Author: Tanay Ved, Source: CoinMetrics, Translated by: Shaw Jinse Finance

Key Takeaways

Tokenized stocks are still in their infancy (market capitalization less than $1 billion), but they represent a huge opportunity relative to the approximately $145 trillion global stock market.

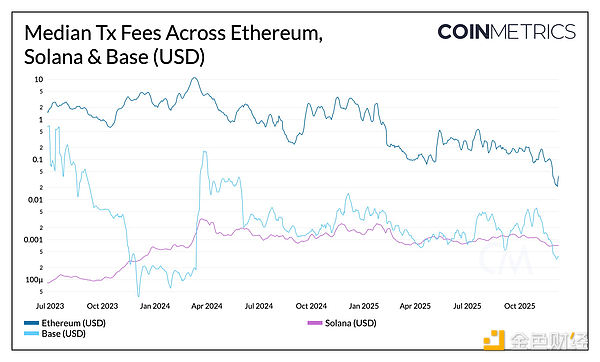

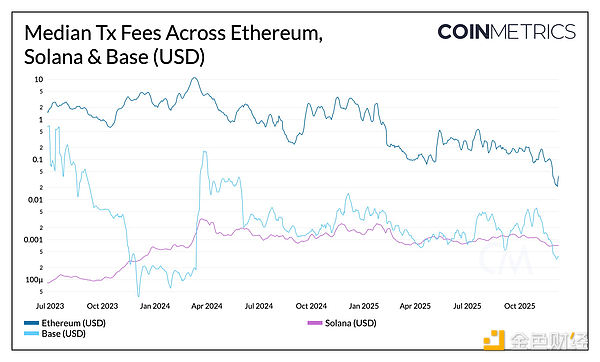

High-throughput, low-cost blockchain infrastructure, clearer securities guidance, and increasing participation from fintech companies, exchanges, and decentralized finance (DeFi) protocols are driving compliant issuance and adoption.

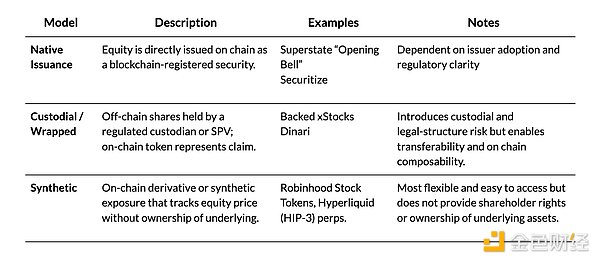

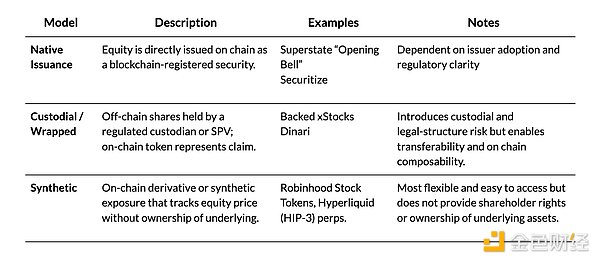

From native issuance and custody structures to synthetic or derivative exposures, a variety of models are emerging in the stock tokenization space.

A variety of models are emerging in the stock tokenization space.

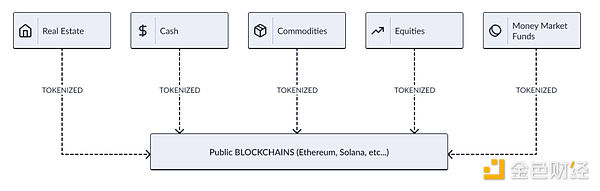

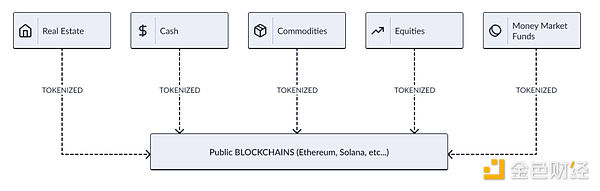

xStocks on Solana is still in its early stages, but it has already shown significant growth momentum, with assets under management (AUM) growing approximately ninefold since its launch to reach approximately $186 million. The number of active wallets and transactions on the blockchain is also steadily increasing. Tokenization, the digital representation of real-world assets and securities on public blockchains, has become one of the most important structural trends in the integration of traditional finance and cryptocurrencies. Although tokenization is still in its early stages of application, the idea of "tokenizing all assets" gained significant momentum in 2025. Initially, it involved putting the US dollar on-chain, but it has now expanded to migrating various financial instruments to the blockchain, covering a wide range of areas from currencies and commodities such as gold to private lending and money market funds.

Source: CoinMetrics Real-World Assets (RWA) Report

Equity tokenization is the next frontier in this multi-year transformation. Programmability, 24/7 diversified access, composability, and instant settlement remain strong value propositions attracting these assets to the blockchain. Increased regulatory transparency, coupled with the maturing blockchain infrastructure, is creating pathways for compliant and scalable on-chain equity issuance and circulation.

Source: CoinMetrics Network Data Pro

These developments collectively constitute an emerging architecture: issuing and guaranteeing institutions for financial products (such as BlackRock and Backed), infrastructure providing product distribution and utility functions (exchanges, DeFi protocols, and oracle networks), and settlement channels providing execution environments (Ethereum, Solana, and other Layer 2 networks). Currently, the issuance models cover a wide range, from fully collateralized issuances to synthetic or derivative exposures. The following table lists these patterns:

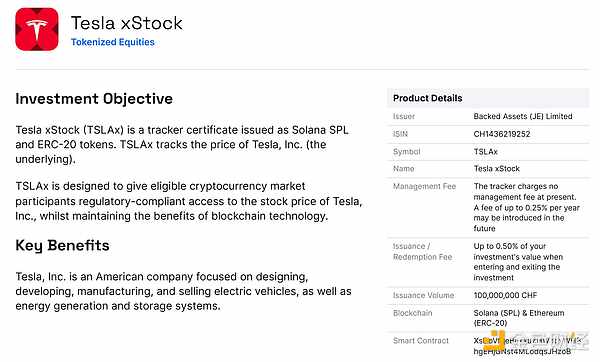

Backed xStocks: Stock Tokenization Based on Solana

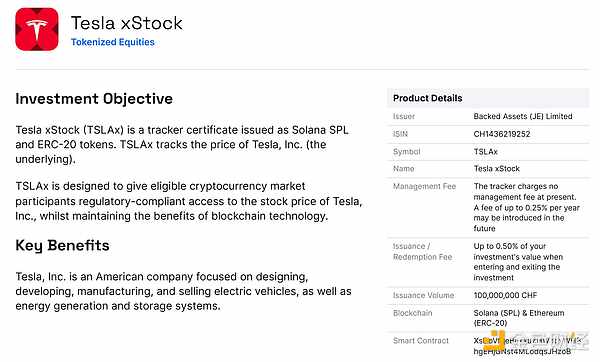

In June of this year, Backed Finance launched xStocks on the Solana network, listing more than 60 U.S. stocks and exchange-traded funds (ETFs), including Apple (AAPL), Nvidia (NVDA), Tesla (TSLA), and the S&P 500 Index Fund (SPY), in the form of freely transferable SPL tokens.

Source: Overview of TSLAx Support

After xStocks is issued, it operates similarly to other transferable on-chain assets. They can be transferred between wallets, settled almost instantly, and directly integrated into Solana's DeFi ecosystem. This makes xStocks accessible 24/7, supports partial ownership, and can be used in combination with lending markets, automated market makers, and trading platforms such as Kamino Finance, Raydium, and Jupiter.

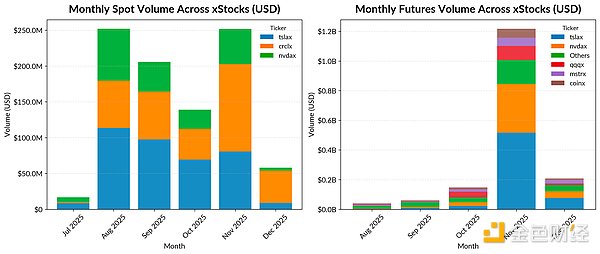

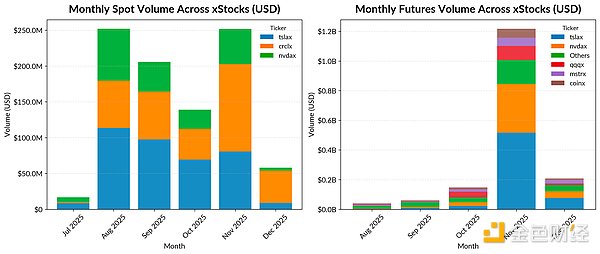

Source: CoinMetrics Market Data Feed

On-chain, the number of monthly active wallets interacting with xStockSPL saw significant growth after launch, reaching approximately 175,000 in July and stabilizing between 80,000 and 100,000 in the fall. TSLA, NVDA, CRCL, and SPY account for approximately 58% of the total active wallets, indicating that users are primarily concentrated on a few popular stocks.

Joy

Joy