Author: 2989 Source: X, @punk2898

Goldman Sachs: Why the plunge in Japanese bonds dragged down the global market.

To make it easier for everyone to understand, this is --- DeFi deleveraging in the real world

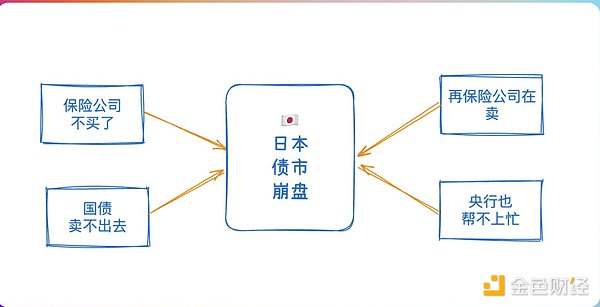

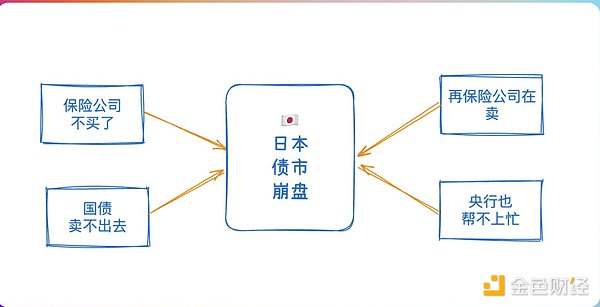

Why did the Japanese bond market collapse?

1. No one is willing to buy

Insurance companies don’t buy anymore: Japanese life insurance companies used to be big buyers of government bonds, but now their asset-liability structure has changed and they don’t need to buy so many long-term government bonds

Government worries about finances: The Japanese government is facing an election and all parties are talking about tax cuts, which makes investors worry that the Japanese government will be even short of money and government bonds will be more risky

Reinsurance companies are selling: Some insurance companies transfer assets to reinsurance companies, which sell Japanese government bonds in exchange for higher-yielding investments in order to make more money

2. The central bank can't help

Although the Bank of Japan holds more than half of Japanese government bonds, it is powerless in the face of this sell-off. Market liquidity is very poor, with many people who want to sell and few who want to buy.

How does the Japanese bond market affect global markets?

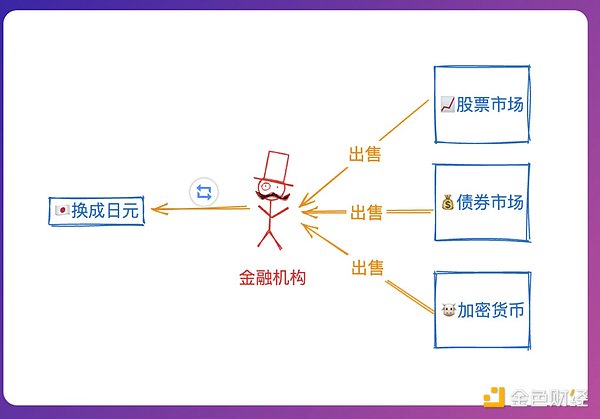

When interest rates in Japan begin to rise, the cost of borrowing yen becomes higher, making the carry trade that previously relied on low interest rates no longer profitable. Investors need to repay their loans, leading to a series of deleveraging behaviors:

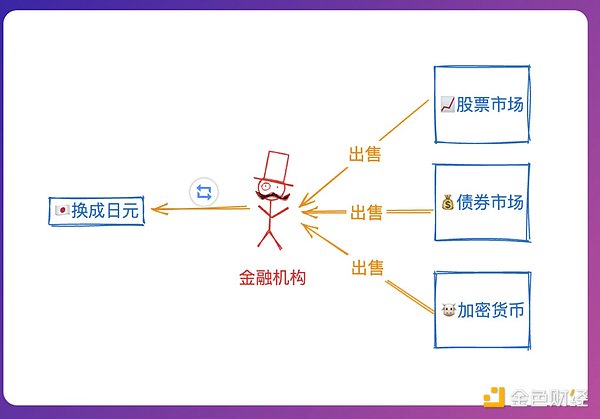

• Asset sales: In order to repay yen loans, investors need to sell the assets they hold (such as stocks, bonds, cryptocurrencies), which will cause the prices of these assets to fall.

• Market volatility: Large-scale asset sales can cause market volatility and instability.

• Changes in capital flows: Capital that previously flowed into high-return markets began to flow back, reducing liquidity in these markets and further exacerbating market uncertainty.

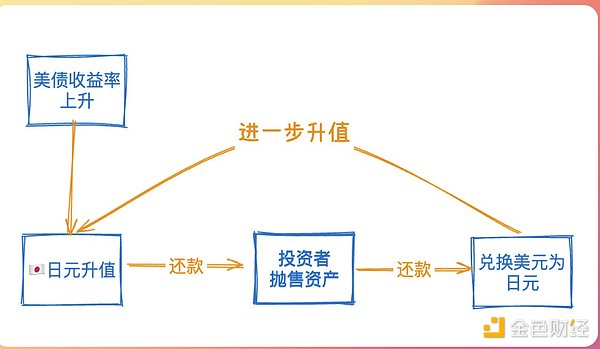

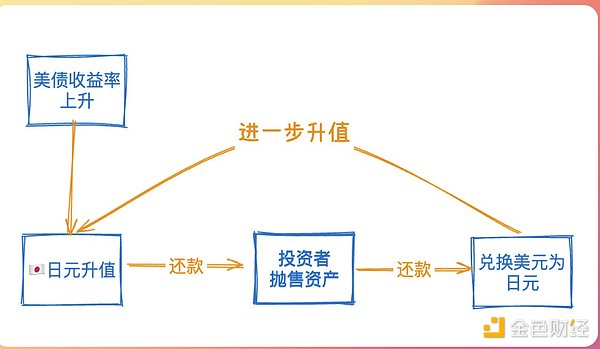

After investors sell assets to obtain US dollars, they need to convert US dollars into Japanese yen to repay their loans. As a large amount of funds flow from US dollars to Japanese yen, the appreciation of the Japanese yen is further driven.

This situation forms a "death spiral": the Japanese yen appreciates -> investors sell assets -> convert US dollars into Japanese yen -> the Japanese yen appreciates further -> repeat this process.

What will happen in the future?

De-leveraging means reducing debt or leverage. As borrowing costs increase, investors have to reduce debt and sell assets to repay loans. This behavior will trigger a series of chain reactions around the world, leading to falling asset prices and increased market volatility.

In fact, this is no different from DeFi back then, and it is also a process of deleveraging.

Goldman Sachs believes that unless there are major policy adjustments, such fluctuations will recur:

The Japanese government may:

Reduce the issuance of long-term government bonds

Repurchase some bonds to stabilize the market

The Bank of Japan's actions are critical:

The next rate hike may not be until January 2026

Any adjustment to monetary policy will affect the market

Weatherly

Weatherly