Senator Cynthia Lummis submitted the BTC Strategic Reserve Act to the U.S. Congress, marking the beginning of a legislative process that could have significant implications for the Crypto asset market and U.S. economic policy.

On August 3, Senator Lummis announced that the Senate Banking, Housing, and Urban Affairs Committee received the BTC Act of 2024 (S.4912).

The Congressional website shows that the bill was read twice before being assigned to the committee. The bill is currently in the submission stage, which is the first of five steps to become law. The bill must also pass votes in the Senate and the House of Representatives before being submitted to the President for final approval.

The bill was originally proposed at the BTC 2024 conference and aims to establish a BTC reserve fund for the United States.

The bill proposes to acquire 1 million BTC, about 5% of the total supply, with funds coming from the surplus funds of the U.S. Treasury. Lummis also stressed the importance of the bill in the context of rising inflation and national debt.

Lummis said: "For my children and grandchildren, I want to leave something better than what we have now. Strategic BTC reserves are for them."

It is worth noting that Republican candidate Trump has also expressed similar intentions to establish a US BTC reserve if elected. He suggested that BTC, the flagship asset, can be used to solve the soaring national debt problem.

At the same time, the bill has also received strong support from the Crypto asset community.

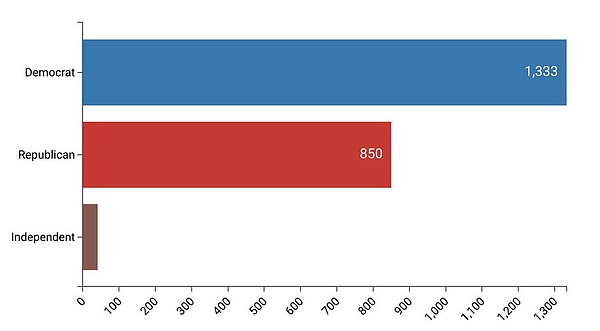

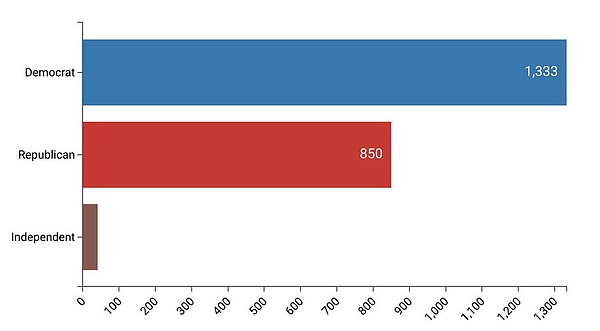

Dennis Porter, founder of the Satoshi Action Fund, said that members of both parties sent about 2,500 letters to lawmakers. Among them, 1,333 were sent to Democratic senators, 850 were sent to Republican senators, and 41 were sent to independents.

Market analysts stressed that the bipartisan engagement highlights the great interest in the value of BTC, as the establishment of a strategic reserve of BTC could affect the U.S. and global Crypto asset markets.

In addition, the move will give BTC official recognition in the United States and could prompt other countries to take similar measures.

Zaprite product head Will Cole added: "BTC is the only credible asset that can outperform Treasury bonds over 20 years, there is no other choice."

Hafiz

Hafiz