Chain abstraction: prism in the multi-chain era

The modular L1 Particle Network provides an SDK platform for implementing chain abstractions.

JinseFinance

JinseFinance

Source: Zuoye Waiboshan

Ethereum is a hot spot for innovation, at least it used to be. Celestia proposed the concept of DA layer, and EigenLayer also created the hot re-staking track. Technology Driving innovation, there is an explanation for the eventual drop in currency prices. Even Uniswap can pull up the currency price by relying on the old topic of fee switching.

However, technology-driven growth has its limits after all. Just like you can eat two more bowls of rice when you are angry, but you cannot penetrate the earth. The long-term ceiling of technology is "cycle", such as the most popular The well-known Kombo (Kondratieff cycle) cycle roughly every 50-60 years. If ChatGPT cannot open the door to the fourth industrial revolution, then we will have to use sticks and wood to welcome the fourth world war.

Ten thousand years is too long, seize the day.

We can’t wait for the long-term cycle, and there are also short-term ones, such as the Bitcoin halving, which will happen every four years, and another example is the re-pledged tokens on Ethereum. I have a hunch that they will also follow my summary. To develop according to the currency price cycle, the concept has just begun--> attracting users--> the airdrop begins--> the currency price goes up--> short-term high--> the price falls--> The good news appears --> surges again --> returns to normal, and then repeats from time to time, and the market begins to focus on the next hot spot.

Day and night are still too long, 5 minutes is enough to understand the concept of re-staking.

Re-pledge is a typical debt-driven economy. It faces the drive of value-added from the beginning. Only by meeting LSD , ETH can only retain its own earnings after pledging double returns, which makes it more "impulsive" to look for high returns, which brings higher returns than LSD, but also leads to higher risks.

What is re-pledged and sold is the security of Ethereum. In the past, L2 Rollup could only be priced based on the size of the Ethereum block space, expressed as DA and Gas Fee, re-staking standardizes and "monetizes" Ethereum's security, providing the same security as Ethereum in a cheaper way.

Let me explain the second point first. Only by understanding what products are produced through re-staking can we understand the rationality of the pricing mechanism and how to borrow real ETH from you. What a wonderful way to go.

Re-staking products are not complicated. In fact, they utilize the security of the Ethereum main network. Whether it is ETH staking or LSD Assets are all part of the Ethereum pledge system. In the past, they could only contribute to the Ethereum main network, and then directly feed back to various L2 or applications on Ethereum. Re-staking actually means to allocate this security separately and provide Give it to dApps or Rollups in need, cut out the middlemen and earn the price difference.

First of all, please do not have any doubts about the PoS (Proof of Staking) mechanism. On the other hand, ETH chose the PoS mechanism, and subsequent re-staking is also based on the principle that staking represents security. PoW and PoS are at least on par with each other now. BTC has a monopoly of 50% of the market share, and the remaining public chains basically choose PoS by default. , the rationality of PoS is recognized by all public chains except BTC. This is also the premise of all our discussions. Let’s silently say: PoS is safe, and the more ETH pledged, the safer it is!

At this time, the only danger of holding ETH is the decline in U-standard pricing. If we look at it based on the ETH standard, then Ethereum will slowly move towards a de facto retreat, and the ETH remaining in hand will definitely become more and more. The more valuable it is. (The risk of being stolen or confiscated is not considered)

Secondly, in order to maintain the security and smooth operation of the Ethereum network, part of the ETH needs to be locked into the pledge system. This is a necessary arrangement for network security. , everyone expressed their understanding, but it is unreasonable to take away ETH from individuals for no reason, so they need to be given pledge income, which is interest.

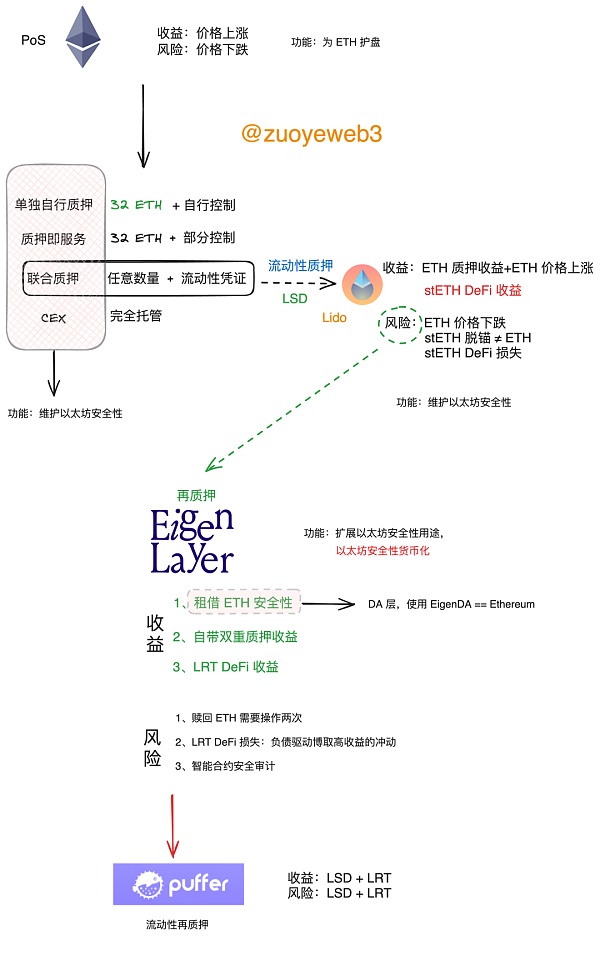

The Ethereum Foundation has summarized 4 modes of staking:

Solo home staking ): You need to own 32 ETH, purchase hardware by yourself to build nodes and access the Ethereum network. This is also the pledge behavior that is most in line with the concept of decentralization. The disadvantage is that you need a little money. At current prices, you need more than 100,000 US dollars in cost. ;

Staking as a service: If you have 32 ETH, but you don’t want or have no money to buy hardware, you can host the ETH to the staking node. But you still retain a fair amount of control, but the downside is that you still have to come up with $100,000 of your own money.

Pooled staking is the familiar Liquid Staking (LSD) model such as Lido. When you pledge ETH, you will be given stETH tokens anchored to ETH at a ratio of 1:1. coins, and can still be exchanged back to ETH, you can also share the staking income, and you can use stETH to participate in DeFi to earn income, and there is no limit on the number of pledges, which is suitable for retail investors. The disadvantage is that stETH still has the risk of unanchoring, and there is a possibility of losing the ETH principal, and Participating in DeFi causes more serious losses.

CEX: It is the simplest way to earn interest by depositing coins. You bear the risk at your own risk. I won’t introduce too much.

In this process, Lido and CEX models have become absolutely mainstream, with Lido accounting for about 30% of the current market share, Binance , Coinbase and other exchanges are also among the best. It can be said that Ethereum's staking and liquidity staking (LSD) are actually synonyms. Even CEX can be regarded as another LSD mode with higher authority.

But whether it is staking or liquidity staking, they are essentially the same in function, that is, staking ETH provides security for the Ethereum network.The difference is that liquidity staking provides additional security for staking. Liquidity incentives.

Re-staking is an improvement on the original function of staking, which can be understood as "part-time job". With the help of the re-staking system, the Ethereum staking network can now independently undertake dAPPs with security requirements, while still providing security guarantees for the Ethereum main network, and claiming staking rewards, LSD rewards and re-staking rewards. (Depending on the collateral)

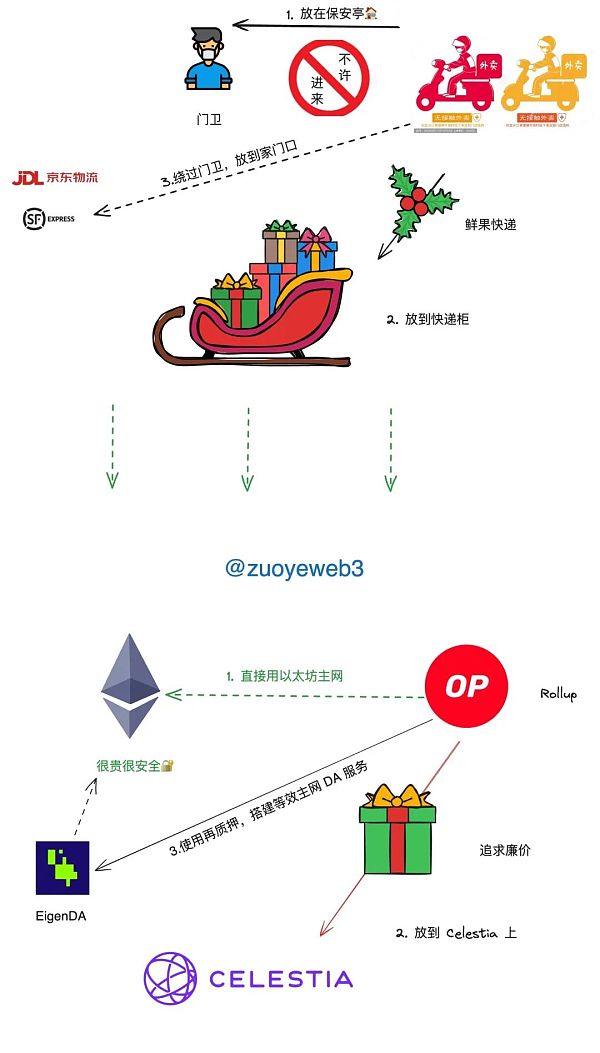

This change of security purpose is not difficult to understand. In theory, the security guard in real life maintains the security of the community, but the occasional takeaway boy also has a card. Of course, if you put the takeaway at the security booth, it is actually equivalent to entering the community. Rollup will save money by using EigenDA for the same reason. If you put it in the express cabinet, it is equivalent to using Celestia as a DA service, which will be cheaper. .

If you have to have takeout or express delivered to your door, you will need to pay more or use high-end express delivery such as JD.com and SF Express, which is essentially equivalent to using Ethereum as the DA layer. The safest and most expensive option.

Before the emergence of re-staking, taking DA as an example, either the expensive but safe Ethereum mainnet was used, or the cheap but unorthodox Services such as Celestia now use re-pledge to use the security of Ethereum while reducing expenses. At the same time, the existing multi-pledge income and the circulation function of LRT re-pledge tokens are not limited.

DA is just an example. EigenLayer is essentially a bunch of smart contracts, not a public chain or L2. Using the services provided by EigenLayer is actually equivalent to using Ethereum itself, which is a bit difficult to understand from the software level. , it is easier to understand when switching to PoW.

For example, although Dogecoin is a PoW token, there has not been a separate Dogecoin mining machine for a long time. Instead, it is sold together with the LTC mining machine. That is, if you buy an LTC mining machine, you will get an extra dog. The currency mining function is called merged mining. Going one step further, when the Solana mobile phone Saga was sold for US$1,000, only a few people responded. However, after the matching BONK token became popular, there were also people who sold it for US$10,000. This is also a "Merge Mining", dig Saga and get Bonk.

To sort it out again, in theory, without using re-staking, the security of Ethereum can still be used by Rollup, but directly interacting with the main network will be more expensive and time-consuming. Ethereum is slow. As we all know, re-staking is actually to visually express the security by the number of pledged tokens:

The composition of re-pledge tokens is ETH or LSD. Any dApp using re-pledge tokens to build its own pledge node network is equivalent to the security of Ethereum;

Re-pledge tokens The greater the number of pledged tokens, the higher the security of its Actively Validated Services (AVS). This is consistent with the fact that the greater the number of ETH pledged, the safer Ethereum is;

The re-pledge service can still issue its own tokens as a certificate for participating in the re-pledge service. This is similar to the role of stETH. The inconsistencies will be mentioned below.

Finally, EigenLayer’s re-pledge has reached its limit in terms of providing security, and other solutions are based on this, or support more public chain, or make some modifications to the security plan. For example, Puffer can share the dual benefits of LSD and LRT at the same time, or ether.fi changes itself from an LSD service to a re-pledge service.

But our journey is not over yet. EigenLayer TVL has exceeded US$10 billion, Lido TVL has exceeded US$30 billion, and the pledge amount of ETH is around 30 million, worth US$100 billion. If we think that derivatives The value of Ethereum should exceed that of spot, so there is still room for appreciation of several times or dozens of times. However, the value of items such as US dollars, gold or crude oil cannot be recognized by all mankind. The capital spillover process of Ethereum still needs a lot of time. For a long time, this is also an important reason why LSD is not very successful, or there is a ceiling for re-pledge, and the value needs time to be poured out.

Rehypothecation not only expands the boundaries in function, but also has a stronger profit-seeking nature in the economic mechanism. This is not a derogatory meaning, but It is an objective description of its operation process. Starting from ETH, to staking/LSD, and then to re-pledge, the three parties are interrelated and indispensable. ETH provides security and income guarantee, pledge/LSD provides liquidity certificates, and re-pledge provides Quantifiable security ultimately comes down to ETH itself.

It should be noted here that the security and income of ETH are built into LSD and re-pledge. Even if LSD tokens are considered to be placed in the re-pledge system, they can be decoupled into LSD and eventually returned to ETH itself. .

But this is where the problem arises. On the one hand, re-pledge wraps up a two-layer pledge system. Each time, more income is needed to cover the cost. Consider a situation where the ETH pledge yield is 4%. The promised re-pledge return needs to be higher than 4% to attract pledges of LSD tokens. In the end, the re-pledge return rate of ETH will be significantly higher than the main network staking return rate. If it is lower than the main network staking return rate or close to it, then ETH will obviously not be able to be pledged. Attracted into the re-pledge system.

The following conclusion can be drawn. Pledge itself is an inflation system, which can be roughly divided into three situations for discussion:

The return rate of ETH mainnet staking is the most guaranteed, because every ETH holder is a source of profit. This is similar to the seigniorage of US dollars. If you hoard coins with US dollars or ETH, you will be slowly harvested by inflation. Purchasing power;

ETH liquidity pledge is a "corporate bond" issued by Lido with a 4% return. stETH is a creditor certificate, and Lido must have a return higher than 4%. To maintain balance, for every stETH minted, Lido generates a liability of 1.04 ETH;

If stETH is used for re-pledge, then the re-pledge network will be re-pledged at a price higher than 1.04 After purchasing this corporate bond at the price of ETH, and then pledging the network to obtain reserves, you can continue to issue your own "currency", such as various types of LRT. This is equivalent to the process of currency creation. It should be noted that before pledging again at this time It is based on credit to create tokens, which is a different logic than LSD's creation of credit in the face of ETH (retail investors' real money), or to put it more bluntly, replenishment assumes the role of a bank.

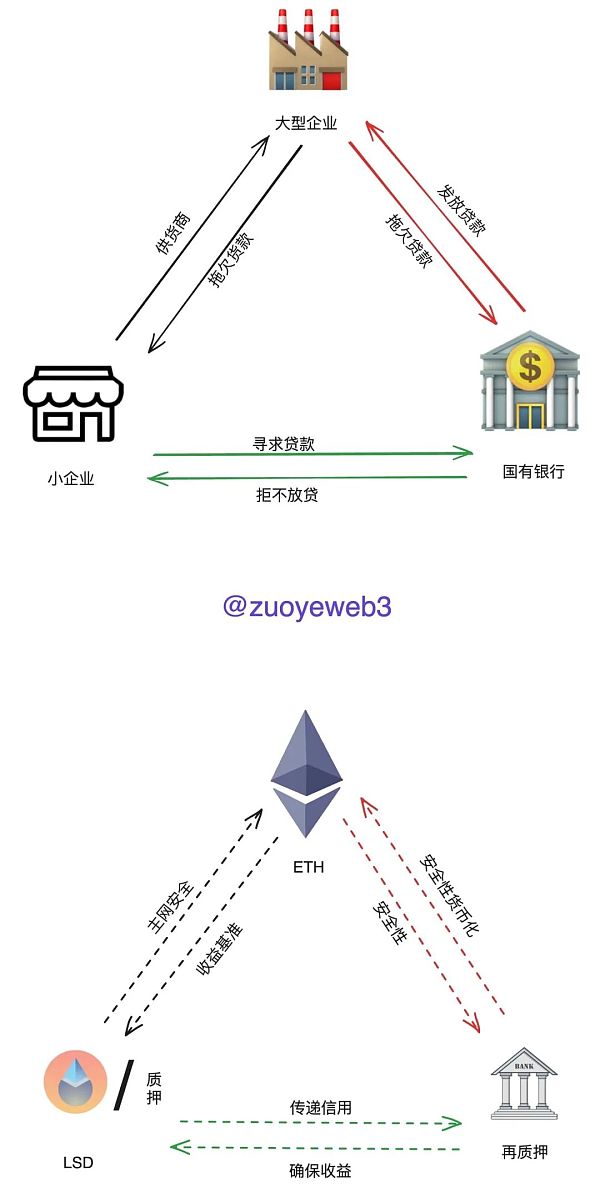

I know this is very abstract, so let’s take a practical case, which is the famous “triangular debt”. In the late 1990s, industrial enterprises across the country, especially state-owned enterprises in Northeast China, Heavy industry has fallen into a vicious cycle:

The goods produced by large industrial enterprises cannot be sold, so they cannot make money and cannot provide supporting products. The payment for goods of small businesses;

The payment for goods of small businesses is held down by large industrial enterprises, and there is a serious lack of funds to expand reproduction, resulting in a debt crisis;

Both large and small businesses have borrowed from banks. Small businesses are mostly private and have difficulty in obtaining loans. Large enterprises are still unable to sell after receiving loans, resulting in further backlog;

The bad loan rate of banks soared, making it harder for large and small businesses to obtain loans, until the economy came to a near standstill and the unemployment problem impacted social order.

On the surface, the bad debt rate of banks is the problem, because they basically have no risk control model, and issuing loans to large enterprises has become a completely political task, which is completely unaffordable. It plays a role in guiding economic production, but from a deeper level, this is a production problem, that is, large and small enterprises cannot directly produce according to market signals, and are even completely decoupled from the production and consumption ends, relying on a kind of inertia to produce. In operation, large enterprises do not want to change product quality, and small enterprises do not open up the civilian market.

But from their own point of view, large enterprises can easily obtain loans, so there is no need to organize production according to the market. As long as small enterprises can sell to large enterprises, sooner or later the government will organize banks to provide them with loans. Large business loans can eventually receive payment.

In fact, although the triangular debt was eventually "solved", it was done by passing on the debt to get rid of the burden on the banks. The signal went to production, but it was too late. The final winners were the Yangtze River Delta and the Pearl River Delta.

By analogy, ETH is a large enterprise, LSD is a small enterprise, and then pledge is a bank. In this logic, it is not the simple ETH leverage that is expanding, but ETH - credit certificate - manufacturing agent. Coin - the cyclical process of feeding back ETH. The core secret is that the return rate of the entire circulation process must be higher than the ETH pledge return rate. Otherwise, it will be insolvent. That is, after the entire debt exceeds economic growth, the economic growth will not even be able to pay debt interest. It is even more impossible to eliminate debt if it is repaid. The United States, Japan and Europe are currently running on this road. The United States is in the best situation, because everyone has to bear the price of inflation of the US dollar. If you have USDT, you must bear it.

The debt economy is indeed unsustainable, but this approach has its rationality. ETH is based on pledges. This is the biggest political correctness. It can only attack and replenish pledge services because the pledge amount is small and insufficient. Decentralization or security issues, but PoS itself cannot be denied.

As a production company, ETH ensures that the pledge income baseline, whether it is LSD or re-pledge, must be higher than or close to this line , and LSD is passed to re-pledged credit certificates. Re-pledged needs to use this to enhance its reserves and participate in higher-yield activities. Transitioning from ETH to re-pledged, the re-pledged ETH certificate tokens on the market have already Higher than 104% of ETH, as long as users do not redeem, the wealth in the market will be invisibly amplified, which will also bring stronger re-pledge purchasing power and debt repayment ability.

However, risks will follow you. Re-pledge is a "currency" system based on credit, so you must maintain your credit to prevent users from running on it, but Luna-UST The lesson is not far away, it depends on the return commitment of the re-pledge system. In fact, the assets available for pledge by EigenLayer include ETH, LSD, LP assets and other types of assets for this reason. After all, the risk is too high.

The risk of LSD lies in the exchange rate between stETH and ETH. In theory, as long as the reserves are sufficient or a white knight comes to the rescue, it can be exchanged back to ETH in the event of a crisis, but then On the one hand, the pledge system must ensure high yields, and on the other hand, it must meet exchange needs. It is safe to only absorb ETH strongly related assets, but the yield cannot be guaranteed. If excessive alternative assets are absorbed, its solvency will be questioned.

The current TVL of EigenLayer is lower than that of Lido. Excessive stacking creates uncontrollable crises. Consider a theoretical scenario: Lido only needs to fall back to ETH, and EigenLayer needs to fall back to stETH. Then return to ETH through stETH. If it is other tokens, there is still a fallback - the exchange is more complicated. (In fact, such a complex mechanism is not necessarily required)

Similar to triangular bonds, the surface of the re-pledge system is the income commitment of the re-pledge network, but the core is the power of ETH, excluding the contract security crisis and other uncontrollable factors. As long as ETH is strong enough and the EVM ecological TVL is higher, the pledge and re-pledge network based on ETH can print unlimited money. The spot value of 100 billion Ethereum pledges is only 10 times the scale of trillions.

As long as ETH is accepted by more people and institutions, the re-pledge system will be an efficient and moderate inflation. We will live through a warm period of prosperity together, and the prices of all ETH-related assets will rise. , and so on, until the building collapses.

The re-pledged product is monetized Ethereum security, the economic model is moderate inflation, and such leverage is slowly rising , rather than being as violent and violent as contract x125 times, the price increase of ETH related assets will not be as rapid as DeFi Summer.

But this has little to do with the price of Lido’s token LDO and EigenLayer’s own token, becausethe core of Ethereum is only ETH, which absolutely cannot accommodate the second mainnet-related assets. This For the Ethereum network under the PoS mechanism, it is the final bottom line, and it is also the fundamental reason why Vitalik violently criticized Celestia. All profits belong to ETH.

Compared with Bitcoin, Ethereum needs to create a source of income for ETH, while BTC itself is the income. This is a completely different situation. As for the pledge and re-pledge of other networks , they must first answer the question of the necessity of the public chain they are attached to, otherwise it will just be a fast Gambling game.

The modular L1 Particle Network provides an SDK platform for implementing chain abstractions.

JinseFinance

JinseFinanceThe SEC's withdrawal of the DEBT Box lawsuit prompts questions about its crypto regulation approach, urging investors to monitor evolving developments in this dynamic landscape.

Xu Lin

Xu Lin91Porn官推显示AVAV即将在Bitget创新区上架交易

铭文老幺

铭文老幺The SEC has frozen Digital Licensing Inc.'s assets and taken legal action against its principals and 13 others for fraudulent activities in crypto mining.

Bernice

BerniceSince 2017, Binance has been striving to obtain a phased 'partially legal' status in certain global regions through diplomacy, acquisitions, joint investments, philanthropic funding, and other means.

CaptainX

CaptainXThe rating downgrade reflects Fitch's apprehension about the country's fiscal outlook and highlights the frequent clashes over the debt limit witnessed in the past two decades.

Coinlive

Coinlive With the cryptocurrency market still in a rut and BTC struggling to reclaim the $20,000 mark, there could be more bad news in store for the largest crypto.

Finbold

FinboldShiba Inu developer promises a bright future with an upcoming NFT gaming project, but SHIB price continues to fall.

Cointelegraph

CointelegraphETH/BTC could reach 0.10 this year as the market anticipates Ethereum's proof-of-stake switch.

Cointelegraph

CointelegraphNearly $170 million left Ethereum-based investment funds in 2022, signaling a drop in institutional demand.

Cointelegraph

Cointelegraph