In April 2025, U.S. President Donald Trump launched a "tariff nuclear bomb" on global trade, "10% base tariff" + "reciprocal tariff" and the policy of imposing tariffs on specific industries such as automobiles, which directly penetrated the financial market's defenses.

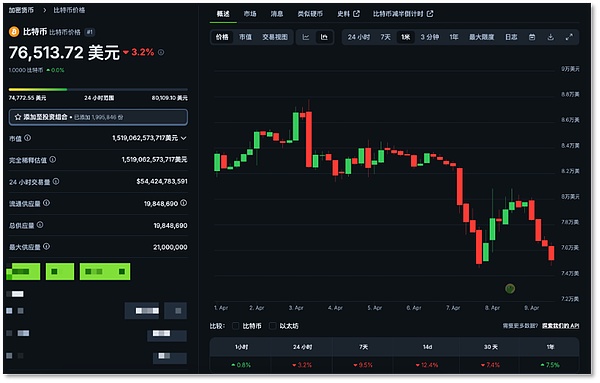

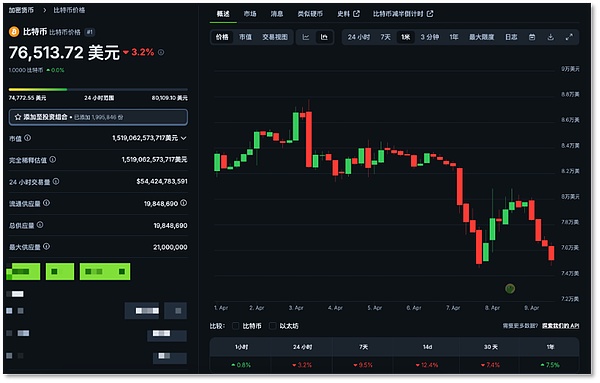

Thismost radical trade protectionism action in the 21stcentury instantly tore apart the global capital market: U.S. stocks evaporated 5.4trillion U.S. dollars in a single week, and the market value of global stock markets has shrunk by 10trillion U.S. dollars; the market value of technology giants evaporated more than one trillion dollars in a single day; the market value of emerging assets representative Bitcoin (BTC) increased from 1.7to 2.51. leaf="">trillion dollars to 1.5 trillion dollars, BTC ETF has experienced 5 consecutive days of capital outflow, with a net outflow of 4.3 billion dollars. The "safe haven" property of Bitcoin has been falsified again, and the Fed's interest rate cut policy has become the "life-saving straw" that the financial market has been waiting for.

However, judging from the statement of Federal Reserve Chairman Powell, it is "too early" to adjust monetary policy at the moment, and the Federal Reserve will maintain a wait-and-see attitude. This means that the Federal Reserve will not cut interest rates in the short term and may continue to maintain the benchmark interest rate at around 4.3%in the coming months.

The market may have to wait until May to see the outcome. According to CME's "Fed Watch", the probability of the Fed keeping interest rates unchanged in May is 54.8%, and the probability of cutting interest rates by 25 basis points is 45.2%. The interest rate policy adjustments of central banks in New Zealand, India, Japan and other countries have already begun this month.

Global stock market value has shrunk10Trillions of dollars

Beijing time4monthOn September 9, Trump's "reciprocal tariffs" on dozens of countries will officially take effect. Since the Trump administration took office in January this year, the US president has rapidly escalated its trade protectionism policy, becoming the core driver of the turmoil in the global financial market.

From March 12, the United States imposed 25% steel and aluminum tariffs on Mexico and Canada, and subsequently imposed 10% tariffs on Chinese goods in two batches until April 2On the same day, the United States announced a unified 10% base tariff on imported goods, as well as a more lethal "reciprocal tariff" plan.

Compared to the previous tariff barriers that only targeted traditional industries such as steel and automobiles, reciprocal tariffs involve a wider range. In addition to the base tariff, the United States will impose higher taxes based on different trading partners, covering major economies such as Europe and Asia-Pacific.

Among them, the United States increased tariffs on China by 34%, plus the previously imposed 20%tariffs, the total increase in this round reached 54%. Even the European Union, Japan and Canada were not immune and implemented reciprocal tariffs of 20%, 24% and 25% respectively, far exceeding market expectations. Vietnam and Cambodia had the highest tariffs, at 46% and 49% respectively.

U.S. tariff rate table for some trading partners

Faced with Trump's "backstab", the once close allies are ready to fight back. On April 7, the European Commission proposed to member states to impose a 25% tariff on some US products. Canadian Prime Minister Carney said that a series of measures will be taken to deal with the US trade war and market uncertainty, and plans to work with "reliable" partners to quickly diversify trade.

On April 4, China's countermeasures against the tariff war were implemented, including but not limited to imposing an additional 34%tax on all imported goods originating in the United States on the basis of the current tax rate from April 10, 2025. leaf="">tariffs. Trump posted on social media that if China cannot cancel the 34% tariffs on U.S. goods before April 8, the United States will impose an additional 50% tariff on China from April 9.

White House economic officials revealed that 50 countries have called the White House to seek negotiations in the hope of mitigating the impact, but Commerce Secretary Lutnick emphasized on the CBS Face the Nation program that Trump "is not joking" and the tariff strategy will not be delayed.

This silent "war" is still escalating, and the financial market is the first to bear the brunt and is experiencing severe turbulence.

In just a few days, the U.S. stock market evaporated 5.4 trillion U.S. dollars sharply. On April 7, "Black Monday" took place. U.S. stocks opened low and then surged. The Nasdaq rose by more than 4% at one point, but then fell back and fluctuated. The Dow fell by more than 390 points, a drop of 4. lang="EN-US">1.02%. Apple's stock price plummeted 9.3% in a single day, and its market value evaporated by about US$311 billion; Amazon and Meta both fell by about 9%; although Nvidia's chips were temporarily exempted from tariffs, its stock price still fell by 7.8%; Google's parent company Alphabet also fell. leaf="">and Microsoft fell 4% and 2.4% respectively.

Other Asian stock markets including Japanese stocks, A shares and Korean stocks were also slaughtered in early trading. Among them, the three major stock indices of Ashares opened lower across the board in early trading, with the Shanghai Composite Index opening 4.46% lower, the Shenzhen Composite Index opening 5.96% lower and the ChiNext Index opening 6.77% lower. At the same time, gold, as a safe-haven asset, was not spared. On April 7, gold once fell below 3,000 U.S. dollars, but has now rebounded. When the traditional financial markets collectively dived, some people turned their attention to the emerging financial sector - crypto assets, but the results were disappointing.

Bitcoin fell more than 9% "safe-haven property" was falsified again

On April the day Trump's tariff policy was announced, the market value of crypto assets accounted for more than 60%of Bitcoin, which had jumped to

. lang="EN-US">88500US dollars, but as Trump's speech continued, Bitcoin began to fall, but then it held the 82000mark for 4day.

Some analysts and industry insiders are optimistic that Bitcoin is showing "safe-haven properties."

Mudrex CEO and co-founderEdul Patelnoted that "these tariffs could weaken the dominance of the U.S. dollar and create opportunities for Bitcoin and other digital assets," he stressed that as concerns about inflation grow, Bitcoin remains a preferred safe-haven asset.

Bitget chief analystRyan Leealso said, "The 20% universal tariff risks stagflation (that is, rising costs without economic growth), coupled with retaliatory measures from other countries around the world, traders may increasingly turn to Bitcoin as a safe haven, using its decentralized nature to circumvent the impact of the trade war."

However, this optimism was shattered in April. lang="EN-US">6Day was completely shattered.

With the basic tariffs taking effect, various countries expressing their inclination to "counterattack" and Trump's insistence on reciprocal tariffs, on the night of April 6Bitcoin fell to around 77,000 US dollars, and reached a new low for the year on April 7. leaf="">74508US dollars, the cryptocurrency market has seen a nearly 24-hour liquidation volume of over 890 million US dollars, and more than 299,000 people have been liquidated. As of4month9day,BTCThe price fell 4month2day 7.1%

Bitcoin has continued to fall since Trump's tariff policy

Just like the COVID-19 pandemic and the outbreak of the Russia-Ukraine war, Bitcoin's "safe-haven property" has been falsified again.

Although Bitcoin has continued to rise in the 17 years since its birth, and in 2024 and 2025, it was included in the US stock ETF and the US national strategic reserve assets supported by Trump, but the volatility still makes Bitcoin closer to risky assets rather than being used for "risk hedging".

As a risky asset, whether liquidity is willing to enter Bitcoin becomes the key. Theoretically, when stocks are sold off and liquidity is released, Bitcoin may be expected to catch up. However, ETFs, which are regarded as a weather vane, have not provided strong data.

4Month3Daily Bitcoin Spot ETF Total net outflow 9985.91 million US dollars,4month4Bitcoin spotETFtotal net outflow$6487.76 millionon April7, Bitcoin spotETFtotal net outflow$1.09 millionon April7, Bitcoin spotETFtotal net outflowon a single day leaf="">US$ billion, with capital outflows for 5 consecutive days, and total net asset value lost for 5 days totaling US$4.3 billion, and the outflow is still continuing.

In addition, Bitcoin, which has not shown "safe haven properties", is still highly correlated with US stocks. According to TradingViewstatistics, over the past decade, the correlation between Bitcoin and the S&P 500 index was 0.17, and this correlation is still increasing. In the past five years, its correlation has risen to 0.41.

When macro hot events occur, the strong correlation between Bitcoin and US stocks is more obvious. For example, during the market recovery after the epidemic in 2020, both showed a significant upward trend. This means that the recovery of Bitcoin may need to wait for the recovery of the US stock market. During the trade war in 2018, the recovery cycle of the US stock market was 4 months, and then it ushered in a 10-month long rise. The liquidity of the risk asset market is also closely related to the monetary policies of central banks in various countries. At present, the Federal Reserve needs to be paid special attention to, and the pressure is directly given to Powell.

After Trump's tariff policy, at an event in Arlington, Virginia on April 4, local time, Federal Reserve Chairman Powell said that considering that the tariff policy was "far beyond expectations" and the impact on the economy and inflation may be "more lasting", it is "too early" to adjust monetary policy at the moment.

In his speech, Powell emphasized that the full impact of tariffs on the economy is still unclear and the Federal Reserve will remain on the sidelines. The Associated Press pointed out that Powell's statement means that the Federal Reserve may continue to maintain the benchmark interest rate at around 4.3%in the coming months and will not cut interest rates in the short term.

Powell revealed that the Federal Reserve officials will hold another meeting from May 5 to 6 to 7 to formulate interest rate policy. "We need to wait and see how things will develop."

The market may have to wait until the Fed's interest rate cut rhythm becomes clearer in May before there is a chance to see the light.

Currently, central banks of other countries have begun to take action.

On April 9, the Reserve Bank of New Zealand decided to cut the benchmark interest rate by 25 basis points to 3.5%. This is the fifth consecutive meeting of the country's central bank to cut interest rates; the Reserve Bank of India lowered the CPI by 2026. leaf="">The inflation rate is expected to reach 4%, which was previously expected to be 4.2%, and the policy stance will be adjusted to "loose"; Bank of Japan Governor Kazuo Ueda said at a meeting held today that if the economy improves as expected, interest rate hikes will continue; Barclays economists report predicts that the European Central Bank may cut the policy rate by 25 basis points on April 17.

Catherine

Catherine