Lowercase "Neiro" listed, Binance in a public opinion crisis.

A week ago, Gyro Finance wrote "Exchanges stand on "NEIRO"? MEME Civil War in Progress", mentioning the exchange standing on the uppercase "NEIRO" to cause MEME controversy. At that time, although users were quite dissatisfied with the exchange, because the uppercase NEIRO contract was launched by OKX and Binance, community users still flocked to NEIRO driven by orthodoxy, and the battle of inheritance between uppercase and lowercase was put to an end.

I thought the matter had come to an end, but I never thought that Binance would launch the lowercase "Neiro" spot soon after. The extreme operation of the exchange put the "cryptodog" on the cusp again, and it also triggered strong doubts about Binance and He Yi in the market.

After Binance and OKX launched the uppercase "NEIRO" contract on September 6, the uppercase and lowercase Neiro went to completely different fates.

NEIRO's biggest positive news landed, and the trend rose first and then fell. Community users quickly poured in, and the price accelerated from $0.06 to $0.2 before falling. The market value also rose to $200 million before falling back. On September 15, the price of NEIRO stabilized at $0.13, with a market value of about $130 million. The lowercase "Neiro", which was considered to be a fake Monkey King, was defeated, with a market value of $20 million falling to $4.81 million, and the price fell to $0.000039, and once again faced the risk of returning to zero. If nothing unexpected happens, as expected, after the orthodoxy decides the winner, although the winners are often short-lived, the losers can only wait for the end to come.

But the turn of events on September 16 made things confusing. On September 16, Binance released a coin listing announcement, saying that it would add FirstNeiro on Ethereum (Neiro), Turbo (TURBO) and Baby Doge Coin (1MBABYDOGE) to simple coin earning, flash exchange and leveraged trading. Binance margin will add Neiro, TURBO and 1MBABYDOGE as borrowable assets in full-position and isolated-position leverage, and add Neiro/USDT, TURBO/USDT and 1MBABYDOGE/USDT trading pairs in full-position and isolated-position leverage.

As a leading exchange, Binance is more cautious in listing coins. The listing of three MEME tokens in a short period of time has already attracted attention, and the appearance of lowercase Neiro is even more jaw-dropping. After all, just two weeks ago, Binance seemed to be a supporter of "NEIRO".

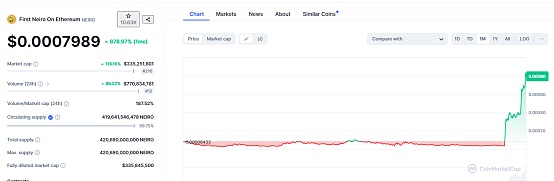

Under the influence of this news, lowercase Neiro was reborn and ushered in an accelerated rise, soaring from 0.00036 to 0.00082 US dollars, an increase of about 3 times in 2 days, and now reported at 0.00079 US dollars, with a market value of more than 300 million US dollars. NEIRO was defeated, and its price plummeted more than 30 times, reaching a minimum of $0.0038, and its market value fell below $4 million. Although it rebounded later, it still dropped significantly compared to the peak period. Its current price is stable at around $0.072, and its market value is less than 80 million.

After the fierce trading behavior in the market ended, community users finally had a chance to breathe, and dissatisfaction with Binance was imminent. Most users said that Binance's move was incredible and treated users as toys. Some users sold lowercase coins and became uppercase dog holders only after they made it clear that they supported "NEIRO", but this wave of reversal undoubtedly caused serious losses to the holders.

On the other hand, the listing of a MEME token with a market value of less than 16 million US dollars and a community of only a few thousand members on the top exchange Binance also made the market dissatisfied. Some KOLs were quite fierce in their words. @cozypront said that Binance had already listed a token of the same name with a market value of 130 million US dollars, but turned around and supported a lowercase token with a market value of 15 million US dollars. This is simply a blatant "idiotic operation".

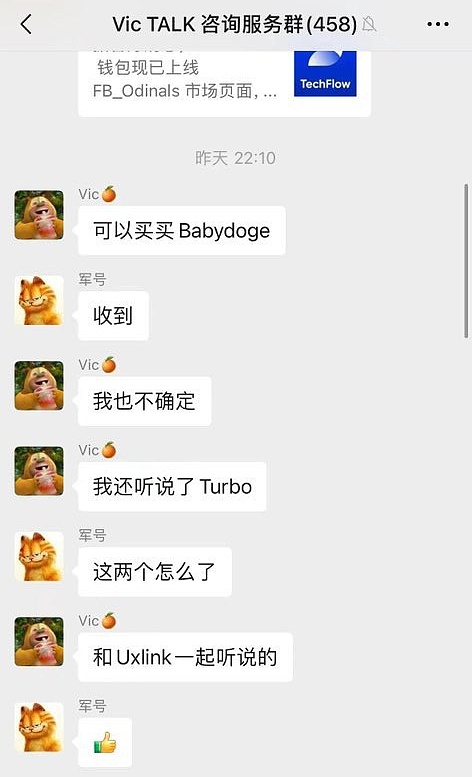

In the verbal criticism, the suspicion of insider trading was also brought to the table. A screenshot of a WeChat account called "Vic TALK Consulting Service Group" was circulated wildly. In it, the group owner Vic suggested buying BabyDoge, and also mentioned that he had heard of Turbo, and said that he heard about it at the same time as UXLINK. But coincidentally, Binance launched the UXLINK contract on September 15, and the next day, BabyDoge and Turbo also appeared together in Binance's listing announcement.

Such an accurate prediction, is it really just a coincidence? The market obviously doesn't think so, believing that this is undoubtedly insider information and the insider operation of Binance's internal staff. For a time, abuse and doubts were rampant, pointing directly at Binance's lowering of the standard for listing coins, abandoning the community, and guiding the direction of MEME.

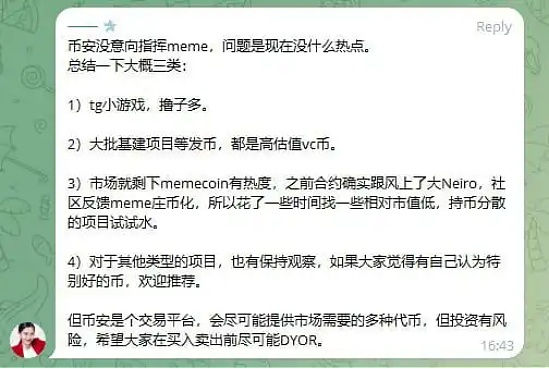

Against this background, He Yi once again stepped forward to maintain stability. He Yi responded in TG that Binance had no intention of directing MEME, and listing coins was only because there was no hot spot at present. He Yi summarized the categories of listed coins, saying that there are currently only three types of tokens, TG mini-games, high VC tokens for infrastructure projects, and MEME coins, and explained this incident accordingly, saying that the contract followed the trend and listed NEIRO, but the community reported that the coin had obvious insider trading, so he spent time looking for projects with lower market value and dispersed coin holdings.

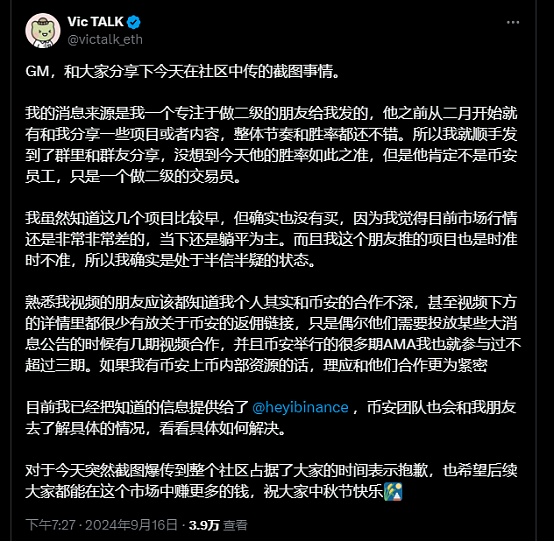

As for the issue of insider trading, Vic TALK also responded on X, saying that the source of the news was a trader focusing on the secondary level, who shared it in the group because of his high winning rate. He was not an insider of Binance, and his personal cooperation with Binance was very limited, with only a few video releases and AMAs, far from the level of internal resource sharing. The Binance Chinese Community also forwarded and responded that Binance attaches great importance to any behavior involving leakage or corruption. The Neiro incident was just a mistake. Binance will also strictly investigate employee violations, and will pursue criminal responsibility for serious circumstances. It also called on the market to report corruption, and the reward will be as high as 5 million US dollars.

Users are clearly not buying into the various responses, and some even brought up old issues regarding news leaks when other currencies were launched. Coincidentally, regulators have also intervened, with the U.S. Securities and Exchange Commission (SEC) recently filing a proposed revised complaint against Binance, focusing on Binance’s token listing process, emphasizing BNB secondary sales and Binance Simple Earn, and accusing Binance of acting as an unregistered securities provider.

As public opinion continued to ferment, He Yi had no choice but to write another long article "If We Have Different Opinions, Then You May Be Right" to respond, expounding on the current anxiety in the cryptocurrency circle and focusing on the listing process, saying that listing is composed of four links: business, research group, committee, and compliance review. The core principle is projects with users and traffic, projects that have a long life, and projects with solid business logic. Regarding the issue of insider trading, He Yi also stated that the current Binance listing process is monitored by Monitor, and if insider trading is found, it will be reported to the U.S. Department of Justice and the inspectors stationed by Fincen, and employees involved in insider trading will be held criminally responsible.

For now, this incident seems to be gradually coming to an end. Although the controversy has not been cut off, public opinion is slowly calming down. In addition to the incident, Binance's situation is also worth thinking about. As a leading large exchange, Binance bears a lot of expectations. Most projects, no matter how decentralized they claim to be, are ultimately proud of being listed on the so-called large exchange.

In this context, Binance is not just an exchange, it symbolizes the concentration of traffic and user expectations, and is the existence of an industry vane. It naturally has a huge influence, and therefore all its actions will be infinitely magnified by the spotlight. This is why other exchanges have no objections to listing MEME and TG game tokens, but Binance has become the target of public criticism. At present, Binance is indeed in a dilemma. It has been criticized for deviating from the community and standing with VC by listing infrastructure tokens, and for lowering the listing standards and manipulating the market by listing MEME tokens. If it remains unchanged, it will be dissed for lack of innovative spirit and difficulty in guiding the development of the industry.

On the other hand, as the industry gradually moves towards compliance, as He Yi said, the Wild West is gone, and the era of making money with courage and bravery is gone. The current intuitive situation facing the industry is the macro resonance and traffic dilemma. When it comes to the most affected individuals, the exchanges that have reaped the benefits must be the first to bear the brunt. Not only do they have to dance with regulatory shackles, but they also have to face the decline in traffic. In this case, the exchange has finally been disenchanted and returned to the platform positioning of making a living by traffic.

The core of the current public criticism of the exchange also starts from this. There is a structural misalignment between the user's positioning of Binance and Binance's positioning of itself. Users expect the exchange to be the "light of the right path" and the industry vision, but the exchange is just a part of the ecosystem. Since it is just a part, Binance will inevitably face the game of commercialization, not to mention the compliance sickle hanging high. Of course, with the natural traffic advantage, the exchange does not worry about profits, but how to make more money while maintaining the trust of the industry is still a far-reaching topic.

In the eyes of many users, the so-called "MEME test water" should not appear in the context of Binance, but from the perspective of Binance, even the industry's leading exchange faces a lot of competition. Compliance exchanges are hitting the nail on the head, and offshore exchanges are pressing forward step by step. If there are no popular coins, they will only make wedding clothes for competitors. It is understandable to try innovation, especially at present, the voice of exchanges is rapidly decreasing, and the creators of hot spots are no longer monopolized by exchanges.

It is with this concept that since CZ left, Binance 2.0 has made many attempts under the leadership of the new CEO and He Yi. The so-called girlfriend coins and air coins are also derived from this. After all, the market is seriously lacking in hot spots, and high FDV tokens are even more collapsed as soon as they are launched. Under the pressure of public opinion, Binance is more cautious about this.

However, returning to the choice of listing coins, Binance also has something to consider. TON games and MEME are flying, but the selected currencies are not at the forefront of the track, and there is no strong community. Can the rat warehouse scam be completely ruled out? Interestingly, in May this year, Binance issued an announcement stating that the requirements for listing a coin are a small or medium market value in the track, a large number of tokens reserved for community users, a self-sufficient business model and a sustainable community foundation. Looking at the currencies that have been launched recently, it seems that most of them do not belong to the above categories.

But from the user's perspective, the butt determines the head, and it is inevitable. The investors who suffered the most serious condemnation in this incident are undoubtedly the investors who suffered losses. When the capital coin was launched, the lowercase coin community wailed, and when the lowercase coin was launched, the supporters of the capital coin abused again. In the final analysis, interests are the key to making users stand in line. Some users joked, "I don't hate the shady dealings, I hate that there is no me in the shady dealings."

Despite facing numerous doubts, it is undeniable that Binance is still the leader in the ecosystem. Regarding the strategic path of this leader, users and real managers have faced a destined disagreement when the ecological network moves from open to closed. Various internal and external uncertainties can become the fuse of disagreement. For example, at present, there are endless personal attacks and biased refutations against He.

Would it be better to return to the original state? Perhaps the market expects CZ, who will be released from prison on September 29, to give a new answer.

JinseFinance

JinseFinance

JinseFinance

JinseFinance WenJun

WenJun JinseFinance

JinseFinance Kikyo

Kikyo JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Bitcoinist

Bitcoinist