Author: Arthur Hayes, Founder of BitMEX; Translated by: Jinse Finance

Praise to Satoshi Nakamoto! Time and compound interest apply equally to everyone.

Even for governments, there are only two ways to pay: using savings or borrowing. For governments, savings are equivalent to taxes. Taxes are less popular, but spending is very popular. Therefore, politicians prefer to issue debt when distributing benefits to the common people and the elite. Politicians always like to borrow money from the future to win re-election in the present, because when the bill comes due, they will no longer be in office.

If all governments, due to the incentives of their officials, are inherently inclined to issue debt rather than increase taxes to distribute benefits, then the next question is: how do government debt buyers finance these purchases?

Are they using savings/equity, or are they financing their purchases by borrowing? Answering these questions is crucial to my vision of future dollar money creation in the context of "American Doctrine." If the marginal buyers of U.S. Treasury bonds are financing their purchases, then we can observe who is lending them the money. Once we know the identity of the debt buyers, we can determine whether they are creating money out of thin air or lending using their own equity. If, after answering all the questions, we find that a particular Treasury bond buyer is lending by creating money, then we can make the following logical leap: Government debt issuance increases the money supply. If this is true, then we can estimate the maximum amount of credit that buyer can provide (assuming there is an upper limit). These questions are important because I will argue that if government borrowing continues as predicted by "too big to fail" banks, the U.S. Treasury, and the Congressional Budget Office, then the Federal Reserve's balance sheet will also grow accordingly. If the Federal Reserve's balance sheet grows, this is positive for dollar liquidity and will ultimately push up the price of Bitcoin and other cryptocurrencies. Let's analyze these questions step by step and assess this logical puzzle. Q&A Time Question 1: Will US President Trump make up for the deficit by raising taxes? Answer: No. He and the Republicans recently extended the 2017 tax cuts. Question 2: Is the Treasury Department making up for the federal deficit by borrowing money, and will it continue to do so in the future? Answer: Yes. The above estimates come from "too big to fail" banks and some U.S. government agencies. As you can see, the deficit is projected to be around $2 trillion, to be covered by issuing approximately $2 trillion in debt. Given that the answers to the first two questions are both yes, then: Annual Federal Deficit = Annual Treasury Debt Issuance. Let's analyze step by step the major buyers of Treasury bonds and how they finance their purchases.

Buyers of US Treasury Bonds

Foreign Central Banks

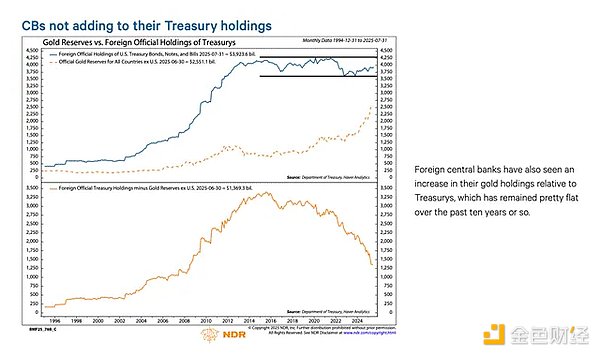

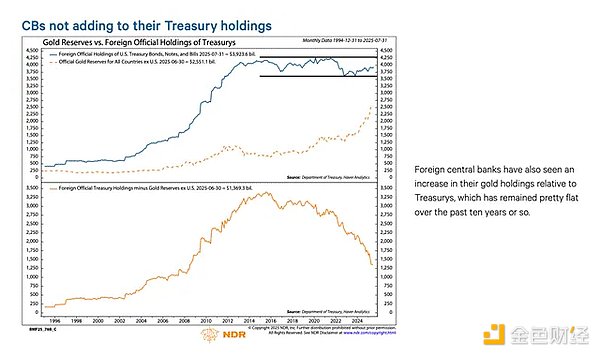

If "American rule" even dares to confiscate the money of Russia (a nuclear power and the world's largest commodity exporter), then no foreign holder of US Treasury bonds is safe. Realizing the risk of expropriation, foreign central bank reserve managers prefer to buy gold rather than US Treasury bonds. Therefore, gold only began to truly surge after Russia's invasion of Ukraine in February 2022.

US Private Sector

According to data from the US Bureau of Labor Statistics, the personal savings rate in 2024 was 4.6%. In the same year, the US federal deficit accounted for 6% of GDP.

Given that the deficit exceeds the savings rate, the private sector is unlikely to be the marginal buyer of Treasury bonds. Are the four major U.S. commercial banks (JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo) buying large amounts of Treasury bonds? No. As shown in the figure, in fiscal year 2025, the four major banks purchased approximately $300 billion in Treasury bonds. In the same fiscal year, the Treasury issued $1.992 trillion in Treasury bonds. While this group is undoubtedly a significant buyer of Treasury bonds, they are not the marginal buyer of last resort. Relative Value (RV) Hedge Funds

According to a recent paper by the Federal Reserve, RV funds are marginal buyers of U.S. Treasury bonds.

"Our findings indicate that Cayman Islands hedge funds are increasingly becoming marginal foreign buyers of U.S. Treasury notes and bonds. As shown in Figure 5, between January 2022 and December 2024, when the Federal Reserve was reducing its balance sheet through rollover of maturing Treasury bonds, Cayman Islands hedge funds made net purchases of $1.2 trillion in Treasury bonds. Assuming these purchases consisted entirely of Treasury notes and bonds, they absorbed 37% of net issuance of notes and bonds, almost equivalent to the total of all other foreign investors combined." alt="eeFbw8B7Y3BwA2cY1IVNY4IRwpiUqODGZG6fpF9y.png">

Trading Strategy:

Buy spot Treasury bonds

Compare

Sell the corresponding Treasury bond futures contract

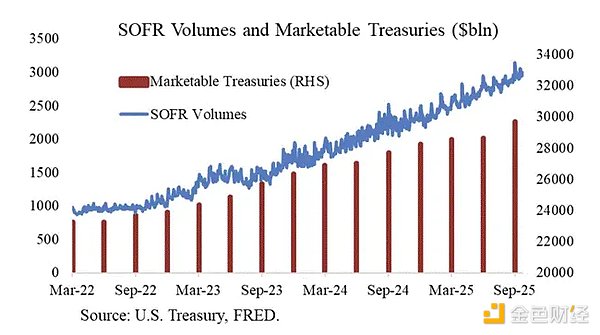

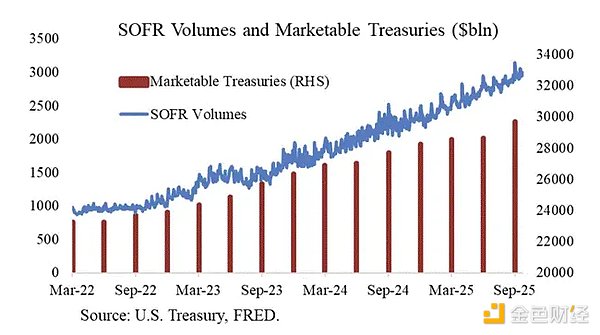

Thanks to Joseph Wang for providing this chart. SOFR (Secured Overnight Funding Rate) volume is a proxy for the size of RV funds' participation in the Treasury market. As you can see, the increase in debt burden corresponds to the increase in SOFR volume. This indicates that RV funds are marginal buyers of Treasury bonds.

RV hedge funds engage in this trade to profit from the spread between the two instruments. Because the spread is very small (measured in basis points; 1 basis point = 0.01%), the only way to truly profit is by purchasing financing for Treasury bonds. This leads to the most important part of this article, to understand what the Federal Reserve will do next: How will RV funds purchase financing for their Treasury bonds?

RV Fund finances its Treasury purchases through repurchase agreements.In a seamless transaction, RV Fund pledges the Treasury it purchases to borrow cash at the overnight rate, and then uses the borrowed cash to settle the Treasury purchases. If cash is plentiful, the repurchase rate will trade at or slightly below the federal funds rate ceiling. Why?

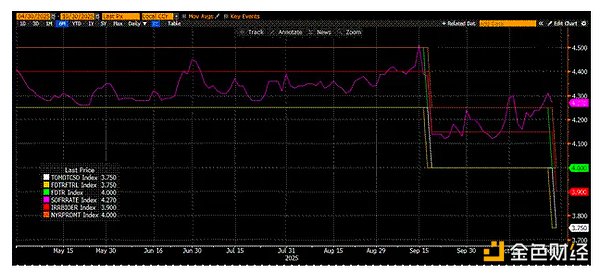

Let's review how the Federal Reserve manipulates short-term interest rates. The Federal Reserve has two policy rates: the upper and lower bounds of the federal funds rate; currently 4.00% and 3.75%, respectively. To force the effective short-term rate (SOFR, or secured overnight funding rate) to fall within this range, the Federal Reserve uses some rather rigid tools.

I will briefly introduce them in order of interest rates from low to high: Reverse Repo Facility (RRP) Eligible Participants: Money market funds and commercial banks Purpose: Overnight cash held here earns interest paid by the Federal Reserve. Interest Rate: Federal Funds Rate Floor Interest Rate (IORB) Eligible Participants: Commercial banks Purpose: Banks earn interest on their excess reserves held at the Federal Reserve. Interest Rate: Between the lower and upper bounds of the federal funds rate. Standing Repo Facility (SRF) Eligible Participants: Commercial banks and other financial institutions. Purpose: To allow financial institutions to pledge eligible securities (primarily Treasury bonds) and obtain cash from the Federal Reserve when cash is tight. In effect, the Federal Reserve prints money and exchanges it for the pledged securities.

Interest Rates: Federal Funds Rate Ceiling

Putting them together, we get this relationship:

Federal Funds Rate Lower Bound = RRP < IORB < SRF = Federal Funds Rate Ceiling

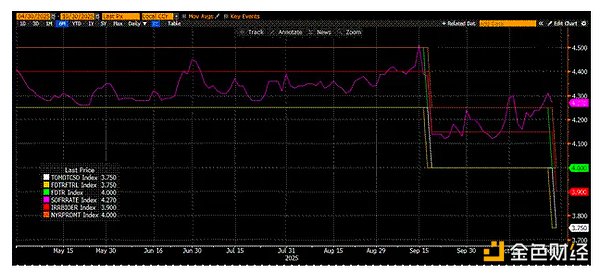

This is a chart of real-world values that helps visualize the relationship between these key dollar money market interest rates. At the top, orange (SRF) and green (Federal Funds Rate Ceiling) are equal. Immediately below that is the red line (IORB). The magenta line (SOFR) typically fluctuates between the upper and lower bounds.

This is a chart of real-world values that helps visualize the relationship between these key dollar money market interest rates.

At the top, orange (SRF) and green (Federal Funds Rate Ceiling) are equal.

Next is the red line (IORB).The magenta line (SOFR) typically fluctuates between the upper and lower bounds. Yellow (Federal Funds Rate floor) and white (RRP) are equal. The SOFR is a composite index based on the rates of various types of repurchase agreements. Unlike the London Interbank Offered Rate (LIBOR), which is based on bank quotes, the SOFR is based on actual market transactions. This is the Federal Reserve's target rate. If SOFR transactions are above the federal funds rate ceiling, it means there is a cash crunch, which is a problem. Because once there is a cash crunch, the SOFR spikes, and the dirty fiat currency financial system comes to a standstill. This is because both marginal buyers and suppliers of liquidity are using leverage. If they cannot reliably roll over their liabilities at the federal funds rate, they will suffer huge losses first, and then stop providing liquidity to the system. Worryingly, without access to cheap leverage, no one will participate in the Treasury market. (Note: SOFR surged to 4.22% last Friday, October 31, while the Fed had already cut rates again last week, SOFR should have remained around 4.00%). What caused SOFR to trade above the federal funds rate ceiling? To answer this question, we must first ask who the marginal providers of cash in the repo market are? Money market funds and commercial banks provide cash to the repo market. Let's assume they are profit-maximizing entities and examine why they do this. Money market funds aim to take on as little credit risk as possible and earn short-term interest rates. This means that money market funds primarily earn returns by depositing funds in RRPs, lending cash in the repo market, and purchasing Treasury bills. In all three cases, they are taking on the credit risk of the Fed or the U.S. Treasury, which is essentially risk-free because the government can always print money to pay off its debts. The billions or trillions of dollars deposited there will provide cash to the repo market until the RRP balance runs out. This is because the RRP rate is lower than the SOFR rate, so profit-maximizing money market funds would withdraw cash from the RRP and lend it to the repo market. But now the RRP balance is zero because Treasury rates are very attractive; money market funds maximize profits by lending money to the U.S. government. As money market funds exit the game, commercial banks must fill the gap. They will be happy to lend reserves to the repo market because the IORB is lower than the SOFR. The factor limiting banks' willingness to provide cash at a "reasonable" level (i.e., SOFR <= the federal funds rate cap) depends on the adequacy of their reserves. Various regulatory requirements force banks to maintain a certain amount of reserves, and once balance sheet capacity shrinks, they must charge increasingly higher interest rates to provide cash to the repo market. Since the Fed began quantitative tightening in early 2022, banks have lost trillions of dollars in reserves. Starting in 2022, the two marginal providers of cash—money market funds and banks—have reduced the amount of cash available to supply the repurchase market. At some point, neither is willing or able to provide cash to the repurchase market at a rate equal to or below the federal funds rate ceiling. Simultaneously, the supply of cash available to supply the repurchase market at a reasonable rate has decreased, while demand for that cash has increased. This increased demand is due to the continued massive spending by former President Biden and current President Trump, which requires the issuance of more Treasury bonds. The marginal buyers of this debt—RV funds—must finance these purchases in the repurchase market. If they cannot reliably obtain funding daily at a rate equal to or slightly below the federal funds rate ceiling, they will not buy Treasury bonds, and the U.S. government will be unable to finance itself at an affordable rate. Because of a similar situation in 2019, the Federal Reserve created the Special Revenue Fund (SRF). As long as acceptable forms of collateral are provided, the Federal Reserve can use its printing press to provide an unlimited amount of cash at the SRF rate. Therefore, RV funds can be confident that no matter how tight cash becomes, they will always be able to obtain funding at the federal funds rate ceiling in the worst-case scenario.

If the SRF balance is above zero, then we know that the Federal Reserve is cashing in the checks of politicians with the money it has printed.

Treasury issuance = Increase in the dollar supply

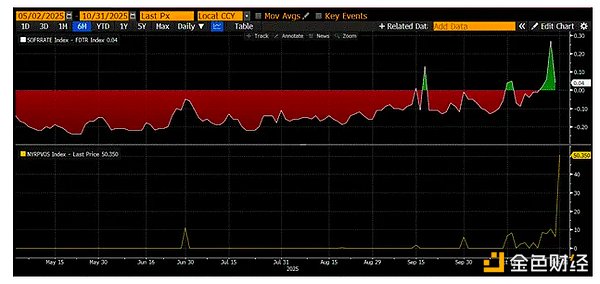

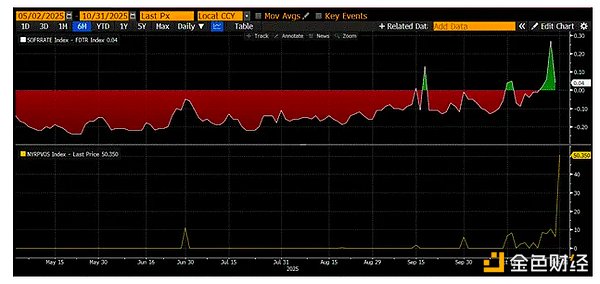

The above chart is (SOFR - Federal Funds Rate Ceiling).

When this difference is close to zero or positive, cash is tight. During these periods, SRF (lower half of the chart, in billions of dollars) sees significant use. Using SRF allows borrowers to avoid paying higher, unmanipulated SOFR rates. The Federal Reserve can ensure sufficient cash in the system to facilitate repurchase agreements needed for the RV Fund to purchase Treasury bonds in two ways. The first is by creating bank reserves through the purchase of securities from banks. This is the textbook definition of quantitative easing. The second is by freely lending to the repurchase market through SRF. As I have said many times, quantitative easing is a dirty word. Even the most financially naive civilians now understand that QE = printing money = inflation. When inflation escalates, ordinary citizens will vote for the opposition. Given that Trump and Bessant want the economy to overheat, they don't want to be blamed for high inflation caused by credit-driven economic expansion. Therefore, the Federal Reserve will do everything in its power to solemnly declare that its policy mix is not quantitative easing and will not fuel inflation. Ultimately, this means that the SRF will become a channel for printing money into the global financial system, rather than using quantitative easing to create more bank reserves. This will buy some time, but the exponential expansion of Treasury issuance will eventually force the SRF to be used repeatedly. Remember, Bessant not only needs to issue $2 trillion annually to fund the government, but also trillions of dollars to roll over maturing debt. Implicit quantitative easing will begin soon. I don't know when it will begin. But if current money market conditions persist and the size of the Treasury grows exponentially, then the balance of the SRF as lender of last resort must also grow. As the SRF balance grows, the amount of fiat US dollars in the world will also expand. This phenomenon will reignite the Bitcoin bull market. Between now and the start of implicit quantitative easing, people need to conserve strength. Market volatility is expected, especially before the US government shutdown ends. The US Treasury is borrowing money through its debt auctions (negative dollar liquidity), but not spending it (positive dollar liquidity). The Treasury General Account (TGA) is about $150 billion above its $850 billion target, and this additional liquidity will not be released into the market until the government reopens. This liquidity withdrawal is one of the reasons for the current weakness in the crypto market. Given the upcoming four-year anniversary of Bitcoin's all-time high in 2021, many will mistake this period of market weakness and stagnation for a top and sell their positions—provided they weren't wiped out in the altcoin crash a few weeks ago. This is a mistake; the workings of the dollar money market don't lie. This corner of the market is shrouded in obscure jargon, but once you translate the terms into "printing money" or "burning money," it's easy to see how to dance.

Catherine

Catherine