Regulatory documents: https://public-inspection.federalregister.gov/2024-30496.pdf

The U.S. Treasury Department and the Internal Revenue Service recently issued an important new regulation (RIN 1545-BR39), expanding the scope of application of existing tax laws and incorporating DeFi's front-end service providers into the definition of "brokers." These service providers, including any platform that interacts directly with users (such as Uniswap's front-end interface), are required to collect user transaction data starting in 2026 and submit information to the IRS via Form 1099 starting in 2027, including the user's total income, transaction details, and taxpayer identity information.

We all know that Trump's political stage is never short of drama, and his attitude towards cryptocurrency is even more so. From his early criticism of Bitcoin, calling it a "scam based on air", to his later attempts at NFT projects and the issuance of Defi projects such as World Liberty Financial (WLF), he also boldly proposed the idea of incorporating Bitcoin into the national strategic reserve (From Successful Strategic Land Purchases in American History to Bitcoin Reserves: A Forward-Looking Vision of the 2025 Bitcoin Strategic Reserve Draft), his behavior reflects the drive for personal interests and is also a metaphor for the complex position of the encryption industry in the American political system.

Although the new regulations are still a year or two away from taking effect, and there is also considerable controversy about the definition of "broker", after all, the old set of regulatory policies cannot be so rigidly applied to crypto projects, so they may also be overturned, but Aiying would like to discuss with you today from several dimensions the historical inevitability of the introduction of the new regulations, as well as how industry practitioners should make strategic choices.

Part I: The logical evolution from traditional colonization to new financial colonization

1.1 The resource logic of traditional colonization

The core of the traditional colonial era was to plunder resources through military force and territorial possession. Britain controlled cotton and tea in India through the East India Company, and Spain plundered gold from Latin America. These are typical cases of wealth transfer through direct possession of resources.

1.2 Modern model of financial colonization

Modern colonization is centered on economic rules and realizes wealth transfer through capital flow and tax control. The United States' Foreign Account Tax Compliance Act (FATCA) is an important manifestation of this logic. It requires global financial institutions to disclose asset information of American citizens and force other countries to participate in the United States' tax governance.The new DeFi tax regulations are the continuation of this model in the field of digital assets. Its core is to use technical means and rules to force global capital transparency, obtain more tax revenue for the United States, and strengthen its control over the global economy.

Part II: America’s New Colonial Tools

2.1 Tax Rules: From FATCA to DeFi New Rules

Tax rules are the foundation of America’s new colonial model. FATCA forced global financial institutions to disclose asset information of American citizens, setting a precedent for the weaponization of taxation. The new DeFi tax rules further continue this logic, expanding the United States’ control over the digital economy by requiring DeFi platforms to collect and report users’ transaction data. With the implementation of this rule, the United States will obtain more accurate data on capital flows around the world, thereby further strengthening its control over the global economy.

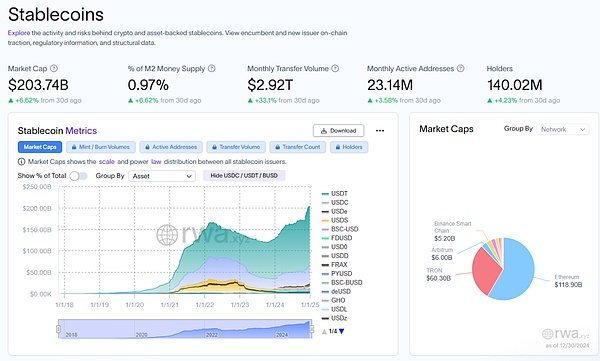

2.2 Combination of Technology and the US Dollar: Dominance of Stablecoins

In the $200 billion stablecoin market, US dollar stablecoins account for more than 95%, and the anchor assets behind them are mainly US Treasury bonds and US dollar reserves. US dollar stablecoins represented by USDT and USDC, through their application in the global payment system, have not only consolidated the global status of the US dollar, but also locked more international capital in the US financial system. This is a new form of US dollar hegemony in the digital economy era.

2.3 Attractiveness of financial products: Bitcoin ETF and trust products

The Bitcoin ETF and trust products launched by Wall Street giants such as BlackRock have attracted a large amount of international capital to flow into the US market through legalization and institutionalization. These financial products not only provide greater enforcement space for US tax rules, but also further integrate global investors into the US economic ecosystem. The current market size is US$100 billion.

2.4 Real Asset Tokenization (RWA)

Real asset tokenization is becoming an important trend in the DeFi field. According to Aiying, the scale of U.S. Treasury tokenization has reached 4 billion U.S. dollars. This model improves the liquidity of traditional assets through blockchain technology, and also creates a new dominant force for the United States in the global capital market. By controlling the RWA ecosystem, the United States can further promote the global circulation of Treasury bonds.

Part III: Economy and Finance—Deficit Pressure and Tax Fairness

2.1 US Deficit Crisis and Tax Loopholes

The US federal deficit has never been as worrying as it is now. In fiscal year 2023, the deficit was close to $1.7 trillion, and post-epidemic fiscal stimulus and infrastructure investment have exacerbated this burden. At the same time, the global market value of the cryptocurrency market once exceeded $3 trillion, but most of it was outside the tax system. This is obviously intolerable for a modern country that relies on tax support.

Taxation is the cornerstone of state power. Historically, the United States has always sought to expand its tax base under deficit pressure. The hedge fund regulatory reform in the 1980s was a model of filling the fiscal gap by expanding the coverage of capital gains tax. And now, cryptocurrency has become the latest target.

2.2 Financial sovereignty and the defense of the US dollar

But it's not just a tax issue. The rise of DeFi and stablecoins has challenged the dominance of the US dollar in the global payment system. Although stablecoins are an extension of the US dollar and create a parallel "private currency" system by anchoring the US dollar, they also bypass the control of the Federal Reserve and traditional banks. The US government realizes that this decentralized form of currency may pose a long-term threat to its financial sovereignty.

Through tax supervision, the United States not only intends to obtain fiscal benefits, but also attempts to re-establish control over capital flows and defend the hegemony of the US dollar.

Part IV: Industry Perspective - Practitioners' Choices and Trade-offs

3.1 Importance Assessment of the U.S. Market

As a practitioner of DeFi projects, the first step is to rationally assess the strategic value of the U.S. market to the business. If the platform's main trading volume and user base come from the U.S. market, then withdrawing from the United States may mean huge losses. If the U.S. market does not account for a high proportion, then a complete withdrawal becomes a viable option.

3.2 Three major response strategies

Partial compliance: a compromise path

Establish a US subsidiary (such as Uniswap.US) to focus on meeting the compliance needs of US users.

Separate the protocol from the front end and reduce legal risks through DAO or other community management methods.

Introduce a KYC mechanism to report only necessary information to US users.

Complete withdrawal: Focus on the global market

Focus resources on markets that are more friendly to cryptocurrencies, such as Asia Pacific, the Middle East, and Europe.

Complete decentralization: Adherence to technology and concepts

Develop trustless compliance tools (such as on-chain tax reporting systems) to technically bypass regulation.

Part V: Further Thinking - Future Game between Regulation and Freedom

4.1 Evolution of the Act and Long-term Trends

In the short term, the industry may delay the implementation of the rules through litigation. But in the long run, the trend of compliance is difficult to reverse. Regulation will lead to polarization in the DeFi industry: on one end are large platforms that are fully compliant, and on the other end are small decentralized projects that choose to operate secretly.

The United States may also adjust its policies under the pressure of global competition. If other countries (such as Singapore and the UAE) adopt more relaxed regulations on cryptocurrencies, the United States may relax certain restrictions to attract innovators.

4.2 Philosophical Reflection on Freedom and Control

The core of DeFi is freedom, while the core of the government is control. There is no end to this game. Perhaps the future crypto industry will exist in a form of "compliant decentralization": technological innovation and regulatory compromise coexist, and privacy protection and transparency move forward alternately.

Aiying Conclusion: Historical Inevitability and Industry Choice

This bill is not an isolated incident, but an inevitable result of the development of American political, economic and cultural logic. For the DeFi industry, this is a challenge and an opportunity for transformation. At this historical node, how to balance compliance and innovation, protect freedom and bear responsibility is a question that every practitioner must answer.

The future of the crypto industry depends not only on technological progress, but also on how it finds its place between freedom and rules.

Aaron

Aaron

Aaron

Aaron Jixu

Jixu Aaron

Aaron Clement

Clement Hui Xin

Hui Xin Alex

Alex Hui Xin

Hui Xin Jixu

Jixu Jixu

Jixu Jasper

Jasper