Written by: VC Popcorn

Abstract

This article is an academic survey, which aims to explore the operating logic, value and impact of digital currency and its subjects in economic activities on the macro economy.

Transfer of economic power:Investment or speculation in digital currency actually reflects people's pursuit and desire for economic power.

The impact of monetary technology on economic power:On the surface, the change of monetary technology has dominated the transfer of monetary power, but before the emergence of blockchain, this process was more driven by political power and military force.

The core problem of digital currency:P2P transfer technology has reshaped the existing economic power structure with its decentralized characteristics, but it has not solved the trilemma of traditional finance. Its essence is still transfer technology, not real currency.

Conclusion:Some "investment institutions" advocate that Bitcoin is the currency of the future, which shows a lack of common sense in economics, because Bitcoin is not suitable as a unit of daily transactions.

01. Introduction

This article is an academic discussion article. We have done a lot of academic research and reference; it does not involve any investment advice or related content. The article mainly analyzes the technical characteristics of digital currencies represented by Bitcoin, and deeply explores its role, influence and value in the macro economy. And further analyzes the underlying operating logic of the Web3 world, providing theoretical support for it.

02. Evolution of Currency and Transfer of Economic Power

2.1 Evolution of Currency and Carrying of Trust

As a medium of transaction, a storage and calculation unit of value, currency carries the trust and commitment between all parties inside and outside the society. However, the demand for the role of currency in economic activities is eternal, but the form of currency is iterative with the development of science and technology and society. From the earliest shells and metals to today's paper money, the forms vary, but they are constantly evolving to meet human needs. Currency is not only a medium of economic activities, but also a reliable technology that enables the realization of commitments between economies. With the complexity of social and economic activities, monetary technology is also constantly developing.

2.2 Transfer of Economic Power

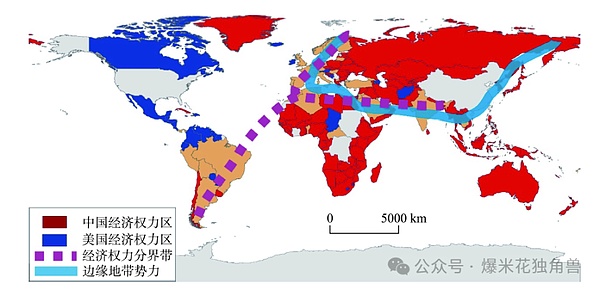

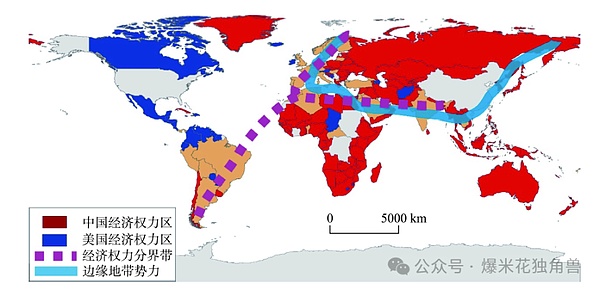

What is economic power? In the words of economist Richard Cooper, economic power is the ability to apply economic means to punish or reward another party (Eichengreen, 2022). This ability is usually the result of its economic size, and it is also the basis for economic growth. Economic strength is related to a country's purchasing power. Purchasing power is determined by the strength of a country's currency. For example, the US dollar is currently considered the most powerful currency, so much so that other countries use it as an emergency reserve currency for their central banks. In 1920 and 2008, we have seen global economic crises caused by the collapse of the value of the US dollar.

Digital currency is the latest stage of currency technology. Digital currency, led by Bitcoin, seems to provide an opportunity for ordinary investors to master economic power. This view believes that Bitcoin is another form of central bank. They believe that digital currency technology is not only to solve the problem of economic efficiency, but more importantly, it impacts and reshapes the power relationship in the existing economic field.

This is why all walks of life and governments of various countries regarded digital currency as a scourge in the early days, but now they have to be forced to accept it and need to actively embrace it, because the top-level design of digital currency is directly related to the influence trend of all parties in economic competition. Therefore, we want to explore the dynamic relationship between the development of digital currency and economic power in depth.

03. The impact of monetary technology on economic power

3.1 Monetary technology and transaction efficiency

Past history has told us that the emergence of currency has greatly improved the efficiency of transactions, and the advancement of monetary technology is mainly for the purpose of transaction efficiency (Jenkins, 2014). Under the premise of "trust", the transaction parties usually choose the most efficient currency as the transaction medium. Therefore, the innovation and application of monetary technology have a profound impact on the economic structure and thus change the distribution of economic power. In other words, the leaders of economic activities are usually the masters of the most advanced monetary technology.

As we know, the earliest appearance of currency was to solve the need for "double coincidence" in ancient transactions, which was the main problem faced when trading through barter (i.e., barter) in a currencyless economy. The transaction can only be concluded if both parties have the goods that the other party needs (O'Sullivan & Sheffrin, 2003).

This transaction method is inefficient and limits the scale and scope of transactions. The introduction of precious metal currency greatly simplified this process (Crawford, 1985), making economic activities more fluid and extensive. The currency technology of this period was relatively primitive, and the value of currency depended on the value of the precious metals themselves. However, it is inconvenient to carry and trade precious metals. Secondly, the scarcity and production cost of precious metals such as gold and silver are much higher than those of general trade commodities.

Therefore, the world economy needs a portable and low-production emerging currency. The invention of paper money and the use of banknotes are major advances in currency technology. They first appeared in the Song Dynasty in China (Moshenskyi, 2008) and later spread to Europe, greatly improving the efficiency of currency circulation.

Given the paper currency system, Britain developed a complex banking system and credit currency system in the 17th century (Richards, 2024), which promoted the Industrial Revolution and expanded its economic and military global influence.

In the late 20th century and early 21st century, the emergence of electronic money and electronic payment systems (such as credit cards, electronic transfers) further innovated monetary technology (Stearns, 2011), which improved the efficiency of financial markets and strengthened the country's economic control. For example, the global dominance of the US financial system and the US dollar is partly due to its central position in the global payment system, such as the SWIFT system (Gladstone, 2012).

3.2 Power drives monetary innovation

There is no doubt that every new monetary technology is an improvement on the inefficiency of the previous currency. But this does not explain why people are willing to accept this kind of "currency" that has no production value as a medium of exchange, that is, "under the premise of trust" mentioned above, who will provide or guarantee trust?

In fact, the change in the form of currency is not just a technological iteration in economic activities. More often, it is a choice for the party that holds power in commercial activities to maximize its own interests, but this choice happens to coincide with the development of science and technology. Usually, the party with stronger technological capabilities also holds more power in commercial activities. In other words, the party that controls power provides security, or represents security, whether through advanced weapons technology or advanced currency technology.

For example, between economies.

India has been using shells as the base currency since the Neolithic Age until Britain began to colonize India in the 18th and 19th centuries. In order to better control the Indian economy and facilitate tax collection, the East India Company introduced paper money in 1812 (Tanabe, 2020). These notes were initially optional and not mandatory for the public to use; in 1861, the Paper Currency Act was passed (Lopez, 2021), making the Company Rupees the legal tender of India. This meant that all public and private debts had to be settled in Company Rupees, which became the only legal means of payment.

This iteration and upgrade of monetary technology was not welcomed by the Indian people because it conformed to the objective laws of historical development. On the contrary, it increased the dissatisfaction of the local people.The paper money strengthened the British government's economic exploitation of the Indian people and made it easier to levy heavy taxes; these dissatisfactions eventually converged into wider protests and resistance activities (Tanabe, 2020).

In the end, the Indian people were forced to accept advanced paper money, which was based on a compromise with advanced military technology rather than recognition of the advancement of monetary technology. This is exactly the same as the current world economic situation. The technological and military attributes of the US dollar are indispensable. The combination of the two guarantees its financial attributes, thus achieving the security and convenience of trade.

(III) The success and failure of technology-driven monetary power transfer

Secondly, within an economy, the party that masters technology often challenges the original power-dominant party. Successful cases, such as credit cards, are the innovations in technology and business models that disperse the power of money supply from the government to private financial institutions.

The original credit card system was launched by Diners Club in the 1950s, and then brands such as Visa and Mastercard launched their own credit card products (Stearns, 2011). These cards allow consumers to make purchases without immediate cash payment, with the consumer promising to repay the debt at some point in the future.

From a technical perspective, credit cards do not directly change the money supply (i.e., the money supply indicators such as M1 and M2 controlled by the central bank) because credit cards actually create a form of "credit money" or borrowing rather than actual money supply (Stearns, 2011). However, credit cards do play a currency-like function in actual economic activities, affecting the circulation of money in the economy through credit creation. This reflects the decentralization of power and functions in the modern financial system (Simkovic, 2009).

Failed cases, for example, Long before the emergence of Bitcoin, for example, in 1983, David Chaum, a cryptographer and digital privacy pioneer, proposed the "blind signature" technology (Chaum, 1983). A blind signature is a form of digital signature in which the content of a message is hidden from the signer before it is signed (Chaum, 1983). This means that the signer can sign without knowing the content of the message, but can verify the authenticity and integrity of the message after signing. The blind signature system invented by David Chaum was originally intended to serve large financial institutions or government agencies. This method helps to increase the transparency of data processing without sacrificing privacy. However, the design of early distributed ledger technologies like this is based on a common assumption that there is an authority, such as a central intermediary such as a traditional retail bank or a central bank. Therefore, these proposals were aborted because they could not bypass the centralized authority (Tschorsch, & Scheuermann, 2016). In summary, monetary technology can affect the economic structure and thus affect economic power, but the promotion and popularization of monetary technology is also extremely dependent on the support of the power holder in the existing economic system. The monetary technology before blockchain technology needs to rely on strong government authority to be expanded.

04. Challenges and helplessness of blockchain technology to the economic order

4.1 Bitcoin: Resistance to centralized economy

Bitcoin, which emerged in 2008, is a thorough resistance to the centralized economic phenomenon and order. Its birth stems from dissatisfaction with the traditional financial system, that is, the financial system controlled by the central government, and is a social response to the global financial crisis (Nakamoto, 2008).Its core proposal is to establish a decentralized economic system, abandoning intermediaries such as central banks (Joshua, 2011). This is not only a response to the financial crisis, but also a technical commitment to overcome obstacles to the development of digital currency (Marple, 2021).

Blockchain technology, which was created along with Bitcoin, also suffered a lot of doubts from the technology circle in its early days. After withstanding countless hacker attacks, its security was truly recognized by the technology circle (Reiff, 2023).

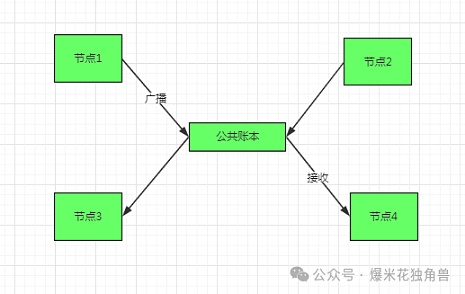

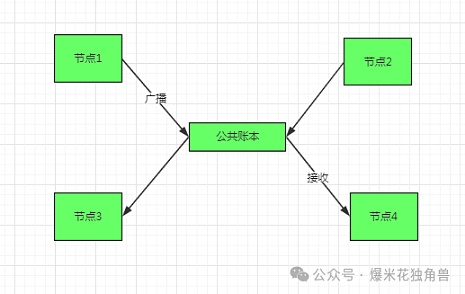

Hackers found that blockchain technology can really complete peer-to-peer transactions across the ocean without any intermediary or any permission, and in the process, its transaction results cannot be tampered with (Reiff, 2023). This is also the first time that a currency technology itself provides enough trust (trust), rather than relying on centralized power, or this technology has realized trustless and permissionless P2P transactions for the first time. Thus, blockchain technology has created a new currency species, digital currency (Nakamoto, 2008).

4.2 The rise of altcoins and the competition of technological innovation

Based on blockchain technology, a large number of altcoins have emerged rapidly since 2011, maintaining the decentralized technical characteristics, but there are differences in the application of blockchain technology. These altcoins achieve social and economic goals in different ways (Halaburda & Gandal, 2016).

In the altcoin ecosystem, we can clearly see the relationship between technological innovation and transaction efficiency iteration, whether it is through the iteration of consensus protocols (such as POW, POS and POS), or through Layer2 to increase the elasticity of the main network, it is to increase transaction efficiency (Halaburda & Gandal, 2016). At the same time, we found that digital currency decentralizes and de-powers the traditional financial world, but within them, everyone is playing the game of thrones, and various altcoins are constantly iterating or boasting about iterating their own digital currency technology, thereby constantly attacking the throne of power.

As a result, ICO (initial coin offering) came into being. In 2013, Mastercoin was the world's first ICO, but Ethereum Eth's ICO in 2014 is more widely known (HackerNoon.com, 2019). Companies preparing for ICOs usually publish a development roadmap, indicating that they need to raise funds to develop the most advanced digital currency technology, or to develop and expand their crypto ecosystem, etc. ICOs allow companies or organizations to raise funds by offering crypto tokens instead of stocks. These tokens usually do not provide company ownership, but allow buyers to profit from the company's success and use these tokens to purchase products or services (Hargreaves, 2013). Quite often, these ICOs are more centrally managed by the issuing companies. In other words, the power is in the hands of the issuing companies, rather than being completely decentralized. In addition, the design of ICOs is aimed at the value of the company, that is, the buyers expect the company to continue to create value, continue to iterate technology, and expand the ecosystem (Hargreaves, 2013). Unlike Bitcoin itself, everyone's expectations of Bitcoin's value come entirely from consensus, and users do not expect Bitcoin to evolve new additional value as an organism. ICOs are beyond the digital currency itself defined by Bitcoin, and have become a substitute for securities (Hargreaves, 2013). So in 2021, when Sam Bankman-Fried proposed to the US SEC that digital currencies should be managed and compliant in a completely different way from securities, it was immediately rejected (SEC document, 2022), because no one could clearly explain the difference between the two from this perspective. In fact, digital currencies and securities are a dialectical relationship of unity of opposites. Securities are more about the buyer's expectation of the future profits of the issuing company, while digital currencies are more about the holder's expectation of the issuer's power and status trend in the field of digital currencies. Unlike the fundamental analysis in the traditional financial field, ICO investors pay more attention to the company's ability to continuously improve its technological advancement and technological influence, which later evolved into ecological influence. This influence is usually unquantifiable at the current stage of digital currencies, and there is no clear standard. Most investors must be forced to be logically self-consistent and self-justified. Ideally, assuming that economic activities around the world should be traded using a most advanced currency, because it is the most efficient and the lowest cost, then the profit growth trend of the issuer of this currency is also imaginable.

4.3 Stablecoins and the Competition for Economic Power

So we saw the birth of stablecoins. In 2014, USDT appeared (Cuthbertson, 2018), which maintained a stable price relationship with the US dollar, thereby reducing price fluctuations in the digital currency market. In this way, stablecoins such as USDT attempt to make all digital currency transactions must be conducted through it, thus standing at the center of digital currency. Thanks to the stability brought by stablecoins, decentralized finance and centralized digital currency transactions have flourished. Here, the relationship between efficiency gains and economic power is clearly visible.

Many people think that stablecoins, such as USDT, make the influence of digital currency still anchored on traditional currency, which is a technological regression, so algorithmic stablecoins have emerged, which will not be expanded here. From another perspective, central banks of various countries have seen a new opportunity to expand their power through stablecoins, that is, they can sit on the iron throne of the crypto world through stablecoins.

Central banks around the world are conducting pilots of sovereign digital currencies, better known as central bank digital currencies (CBDCs). A recent survey by the Bank for International Settlements showed that more than 70% of central banks are actively conducting research on their own CBDCs, and China's encrypted RMB is one of the most well-known CBDC plans (Barontini & Holden, 2019).

It is worth noting that many countries have relied on digital currencies to circumvent international sanctions, and are also developing central bank digital currency projects to achieve this goal more effectively (Barontini & Holden, 2019). Typically, strong governments exercise non-violent power through legal tender, especially in international relations. By controlling currency, governments are able to influence the economic activities of other countries and individuals (Barontini & Holden, 2019). Especially in international sanctions, for example, if country A wants to impose economic sanctions on country B, it can be achieved by cutting off country B's connection with the SWIFT system, and country B's financial institutions cannot access international financial markets.

However, digital currencies challenge this inherent rule. If country B develops its own central bank digital currency (CBDC) and establishes direct encrypted transaction channels with other countries, then country B can bypass the restrictions of the SWIFT system and reduce the impact of sanctions. This shows that CBDC helps reduce the control of certain countries in international financial flows, thereby undermining the rules of traditional economic sanctions. This also proves once again that digital currency has greatly weakened the power structure within the existing economic system. In general, whether in completely decentralized digital currency, corporate ICO or government-produced stablecoins, we see the important connection between the advancement of currency technology and the pursuit of economic power. 05. Thinking about the operating rules of digital currency I think everyone who comes into contact with digital currency will think about this question: what is the use of digital currency and how to use it. Or what are the rules for the operation of digital currency? Can I make a fortune by mastering these rules? Today I still can't help you make a fortune, but I can discuss the underlying logic of the operation of digital currency. There are three issues that I think are the most important, and these three issues are also the most concerned issues of traditional financial institutions: 1. What is the value of digital currency; 2. What mechanism controls and affects the price of digital currency? 3. What is the impact of digital currency ledger technology on traditional financial behavior? 5.1 What is the value of digital currency? I think there are usually four types of digital currency. The first type is the transaction value itself (Nakamoto, 2008). As a trading tool, its fast and decentralized characteristics can enable some transactions that cannot be achieved in traditional finance to be realized through digital currency. The second type of value is speculative value (Gronwald, 2019), such as Bitcoin, because of its limited nature, it is more like a commodity than a currency. The third type is anchored (Dell’Erba, 2019), such as stablecoins, which are bound to the value of a real asset.

The fourth type is based on function (Golem. 2020), such as privacy coins, which users can use to keep transaction information on the blockchain confidential; for example, various coins can be used to use the services of a certain blockchain network, such as using ionet coins to purchase GPU services.

The first type of value is the object that sovereign states are trying to control and actively combat.

The second type of value has given rise to a huge hype and speculation market, which is not tolerated by financial regulators, and related warnings are endless.

The third type of value has found its natural home in the banking industry, and therefore falls within the scope of banking regulators.

The fourth value spreads in corporate financing and is regulated by securities laws.

5.2 What mechanism controls and influences the price of digital currency?

The price of digital currency is closely related to its supply management mechanism, which is no different from traditional legal currency.

For sovereign legal currency, prices are controlled by controlling the supply mechanism. Sovereign governments can influence the confidence and liquidity of currency in economic activities by issuing or destroying currency (Fenu, Marchesi, Marchesi & Tonelli, 2018). Here we have to talk about a trilemma that traditional monetary policy usually encounters, also known as the impossible triangle in economics, which refers to the three main goals a country faces when formulating monetary policy (Lawrence & Frieden, 2001): exchange rate stability, free capital flow, and independent monetary policy. These three goals are usually difficult to achieve at the same time, and the country must choose two of them. If a country chooses a fixed exchange rate and allows free capital flow, it will be difficult to maintain an independent monetary policy. This is because a fixed exchange rate requires a country's monetary policy to be consistent with its major trading partners or currency anchors in order to maintain the exchange rate target. At the same time, the free flow of capital will enable market forces (such as speculation) to put pressure on the fixed exchange rate, which may force the country to adjust its monetary policy to maintain the stability of the exchange rate (Lawrence & Frieden, 2001).

If a country chooses an independent monetary policy and allows free capital flows, it will be difficult to maintain a stable exchange rate. In this case, the central bank adjusts interest rates or money supply to achieve domestic goals, such as fighting inflation or stimulating the economy, which may lead to capital inflows or outflows, thereby affecting the exchange rate (Lawrence & Frieden, 2001).

If a country chooses an independent monetary policy and maintains a stable exchange rate, it may need to restrict the free flow of capital. This is because the freedom of capital flows may put pressure on the exchange rate, thereby conflicting with the country's independent monetary policy (Lawrence & Frieden, 2001).

The best example here is that China has chosen a relatively independent monetary policy and a stable exchange rate. The eurozone countries have chosen exchange rate stability and free capital flows (Lawrence & Frieden, 2001).

Some digital currencies also exhibit this centrally issued supply logic (Jani, 2018), such as Ripple (XRP). A large number of Ripple coins have been created before the public release through the pre-mining model. The management company of Ripple coins will increase or decrease the number of Ripple coins circulating in the market as needed to maintain the cost and efficiency of cross-border transfers, thereby achieving price control (Jani, 2018). Although this supply control strategy can help stabilize prices, it also introduces the risk of centralization. Similar to the issuance and adjustment logic of traditional legal currencies, Ripple coins will inevitably face the impossible triangle in economics, especially the risk resistance of individual companies is far lower than that of sovereign states. Once a debt crisis occurs, hyperinflation may occur.

Another way is algorithmic supply (Yermack, 2015). Unlike central issuance, algorithmic supply relies on preset rules to automatically control the generation and issuance of digital currencies. These rules are coded into the blockchain, without human intervention (Yermack, 2015). Bitcoin is a typical example, with a fixed supply cap of 21 million, which is expected to be reached around 2140 (Nakamoto, 2008). This preset supply rate makes Bitcoin's supply predictable, but it also makes it more sensitive to market speculation, resulting in greater price volatility. Despite the high price volatility, the characteristics of algorithmic supply (such as the predictability of supply) make such currencies very useful in trading. Traders can predict their performance relative to other currencies based on the known supply patterns of these currencies, and thus conduct strategic buying and selling.

In summary, in the field of digital currencies, central issuance mechanisms allow for more flexible management of prices and supply, but may cause credibility issues because market participants may worry about the abuse of central power, such as the occurrence of hyperinflation. In contrast, algorithmic supply (such as Bitcoin's fixed cap) provides a high degree of predictability and transparency, increasing the credibility of the currency, but at the expense of the ability to respond quickly to market changes. 5.3 What is the impact of digital currency ledger technology on traditional financial behavior? The design of blockchain distributed ledger technology is a great innovation to traditional ledger technology (Nakamoto, 2008). Whether the digital currency ledger is public or private also has a significant impact on its role in economic relations and the acceptance of regulators. In a public ledger, the responsibility for bookkeeping is dispersed among a large number of end users, forming a decentralized governance structure; anyone can view and verify transactions in the ledger, so public ledgers are generally regarded as more transparent and decentralized (Nakamoto, 2008). In contrast, private ledgers have a more centralized responsibility structure and are usually carried by one organization. This means that the cost of account management is concentrated on one organization or a group of actors, rather than being dispersed throughout the network.

Because public ledgers lack centralized regulatory objects, regulators need to supervise more participants, so they may take more rude bans and warnings to manage the digital currency market (O’Dwyer & Malone. 2014). Private ledgers are managed by specific organizations, and regulators can more easily carry out specific governance responses because they can communicate and cooperate directly with these organizations. For example, the ledgers of traditional banks are usually centralized, which means that all data and transaction records are stored on the bank’s internal servers. The relevant government departments only need to constrain and manage the banks.

Bitcoin chose the public ledger because it is a decentralized digital currency that emphasizes the decentralization of finance and currency (Nakamoto, 2008). This bypasses the traditional banking model, where cross-border remittances and large transactions usually involve complex intermediaries and high fees, and also bypasses effective government supervision. This has led regulators to take more stringent measures to manage its market. This shows that the development and adoption of digital currency is not just a choice at the technical level, but also involves power games and decisions at multiple levels such as politics, economy and society. 06. Conclusion Digital currency is the latest stage in the history of currency development. Crypto Currency, Crypto encryption technology represents its technological attributes, and Currency represents its monetary attributes. Its technological attributes are perfectly reflected as a payment tool. It solves many problems that traditional banking cannot solve. It can achieve fast and direct cross-border transfers through its global distributed ledger system, greatly reducing transaction costs and time, without the need for intermediaries and approval. However, most currency technologies must be supported by centralized economic power to develop. For the first time, blockchain technology has achieved the goal of flourishing without the permission of vested interests, and directly attacked the traditional economic order. Within digital currency, countless copycat coins are also attacking the inherent economic structure (Bitcoin, Ethereum) within digital currency, trying to compete for the throne through continuous technological iteration. Therefore, although the endless ICO coins do not generate cash flow in the short term, investors seem to see their huge value in future transaction efficiency.

However, if digital currency is regarded as a currency itself, the economic and political problems it faces are not much different from those of traditional legal currency.The problems encountered in traditional economic activities, such as the impossible triangle, have not been solved in the field of digital currency. Based on this, we also found that in this crypto world that claims to be decentralized, it emphasizes and worships orthodoxy. This orthodoxy is centralized, centripetal, and even superstitious, which runs counter to its scientific attributes. This phenomenon is exactly the same as the traditional world's obsession with and worship of power, while ignoring scientific laws.

That is why some crypto institutional investors absurdly but complacently advocate that Bitcoin is equivalent to the central bank, and the operating model of other digital currencies is comparable to that of the country, which shows their ignorance of economic knowledge.

JinseFinance

JinseFinance