Source: Beijing Business Daily reporter Liao Meng

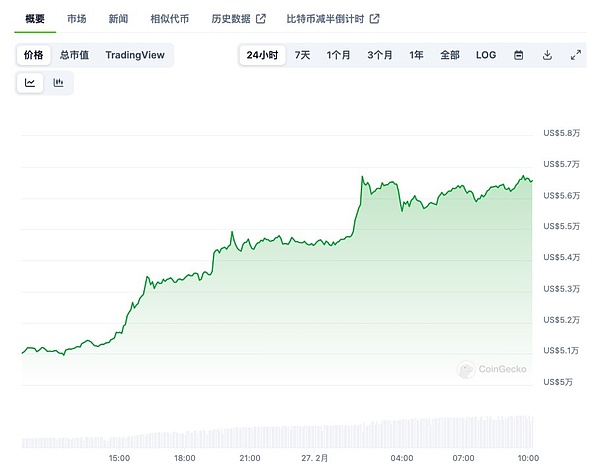

Bitcoin skyrockets again. After breaking through the $50,000 mark, Bitcoin traded sideways near $51,000 for many days until January 24, when Bitcoin began an upward trend near $50,500. On February 27, Bitcoin’s rally continued to expand, and it once approached US$57,000 during the session, continuing to hit a new high since December 2021.

Bitcoin's rise is eye-catching, and it has also brought about a crazy situation in which more than 2.5 billion yuan of funds were liquidated. The risks cannot be ignored. According to analysts, no matter whether Bitcoin rises or falls, some players may face huge losses. This is a stupid game full of gambling, and it also truly reflects the cryptocurrency market. speculative and high-risk.

Bitcoin rises above $56,000

Global currency prices Data from the website CoinGecko shows that on February 27, Bitcoin broke through the US$56,000 mark. In the past 24 hours, it rose nearly 10%, reaching a maximum of US$56,726.52, reaching the highest level since December 2021. As of 18:00 on February 27, Bitcoin was trading at $56,577.28, a 24-hour increase of 10.9%.

Image source: CoinGecko

After many days of shock at $40,000, can it break through the $50,000 mark? It is an important part of the market speculation on the trend of Bitcoin in the past two months. But in fact, after briefly falling below the $40,000 mark on January 23, Bitcoin rebounded strongly and reached the $50,000 level within half a month. Looking at the timeline further, the price of Bitcoin has been on an upward trend for six consecutive months, compared to the price low of $24,900 in September 2023, an increase of nearly 125%. Especially in February 2024, Bitcoin’s monthly increase has reached 30%.

Since hitting its all-time high in November 2021, approaching $70,000, Bitcoin has entered a long cold winter. In November 2022, the trading price of Bitcoin hit a minimum of $15,500, and then began to rebound one after another. CoinGecko data shows that with the rise in Bitcoin prices, other mainstream cryptocurrencies have also experienced significant increases. The current total market value of Bitcoin has exceeded US$1.1 trillion, and the total market value of cryptocurrency has also exceeded US$2.24 trillion.

In the past six months, the trading price of Bitcoin has risen again. What is the reason? Wang Peng, an associate researcher at the Beijing Academy of Social Sciences, told a Beijing Business Daily reporter that Bitcoin’s current rise is influenced by many factors. First, expectations of global economic recovery have increased and investor confidence has increased, driving up the prices of cryptocurrencies such as Bitcoin. Secondly, as the Bitcoin ETF was officially approved in the United States, and February 26 was the settlement day of Bitcoin futures, it attracted more capital inflows and pushed up the price.

"In addition, Bitcoin’s halving event may also have had a positive impact on the price. The halving event refers to the halving of Bitcoin’s mining rewards, which reduces the supply of new Bitcoins, which may have a positive impact on the price Supporting role." Wang Peng added. However, Wang Peng also reminded that the fluctuation of Bitcoin price is affected by many factors, including market sentiment, policy changes, technological innovation, etc., so comprehensive consideration is needed to evaluate the price trend.

On January 11, 2024, the cryptocurrency market received the long-awaited good news, that is, the United States Securities Regulatory Commission officially The listing and trading of Bitcoin ETF was approved, and the trading volume reached 4.6 billion US dollars on the first day, which further promoted the increase in the trading price of cryptocurrencies including Bitcoin.

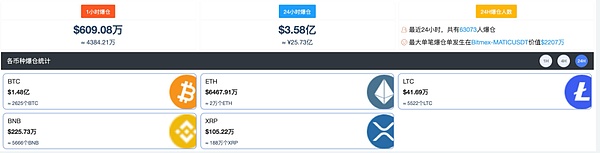

Liquidation is still intensifying

Bitcoin rally Fanaticism, but still some people are happy and some are sad. As Bitcoin has been rising in recent days, especially the increase on February 27, players involved in currency contract transactions, especially "short selling", have suffered heavy losses.

According to data from the third-party currency price website Bijiayuan, in the last 24 hours as of 10:40 on February 27, a total of 64,701 users had liquidated positions. , a total of US$205 million in funds was wiped out, equivalent to approximately 1.473 billion yuan. As Bitcoin prices fluctuate, related liquidation data are still intensifying. In the last 24 hours as of 18:00 on February 27, the number of liquidated users decreased slightly to 63,073, but the amount of liquidated liquidation increased to US$358 million, approximately RMB 2.573 billion.

Image source: Bijiayuan

In the past 30 days, the liquidation amount of the entire cryptocurrency market reached 3.681 billion US dollar, of which "short" positions accounted for 90%.

"The people standing on the balcony now are all 'air force' speculating on currency." February 27, Beijing Business Daily reporter Noticed that some users in the currency circle joked this on social platforms. The user explained to a reporter from the Beijing Business Daily that according to the currency circle’s gameplay, virtual currencies including Bitcoin can be traded “long and short” through contract transactions, and can be traded in both directions by analyzing and comparing rising or falling prices, and can be added by adding Leverage to expand trading. Once the currency price fluctuation level exceeds the corresponding limit range, the position will be forced to be liquidated by the system. “Under such a surge in prices, users who predict that currency prices will fall often suffer huge losses.” said the aforementioned user.

Amid the frenzied rise in Bitcoin, some users are also deterred. Reader Zhang Xu (pseudonym) pointed out in the interview that the popularity of Bitcoin has declined in the past two years. In less than a year of speculating in the currency, he stopped his losses in time after handing over nearly 600,000 yuan in "tuition fees" and no longer participate. "Now that the currency price has risen, the friends who participated around me have become active again. But from personal practical experience, the risks of transactions such as currency speculation are really difficult to control, and ordinary users can easily lose their money by participating in it. So I will still keep a sensible distance." Zhang Xu said calmly.

In Wang Peng's view, no matter whether Bitcoin rises or falls, some players may face huge losses. This is a stupid game full of gambling, and it also truly reflects the speculative nature of the cryptocurrency market. High risk. Wang Peng said: "This also reminds us that the supervision and standardization of the cryptocurrency market is still an important issue, and relevant departments need to strengthen regulatory measures to protect the legitimate rights and interests of investors."

Chen Jia, a researcher at the Institute of International Monetary Studies at Renmin University of China and an independent international strategy researcher, even pointed out that cryptocurrencies such as Bitcoin do not belong to the traditional low-frequency asset categories. We cannot apply the year-on-year indicator changes of traditional assets for analysis. The range and frequency of intraday fluctuations are difficult for traditional financial institutions and individuals to understand, and cannot be controlled by traditional investment and trading techniques. Overlay currency trading has always been highly leveraged. Without risk hedging mechanism design and investor protection mechanism, liquidation is more likely to occur.

The risk cannot be ignored

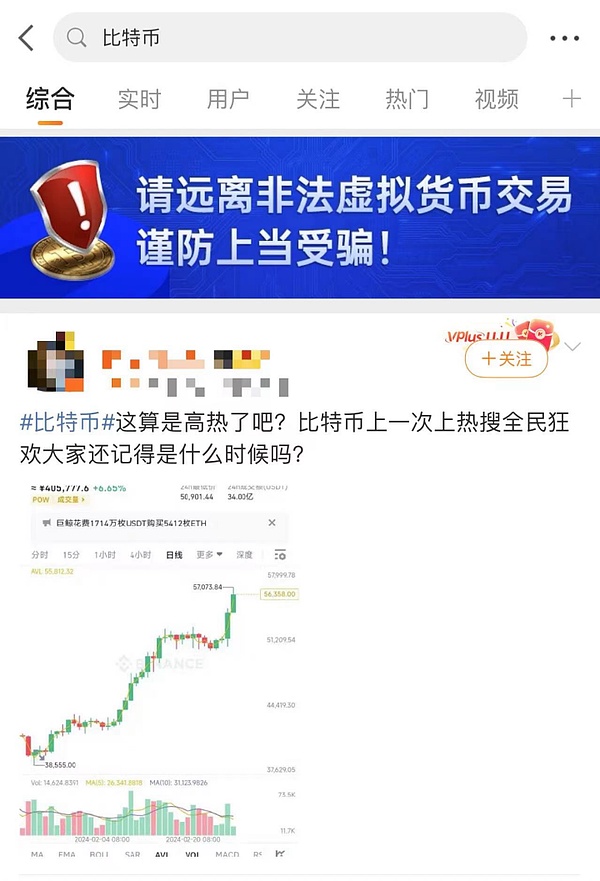

On February 27, the rise in the price of Bitcoin continued to grow, and Bitcoin also appeared on Weibo's hot search list for the first time in a long time. In the discussion surrounding the price trend of Bitcoin, some people are advocating that "the bull market is coming and the prospects are unlimited"; some people can't forget the pain of being bloodbathed in the previous plummets; and some people point out that cryptocurrency has been completely banned in the country, so give up the plunge as soon as possible. The fantasy of wealth... and the related pages also have a striking reminder: Please stay away from illegal virtual currency transactions and be careful not to be deceived.

Image source: Weibo

On the other hand, after experiencing the previous plunge and the collapse of stablecoins, And after the exchange ran away, trust in cryptocurrency took a bigger hit. According to foreign media reports on February 22, the spokesperson of the Nigerian President confirmed that Nigeria requires its telecommunications companies and other Internet service providers to block people from accessing cryptocurrency trading platforms in order to prevent the continued weakening of the national currency.

On February 24, the Beijing Municipal Public Security Bureau Cyber Security Corps also issued a risk warning on virtual currencies. On the one hand, it stated that my country currently does not recognize the legal status of virtual currencies. , any act of engaging in token issuance and financing is illegal. On the one hand, it is pointed out that there are still criminals who absorb funds by issuing so-called "virtual currencies" and are suspected of conducting illegal fund-raising, pyramid schemes, fraud and other activities through hyping concepts, emphasizing that virtual currenciesWhat is speculated is "miracle mirror" and what is lost is "real money".We must establish correct concepts of currency and financial management.

As for the behavior of currency speculation, Chen Jia said that due to the violent fluctuations in currency circle transactions and the lack of necessary regulatory protection mechanisms, whether it is on-site trading or on-site trading, In the foreign trading market, whether long or short, except for a few institutions and bookmakers who specialize in high-frequency trading, most investors cannot escape the fate of being out.

In this regard, Wang Peng suggested that ordinary users should not blindly follow the trend of investment just because the price of Bitcoin rises, but should combine their own investment goals and risk tolerance When making a decision,be sure to fully understand the risk of price fluctuations and assess your own risk tolerance. At the same time, you must pay close attention to the regulatory policies of relevant departments on the cryptocurrency market to ensure that your investment behavior complies with the requirements of laws and regulations.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Kikyo

Kikyo JinseFinance

JinseFinance Olive

Olive Samantha

Samantha Coinlive

Coinlive  Blockworks

Blockworks Miami Web3

Miami Web3 Coinlive

Coinlive  Cointelegraph

Cointelegraph