Source: The Surplus of the Wealthy

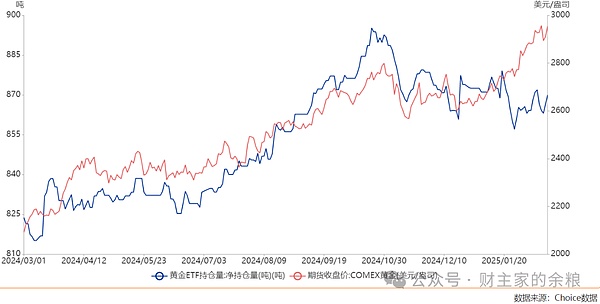

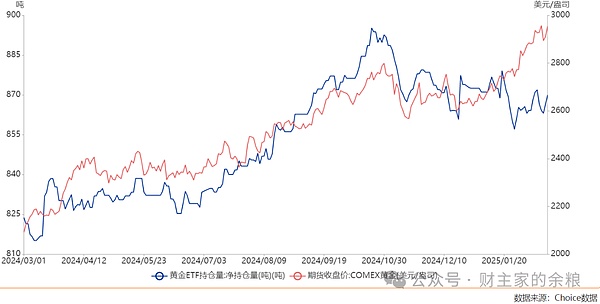

In recent times, gold has been rising like crazy.

Comex gold started at less than $2,600 in early December, and in just two months, it has risen sharply to nearly $3,000 per ounce - the key is that there has been almost no decent correction in these two months, which is equivalent to rising, rising, rising, rising...

According to the traditional interest rate pricing theory of gold, the yields of TIPS of various maturities representing the real interest rate in the United States have not fallen outrageously in the past two months, so the real interest rate cannot explain the surge in gold prices.

From the scale of gold ETFs, which have been closely related to gold prices in the past few months, the scale of gold ETFs has actually been declining in the past two months, which cannot explain the surge in gold prices.

From a geopolitical perspective, the war between Israel and Gaza in the Middle East has ended, and after Trump took office, there is a high probability that the Russia-Ukraine war will stop or maintain the current ceasefire for a period of time. According to the impact of traditional geopolitical crises, the price of gold should fall sharply at this stage.

Even from the perspective of the credit of the US dollar, after Trump took office, the Department of Government Efficiency (DOGE) led by Musk is conducting a large-scale "audit" of the federal government's spending. From the International Development Agency to the Ministry of Education, to social security payments and even military spending, the tone of the federal government's spending cuts has become louder and louder, which is obviously a negative impact on the price of gold...

Even if Trump's tariff policy includes gold, theoretically, it can only cause gold to fluctuate for a few days, and the actual gold price has been rising strongly in the past three weeks...

Even the so-called gold purchase activities of central banks in various countries are not what everyone imagines. Take the People's Bank of China, the world's largest central bank buyer of gold, for example. During the period when gold prices grew the most in the past three weeks, China's gold reserves only increased slightly by 160,000 ounces, which is nothing at all?

So, what is the reason for the sharp rise in gold prices?

My personal guess is that the Trump administration has reached out to the US gold reserves.

It is well known that since World War II, the United States has been the world's largest gold reserve country. To this day, the United States' gold reserves still exceed 8,100 tons, firmly ranking first in the world.

For the governments of most countries, gold reserves are kept by the central bank, and their purchase and sale affairs are basically handled by the central bank, but this is not the case in the United States.

The United States' gold reserves are indeed recorded in the name of the Federal Reserve, but its rights and interests clearly belong to the Treasury Department - these gold reserves are equivalent to the Treasury Department's special deposits in the Federal Reserve.

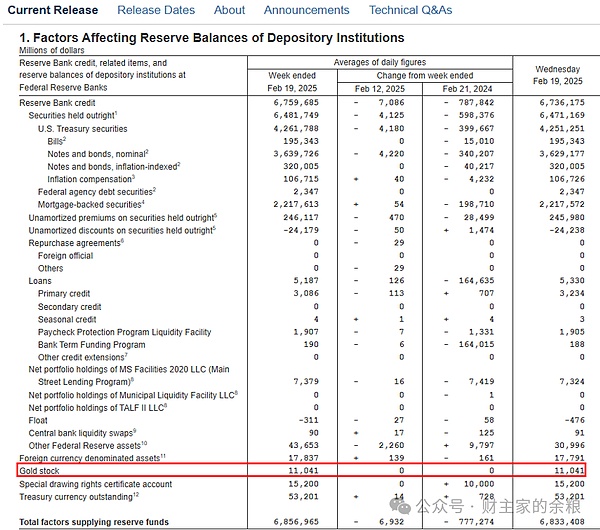

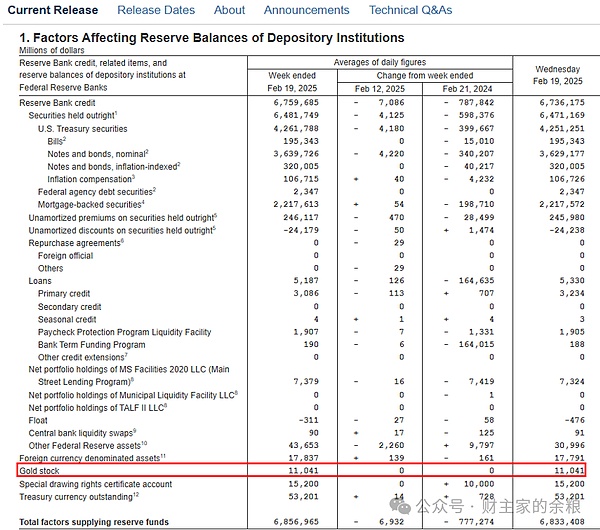

According to the Federal Reserve's latest balance sheet report on February 20, 2025, the total value of the United States' gold reserves is US$11.041 billion.

If you use a calculator to click on it, you will find something wrong - 8,133.5 tons of gold, equivalent to 261.5 million troy ounces of gold, how can the total value be only $11 billion?

Yes, according to the last time the US Treasury set the value of its gold reserves (when the Bretton Woods system collapsed in 1973), in the Federal Reserve's accounting system, gold is calculated based on the price of 50 years ago.

Yes, you heard it right, based on the price of 50 years ago, $42.22 per ounce, so the United States, which has 8,100 tons of gold reserves, only shows $11 billion in gold reserves on the Federal Reserve's balance sheet.

If calculated at the current market price of $2,935 per ounce, the actual value of this part of gold is $767.5 billion.

Scott Bessent, the new Treasury Secretary of the Trump administration, recently made a statement:

"Monetize U.S. industrial assets in the next 12 months!"

It was this sentence that caused huge ripples in the gold market.

You know, the gold that originally belonged to the Treasury Department in the books was shown as $11 billion in the Federal Reserve's books, but the actual value was as high as $767.5 billion - the Treasury Department can ask the Federal Reserve to recalculate the gold reserves according to the market price, which means that the Federal Reserve needs to print an additional $756.5 billion in cash for the Treasury Department.

This is a lot of money for the U.S. Treasury Department, which has been living beyond its means.

How should we view this?

For me, from the perspective of monetary credit, this is shameless + shameless squared...

First of all, we need to know why this part of gold is priced at $42.22 per ounce.

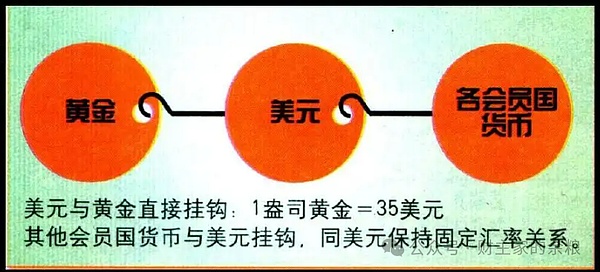

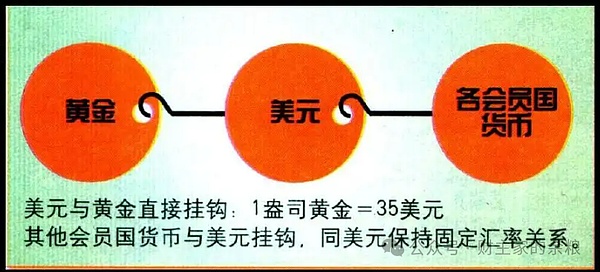

After the end of World War II, the United States led the establishment of the global Bretton Woods system, which stipulates:

The US dollar is equivalent to gold.

The central bank or finance ministry of any other country can, at any time, take US dollars and exchange them for gold from the US Treasury at a price of US$35 per ounce.

This is the basis of US financial hegemony since the end of World War II.

The US Treasury at that time had 21,300 tons of gold, equivalent to 70% of the gold reserves of all governments in the world at that time. It was rich and powerful, and at least 40% of the gold reserves were used to support every US dollar, so it made such a promise.

However, the US government spent money without restraint, and printing US dollars became increasingly dependent on national debt rather than gold.

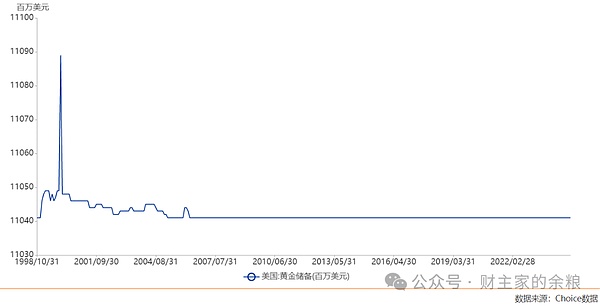

From 1945 to 1971, the central banks and governments of other countries continued to exchange dollars for the US gold reserves. The US gold reserves fell all the way to 8,222 tons, and the proportion of gold in the Federal Reserve's balance sheet also fell all the way to about 20%.

At this time, the Nixon administration began to cheat. On August 15, 1971, Nixon closed the gold exchange window on the pretext that there were too many speculators in the international gold market, which was equivalent to the United States openly cheating the world.

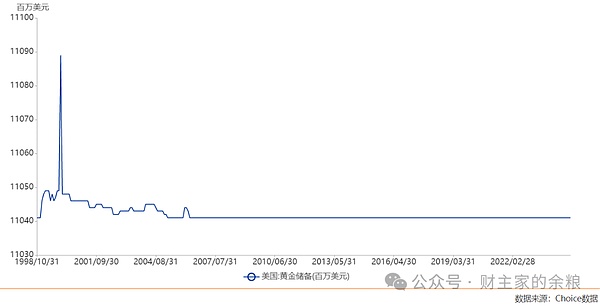

After that, after three years of turmoil in the international financial market, the United States and Western countries finally agreed to set the official US gold price at $42.22 per ounce (but other countries were not allowed to exchange). This is the reason for the price of $42.22. Moreover, from 2000 to today, the US gold reserves have basically remained between 8,130 and 8,200 tons.

So, according to the initial price of 35 US dollars per ounce of the Bretton Woods system, these 8,100 tons of gold had already been used as collateral to print US dollars. If the Ministry of Finance again asks the Federal Reserve to print additional US dollars for the Ministry of Finance at the current price, what is this if not shameless square?

This is equivalent to, 50 years ago, your house was worth 10,000 yuan, you mortgaged it all for 10,000 yuan, you completely spent the 10,000 yuan, the house is no longer yours, but today, you suddenly ask, according to the current house price that has increased 80 times, to give you another 790,000 yuan...

Think about it, how shameless would someone be to have such an idea?

This is just one possibility of the Trump administration's "revaluation" of gold value - in fact, the bigger question that countless gold investors in the United States and even the world are suspicious of is:

The US gold reserves are not as much as 8,100 tons!

For many years, the United States has been one of the world's largest gold exporters, and its gold exports have far exceeded the total amount of gold produced by the United States every year. Therefore, there have always been gold investors who believe that the 8,100 tons of gold reserves on the books of the United States have long been sold by major commercial banks in the market through gold leasing transactions.

On February 18, 2025, Musk, who is the head of the Trump Administration's Department of Efficiency (DOGE), said that he would investigate and audit the gold in Fort Knox, because it is the main gold reserve in the United States. According to the Federal Reserve's documents, the gold reserves there are as high as 147 million ounces, accounting for 56.35% of the United States' 262 million ounces of gold reserves. The U.S. Mint Police has always been responsible for protecting this batch of gold.

Trump said on February 20 that he would go to Fort Knox to make sure that the gold is indeed there.

After the Nixon administration ended the gold standard in 1971, the frequency of audits of U.S. gold reserves dropped from once a year to once every ten years. It is reported that the last time the U.S. Treasury Department audited the gold reserves in Fort Knox was on September 23, 1974.

From then until now, apart from the annual formal "vault seal inspection", no independent audit department has verified the approximately 4,580 tons of gold stored in Fort Knox.

Musk said:

"Who can prove that the gold in Fort Knox has not been stolen? Maybe it has, maybe it hasn't. Gold belongs to the American public! We want to know if it is still there."

The recent surge in gold prices is partly due to concerns that the US government will really monetize the US gold reserves for the second time. The more serious problem is that investors are worried that the US's 8,100 tons of gold reserves are just book data, and the actual gold reserves are far lower than this amount.

If the US gold reserves, after Musk's audit, really disappeared as countless gold investors have guessed, then it will surely set off a huge wave in the gold market, and it will be easy for gold to rise to $5,000 per ounce.

Kikyo

Kikyo