Under normal circumstances, the price of one USDT or USDC should be 1 US dollar, or the normal fluctuation range should not be greater than 1 cent. However, if the market believes that the issuer of the stablecoin is in trouble, the price of the currency may be de-anchored.

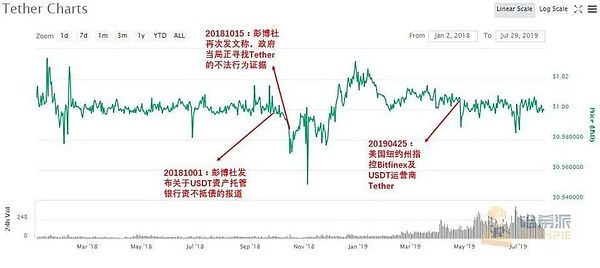

Historically, USDT has experienced three major de-anchoring incidents due to its wild approach:

The first was in April 2017, when Wells Fargo Bank announced the termination of its clearing agency service for Bitfinex. At that time, Tether had nothing, no audit report, and no proof of reserves.

Bitfinex's Taiwan partner bank was also pressured by the United States, and its capital inflow and outflow were restricted.

Users were unable to withdraw cash in time, raising concerns that "the platform could not redeem"

So the price of holding USDT fell to 0.91

The second depegging of USDT occurred in October 2018. This time, Bitfinex was accused of misappropriating Tether's reserve funds to make up for operating deficits. This matter was also investigated by the New York Attorney General, and it was finally confirmed that $850 million was indeed misappropriated.

The third major depegging occurred in 2022, when the algorithmic stablecoin UST collapsed, falling from $1 to $0.1, so many users also wondered whether USDT would collapse as well? So in panic, the price of USDT was also squeezed to $0.95.

Tether did not undergo a complete third-party audit at the time, and only issued quarterly reports. The reserves included commercial paper. There were rumors in the market that these commercial papers might contain Evergrande shares.

So we see USDT depegging three times. It seems that the core reason at the bottom is that Tether has not accepted a complete third-party audit, which makes users panic.

Then if we change to USDC, a good baby, a stable currency that has been fully audited from the beginning, will it not depeg?

In fact, it is not. On March 11, 2023, USDC was once depegged to $0.88.

The reason for USDC's depegging at that time was that Circle's core custodian bank, Silicon Valley Bank, went bankrupt!

At that time, Circle had $3.3 billion in reserves in SVB, accounting for about 8% of USDC's total reserves.

The USDC depegging actually had a big impact on Circle, which has always advertised that they are "compliant stablecoins, so they are more stable."

It turned out that compliant institutions were also unreliable, and they went bankrupt anyway.

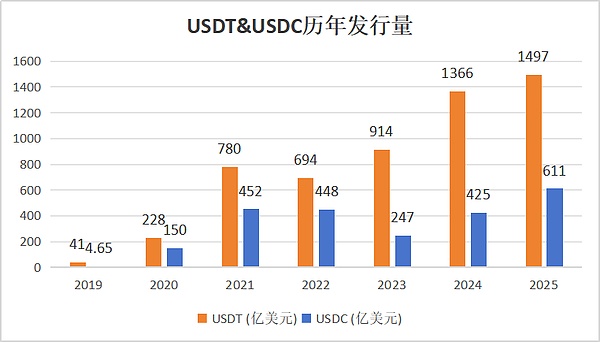

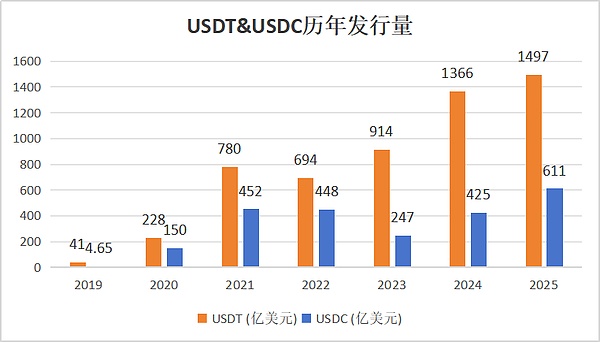

Originally, in 2022, the issuance of USDC accounted for 70% of USDT, and it was only 20 billion away from becoming the number one stable currency. As a result, it was left behind by USDT because of this incident. Now the difference between the two is about 90 billion, and the issuance of USDC is only 40% of USDT

Joy

Joy