Tornado Cash, as one of the most controversial decentralized privacy protocols in the blockchain field, has sparked extensive discussions on privacy, regulation and technology since its birth. It provides users with anonymous transaction services through zero-knowledge proof (ZK Proof) technology, but it has also become the focus of regulators because it is used for money laundering activities.

Recently, after the news that the U.S. Treasury Department removed the encryption mixer Tornado Cash from its Office of Foreign Assets Control (OFAC) sanctions list, its related token TORN soared more than 70% on Friday. This article will deeply interpret the fate and future of this protocol from multiple angles, including Tornado Cash's technical principles, regulatory sanctions, legal proceedings, industry positions and latest developments.

1. Concept and technical principle of Tornado Cash

Tornado Cash is a decentralized privacy protocol that aims to hide the identity information of users through mixed transactions. Its core mechanism is based on zero-knowledge proof (ZK Proof), which allows users to prove the legitimacy of their transaction behavior without revealing their specific identity.

1.1 Implementation of privacy protection

After the user deposits the token into the Tornado Cash smart contract, he will obtain a zero-knowledge proof. This proof allows the user to use a brand new address when withdrawing money, thereby cutting off the association between the deposit and withdrawal addresses. To further enhance privacy, the amounts of all deposits and withdrawals in the Tornado Cash pool are consistent. For example, if 100 users deposit the same amount of tokens, and then 100 users withdraw the same amount, although the transaction records are public, the specific deposit and withdrawal correspondence cannot be traced.

1.2 Decentralization and immutability

Tornado Cash's smart contracts are completely open source and deployed on the Ethereum blockchain. This means that anyone can view and use these contracts, but cannot modify or control them. This decentralized feature makes Tornado Cash a neutral tool rather than a platform controlled by a certain entity.

II. OFAC's sanctions: Conflict between privacy and security

In August 2022, the Office of Foreign Assets Control (OFAC) under the U.S. Treasury Department listed Tornado Cash on the "Specially Designated Nationals and Blocked Persons List" (SDN) on the grounds of its widespread use in money laundering activities.

2.1 Sanctions Background

OFAC pointed out that since 2019, the hacker group Lazarus has repeatedly used Tornado Cash for money laundering activities, involving amounts as high as hundreds of millions of dollars. For example:

● In March 2022, in the Axie Infinity incident, more than $455 million in funds were laundered through Tornado Cash.

● In June 2022, in the Harmony Horizon incident, $96 million was laundered.

● In August 2022, in the Nomad incident, at least $7.8 million was transferred.

OFAC believes that these illegal funds were used to finance North Korea's missile and nuclear weapons programs, and therefore imposed sanctions on Tornado Cash.

2.2 Impact of Sanctions

The sanctions caused the smart contract address of Tornado Cash to be blocked, and many users and developers were unable to access their funds. This move triggered strong opposition from the blockchain community, who believed that it violated the right to privacy and the freedom of open source technology.

III. Legal proceedings and industry stance: the game between technology and law

In August 2023, the U.S. Department of Justice filed criminal charges against Roman Storm and Roman Semenov, co-founders of Tornado Cash, accusing them of “conspiracy to launder money, operating a money transfer business without permission, and violating sanctions regulations.”

3.1 Opposition from industry organizations

● Coin Center pointed out that treating the development of open source software as a crime is a suppression of technological innovation.

● Coinbase made two main arguments:

(1) OFAC’s action violates the International Emergency Economic Powers Act (IEEPA) because smart contracts are not anyone’s property and should not be subject to sanctions.

(2) The ban on open source code violates the First Amendment of the U.S. Constitution, and code should be protected by free speech.

3.2 Web3 Industry’s Position

● Tornado Cash’s smart contracts are open source and immutable, and no individual or entity can control their operation.

● The Treasury Department attempted to classify Tornado Cash as an entity associated with a foreign national, but the agreement does not meet the definition of a legal entity.

● The sanctions violate the First Amendment of the Constitution because code should be considered a form of speech and protected by law.

Fourth, the court overturned the decision to sanction

In January 2025, a Texas court ruled that the sanctions against Tornado Cash were not established, believing that smart contracts were not sanctionable property and required it to be removed from the SDN list. The key to the court's decision was that:

● Smart contracts do not meet the legal definition of property.

● OFAC exceeded its statutory authority in this case.

This ruling is seen as an important victory for the blockchain industry and provides a legal precedent for similar cases.

V. Latest Developments: Tornado Cash Removed from SDN List

On March 21, 2025, Tornado Cash was finally removed from the Specially Designated Nationals and Blocked Persons List (SDN). This event marks an important victory for its supporters and highlights the continued controversy between balancing security measures and freedom of speech in the development of digital privacy, regulation, and cryptocurrencies.

5.1 Market Reaction

After the news that the U.S. Treasury Department removed Tornado Cash from its sanctions list, the price of TORN tokens soared by more than 70% in a short period of time, returning to the price level of $15. Its weekly increase also exceeded 100%, making it the leader in the privacy coin field. This market reaction not only reflects investors' optimistic expectations for the future development of Tornado Cash, but also highlights the important position of privacy technology in the cryptocurrency market.

5.2 Impact on privacy coins and DeFi

The lifting of the ban on Tornado Cash is seen as a major victory in the field of privacy coins and decentralized finance (DeFi). This event not only provides a more relaxed regulatory environment for the development of privacy technology, but may also trigger an overall rebound in the privacy coin field in the next few days. The restoration of investor confidence in privacy technology may drive more funds to flow into related projects.

Sixth, Beosin pays attention to sanctions risks

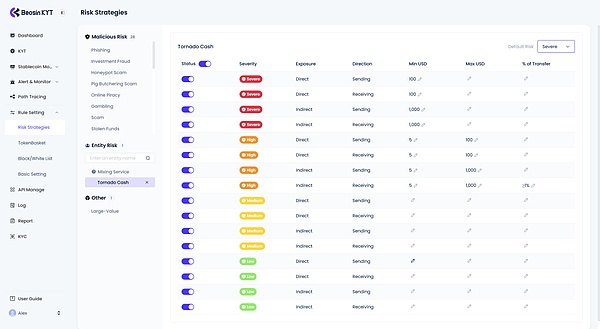

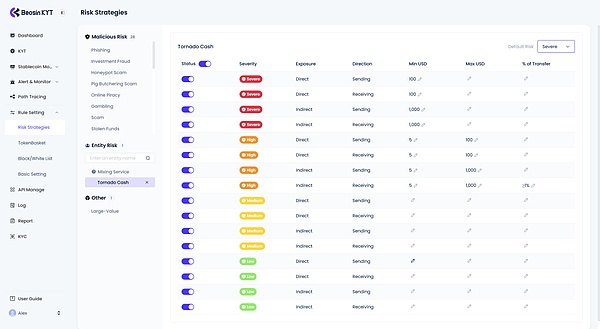

As a leader in blockchain security compliance, Beosin always pays attention to the latest regulatory trends. In response to the removal of sanctions on Tornado Cash, Beosin has made corresponding adjustments to its labeling system. Users can manually designate Tornado Cash as a risky entity in product configuration (in addition to the sanctions label, Tornado Cash itself as a mixing service should also be paid attention to) and set corresponding rules.

6.1 Beosin KYT tag data

In addition to the OFAC list, Beosin KYT also covers the following sanctions lists:

● UN Security Council Sanctions List

● US Consolidated Sanctions List

● EU Consolidated Sanctions List

● UK HM Treasury OFSI Sanctions List

● MAS Designated Individuals and Entities List

● SFC List

6.2 Risk Rule Configuration

Users can customize risk rules through the Beosin KYT platform and monitor transactions related to Tornado Cash in real time to ensure compliance and security.

Written at the end

The story of Tornado Cash is not only a game between technology and regulation, but also a contest between privacy and security, freedom and control. With the continuous development of blockchain technology, how to prevent illegal activities while protecting privacy will become a challenge faced by the industry and regulators. Tornado Cash's journey from sanctions to lifting of the ban provides valuable experience and inspiration for solving this problem. In the future, with the further integration of law and technology, the blockchain industry is expected to find a better balance between compliance and innovation.

Joy

Joy