Source: C Labs Crypto Observation

Recently, altcoins have been making a lot of trouble. I wonder if it feels like the market is a bit cold, and the dealers feel that they will lose their money if they don’t do anything.

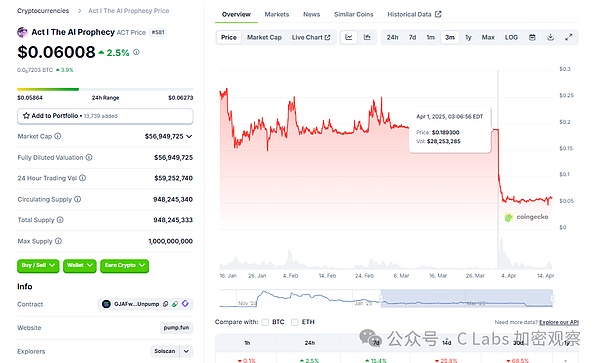

First, on April 1, $ACT, known as the leader of AI meme, collapsed and brought a bunch of altcoin memes to a standstill, opening up various performances of altcoins in April:

The project party attributed the cause of this avalanche to the reduction of leverage of Binance contracts and the selling of market makers.

Half a month after this incident, the price of $ACT is still flat, with no signs of rising at all. It is estimated that it will fall again soon.

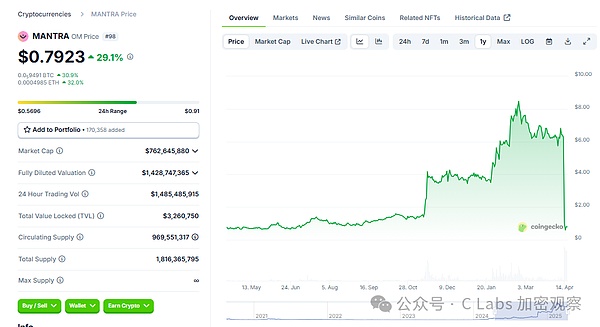

Not long after the cessation, on April 13, the market maker pulled $OM, which had been rising for a year, back to the pre-liberation period in one day, performing a high-diving show to everyone.

Before the plunge, Mantra ($OM) once ranked 30th in the market value of the entire network. It is known as the hot RWALayer-1 blockchain now, and has attracted much attention due to the cooperation between Google Cloud and Dubai DAMAC Group.

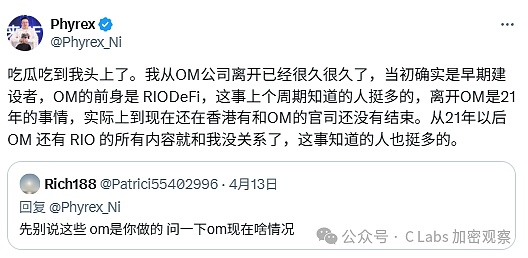

However, the most widely recognized aspect of this project is Ni Da, who is currently very popular in the Chinese currency circle and is an early builder of $OM.

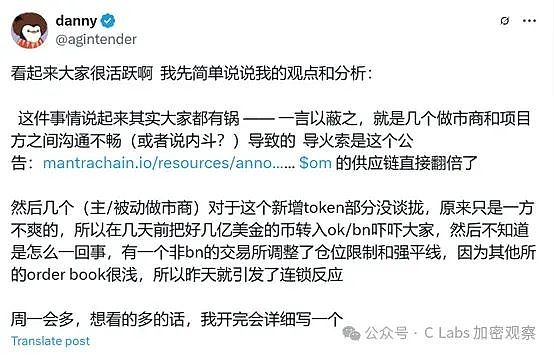

The direct cause of the $OM collapse is said to be the "reckless forced liquidation" of a centralized exchange.

But the actual reason is said to be due to infighting between the project party and the market maker.

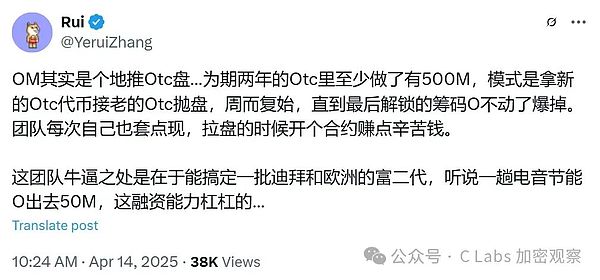

Recently, as more gossip came out, the fact that finally pointed to was probably that the project party's energy was basically not on the project, but mainly on CX and market value maintenance~

It feels like market makers are often failing recently. I wonder if it's intentional.

$IP, which claimed to have plenty of money, also collapsed by 1/3 in the middle of the night and then quickly recovered. Some traders believed that this flash crash might be a "deliberate dump to lure in short sellers" by the project owner, because the trend of the $IP token is also dominated by strong market makers.

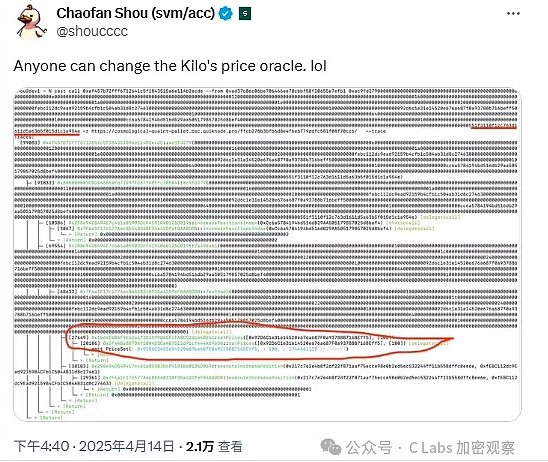

If the above are all performances by dealers or market makers, the following tokens are even more surprising~ On April 14, the price of $Kilo exchange fell by about 30% due to a hacker attack on the platform (Vault vulnerability was exploited), and the market value shrank from US$11 million to about US$7.5 million.

According to the research of the technical leader Chaofan, anyone can change the price of the Kilo platform oracle, which is a low-level vulnerability.

At present, the funds lost by the platform are higher than the market value of the project. The onlookers are very curious about what the project will use to compensate the users' losses~

If Kilo is still a trading platform, its technical strength may be a little worse, and the melons exposed by $Zk are even more chilling.

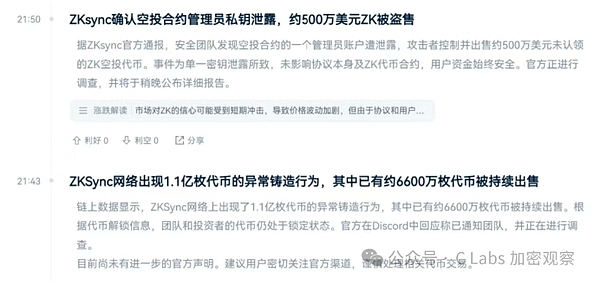

Zksync issued 110 million tokens on the chain, and sold more than 66 million tokens on the chain. The team explained that the token lock was hacked.

In other words, the administrator of the project can actually issue coins at will, but they just don’t do so normally...

Zksync is known as the leader in zero-knowledge proof and can ensure the security of the blockchain.

But in the end, it seems that they couldn’t even protect the security of their own tokens~

With so many unexpected things happening, isn’t it a bit like the bear market in previous years?

Brian

Brian

Brian

Brian Joy

Joy Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex Kikyo

Kikyo Davin

Davin Brian

Brian