdraw Bitcoin until it was converted to an ETF).

So you can keep your Bitcoin at Grayscale and sell publicly traded GBTC shares. As mentioned earlier, by holding Strategy’s bonds, holders can enjoy a compound annual growth rate (CAGR) of more than 9%.

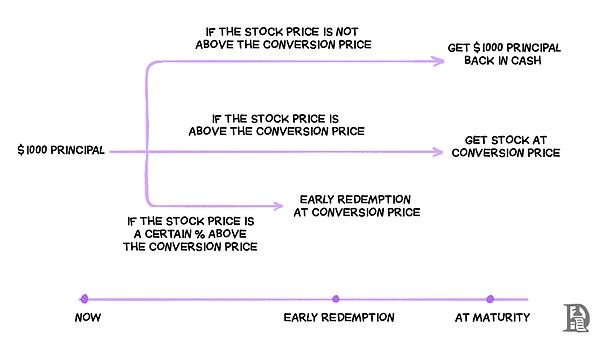

So what could possibly go wrong? Strategy may need to sell Bitcoin to meet redemption or interest payment obligations. But how big is this risk? Strategy 's total annual interest burden is $34 million. With gross profits of $334 million in fiscal 2024, Strategy is fully capable of repaying its debt. The maturity of the convertible bonds issued by Strategy matches the four-year cycle of Bitcoin, which is long enough to reduce the risk of price declines. Therefore, as long as Bitcoin grows more than 30% in four years, redemptions can be easily paid by issuing new shares.

When redeeming these convertible bonds, Strategy can simply issue new shares to bondholders. The reference share price that bondholders receive is noted at the time of issuance, which is usually about 30-50% higher than the share price at the time of issuance. Problems only arise if the share price falls below the specified conversion price. In this case, Strategy needs to return cash, and it can do so by issuing a new round of debt with more favorable terms to repay earlier debt, or by selling Bitcoin to cover the cash needs.

Value Chain

Obviously, it all starts with companies trying to acquire Bitcoin. But eventually they use exchanges and custodial services. For example, Strategy is a Coinbase Prime customer. It buys Bitcoin through Coinbase and stores it in Coinbase Custody, Fidelity, and its own multi-signature wallet. The exact amount of revenue Coinbase earns from Strategy's Bitcoin trading and storage is difficult to estimate, but we can make some guesses.

Assuming Transaction Fees and Custody Costs

Assuming an exchange like Coinbase charges 5 basis points (0.05%) for over-the-counter (OTC) purchases of Bitcoin on behalf of Strategy, the purchase of 500,000 Bitcoins would generate $17.5 million in revenue for the exchange at an average execution price of $70,000. Bitcoin custodians typically charge annual fees of 0.2% to 1%. Assuming the lower 0.2%, storing 100,000 Bitcoins (at $108,000 each), the custodian would earn $21.6 million per year for storing Strategy's Bitcoins.

Beyond Bitcoin

So far, good progress has been made in creating investment vehicles to increase BTC exposure in capital markets. In May 2025, SharpLink raised $425 million through a private equity investment (PIPE) led by ConsenSys founder Joe Lubin, who also served as executive chairman. The round was priced at $6.15 per share and issued about 69 million new shares, which will be used to purchase about 120,000 ETH, which may be staked later. Currently, ETH ETFs do not allow staking.

This type of tool that provides a 3-5% yield is automatically more attractive than ETFs. Before the announcement of the offering, SharpLink's share price was $3.99, with a market value of about $2.8 million and about 699,000 shares outstanding. The offering price was a 54% premium to the market price. After the announcement, the stock price soared to a high of $124.

This type of investment tool also provides a 3-5% yield, so it is naturally more attractive than ETFs. Prior to the offering announcement, SharpLink was trading at $3.99 per share, with a market cap of approximately $2.8 million and approximately 699,000 shares outstanding. The offering price represents a 54% premium to the market price. Following the announcement, the stock surged to a high of $124.

The newly issued 69 million shares represent approximately 100 times the current outstanding shares.

Upexi plans to acquire over 1 million Solana (SOL) by the fourth quarter of 2025 while remaining cash flow neutral. The plan begins with raising $100 million through a private placement of 43.8 million shares, led by GSR. Upexi expects to cover preferred stock dividends through a 6-8% staking yield plus a maximum extractable value (MEV) rebate, and self-fund the purchase of more SOL. On the day of the announcement, the share price jumped from $2.28 to $22, and finally closed at about $10.

Upexi originally had 37.2 million shares, and the newly issued shares had a dilution rate of about 54% for existing shareholders. But the share price rose by about 400%, which completely offset the dilution effect.

Sol Strategies is another company that raised funds through the capital markets to buy SOL. The company operates Solana's validation node and earns more than 90% of its revenue from staking rewards. The company has currently staked 390,000 SOLs, and another approximately 3.16 million SOLs are entrusted by third parties. In April 2025, Sol Strategies obtained a financing facility of up to $500 million through a convertible bond agreement with ATW Partners. The first $20 million has been used to purchase 122,524 SOLs.

Recently, the company filed a plan for up to $1 billion of hybrid securities offerings, including common stock (including a "market offering"), warrants, subscription receipts, units, debt securities, or a combination thereof, providing it with the flexibility to raise funds through different mechanisms.

Unlike Strategy's convertible bonds, SparkLink and Upexi raised funds through direct issuance of new shares. In my opinion, Strategy's option model that allows 100% cash redemption targets a different type of investor. If I can only get exposure to ETH or SOL by buying your shares, why don't I buy ETH or SOL directly? Why take the additional risk of excessive leverage of the middleman? Unless there are additional services, it makes more sense to raise funds using convertible bonds with enough operating profit cushion to pay interest.

When the Music Stops

These convertible bonds are targeted at hedge funds and institutional bond traders seeking asymmetric risk-return opportunities, rather than retail investors or traditional equity funds.

From their perspective, these instruments offer a “heads I win big, tails I lose little” investment opportunity that fits their risk framework. If Bitcoin achieves the expected 30-50% rise in two to three years, the bonds are converted; if the market goes bad, even with a slight loss accounting for inflation, 100% of the principal can be recovered.

The beauty of this structure is that it solves a real problem for institutional investors. Many hedge funds and pension funds either lack the infrastructure to hold cryptocurrencies directly or are restricted by investment mandates and cannot buy Bitcoin directly. These convertible instruments provide a regulatory-compliant backdoor into the crypto market while maintaining the downside protection required for fixed income allocations.

This advantage is temporary in nature. As regulatory clarity improves and more direct crypto investment vehicles with custody solutions, regulated exchanges, and clearer accounting standards emerge, the need for these complex detours will decrease. The 73% premium that investors currently pay for Bitcoin exposure through the Strategy is likely to compress as more direct alternatives emerge. We’ve seen this before. Opportunistic managers have taken advantage of the Grayscale Bitcoin Trust (GBTC) premium by buying Bitcoin and depositing it with the Grayscale Trust, then selling GBTC shares in the secondary market at a 20-50% premium to net asset value (NAV). When everyone started doing this, GBTC went from a peak premium to a record 50% discount at the end of 2022. This cycle shows that without sustainable income to support repeated financing, the equity play backed by crypto assets will eventually be eliminated by arbitrage.

The key question is, how long can this last? Who will be left standing when the premium collapses? Companies with strong underlying businesses and conservative leverage ratios are likely to withstand the transition. Those chasing crypto reserves without sustainable revenue streams or defensive moats may face a dilution-driven sell-off after the speculative craze bursts.

For now, the music is playing and everyone is dancing. Institutional capital is flowing in, premiums are widening, and more companies are announcing Bitcoin and crypto reserve strategies every week. But the smart money understands that this is a trade, not an investment thesis. The companies that survive will be those that use this window to build lasting value beyond the value of their crypto holdings.

The transformation of corporate balance sheets may be permanent, but the outsized premiums we see today are not. The question is whether you are positioned to profit from this trend or are just another player hoping to find a seat when the music stops.

Joy

Joy