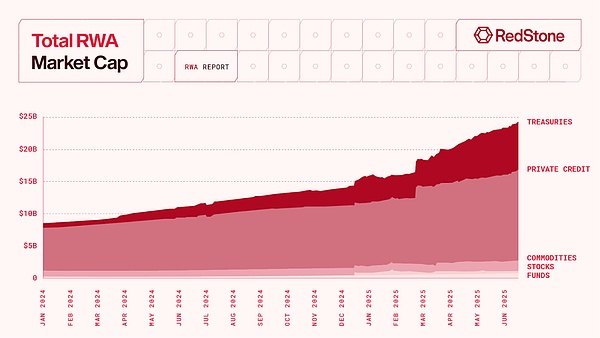

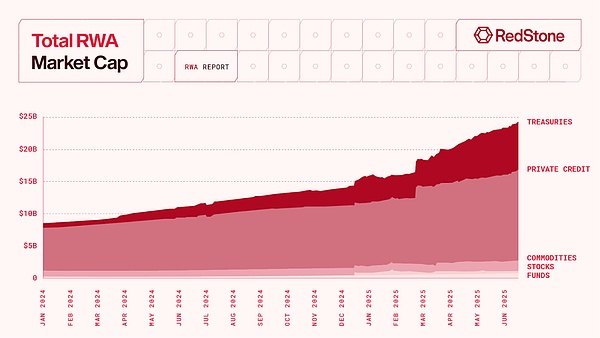

Recently, the report "RWA in OnChain Finance" jointly released by RedStone, Gauntlet and RWA.xyz shows that as of June 2025, the scale of RWA (real world assets) in on-chain finance has exceeded 24 billion US dollars, an increase of more than 380% from 5 billion US dollars in 2022. Behind this explosive growth, on-chain finance is entering a new stage.

1. The rise of the RWA market: Behind the explosive growth

According to the report,the growth rate of the RWA market is second only to stablecoins, becoming the second fastest growing area in on-chain finance. From US$5 billion in 2022 to more than US$24 billion in June 2025, the annual compound growth rate exceeds 85%. In particular, between 2024 and 2025,RWA tokenization will move from small-scale pilots to large-scale institutional applications.

This momentum not only reflects people's enthusiasm for cryptocurrencies, but also attracts the attention of major institutions. BlackRock CEO Larry Fink once said: "Securities tokenization will be the next generation of market development."

2. Institutional shift to practice: from spectators to participants

Currently,the wave of institutional adoption represents years of infrastructure development, which has finally achieved large-scale deployment. Financial giants represented by BlackRock, JPMorgan Chase, Franklin Templeton and Apollo are moving from experimental exploration to actual deployment:

BlackRock: The first on-chain fund allocation was achieved through the BUIDL fund, and it actively participated in the construction of on-chain fund market infrastructure;

JPMorgan Chase: Completed asset tokenization and on-chain settlement pilot on the Onyx platform;

Franklin Templeton: Its U.S. Treasury bond fund is deployed on Coinbase L2 Base, bringing composable fixed-income liquidity to the chain;

Apollo and other institutions have introduced high-quality credit assets to the chain through cooperation agreements to support refinancing needs.

With the implementation of these actions, the integration of DeFi and RWA is also moving from "proof of concept" to "real operation" stage . The RedStone report emphasizes that several protocols have emerged in this process, attracting billions of dollars of institutional capital and reshaping the underlying logic of financial infrastructure:

Ethena: Its USDtb helps institutional adoption through BUIDL;

Maple Finance: In 2025, the asset management scale will exceed 1 billion US dollars, becoming the leading institutional lending platform in DeFi;

Superstate, Backed Finance, Matrixdock, OpenEden: Provide on-chain native fixed-income products such as government bonds and structured credit;

Centrifuge and Goldfinch: Realize the on-chain review and risk assessment mechanism of off-chain borrowers;

Securitize: Build a compliant real-world asset token issuance channel.

These platforms are injecting a new paradigm of "compliance + cash flow" into on-chain finance, and promoting the evolution of DeFi towards a modular, composable, and highly transparent infrastructure network.

3. Trends and Outlook: Structural Migration Has Already Begun

The report not only presents the current situation, but also clearly points out that RWA is not a short-term hot spot, but the starting point of the structural migration of global assets. The core of this migration is the reshaping of the underlying logic of on-chain finance:

Transformation of asset types: from crypto-native tokens to digital forms of real assets such as bonds, loans, real estate, and equity;

Transformation of income sources: from relying on on-chain inflation incentives to real income based on off-chain coupons, debt spreads, structured products, etc.;

Transformation of participating entities: crypto-native participants are gradually supplemented by traditional institutions, asset management funds, and legal and auditing professional networks;

Transformation of on-chain inflation incentives: from relying on on-chain inflation incentives to real income based on off-chain coupons, debt spreads, and structured products;

Transformation of participating entities: crypto-native participants are gradually supplemented by traditional institutions, asset management funds, and legal and auditing professional networks;

The key to this paradigm shift is to embed the income rights, compliance framework, and risk control structure of the off-chain world natively into the chain to achieve more efficient clearing, more transparent risk management, and broader global capital docking.

As the report concludes: “DeFi is becoming RealFi.”

DeFi is evolving from an experimental fringe scenario to a core component of the global financial infrastructure.

Written at the end

The rise of RWA is no longer just a new round of hype in the crypto narrative. It marks that on-chain finance is moving from relying on native inflation incentives and technical experiments to the "real finance" (RealFi) era supported by real cash flow, compliance mechanisms and institutional trust.

Catherine

Catherine