Author: Stacy Muur Translation: Shan Ouba, Golden Finance

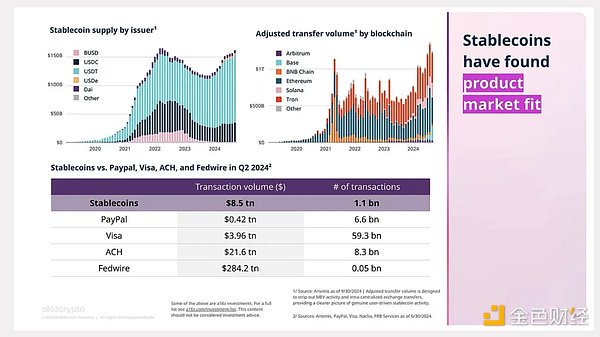

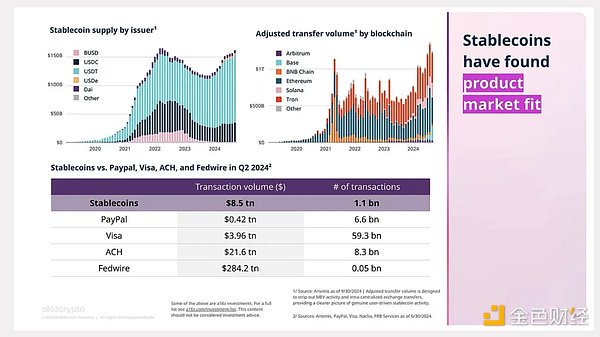

While Bitcoin and Ethereum pioneered digital payments, their slow speed, high cost, and high price volatility have made it difficult to achieve mainstream adoption.

We rarely see people using BTC or ETH to buy coffee or pay rent, and the reason is simple: high transaction fees, slow settlement times, and price volatility make them difficult to use for daily payments.

Stablecoins (such as USDC and PYUSD) have improved payment efficiency, but have not yet fully unlocked the time value of money or achieved seamless integration with traditional finance.

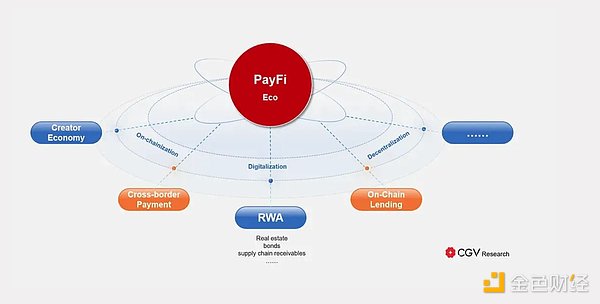

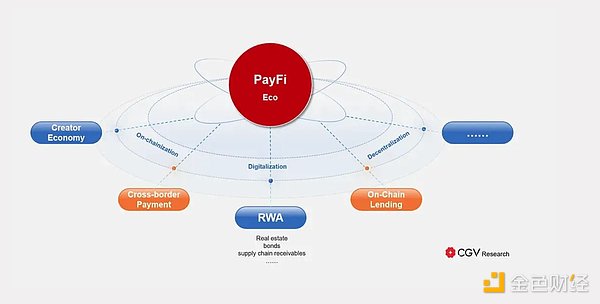

This is where PayFi comes in. It connects DeFi, real-world assets (RWAs), and on-chain credit to make payments instant, efficient, and scalable.

PayFi: A new model of payment finance

PayFi (Payment Finance) is an innovative financial model that integrates traditional payment systems with decentralized financial services through blockchain technology to improve the efficiency, transparency and accessibility of financial transactions.

PayFi's Core Value Proposition

PayFi's core concept is the Time Value of Money (TVM), which means that money today is more valuable than the same amount of money in the future due to its potential appreciation.

In other words, would you rather have $100 today or $100 in a year?

Most people would choose to receive it today because it can be invested, pledged, or generate income, while the $100 received in the future may depreciate due to inflation and opportunity costs.

How does PayFi unlock the time value of money?

Traditional finance traps capital in a slow-moving system. Delayed settlements, illiquid assets, and rigid credit structures hinder the efficient operation of funds, creating bottlenecks for individuals and businesses alike. PayFi changes this by enabling real-time transactions, automated lending, and instant access to future cash flows to keep liquidity flowing.

Whether it's transforming a "buy now, pay later" model into a revenue-generating model, helping businesses access funds from unpaid invoices, or giving creators instant access to income, PayFi is making the financial system more flexible and efficient. By connecting DeFi, risk-weighted assets, and on-chain credit, it ensures that funds are not idle but actively working.

Buy Now Pay Later (BNPN): Beyond Debt-Driven Consumption

BNPN redefines the way people consume, replacing the debt model with yield-based spending. Instead of taking out a loan and repaying it in installments, users pledge their assets and use their earnings to pay for their expenses. The principal remains unchanged, so users can consume without borrowing.

Before PayFi:

Traditional buy now, pay later (BNPL) services may seem convenient at first, but they rely on credit and debt. Users often face hidden fees, interest, and late penalties, making the cost of consumption escalate over time. Moreover, a single late payment may affect a credit score.

With PayFi:

BNPN allows users to pledge assets and use the generated income to pay for consumption. Users can enjoy the benefits of consumption without the financial burden of repayment. No interest, no late fees, no credit score impact - a smarter, more sustainable way to consume.

Accounts Receivable Financing (ARF): Solving Cash Flow Problems for Business

For businesses, waiting for customers to pay can be a major obstacle to operations. ARF allows businesses to convert unpaid invoices into real-time capital, ensuring a steady cash flow without relying on expensive loans or lines of credit.

Before PayFi:

Businesses often have to wait weeks or even months to receive payments from customers. This delay increases the difficulty of operating management, making it more difficult to pay wages and invest in growth. Many businesses have to rely on loans or lines of credit to fill funding gaps, which incurs additional interest costs.

With PayFi:

Accounts Receivable Financing (ARF) enables businesses to tokenize invoices and gain immediate access to working capital. Instead of waiting for payments to arrive, businesses can directly convert unsettled accounts receivable into funds, ensuring smooth business operations and reducing reliance on traditional financing.

PayFi Overview

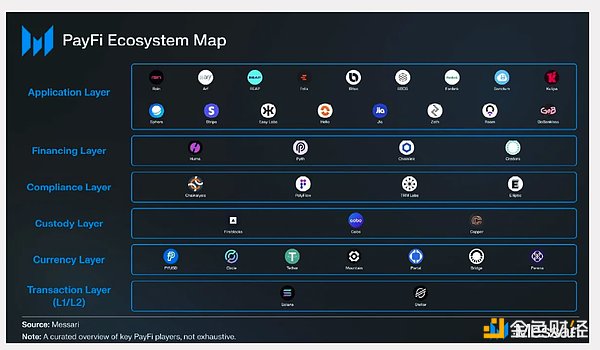

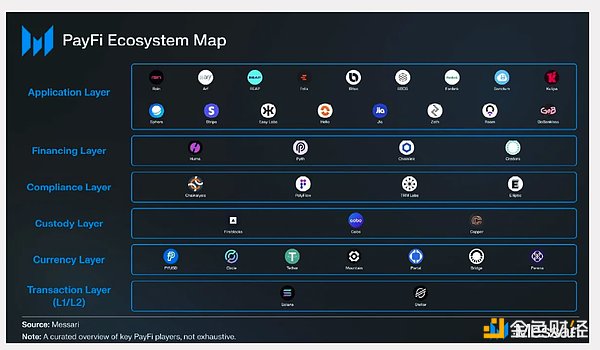

Imagine PayFi as a multi-layered financial cake, where each layer plays a vital role in making decentralized payments faster, more efficient, and more scalable.

1. Application Layer (Front-end Experience)

Think of it as the applications you use every day, whether it is a payment platform, lending service, or DeFi wallet. These companies are building real-world user experiences on top of PayFi’s technology.

This is where users, businesses, and financial applications connect to PayFi.

From DeFi lending to cross-border payments, this layer makes PayFi usable.

Here is a list of projects that are embedding blockchain payments into everyday finance and enabling real-world applications.

Stripe makes it easy for businesses to accept crypto payments while maintaining compliance with traditional finance.

Rain and ReapGlobal are focused on simplifying cross-border payments and solving real inefficiencies in global transactions.

Arf is providing a bridge to instant credit through stablecoin-driven trade finance.

Other well-known players include Bitso, Sanctum, Sphere, Kulipa, Fonbnk1, etc.

2. Financing Layer (Fund Enabler)

This is where the real magic of PayFi lies - liquidity providers, credit markets, and financial instruments are all here. These protocols help users unlock funds, borrow and lend funds in real time.

If PayFi is a car, then this layer is the engine - pushing funds to where they are needed in seconds instead of days.

Some of the pioneering entities in this space include:

Huma pioneered lending against future cash flows, allowing businesses and individuals to borrow based on expected returns.

Credora makes risk assessment more transparent and actionable, giving lenders, borrowers, and ecosystem participants the confidence they need to make informed decisions.

3. Compliance Layer (Supervisors)

Cryptocurrencies still require security and compliance, and this layer ensures that funds flow safely and legally. Companies here focus on fraud detection, KYC, AML, and regulatory risk management.

PayFi adoption will be slowed by regulatory uncertainty. These platforms help bridge DeFi with real-world regulations.

Chainalysis helps track blockchain transactions, prevent fraud, and ensure PayFi operates in a legal environment.

TrmLabs focuses on real-time risk monitoring, helping institutions and regulators to ensure the security of financial transactions.

Polyflow is a PayFi protocol that connects real-world assets to DeFi through a modular, compliance-friendly crypto payment infrastructure.

Elliptic - A blockchain analytics company that provides risk intelligence, compliance solutions, and fraud detection for cryptocurrency businesses and regulators

4. Custody Layer (Digital Safe)

This layer provides secure storage for assets, ensuring that institutions and individuals do not lose funds due to hackers or mismanagement. Think of it as the crypto equivalent of a bank vault.

Large institutions need a secure way to hold their funds before entering the PayFi market.

FireblocksHQ is one of the biggest names in digital asset security, providing enterprise-grade custody solutions.

Copper& Cobo specializes in multi-party computation (MPC) security, helping institutions to securely manage their assets.

5. Currency Layer (Currency Itself)

This layer powers the actual transactions, using stablecoins and digital assets to efficiently transfer value across borders.

PayFi would not exist without digital currencies - stablecoins ensure transactions are fast, cheap, and borderless.

USDC and PYUSD (Circle and PayPal) are regulated stablecoins, making PayFi transactions more reliable for businesses and financial institutions.

Tether (USDT) remains the most widely used stablecoin, ensuring liquidity in global markets.

6. Transaction Layer (L1/L2 Blockchain Infrastructure)

The foundational layer that makes it all possible. Here, transactions are processed, verified, and settled at lightning speeds.

The faster and cheaper this layer is, the better PayFi will perform. This is why high-speed blockchains like Solana and Stellar are at the forefront.

This chart is more than a detailed analysis of the company, it is a snapshot of the future of decentralized finance. PayFi bridges traditional finance and DeFi while making payments instant, scalable, and accessible.

Solana and Stellar are designed for financial transactions, providing high-speed processing at a fraction of the cost of traditional networks.

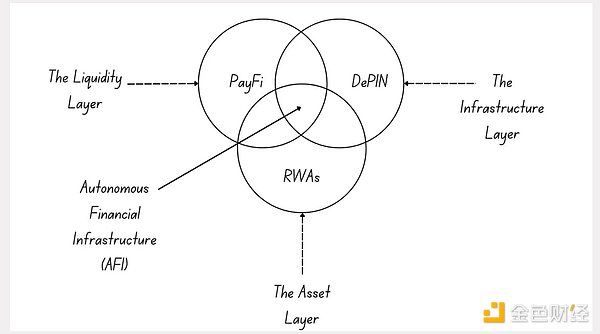

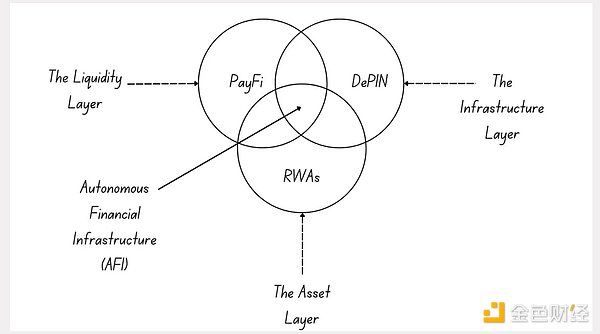

Future Outlook: The Convergence of PayFi, DePIN, and RWA

PayFi, DePIN, and RWA are converging because finance is evolving in real time. Traditional systems are slow, DeFi has been stuck in its own bubble, and real-world integration has always been the missing link. That gap is closing, and everything is changing.

For the first time, money is not just flowing, it’s working. PayFi turns payments into a system that generates yield. Risk-weighted assets unlock liquidity from real-world assets. DePIN ensures that infrastructure can run on its own through automated on-chain payments. The lines between finance, infrastructure, and commerce are blurring. As a result, the economy will run on real-time, programmable liquidity rather than outdated financial rails.

This shift is not about speeding up transactions, but about redefining how money, assets, and infrastructure interact. PayFi is not another DeFi trend, but the foundation of a system that integrates finance into everything we do.

Conclusion

PayFi is a structural upgrade to the way funds flow. With the deep integration of real world assets (RWA) and blockchain, finance is transforming from static traditional institutions to dynamic, programmable systems. Payments are no longer simple transactions, but profitable, automated, and embedded in infrastructure.

The boundaries between finance, commerce, and infrastructure are blurring, and PayFi is at the core of this change. Whether it is instant settlement, machine-driven payments, or revenue-based spending models, a system that runs in real time, is frictionless, and does not rely on traditional financial tracks is being established.

The trend is clear: Finance is being coded, liquidity is becoming programmable, and financial access is becoming borderless. PayFi is not a short-lived innovation, but the infrastructure of the next generation of the economic system.

Anais

Anais