2024 has been full of ups and downs. In the past year, the hope brought by the approval of the BTC spot ETF at the beginning of the year did not burn as brightly as expected. The market quickly pulled back after a brief rise. In Q2 and Q3, the entire market entered a consolidation phase, and exchanges were also recuperating. The turning point came in September. The dual benefits of the Fed's interest rate cut and the expectation of Trump's inauguration injected new momentum into the market and kicked off the bull market. The rise of the Meme craze and the AI Agent narrative completely ignited the passion of crypto traders. As one of the most critical components of the cryptocurrency industry, the changes in the trading volume and market share of exchanges reflect the evolution of market structure and the emotional changes of participants.

TokenInsight, as a rating and research company in the Crypto industry, has been tracking the data of currencies and exchanges. In this report, we summarize the data performance of the exchange industry over the past year, and select the top ten centralized and decentralized exchanges. We hope to understand the changes in the year and the competition in the exchange industry through the changes in data.

The following data is a summary of the top ten exchanges selected by TokenInsight. This report does not include the total trading volume data of all exchanges. The main reasons are as follows:

There are so many exchanges in the Crypto industry that it is almost impossible to compile data for all exchanges

The top ten exchanges we selected can occupy more than 95% of the market share, and thus can roughly reflect the overall market situation

The annual trading volume of the top 10 exchanges in 2024 is $76.88 trillion, nearly doubled compared with last year

In Q1 2024, affected by the approval of Bitcoin spot ETF, the sluggish market slightly recovered, pushing the price of BTC to break through the $70,000 mark at the end of March. At the same time, the market's daily trading volume also rebounded to more than $200 billion.

However, the Bitcoin halving event in April did not continue the upward trend of BTC prices. The overall market performance in Q2 and Q3 was mediocre, and the BTC price stagnated and continued to fluctuate between $50,000 and $60,000; the market's daily trading volume remained in the range of $100 billion to $200 billion.

Q4, the bull market in the crypto market finally returned. The Fed's interest rate cut and the US election in November jointly kicked off the bull market. Subsequently, the Meme craze and AI Agent narratives helped this carnival and further ignited the market's trading enthusiasm. The total daily trading volume of the market peaked on December 21, approaching $700 billion; the BTC price also broke through the 100,000 mark, setting a new high, reaching a maximum of $106,074.11.

The top three exchanges in terms of cumulative market share of spot derivatives: Binance, OKX and Bybit

In terms of the cumulative trading volume for the whole year, Binance continued to occupy the first place in the market with a cumulative spot and derivatives trading share of 38.6%. Its independent trading share in the spot and derivatives markets also ranked first.

OKX and Bybit ranked second and third with cumulative market shares of 13.5% and 12.8% respectively. Among them, Bybit surpassed OKX in terms of spot market share, ranking second with a spot trading share of 11.5%. In terms of derivatives, Bitget is gradually approaching the first echelon, occupying about 11.6% of the derivatives market.

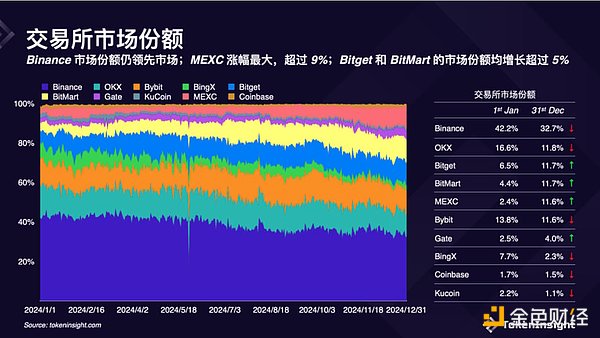

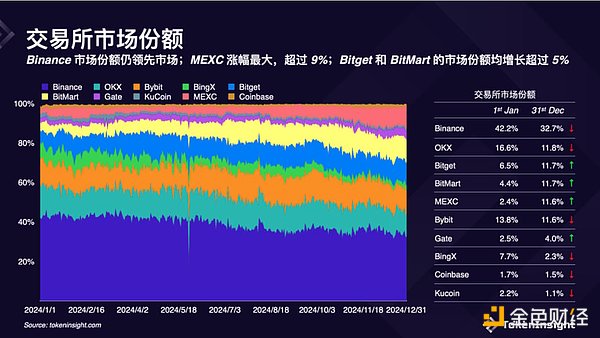

Binance's market share still leads the market; MEXC has the largest increase, exceeding 9%

In 2024, Binance's market share fell from 42.2% at the beginning of the year to 32.7%, but it still leads other exchanges in the market.

Amid the changes in the overall cryptocurrency exchange market landscape, the market shares of Bitget, BitMart, MEXC and Gate have all increased. Among them, MEXC had the largest increase, up about 9% from the beginning of the year. Although Bitget and BitMart did not perform as well as MEXC, their market share also increased by more than 5%.

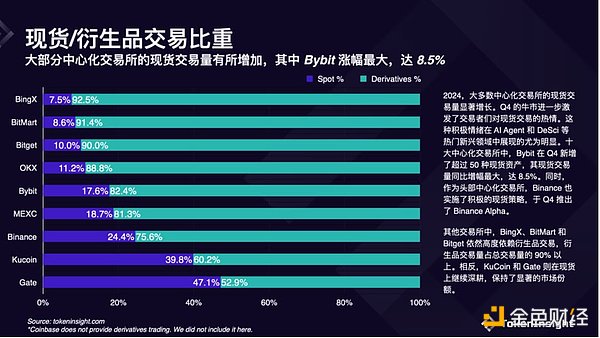

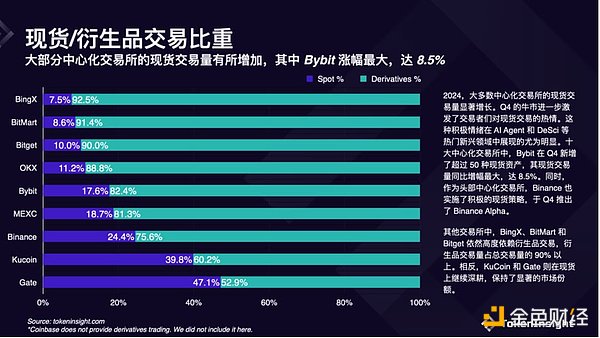

The spot trading volume of most centralized exchanges increased, among which Bybit had the largest increase, reaching 8.5%

In 2024, the spot trading volume of most centralized exchanges increased significantly. The bull market in Q4 has stimulated traders' enthusiasm for spot. This positive sentiment is particularly evident in popular emerging tracks such as AI Agent and DeSci. Investors are keen to seize the next 100x or even 1000x opportunity in the bull market, actively investing in spot and purchasing a large number of early potential project tokens.

Among the top ten centralized exchanges, Bybit added more than 50 spot assets in Q4, and its spot trading volume increased the most year-on-year, reaching 8.5%. At the same time, as a leading centralized exchange, Binance also implemented an active spot strategy and launched Binance Alpha in Q4.

Among other exchanges, BingX, BitMart and Bitget are still highly dependent on derivatives trading, and their derivatives trading volume accounts for more than 90% of the total trading volume. On the contrary, KuCoin and Gate continued to deepen their presence in the spot market and maintained a significant market share.

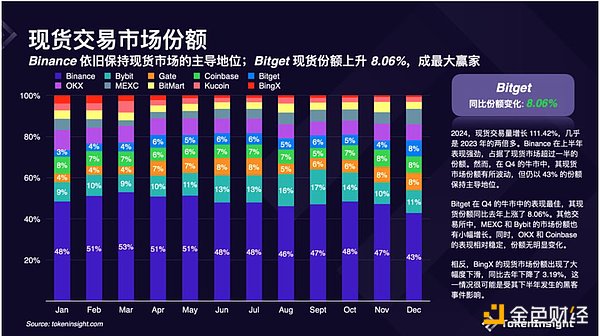

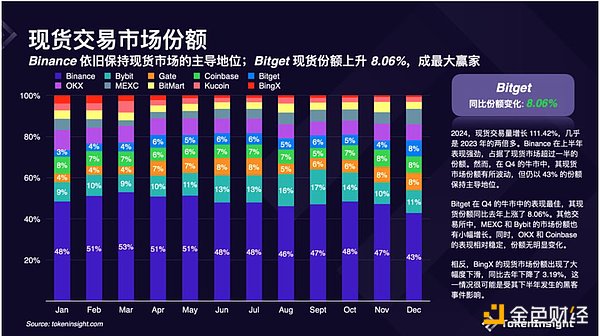

Binance still maintains its dominance in the spot market; Bitget's spot share rose by 8.06%, becoming the biggest winner

In 2024, the total spot trading volume increased by 111.42%, more than double that of 2023. Binance performed strongly in the first half of the year, accounting for more than half of the spot market. However, its spot market share fluctuated during the bull market in Q4, but it still maintained its dominant position with a share of 43%. Bitget performed best in the bull market in Q4, with its spot share rising 8.06% year-on-year. Among other exchanges, MEXC and Bybit also saw a slight increase in their market share. In contrast, BingX's spot market share fell sharply, down 3.19% year-on-year, which was likely affected by the hacking incident in the second half of the year.

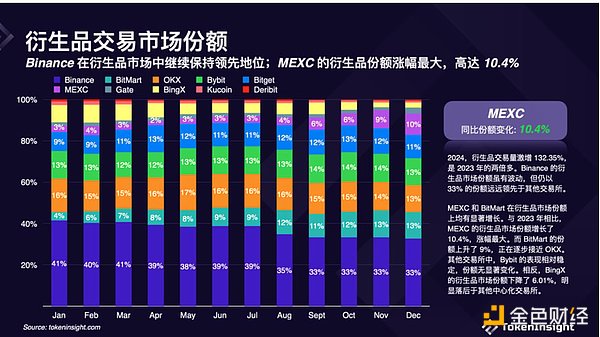

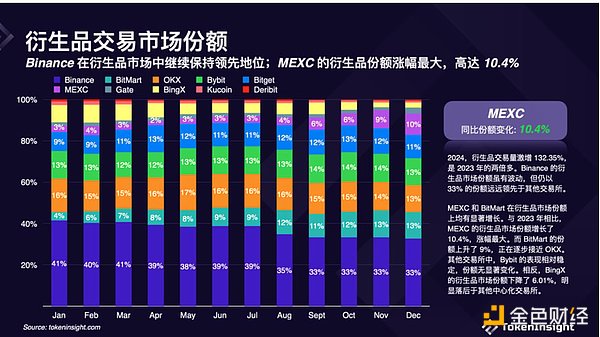

Binance continues to lead the derivatives market; MEXC's derivatives share increased the most, up to 10.4%

In 2024, the total derivatives trading volume surged by 132.35%. Although Binance's derivatives market share has declined, it is still far ahead of other exchanges with a share of 33%.

MEXC and BitMart have both seen significant growth in their derivatives market share. Compared with 2023, MEXC's derivatives market share increased by 10.4%, the largest increase. BitMart's share increased by 9%, and its market share is gradually approaching OKX.

Among other exchanges, Bybit's performance is relatively stable, and its share has not changed significantly. On the contrary, BingX's derivatives market share has decreased by 6.01%, significantly lagging behind other centralized exchanges.

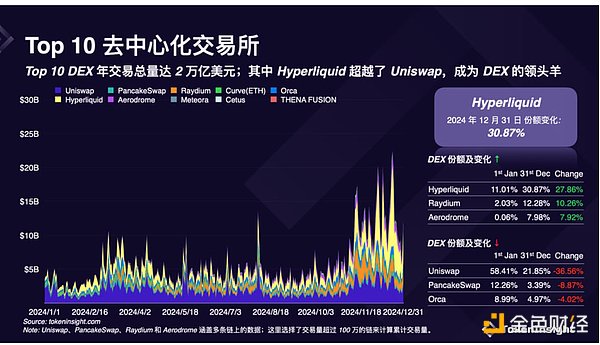

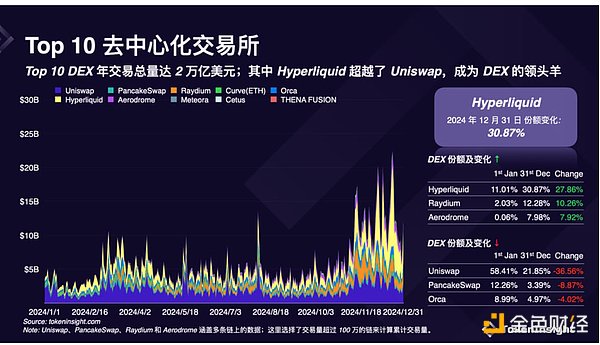

Top 10 DEXs have an annual transaction volume of 2 trillion US dollars; Hyperliquid surpasses Uniswap to become the leader of DEX

With the Meme craze led by Pump.fun at the end of the year, the price of SOL soared, and the Solana ecosystem became the most watched Layer1 besides Ethereum in 2024. As the head exchange in the Solana ecosystem, Raydium's market share increased by 10.26%. On the contrary, Orca's performance is regrettable. Under the premise of a favorable ecosystem, its market share has declined by about 4%.

In early November 2024, with the arrival of Hyperliquid's coin issuance news, Hyperliquid became the most watched new dark horse DEX in the bull market. Its average daily trading volume surpassed Raydium and big brother Uniswap in December, jumping to the top of DEX. Its market share reached 30.87% at the end of the year, an increase of 27.86% from the beginning of the year.

In contrast, the performance of the old traditional DEX: Uniswap and Pancakeswap in 2024 was not satisfactory. Uniswap's market share was eaten up by Raydium and Hyperliquid, falling to 21.85%, falling from the first place. Pancakeswap's share fell by about 8.9%, being squeezed to 3.39%.

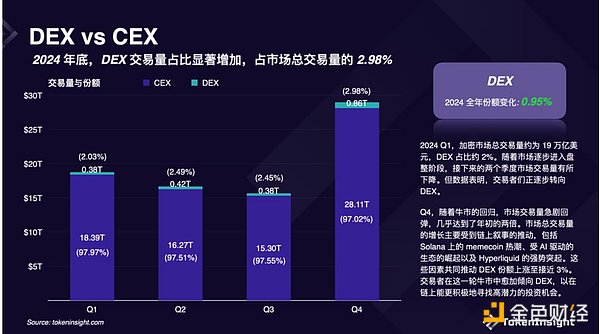

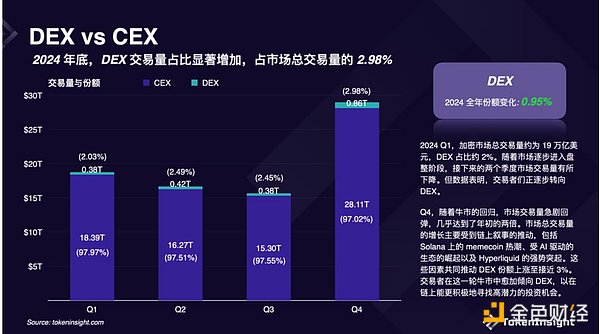

By the end of 2024, DEX trading volume accounted for a significant increase, accounting for 2.98% of the total market trading volume

In Q1 2024, the total trading volume of the crypto market was about 19 trillion US dollars, and DEX accounted for about 2%. As the market gradually entered a consolidation phase, market trading volume declined in the next two quarters. But the data shows that traders are gradually turning to DEX.

In Q4, with the return of the bull market, market trading volume rebounded sharply, almost double the level at the beginning of the year. The growth of total market trading volume was mainly driven by on-chain narratives, including the memecoin boom on Solana, the rise of the AI-Driven ecosystem, and the strong performance of Hyperliquid. These factors jointly pushed the DEX share up to nearly 3%. Traders are increasingly inclined to DEX in this round of bull market, and are more actively looking for high-potential investment opportunities on the chain.

By the end of 2024, Hyperliquid's trading volume reached $12 billion, and its total locked value exceeded $3 billion

Hyperliquid became the biggest winner in DEX in Q4 2024. Affected by the overall market trading sentiment in the first half of the year, Hyperliquid's average daily trading volume has been fluctuating between $2 billion and $3 billion from Q1 to Q3. In Q4, Hyperliquid's trading volume climbed sharply, breaking the historical high in the mid-term, and the trading volume reached 12 billion US dollars at the end of the year.

At the same time, Hyperliquid's ecosystem is also expanding steadily, and a large number of emerging projects in different fields have emerged within its ecosystem. These include DeFi infrastructure, token issuance platforms, AI trading robots, etc. As of December 31, 2024, Hyperliquid's total locked value has exceeded 2 billion US dollars.

Most centralized exchange platform coins performed well in Q4, among which BGB performed the best

BGB performed outstandingly in Q4 2024. On December 28, its price soared 1308% from the beginning of the year, far exceeding Bitcoin and other centralized exchange platform coins. GT followed closely behind, with a year-end increase of 213%, ranking second. Among other exchange coins, the price returns of BNB and LEO also outperformed Bitcoin. Among them, BNB's market value ranks fifth among all cryptocurrencies and is currently the exchange coin with the highest market value.

On the contrary, OKB's performance is relatively weak. At the end of 2024, its price fell by 9% from the beginning of the year.

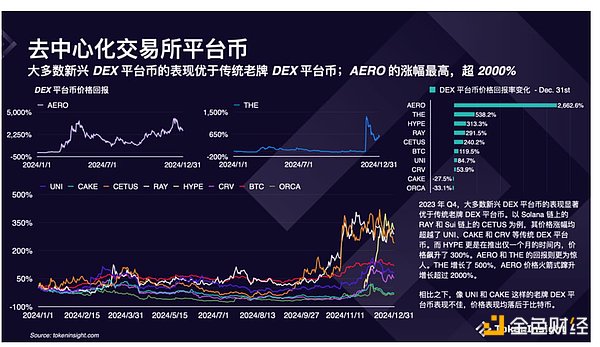

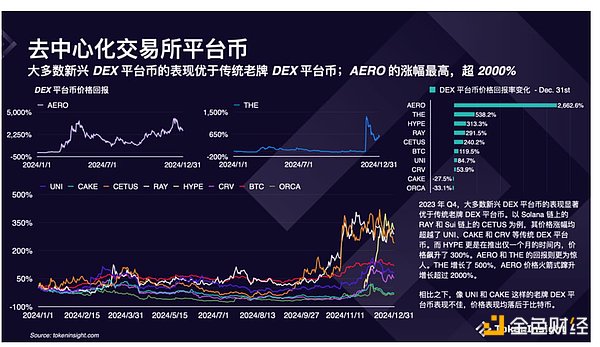

Most emerging DEX platform coins performed better than old DEX platform coins; AERO had the highest increase, exceeding 2000%

In Q4 2023, most emerging DEX platform coins performed significantly better than traditional old DEX platform coins. Take RAY on the Solana chain and CETUS on the Sui chain as examples. Their price increases have surpassed traditional DEX platform coins such as UNI, CAKE, and CRV. And HYPE’s price soared by 300% in just one month after its launch. The returns of AERO and THE are even more amazing. THE has increased by 500%, and AERO’s price has rocketed by more than 2000%.

In contrast, established DEX platform coins such as UNI and CAKE have performed poorly, and their price performance has lagged behind Bitcoin.

Weiliang

Weiliang