Source: LBank Labs

Recently, with the popularity of Notcoin, the market has also ignited unprecedented expectations for the TON ecosystem. Backed by billions of users, 900 million daily active users, and 2.5 million daily users, it received 36.7 million downloads in January 2024 alone. Since the trading bot on Telegram experienced a brief "highlight" moment in July 2023, it has temporarily fallen into a market downturn due to technical failures. However, with the first half of this year, the MEME & game project Notcoin on the TON ecosystem has achieved 35 million user participation in just three months, with an average daily active of 5 million, and after it went online on a centralized exchange on May 16 this year, it has fully ignited the market's attention and expectations for the TON ecosystem.

Below, LBank will sort out and review the current progress of the TON ecosystem based on TON's historical process, growth factors, and data comparisons with other public chains, so that more users can deeply understand the "fission" moment on TON.

TON Introduction

TON (The Open Network) is a decentralized network that aims to build an open Internet environment for everyone. It was originally conceived by Telegram founders Nikolai and Pavel Durov in 2018 to provide Telegram's more than 500 million users with fast and secure decentralized payments, digital identity and other services. TON hopes to reach millions of transactions per second through expansion and support a decentralized ecosystem.

Although TON has encountered some difficulties in regulation and law, it has received widespread support from the Telegram community, continued to develop and was officially released in September 2021.

TON Development History

In 2018, Telegram Open Network released a white paper called Gram and its lite version. Subsequently, it successfully raised 1.7 billion through a private token sale.

In the first quarter of 2020, Telegram was forced to abandon the TON project due to a legal conflict with the U.S. Securities and Exchange Commission (SEC) and was fined $18.5 million. In May 2021, a developer community called NEWTON took over the unfinished TON project and continued its research and development work, and updated the Telegram Open Network to The Open Network. The native crypto token was renamed Toncoin, marking a transition to a more decentralized and open network.

In 2021, the TON Foundation was established, and the NEWTON developer community was officially renamed the TON Foundation, marking a new starting point for the project.

In November 2021, TON was launched on a centralized exchange and received public support from the founder of Telegram.

In April 2022, the TON Foundation established a $251 million ecosystem fund.

In July 2023, Telegram Bots such as Unibot and Bananagun became popular, and the value of TON was rediscovered.

In September 2023, during TOKEN2049 in Singapore, Telegram and TON launched a crypto wallet for billions of Telegram users.

In April 2024, during TOKEN2049 in Dubai, TON announced that Tether will issue USDT on TON and launch the Open League funding program.

TON Technical Analysis

The TON chain is backed by the huge traffic of the world's largest social platform Telegram, so high performance is its first technical element.

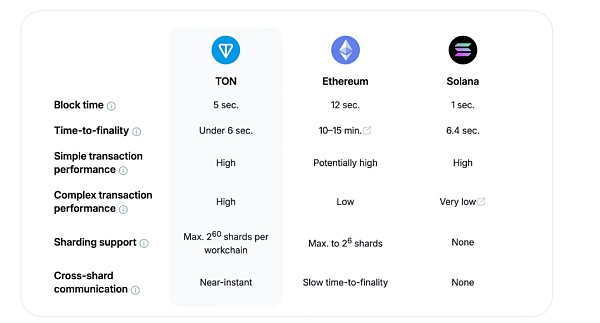

Sharding technology: TON's architecture uses sharding technology to divide the blockchain into multiple shardchains. Each shardchain can independently process transactions and smart contracts, greatly improving the ability to process a large number of transactions. It is claimed that TON can support millions of TPS.

POS consensus algorithm: Combining Byzantine fault tolerance technology with the PoS consensus mechanism, TON's consensus mechanism improves network security while ensuring efficient network operation and lower energy consumption. In addition, by introducing BFT technology, TON can maintain the normal operation of the network even in the face of node failures or malicious attacks, ensuring the correctness and consistency of transactions and data.

Message routing between shard chains: TON uses slow hypercube routing and instant hypercube routing technology to achieve effective message transmission between shard chains, ensuring the scalability of the network and the needs of instant communication. Among them, slow hypercube routing ensures that the distribution of messages between multiple shard chains can logically grow with the increase in the number of shard chains, and instant hypercube routing is used in scenarios where instant messaging between shard chains is required, supporting almost instant communication.

In comparison, TON chain has faster transaction processing performance and speed than Ethereum and Solana chain.

Based on the above technical foundation, it has the advantages of high efficiency, scalability and friendliness, and can directly connect Web2 users to web3, and can directly realize multiple functions such as payment transactions and launching dapps in a social software.

TON's super application design: embedded wallet, mini app and unlimited bot

First of all, as the world's largest social platform, Telegram has hundreds of millions of users, so the design on the TON chain is more in line with the current web2 usage habits and has super compatibility. Its main competitiveness lies in the embedded wallet, mini app and bot.

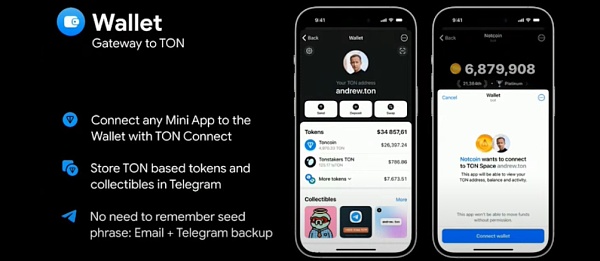

Traffic entry and payment scenarios: wallet

First, the built-in wallet service provides a native wallet experience and can be used in the traditional web2 mailbox mode. In terms of understanding and user acceptance, it is smoother and easier to accept, omitting the complicated registration process and creating a recoverable non-custodial wallet account with one click.

The Telegram wallet allows users to send or receive USDT, BTC, TON and Notcoin directly in Telegram, reducing the complex concepts of private keys for traditional users, and adding channels for purchasing cryptocurrencies with credit cards. It does not force the narrative of the "web3 concept" and avoids the trouble of switching between multiple screens, thus improving retention rates. Users can use TON's built-in wallet to realize payment and transfer functions.

The most important thing is that USDT has been opened up for circulation in the TON ecosystem. As the largest US dollar stablecoin in the crypto world in terms of circulation and market value, USDT plays an irreplaceable role in the public chain ecosystem. Combining the world's largest stablecoin with a highly scalable blockchain and a large messaging platform like Telegram will provide emerging markets with a stable currency to combat inflation. On-chain data shows that the total supply of USDT on TON has increased to $130 million, indicating that on-chain demand and large-scale use of web3 are no longer castles in the air. Among them, TON officials have also launched an activity to earn 50% annualized returns by depositing USDT.

On April 16 of this year, Telegram launched advertising revenue rebates, and advertising was paid in TON. Channel owners can share 50% of the advertising revenue displayed in their Channels. This disguised airdrop reward is undoubtedly an unprecedented "sharing" economy pioneer in the current social platform.

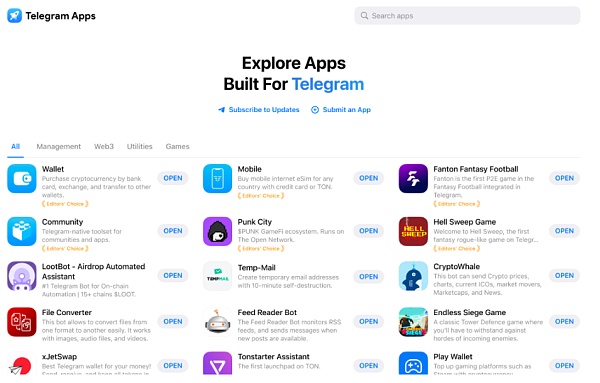

Traffic Carrying and Prosperity: Mini App

Secondly, nimi app has super flexibility and compatibility. As a program that carries 1.5 billion Telegram users, nimi app has super diverse functions of low-speed viewing, strong aggregation and mobility. nimi app can be "summoned" directly in Telegram and follow various instructions to perform ultimate operations, without downloading too many wallets or other applications, which can be achieved in Telegram.

Does this sound similar to OKX's web3 wallet? In fact, it is even cooler!

Notcoin is one of the first successful mini dApp cases, which has demonstrated its great potential and appeal. Here are some other successful mini app cases:

-Catizen: This is a social interactive game in which players can raise cats, dress up cats, and interact with other players. Catizen takes advantage of the high transaction speed and low-cost operation of the TON blockchain to provide users with a smooth experience.

-Paper Plane: This game allows players to control the flight of paper planes through simple operations, collect tokens and rewards. Paper Plane's simple operation and rich social functions quickly attracted a large number of users.

There are also some fascia gun games such as Tapswap and Hamster Kombat.

Mini app is the main product promoted by Telegram and TON. It is like WeChat applet. For users, there is no need to leave Telegram throughout the process. You can complete the application interaction of Web3 with the experience of Web2, which has higher user acquisition and retention efficiency.

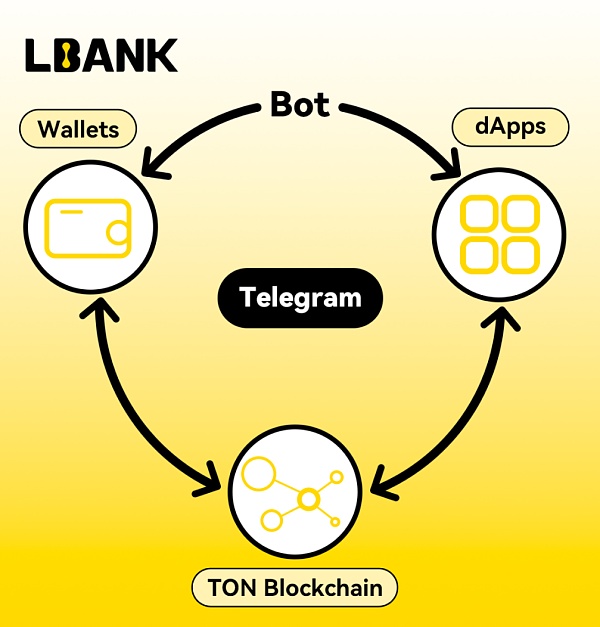

Bridge tool: Telegram bot

Another is Telegram bot. Since July 2023, it has triggered a Telegram bot craze. Although it has fallen into a downturn due to the attack on the leading unibot, the distinction between retail investors and scientists has gradually become equal under this model, and it is talked about by most studios on the market.

Now Telegram's bot mainly provides:

1) Trading: Buy and sell tokens directly through Telegram.

2) Brushing airdrops: Automatically perform a series of operations to increase the chance of obtaining airdrops

3) Chasing transactions: Simulate operations based on on-chain wallet analysis or tracking;

4) Finding the best liquidity pool: Telegram bot can make profits by charging transaction fees and token buying and selling "taxes";

Although Telegram Bot has various risks such as private key leakage and theft, compared with existing DeFi front-ends, Telegram Bot provides a more friendly and convenient user experience, with real practical and large demand.

TON Ecosystem Overview

According to the TON official website, the entire ecosystem currently includes more than 600 ecological projects, including 19 categories such as DEX, wallets, liquidity staking, social, games, launchpad, etc.

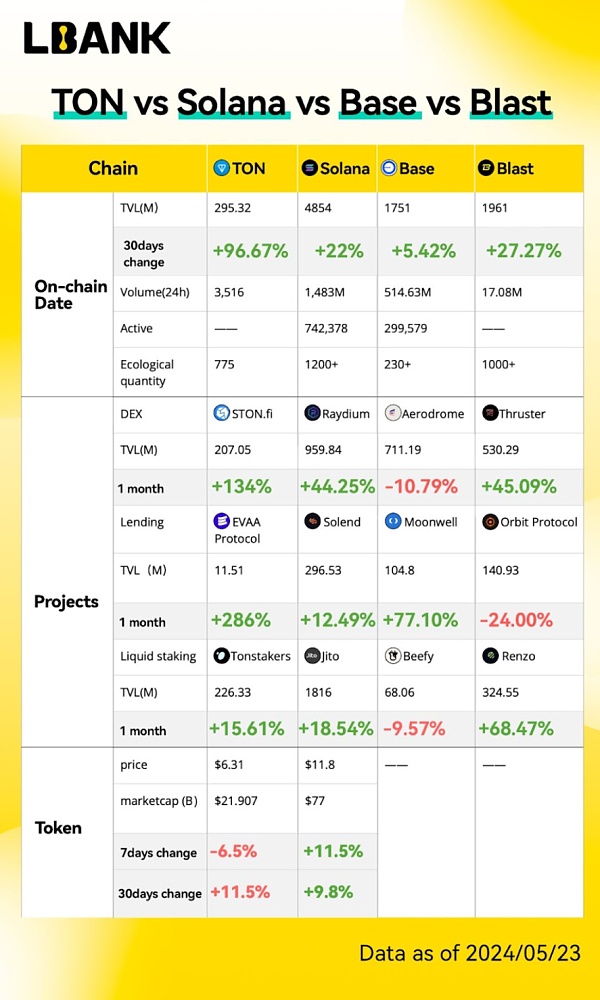

Although TON chain, as a hot "hot chicken" in the market, has received at least US$250 million in investment from Pantera, looking at its ecosystem, it is not difficult to find that as of May 23, TON's TVL reached 295.32M, among which TONstakers (226.33M) and STON.fi (207.05M) ranked the highest. Compared with other public chains that use mass adoption as an indicator and TVL as the main indicator, the DEX and liquidity pledge on TON are not very attractive, with an APY of less than 3%. In addition, the number of cross-chain bridges is extremely small, and mature and large-scale financial projects cannot directly cross the chain to the TON chain. Products with strong financial attributes such as liquidity pledge and lending are relatively weak.

In order to attract more project teams to take root in the TON ecosystem, TON not only provides basic tools such as TON SDK, TON Connect, TACT language and Blueprint framework, but also organizes Open League, Grants, Accelerator and other programs. Since the launch of Open League in March, daily active wallets have increased by 725%, DeFi TVL has increased by 800%, and liquidity providers have increased by 765%. In addition, TON has also established a $250 million TONcoin.Fund to invest in TON ecological projects, and the investment subjects cover Infra, Defi, gaming, socialfi, etc.

At the same time, rooted in a huge user social base, "out-of-circle" mini apps represented by Notcoin are becoming a hot new star in the market, with 35 million users and 6 million daily active users (Axie Infinity's daily active users peak at around 3 million), which is unattainable for the current and past history of GameFi in the crypto market.

In addition, the cat game Catizen has gained 5.66 million gamers with its "Play to Airdrop", with 422k daily active players, and the on-chain user data shows that it has exceeded 200,000, and the number of transactions has exceeded 2.4 million. Not only that, the Catizen team has signed cooperation agreements with 18 popular WeChat mini-games, and will build a game Launchpool to empower game players and holders of governance tokens.

There are other similar mini-games that are spreading and sweeping the TON ecosystem. Among them, imitation disks are frequently appearing. Tapswap and Hamster Hamster have basically made micro-innovations based on the reproduction of Notcoin. In contrast, Yescoin is slightly more innovative, including sliding screen and greedy snake design, which has always maintained user cohesion and attention.

TON Funding & Fundamental Analysis

According to coingecko data, the current TON price is $6.34, the market value is 22.016 Billion, the FDV is 32.359 Billion, and the market value ranks tenth. It has been listed on exchanges such as LBank, OKX, and Bybit.

The initial supply of TON was 5 billion, and its supply was unlimited, growing at a rate of about 0.6% per year (about 3 million). After the settlement with the SEC in 2020, nearly 98.55% of the tokens were controlled by miners.

In response to this situation, in February 2023, after a community proposal vote, 21% of the total amount was frozen, and these tokens will be locked until February 2027. Secondly, the community launched the TON Believers Fund, allowing TON holders to lock their tokens for five years - two years of lock-up and three years of vesting. Together, these measures have locked up about 47% of the total supply.

In addition, with the continued growth of on-chain activities and the mechanism of 50% of TON fees being burned, effective circulation will be reasonably controlled within the price range in a short period of time, among which the TON fee burning mechanism similar to EIP-1559 has been launched.

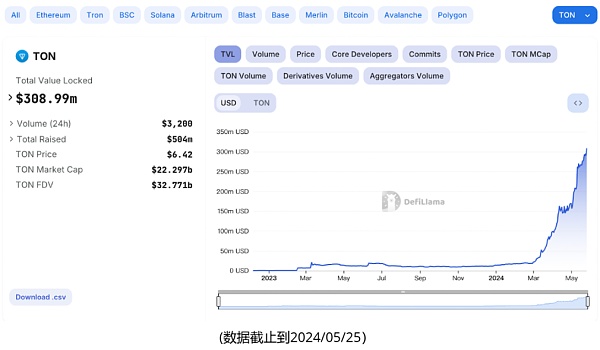

According to DeFiLlama data, the TVL on the TON chain reached 308.99M, an increase of 103.97% compared with last month, and the transaction volume reached $472.8M, an increase of 30.61%. Secondly, according to tonstat data, the number of activated wallets on the chain reached 5.71 million, and the number of daily active wallets was 308,000.

With the promotion of the TON incentive mechanism, various data indicators on the chain have increased significantly.

- TON price has increased by 2.2 times: from 2.27 at the beginning of this year to 6.32 now, it has doubled;

- The number of active addresses on the chain has increased by 4 times: from 1M in January 2024 to 5.3M today, it has achieved a 4-fold increase;

Will it become the next Solana in the crypto market?

Follow LBank to compare the data on the chain, ecological projects and funds to estimate the future potential value of the TON chain.

According to the comparison of on-chain data, TON's current ecology is still in its early stages, and its transaction volume is still weak compared with the mature solana and base chains, and its infrastructure, DEX and liquidity pledge are still weak.

But from another perspective, the traditional way of measuring public chains is not applicable to TON. Game dapps that have emerged in such a rich social environment, backed by Telegram and TON ecology, and wallets and mini apps connected through various bots are bound to benefit from the TON ecology.

As the TON Foundation expects, 30% of Telegram's active users will be able to participate in the TON chain in 2028. According to this plan, 5 billion Telegram users will become users of the TON chain by then. Therefore, we believe that the primary problem that TON needs to solve at present is how to attract Telegram users to the TON ecosystem. In addition to continuously building various types of Dapps to meet the traffic brought by Telegram users, games, DeFi, creator economy, encrypted e-commerce and other fields can also be integrated into daily life through the TON wallet, thereby increasing the frequency and stickiness of users using TON.

From an investment perspective, the current price of TON coins is $3.8 per coin, with a market value of $22.2 billion, ranking 10th. At present, the market value of TON is already quite high, exceeding public chains such as Avalanche, Apt, and Sui. However, in terms of ROI in one year, TON has reached 230.79%, Avalanche has reached 160.10%, and APT and SUI are less than 15%.

Future value prediction

In the Dubai TOKNE2049 at the end of April this year, the TON Foundation stated that the value of Telegram is positioned as "free private communication, expressing yourself and building your application". Now based on Telegram's 800 million daily active traffic, notcoin's pioneering breaking circle effect, rich TON mini-ecosystem and stable currency payment system, these have become a weapon for TON ecology to gain market traffic.

What we can predict is that the TON ecology is igniting the attention of the TON ecology with the momentum of a spark, attracting more ecological developers to join, and the overall development trend is good. It combines the sharing spirit of Web3 and integrates the potential of hundreds of millions of Telegram users to achieve a wider user coverage.

At the same time, we need to note that regulatory risk is still an important factor affecting the development of TON. The second is the balance of inflation, pledge and destruction mechanisms of the token system. If it is not calibrated correctly, it may lead to excessive token supply, reduce the value of individual tokens, and may lead to a decline in investor interest.

As the TON ecosystem continues to develop, it is undeniable that TON has strong development potential with its one-click creation of wallets, miniapps, and payment integration, and what we are seeing now is just the tip of the iceberg. LBank believes that the most influential updates are native currencies, bridges, and stablecoin toolkits, which will jointly expand TON's application scenarios in daily payments and allow more people to start building their own crypto asset portfolios.

References:

OKX Ventures latest research report: TON ecology and investment analysis https://www.techflowpost.com/article/detail_14363.html

OKX VENTURE: TON in-depth research https://www.wublock123.com/index.php?m=content&c=index&a=show&catid=47&id=19913

TON token holdings data https://eagleeye.space/detail/TONcoin

TON chain ecological report: trends and opportunities, how to find the entry point in the TON ecosystem? https://foresightnews.pro/article/detail/46655

TON: Telegram becomes the only link for WeChat in the Web3 field https://www.coinlive.com/id/news/ton-telegram-becomes-the-only-link-for-wechat-in-the

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Joy

Joy Bitcoinworld

Bitcoinworld Coinlive

Coinlive  NFT Now

NFT Now Cointelegraph

Cointelegraph