Author: ignasdefi Translation: Shan Ouba, Golden Finance

Part of what I like about crypto, especially in the financial and trading space, is that the market will clearly tell you if you are right or wrong. In this dystopian world where many industries such as politics, art, and journalism are confused about what is true and what is false, crypto is very direct:

If you are right, you make money; if you are wrong, you lose money. It's that simple.

But I still fell into a very basic trap: I did not re-evaluate my portfolio in time when the market environment changed. While trading altcoins, I became too complacent with my long-term positions that I "could not touch or sell", especially ETH.

Of course, adapting to the new reality is easier said than done. There are so many variables in the market, and we often rely on simple narratives like "HODL" without watching the market or thinking too much. But what if the meta-narrative of “HODL” is dead? What role does cryptocurrency play in this changing world? What else do we miss?

This article is a summary of my thoughts on major changes in the market.

The End of HODL

Let’s go back to the beginning of 2022:

ETH was priced at around $3,000 at the time, after a sharp drop from a high of $4,800. BTC was at $42,000. But with rising interest rates, the collapse of centralized finance (CeFi) and the closure of FTX, both have halved.

Despite this, the Ethereum community is still optimistic: ETH is about to migrate to PoS, and the ETH destruction mechanism (EIP) was launched not long ago. The narrative of ETH as an “ultrasonic currency” and an environmentally friendly and energy-saving blockchain is hot.

By the end of 2022, ETH and BTC were both doing badly, but SOL was the worst, plummeting 96% to $8.

Ethereum won the L1 war, and other L1s had to either move to L2 or die.

I still remember some of the meetings I attended during the bear market. Most people were convinced that ETH would rebound the most, so they added to ETH like crazy, ignoring BTC, let alone SOL.

Just HODL and hold until the 2024/25 bull market peak and sell. Simple.

The result, hehe!

Since then, SOL has rebounded sharply, while Ethereum has been caught in the worst FUD in history. The “ultrasonic currency” narrative is dead (for now), and the environmental protection (ESG) thing is actually not popular in the market at all.

HODL ETH is my biggest mistake in this cycle. Many people are also.

My original bull market logic was that ETH would become the most productive asset in the history of crypto:

Through the re-staking mechanism, ETH can gain "superpowers" to protect not only the Ethereum mainnet, but also the entire DeFi and crypto infrastructure. ETH (re)staking yields will soar, and you can continue to get airdrops just by restaking.

With higher yields, the demand and price of ETH will also rise. In short - go to the moon! The reality is that the value logic of restaking is still unclear, and Eigenlayer also screwed up the token launch.

So what does this have to do with "HODL is dead"?

For many people, ETH is a "buy and hold" asset. If BTC goes up, ETH should go up more, so why hold BTC?

I should have adjusted when the ETH bull narrative - re-staking - failed to materialize. But I got lazy and didn't want to face my mistakes. ETH would rebound sooner or later anyway, right?

But HODL is not just bad advice for ETH, it's worse for any other asset (except maybe BTC, but I'll get to that later).

The crypto market moves too fast to be a good long-term holding strategy for months or even years until retirement. Looking at the charts, most altcoins have already given back the gains of this bull run. Clearly, the way to make money is by selling, not holding.

One successful memecoin trader said that he often held a memecoin for less than a minute.

Some people are still trying to sell you the "HODL dream", but the reality is: this is a "quick in, quick out" cycle, not a "long-term holding" cycle.

BTC is the only macro-level crypto asset

In the "fast in and fast out" strategy, the only exception is Bitcoin (BTC).

Some people think that BTC's good performance is due to Michael Saylor's unlimited buying and our successful packaging of BTC as "digital gold" and selling it to institutional investors.

But the battle is far from over.

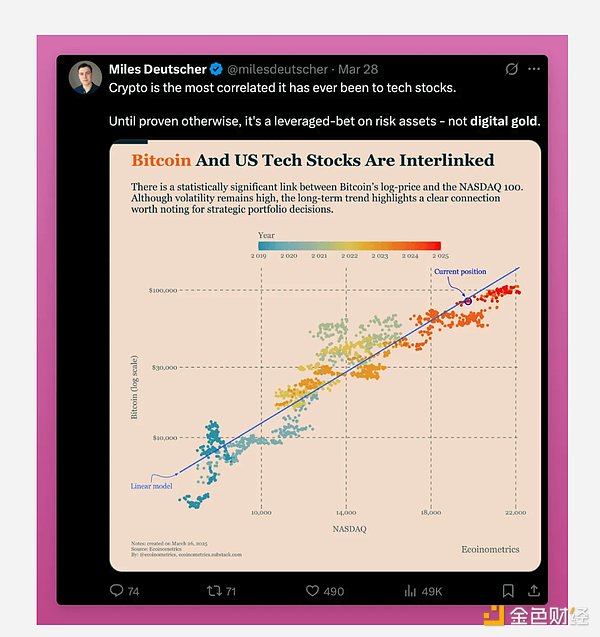

Many crypto commentators still view BTC as a high-volatility risk asset, essentially a leveraged alternative to the S&P500.

This is contrary to Blackrock's research results - they found that the risk-return drivers of BTC are different from traditional high-risk assets, so it is not appropriate to explain BTC using the traditional financial "risk asset/safe haven asset" framework.

So what do you think is the truth?

I think Bitcoin is changing from the "gambler's perspective in the crypto circle" to the "digital gold, safe-haven asset perspective". Mexican billionaire Ricardo Salinas is a good example of a firm holder of BTC.

It is the only truly "macro-level" crypto asset. ETH, SOL and other coins are still measured by indicators such as TVL, trading volume, and handling fees, while BTC has long surpassed these frameworks and become something that even Peter Schiff can understand.

This transition is not over yet, but this stage of switching from "risk assets to safe-haven assets" is a huge opportunity. Once BTC is recognized as a safe-haven asset by the world, its price will be $1 million.

The rot of the private equity market

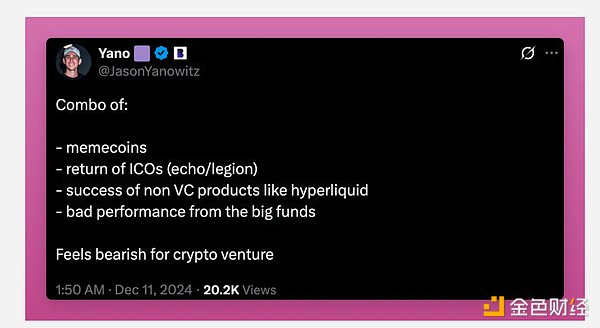

When I found that every KOL who was doing well began to transform into a "VC", buying at ultra-low valuations and then waiting for TGE to directly dump the market, I knew that something was wrong.

But nothing can more accurately describe the current state of the crypto private equity market than Noah's summary of this post.

I suggest you read the original article, but here are the key points I summarized - the evolution of the private equity market over the years.

2015–2019: Belief Stage

The players at that time were true believers. They invested in Ethereum, funded DeFi pioneers such as MakerDAO and ETHLend (Aave), and emphasized HODL. The goal was not to make quick money, but to do something meaningful.

2020–2022: Greed Stage (Summer of DeFi)

Everything has changed. Everyone is chasing the newer, hotter tokens. VCs are throwing money at projects with ridiculous valuations and no use.

The game is simple: buy in at low prices in private placements, hype up the hype, and dump it on retail investors. When the project collapses, we should reflect and clean up, but... nothing has changed.

2023–2025: The Void Phase (after FTX)

VCs today invest in “soulless token machines”: projects that use old ideas, founders with unknown origins (Movement!), and projects with no use cases.

Private valuations can be opened at 50x revenue multiples (if there is revenue), and then the public market will take over. The result is: 80% of tokens issued in 2024 will fall below the private price within six months.

This is the complete “harvest phase”.

Now, retail investors have lost their trust, and VCs have lost a lot of money.

Many VC projects have fallen below the seed round, and the KOL friends I know have also been trapped.

But there are some positive signs:

The co-founder of Movement and Gabagool (the leader of the former rug project of Aerodrome) were opposed by the masses and kicked out of the project. We need more such cleansing.

Valuations in both private and public markets are being adjusted downward.

In the first quarter of 2025, Crypto VC financing finally picked up: The total amount reached US$4.8 billion, the highest quarterly financing since Q3 2022.

Binance's $2 billion deal is the key, but there are also 12 large rounds of financing of more than US$50 million, showing that institutional interest is returning.

Funds mainly flow to areas with practical uses and revenue potential, including CeFi, blockchain infrastructure and services.

New focus areas: AI, DePIN (decentralized physical infrastructure network) and real world assets (RWA) have also attracted a lot of funds.

DeFi is still the track with the most rounds, but the scale of financing has become smaller and the valuation is more conservative.

— Excerpted from CryptoRank's "2025Q1 Crypto Venture Capital Market Report"

We have also begun to try new token issuance models, preferring to reward early supporters rather than insiders. Echo and Legion are at the forefront, and Base has established an exclusive group on Echo. And Kaito's InfoFi model is also bullish - even if you don't have money, as long as you have social influence, you can benefit.

It looks like the market has finally received a signal that the ecosystem is being repaired (although KOLs are still the first to eat meat).

Say goodbye to DeFi and welcome on-chain finance

Remember the short-lived craze for "yield aggregators"? Yearn Finance was the leader, and a bunch of forked projects emerged later.

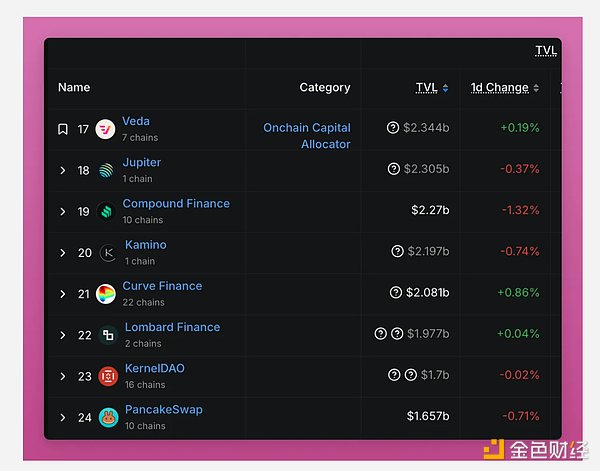

Now we are entering the era of "yield aggregators 2.0", but now we call them "Vault strategies".

As DeFi becomes more complex and more protocols emerge, Vaults become more attractive: you deposit your assets into it, and it helps you find the most suitable risk-return ratio. But the biggest difference between the first generation and the current aggregators is that the degree of centralization of asset management has greatly increased.

Vaults all have "strategists" - usually a group of "institutional investors" who take your funds to chase opportunities and earn fees from them. It's a sure win for them: use your money and collect their management fees.

Representatives of these strategists include: MEV Capital, Seven Seas, Gauntlet, Veda, etc. They work with projects such as Etherfi, Upshift, and Mellow Protocol.

The asset size of Veda alone makes it the 17th largest "protocol" in DeFi, larger than Curve, Pancakeswap, and Compound.

But Vault is just the tip of the iceberg. The vision of DeFi decentralization has long died, and it has evolved into on-chain finance.

Think about it, the fastest growing DeFi and crypto tracks right now are real world assets (RWA), stablecoins with yields, neutral yield coins like Ethena, and even Blackrock's BUIDL. These are far from the original vision of DeFi. Or look at BTCFi and Bitcoin L2, which are essentially multi-signature custodial systems, and you can only trust the custodians to stay.

This trend has been going on since Maker transformed DAI from a decentralized stablecoin to a yield-based RWA protocol. Truly decentralized protocols are already rare, such as Liquity, one of the few examples.

This is not necessarily a bad thing: RWA and asset tokenization can get us out of the previous DeFi Ponzi stage of circular leveraged nesting dolls.

However, this also means that the risk structure is more complicated, and it is difficult to tell where your money is. I will not be surprised to see CeDeFi projects secretly misappropriate user assets in the future.

Remember: Hidden leverage will always find a way into the system.

DAO? Now it's more like LMAO

DAO's decentralized fantasy is also collapsing. The popular "progressive decentralization" theory in the past was proposed by a16z in January 2020: the project first finds market matching → the community gradually takes over → the team gradually withdraws and achieves sufficient decentralization.

Five years later, we are walking back to the old path of centralization. Look at the Ethereum Foundation, they are more actively involved in L1 expansion work.

I talked about the DAO problem in my previous article "The Market's Fearful State and What Happens Next #6":

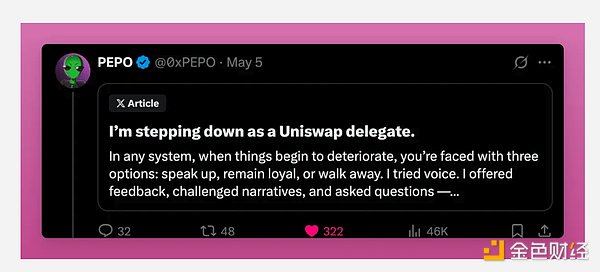

Arbitrum and Lido's DAOs are moving toward more centralized control (such as more direct team involvement, or using a BORG structure), but Uniswap DAO is experiencing a major earthquake.

The Uniswap Foundation passed a $165 million liquidity mining proposal to support Uniswap v4 and Unichain.

But another conspiracy theory is that they are trying to reach the liquidity threshold for the Optimism OP subsidy.

In short, DAO representatives are angry: Why is it that the foundation pays for $UNI rewards, while Uniswap Labs (a centralized company) makes millions of dollars from front-end services?

Recently, a top 20 DAO representative announced his withdrawal from Uniswap governance. In his exit statement, he said:

Governance performance: Uniswap DAO looks democratic, but in fact it marginalizes opposition. Although there are discussions, votes, and forums for proposals, everything seems to be a formality and has been decided long ago.

Concentration of power: The Uniswap Foundation rewards loyalists, suppresses critics, and focuses on image rather than responsibility.

Decentralization failure: If DAO prioritizes brand packaging over actual responsibility, it will eventually become "a dictatorship with a few more steps."

Ironically, a16z is the largest token holder of Uniswap, but Uniswap is far from "gradual decentralization."

Perhaps it is not an exaggeration to say that DAO is just a smokescreen - we just need a beautiful narrative to avoid regulators' scrutiny of centralized crypto companies.

Therefore, tokens that rely solely on "voting rights" have little investment value. The truly valuable tokens either pay dividends or have practical uses.

DAO no longer exists, and now it is LMAO: an oligarchic organization that is lobbied, abused, and controlled by a few people.

DEX (Hyperliquid) is challenging CEX

Now, let me tell you a conspiracy theory.

FTX did Sushiswap because they were afraid that Uniswap would seize the spot trading market. Even if it was not done directly by FTX, they probably provided funding and development support behind the scenes.

Similarly, Binance (whether you call it the team or BNB) launched PancakeSwap for the same reason.

Uniswap once posed a threat to centralized exchanges, but was eventually "de-armed" because it did not threaten the more profitable perpetual contract market of CEX.

How much money do perpetual contracts make? It's hard to say, but you'll understand if you look at the comments.

Hyperliquid (HL for short) is another threat: it started with perpetual contracts, is also planning spot trading, and is building its own smart contract platform.

Currently, Hyperliquid has accounted for 12.5% of the perpetual market. What shocked me was that Binance and OKX actually used "JELLYJELLY" to attack Hyperliquid directly. Although HL has withstood it, HYPE investors must start to seriously consider the risk of further attacks in the future.

It may not be a similar attack, but it may be regulatory pressure. For example, CZ has now become a "national strategic encryption consultant." What do you think he will say to politicians? "Are these perpetual exchanges that don't do KYC bad?"

Anyway, I hope Hyperliquid can continue to impact CEX's spot trading business, launch a more transparent token listing mechanism with reasonable fees, and stop causing protocol finances to collapse due to listings.

I have a lot more to say about HYPE - after all, it is my largest altcoin holding.

But anyway, Hyperliquid has become a force and is challenging centralized exchanges, especially after being attacked by Binance and OKX.

Protocol → Platform

If you follow me on X (formerly Twitter), you may have seen me "promoting" Fluid when talking about how protocols evolve into platforms. The core idea is that protocols are at risk of “infrastructure commoditization”, while most of the benefits are harvested by user-facing applications.

Has Ethereum fallen into the commoditization trap?

To escape this trap, protocols need to become like the App Store, allowing third-party developers to build products on it and keep the value in the ecosystem.

Both Uniswap v4 and Fluid are trying to achieve this goal through Hooks; 1inch and Jupiter teams are also starting to make their own mobile wallets. LayerZero just announced vApps (composable on-chain applications).

I think this trend will only accelerate. The projects that can gather liquidity, attract users, find a way to monetize, and give back to token holders will be the biggest winners.

Crypto is in the midst of a world order change

I wanted to talk more about changes in other areas, such as the development of stablecoins, or why Crypto Twitter (CT) is becoming more and more "confused", but the core reason is: Crypto has become complicated, and CT has lost its alpha.

In the past, we could just post a "Ponzi game" on CT, with simple rules and no one in charge. The regulators either didn't understand or pretended not to see it, hoping that the industry would disappear on its own.

But year after year, regulatory discussions have become more and more frequent on CT. Fortunately, the United States is now moving in a "supportive crypto" direction. Stablecoins, asset tokenization, and Bitcoin as a store of value all make people feel that we are heading towards a critical point for mass adoption.

But everything could change quickly: Once the US government realizes that Bitcoin is really undermining the dollar's hegemony, its attitude may take a 180-degree turn.

Outside the United States, the cultural and regulatory environment is more complex:

China: Currently, there is no sign of turning to "support encryption" (corrections are welcome).

EU: More and more "control", transforming from a welfare state to a war state, and many policies are forcibly promoted under the banner of "national security".

The EU now sees encryption as a threat, not an opportunity:

"ECB warns: US push for encryption may bring financial contagion risks"

"EU plans to ban anonymous encrypted accounts and privacy coins by 2027"

"Blockchain data cannot be deleted individually? Then just delete the entire chain"

"EU regulators: Insurance companies holding crypto assets will face punitive capital rules"

We need to evaluate the attitudes of various countries towards encryption in the context of global political trends. The reality is: the world is moving towards deglobalization, and countries are beginning to close their borders.

“EU plans to cancel visa-free policy for ‘investment-for-nationality’ countries”

“European Court of Justice rules against golden visa program”

“China’s exit ban surges as political control intensifies”

The biggest uncertainty at the moment is what role crypto will play in the “new world order” and this transitional period.

Is it a tool for capital freedom? (Especially when capital controls really begin)Or will countries use increasingly stringent laws to force crypto to comply and move towards thorough regulation?

Vitalik once wrote about the “Annual Ring Model of Culture and Politics”, pointing out that the crypto industry is still in its early stages and has not yet been “institutionalized” like banking regulations and intellectual property rights.

In the 1990s, the Internet was “let go”;

From the 2000s to the 2010s, social media became “this thing is harmful, we must control it!”;

In the 2020s, encryption and AI are in a tug-of-war between “openness vs. control”.

Governments used to lag behind, but are now catching up.

Of course, I hope that countries will embrace an open approach. But seeing the world closing its doors,I really can’t help but worry.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Brian

Brian Jasper

Jasper Catherine

Catherine Clement

Clement Joy

Joy Aaron

Aaron Jasper

Jasper Kikyo

Kikyo Hui Xin

Hui Xin