In the past two weeks, the world's attention has been focused on the Middle East.

As the two most important powers in the Middle East, the conflict between Iran and Israel not only means that the surface peace in the Middle East has been suddenly broken and the chaos continues to escalate, but also further set off waves around the world. From the current point of view, this nuclear-induced war has not only deeply involved Iran and Israel, forcing the proxy war to turn into a head-on confrontation, but also made the United States unable to restrain its rapid intervention, and the situation is gradually expanding.

Under the risk-averse sentiment, the global market has fallen into turmoil, and hard assets such as gold and the US dollar have risen rapidly, while the risk market is in a state of panic. It has to be admitted that the war between Iran and Israel is also spreading to the encryption field.

To talk about the current Iran-Israel conflict, the Iranian nuclear issue cannot be avoided. In fact, Iran's nuclear program is earlier than expected. As early as 1957, during the Cold War, in order to prevent the Soviet Union from infiltrating southward, the United States signed the "Civil Nuclear Energy Cooperation Agreement" with the then pro-American Iranian Pahlavi Dynasty, which opened the prelude to Iran's nuclear program.

In 1967, according to the agreement, a 5-megawatt research nuclear reactor provided by the United States to Iran landed at the University of Tehran. In 1968, Iran signed the Treaty on the Non-Proliferation of Nuclear Weapons (NPT), formally establishing its legal status in the peaceful use of nuclear energy in the international nuclear non-proliferation system. The oil crisis in the 1970s further catalyzed Iran's nuclear industry. Relying on high-yield oil exports, Iran established the Atomic Energy Organization (AEOI) in 1974 and began to carry out nuclear technology cooperation with countries around the world. In 1979, with the completion of about 80% of the construction of the two reactors of the Bushehr Nuclear Power Plant, Iran initially established a relatively comprehensive nuclear industry system.

The turning point occurred during the Islamic Revolution in Iran. After the revolution, Iran changed from a secular monarchy to a theocracy with a combination of religion and politics, marking the end of the honeymoon period between the United States and Iran. The Khomeini regime was completely anti-American, and the United States also listed Iran as a blockade zone. The nuclear program, as a symbol of cooperation between the United States and Iran, fell into silence. After the Iran-Iraq War, Khomeini realized the importance of a modern military system and began to embrace the Soviet Union and other countries. In 1992, he signed the "Agreement on the Peaceful Use of Nuclear Energy" with Russia, and the two countries started high-intensity cooperation.

Since the Iranian nuclear issue was first exposed to the international community in 2002, Iran has held many multilateral negotiations with other countries on the nuclear issue in the following decade. In 2015, Iran signed the "Joint Comprehensive Plan of Action" (JCPOA) with the United States, Britain, France, Germany, Russia and China, and its uranium enrichment activities were temporarily frozen, and Western sanctions were also relaxed. But then Trump came to power, making the war situation confusing again. The United States unilaterally withdrew from the agreement in 2018 and resumed severe sanctions. Affected by this, Iran adopted a more proactive strategy in the nuclear industry and successfully deployed IR-6 centrifuges in 2023. Its enrichment efficiency increased five times compared with the agreement period. According to the latest data in 2025, the International Atomic Energy Agency (IAEA) report showed that Iran had accumulated 408 kilograms of enriched uranium with an enrichment of 60%, approaching the threshold of weapons-grade nuclear materials.

In April this year, the Trump administration said it would restart the Iran nuclear talks, but in early June, on June 12, 2025, the Board of Governors of the International Atomic Energy Agency (IAEA), the United Nations nuclear watchdog, formally determined that Iran had not complied with its nuclear obligations. The negotiations ended unhappily and the situation in the Middle East took a sharp turn for the worse. Among them, Israel has become the most restless country.

The conflict between Israel and Iran has a long history. The absolute opposition of religious ideology determines the inevitable confrontation between the two, and the struggle for geopolitics and hegemony makes this conflict spiral. On the one hand, Iran builds the Shiite Arc to encircle Israel, and on the other hand, it increases its nuclear technology. Israel, which does not have enough strategic depth, retaliates frantically under the anxiety of survival, and the tacit support of the United States makes Israel fearless. Israel and Iran have shown a trend of confrontation in all aspects. The proxy war between the two has become the basic situation in the Middle East in recent years. However, this time, the proxy war buried in the dark quickly turned into a face-to-face confrontation mode.

On June 13, local time, the Israeli Air Force launched an open air strike on dozens of nuclear facilities and military targets in Iran under the code name "The Power of the Lion". Iran was not to be outdone and launched a series of missile and drone attacks on Israel. Since then, Israel and Iran have continuously increased the intensity and scope of their attacks on each other, and the international community has intervened. In fact, looking back at the timeline of the Iran-Israel conflict, the United States can be said to be the initiator. Due to the deep contradictions between the United States and Iran over geopolitics, ideology, historical grievances, and regional hot issues, it chose to support Israel to curb Iran's development. In this conflict, the United States claimed to exert public pressure on Iran by peaceful negotiations and non-intervention, but on June 21, it directed the US military to blow up three Iranian nuclear facilities, which not only further increased the possibility of expanding the scale of the conflict, but also significantly increased the complexity of the situation, thereby threatening global security. Geopolitics is the core focus of the global financial market. Affected by the entry of the United States, the impact continues to amplify. In response to the US move, Iran proposed that the Strait of Hormuz, which carries about one-third of the world's seaborne crude oil trade, should be closed, causing global panic. Just today, international crude oil futures opened up more than 5%, and the international gold price once exceeded US$3,400. Risk markets are not having such a good time. As risk aversion intensifies, the three major U.S. stock index futures opened lower, and the crypto market suffered a heavy blow. In the past three days, the crypto market has continued to fall. Yesterday, Bitcoin fell below the 100,000 mark, reaching a low of $98,000 and now at $101,961. The cottage sector fell straight down, ETH returned to above $2,200, and SOL reached $130 again. Coinglass shows that as of 9 a.m. this morning, the entire network had a liquidation of about $559 million in the past 12 hours, with long orders of $452 million and short orders of $107 million. Among them, Bitcoin liquidated $223 million and Ethereum liquidated $156 million.

On the other hand, in addition to igniting the risk aversion in the crypto market, the war between Iran and Israel is also rapidly spreading to the local crypto industry. On the afternoon of June 18, the mysterious hacker group Gonjeshke Darande claimed that it had launched a large-scale attack on the Iranian cryptocurrency trading platform Nobitex and successfully obtained its source code, internal network data and customer asset data. So far, nearly $90 million in crypto assets have been affected, most of which are stablecoins USDT. It is worth noting that even if the trading platform is controlled, most of the funds have not been transferred from the on-chain data, but directly destroyed, which is more like a demonstration.

The hacker explicitly mentioned the reason for the attack, saying that "Nobitex Exchange is at the heart of the Iranian regime's global terrorist activities, and cooperating with the Iranian regime's infrastructure to fund terrorism and violate sanctions will put your assets at risk." Although the hacker group has never revealed its identity, most experts in the industry believe that it is the famous 8200 unit under the Israeli military intelligence department, looking at its multiple precision strikes against Iran since 2022.

It must be admitted that the hacker's attack is accurate, and this move has indeed hindered the flow of funds between Iran and the outside world. Due to years of suffering from sanctions and inflation, Iran's local encryption industry has actually developed quite rapidly. According to data provided by Maria Noor, there are currently 90 cryptocurrency exchanges operating in Iran, of which more than 10 operate as centralized exchanges, providing websites and applications for users to use. About 15 million to 19 million Iranians are active in the cryptocurrency market, accounting for about one-fifth of Iran's total population. It is enough to see that the crypto market has become one of the important ways for Iran to trade with the outside world.

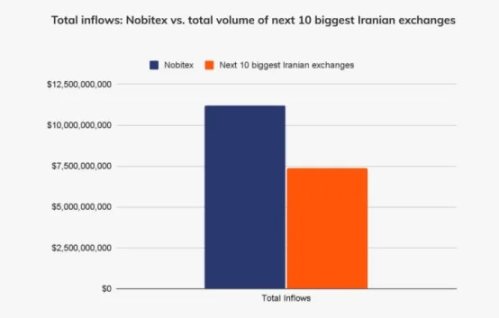

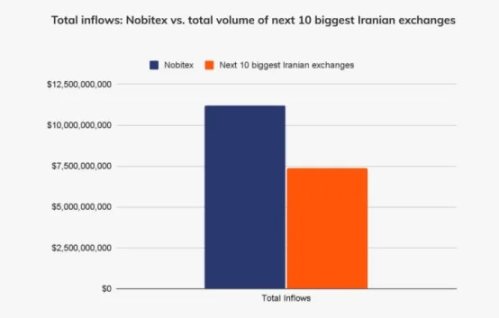

Nobitex, which was attacked this time, is the largest exchange in Iran, with 6 million active users, an annual transaction volume of 68 million, and a market share of almost 87%. Reuters once reported on this project, saying that most of Iran's domestic crypto transactions are connected to the international market through Nobitex or similar exchanges.

In addition to cryptocurrencies, the Iranian government has also invested heavily in the industrial application of blockchain technology, and has successively launched official blockchain projects Kuknos and Borna to promote the improvement and efficiency of financial infrastructure. Despite supporting blockchain technology, the Iranian government's attitude towards the growing trend of cryptocurrency in the local area is quite subtle.

First of all, Iran's attitude in the field of mining is very ambiguous. Compared with other regions where mining farms are the absolute leaders, Iran's mining industry is dominated by retail investors. In 2018, Iran became a popular destination for global mining by legalizing the mining industry and attracting a wide range of miners to come to the local gold rush. Under the rigid demand for transactions, local retail mining is common. Problems also followed one after another. Due to insufficient power infrastructure, Iran frequently faces the challenge of power shortage. Data can also confirm this point. About 300 mining projects have been approved by the government, but according to Wu, citing data from ViraMiner CEO Masih Alavi, to date, Iran's legal mining scale is only 5 megawatts, while the scale of illegal underground mining is close to 2GW, which is 400 times that of legal mining. This electricity is equivalent to 5% of Iran's total electricity consumption in 2023. Against this background, Iran has imposed stricter restrictions and contractions on this industry. In 2020, the Central Bank of Iran announced a ban on individuals using illegal mining currency transactions in the country. In December 2024, the official explicitly banned the promotion of crypto mining machines. So far, although the official has not taken further action, the attitude is obviously not supportive.

The negative attitude is more thorough in cryptocurrency transactions. Faced with the erosion of official monetary sovereignty by cryptocurrencies, Iran has struck hard and tried many times to block the exchange between cryptocurrencies and rials to limit the outflow of local funds. At the beginning of this year, the Central Bank of Iran once stopped all rial payments for cryptocurrency exchanges and required all exchanges to use government-designated interfaces for transactions to achieve fund tracking and user monitoring. In the following February, Iran explicitly banned any local placement of cryptocurrency advertisements. After the attack on Nobitex, the Central Bank of Iran even introduced a crypto curfew policy, strictly stipulating that domestic crypto platforms are only allowed to operate between 10 a.m. and 8 p.m. daily.

From all the restrictions and regulations, we can see that the government is wary of cryptocurrencies. On the one hand, under the current blockade, cryptocurrencies are an important way for local industrial development and foreign exchange acquisition, and an important trading window for Iran. Objectively, they have their own significance. But on the other hand, under the dual influence of the impact of cryptocurrencies on monetary sovereignty and the loss of electricity in the mining industry, the government must not allow them to develop at will, and can only try to strike a balance between innovation and regulation. This point is also reflected in the religious field. In Iran, where theocracy is highly concentrated, speculative cryptocurrencies are naturally taboo. Traditional religious conservatives are quite disgusted with them, but Iran's Supreme Leader Khamenei believes that an attitude of keeping pace with the times should be maintained. The open and conservative factions also maintain a delicate balance on this issue.

Of course, whether it is acceptance or opposition, from the current situation, the flames of the Iran-Israel war have obviously spread from the physical space to the cyberspace and further to the financial field, and the encryption field, as one of them, can only be forced to face this impact. For Iran, the attack on the exchange may be just the beginning. The subsequent game between the two will only be more complex, more sophisticated and more invisible.

For the global encryption industry, geopolitics will become the absolute main line of the market in the short term, and risk aversion will greatly affect the trend of cryptocurrency. From the current point of view, due to the frequent positive news within the industry, the sentiment level is still relatively mild, and market fluctuations are relatively controllable. Bitcoin's support at $98,000 is very strong, and BTC in the exchange also has a trend of leaving the market, and the Bitcoin ETF had a net inflow of $1.02 billion last week, all of which show that the market still has a positive attitude towards Bitcoin. However, the entry of the United States brings a high degree of uncertainty. The scope and degree of its involvement will have a wide impact on the battlefield. If it causes the closure of the Strait of Hormuz in the future, the market will also usher in greater fluctuations.

In addition, it is worth noting that as the conflict leads to a rapid rise in oil prices, the Federal Reserve, which has been wavering between tariffs and inflation, will open a longer observation window. Maintaining high interest rates in the third quarter is gradually becoming a market consensus, and this move will have a more far-reaching impact on the crypto market.

Weatherly

Weatherly