Author: insights4vc Source: substack Translation: Shan Ouba, Golden Finance

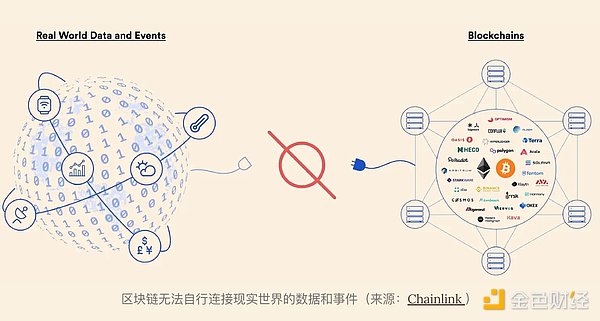

The rapid expansion of decentralized finance (DeFi) highlights the critical role of blockchain oracles in connecting on-chain and off-chain ecosystems. From derivatives, synthetic assets to cross-chain interoperability, smart contract applications rely on timely and verifiable external data to execute trustless agreements. However, blockchains operate in isolated environments and cannot directly access external information, which requires oracle solutions to achieve secure data transmission.

As an intermediary, blockchain oracles are responsible for querying, verifying and authenticating off-chain data before passing it to smart contracts. Oracles are not the primary source of data, but rather serve as a trust layer to ensure the accuracy and reliability of external inputs, such as market prices, real-world events, and IoT sensor readings. Given the deterministic nature of smart contracts, the integrity and security of these inputs are critical. As a result, decentralized oracle networks (DONs) have emerged to enhance data resilience, reduce single points of failure, and maintain the decentralized spirit of the blockchain ecosystem.

As DeFi and broader Web3 applications continue to develop, oracles will continue to play a fundamental role in unlocking new financial primitives and expanding the scope of smart contract functionality. This article will explore the design, security considerations, and ongoing technical advances of oracle architectures, focusing on their role in promoting a strong, decentralized future.

Core components of the oracle system

1. Data aggregation and verification: To mitigate the risks of single point failure and data tampering, the oracle aggregates data from multiple independent providers. Cryptographic signatures, multi-party computation (MPC), and consensus-based verification techniques enhance the reliability and security of on-chain data input.

2. Node operators: The oracle network consists of decentralized node operators who are responsible for retrieving, verifying, and submitting off-chain data to the chain. These nodes can be autonomous or part of a consortium, using cryptographic proofs and economic incentives to ensure accuracy and reliability.

3. On-chain data transmission: Once verified, the data is passed to the smart contract through on-chain transactions. Secure data transmission mechanisms include threshold signatures, zero-knowledge proofs, and trusted execution environments (TEEs) to ensure data integrity and prevent unauthorized tampering.

4. Reputation and economic incentives: The performance of the oracle is evaluated through an on-chain reputation system that tracks historical accuracy and uptime. Many decentralized oracles use a staking mechanism that requires node operators to lock up collateral, which may be slashed in the event of malicious behavior or inaccurate data submission.

Oracle architecture

Depending on the needs of the blockchain application, oracle solutions vary. The most widely used architectures include:

1. Input Oracles: Obtain external data (e.g., financial market prices, sports results) and pass it on-chain to execute smart contracts.

2. Output Oracles: Enable smart contracts to trigger off-chain events, such as processing payments or controlling IoT devices.

3. Cross-Chain Oracles: Facilitate cross-chain interoperability by enabling seamless data exchange and asset transfer between different blockchains.

4. Compute-Powered Oracles: Perform complex off-chain computations, including verifiable random number generation, zero-knowledge proof verification, and automated smart contract execution.

Data Security and Integrity

Given the role of oracles in extending blockchain functionality, they require stringent security measures to maintain trust and reliability. These measures include:

1. Multi-signature data aggregation: Data from multiple sources is aggregated through cryptographic signatures and verified by independent oracle nodes before being submitted.

2. Cryptography and Secure Hardware Implementation: Trusted Execution Environment (TEE) and cryptographic proofs prevent unauthorized data tampering and maintain data confidentiality.

3. Decentralization Strategy: Distributed data sources and diverse node operators eliminate single points of failure and enhance network resilience.

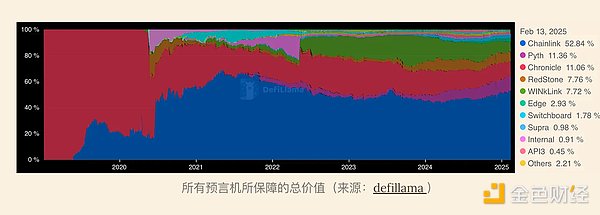

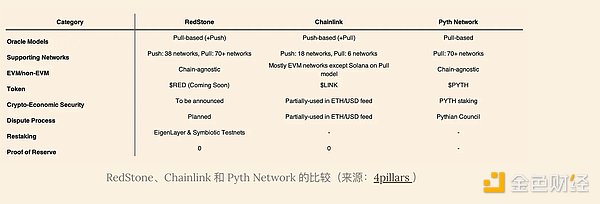

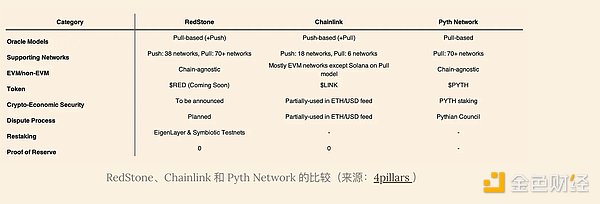

This article will compare the leading entities in the blockchain oracle space: Chainlink, the earliest provider, as well as RedStone and Pyth Network.

Chainlink

Chainlink Core Team:

Co-founder: Sergey Nazarov

Co-founder and CTO: Steve Ellis

Chief People Officer: Giovanna Totini

Chief Business Officer: Johann Eid

Chainlink Financing (Total Financing: US$32 million)

Financing Round:

Initial Coin Offering (ICO)

Date: September 18, 2017 | Capital Raised: $32 million

Selected Investors: 2020 Ventures, Outlier Ventures, Innovating Capital, Unify Fund, Fundamental Labs, Bauhaus Group, Framework Ventures, Next Play Ventures, Monday Capital, AlphaCoin Fund, 8 Decimal Capital, Youbi Capital, Origin Capital, BirdStone Capital, Chainfund Capital, Akwan, SkyChain Capital, SWS Venture Capital , SYD Crypto , Kintsugi Ventures , Validation Capital , Joswig Capital , Zog Capital , Sweat Equity Ventures , STC Capital , Koji Capital , The Whites Holding , FRF Capital , Abstraction Capital , Marshland Capital , Northbund Capital

Chainlink (LINK):

Architecture

Chainlink pioneered decentralized oracles by building a network of independent data providers that continuously update blockchain smart contracts with verified off-chain data. Its core infrastructure relies on a federated model where multiple node operators source, verify, and submit price feeds.

The system underpins two main products:

Markets and Data Feeds: Chainlink uses a push oracle mechanism where predefined price data feeds are updated on-chain at set intervals. These data sources can be used for a wide range of financial applications, including:

Price Feeds: Real-time price data for cryptocurrencies, commodities, and stocks.

Smart Data Feeds: Enables integration of real-world economic indicators.

Rate and Volatility Feeds: Access interest rate and risk indicators for structured financial products.

L2 Sequencer Uptime Feeds: Monitors the availability of Layer 2 network sequencers to mitigate downtime risks.

Data Streams: Unlike market and data feeds, Chainlink’s data streams act as pull oracles, obtaining data on demand rather than pushing periodic updates. This architecture allows high-frequency trading applications to access near-instantaneous price data without incurring excess transaction costs.

Security and Governance

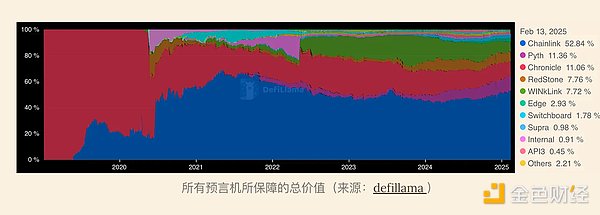

While Chainlink has the highest Total Value Secured (TVS) of all oracle providers, it faces limitations in economic security:

Limited Cryptoeconomic Security: Chainlink’s staking model is still in its early stages, and slashing only applies to the ETH/USD price feed. This limits its deterrent against oracle manipulation.

Dispute Resolution Gap: Whistleblower incentives exist, but are limited to partial information, reducing the ability to punish malicious behavior at scale.

Network Scaling Limitations: Chainlink primarily operates in an EVM-compatible ecosystem and requires additional infrastructure to integrate with non-EVM chains.

A key aspect of Chainlink's strategy is the development of the Cross-Chain Interoperability Protocol (CCIP). This protocol is essential for seamless cross-chain transactions, which is critical for integrating capital markets and real-world assets (RWAs) into blockchains. Chainlink's potential to facilitate the tokenization of RWAs highlights its important role in the future of blockchain technology.

Pyth Network

Pyth core team:

Co-founder and CEO:Michael Cahill

Co-founder and CTO:Jayant Krishnamurthy

Co-founder and COO:Ciaran Cronin

Pyth Network financing (total financing amount: undisclosed)

Financing round:

Strategic Round

Date:December 5, 2023

Selected Investors:Delphi Ventures, Multicoin Capital, CMT Digital, Wintermute, Distributed Global, Borderless Capital, Castle Island Ventures, Bodhi Ventures

Pyth Network (PYTH):

Token Generation Event (TGE):Pyth Network’s TGE was held on It occurs in December 2023, with an initial price of approximately $0.39.

Current Price: $0.203 |Market Cap: $757 million

Architecture

Pyth Network differs from Chainlink's federated model in that it directly obtains price data from first-party providers such as centralized exchanges (CEX), decentralized exchanges (DEX), market makers, and hedge funds. This model reduces reliance on intermediaries and ensures price integrity by reducing the risk of tampering by third-party nodes.

Pythnet Integration with Wormhole: Pyth’s oracle infrastructure runs through Pythnet, a separate blockchain built using the Solana client. Pythnet aggregates price information and distributes it across chains via the Wormhole bridge.

Staking and Security: The Oracle Integrity Staking (OIS) mechanism requires data publishers to stake PYTH tokens as collateral, with over $100 million staked as of January 2025. This ensures economic security through slashing conditions when malicious activity is detected.

Dispute Mechanism: If the price deviation exceeds 250 basis points and lasts for more than 60 seconds, the Pythian Committee, a semi-centralized governing body, will review the discrepancy and enforce slashing penalties if necessary.

Potential Weaknesses

Dependence on Wormhole: Any vulnerabilities in the Wormhole bridge would pose a systemic risk to Pyth’s cross-chain operations.

Limited Dispute Decentralization: Governance oversight still relies on a committee structure, rather than fully decentralized arbitration.

Restrictive Scaling Model: Pyth can only provide data to Wormhole-powered networks, limiting broader adoption.

Redstone

Redstone core team:

• Co-founder and CEO: Jakub Wojciechowski

• Co-founder and COO: Marcin Kazmierczak

• Co-founder: Alex Suvorov

• Head of Business Development: Matt Gurbiel

RedStone Financing Situation:

• Total Financing: US$22 million

• Financing Rounds:

• Series A

• Date: July 2, 2024

• Funding Amount: US$15 million

• Selected Investors: The Spartan Group (lead investor), Arrington Capital, IOSG Ventures, Kenetic Capital, Amber Group, SevenX Ventures, HTX Ventures, gumi Cryptos, Chorus One, Selini Capital, White Star Capital, Fourth Revolution Capital, Samara Asset Group, Alphemy Capital, Smokey (angel investors)

• Angel Round

• Date: May 22, 2023

• Selected Investors: Stani Kulechov, Sandeep Nailwal, Alex Gluchowski, Emin Gün Sirer

• Seed Round

• Date: August 30, 2022

• Raise Amount: $7 million

• Selected Investors: Coinbase Ventures (lead), Blockchain Capital (lead), Maven 11 Capital, Distributed Global, Lemniscap, SevenX Ventures, Folius Ventures, Arweave, Compute Ventures, Permanent Ventures

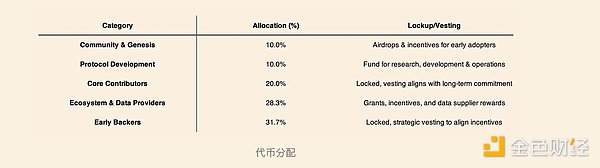

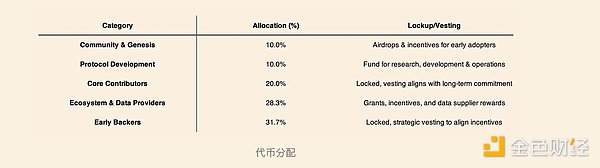

$RED Token Economic Overview:

• On February 12, 2025, RedStone launched the RED token, a tool for enhancing the decentralization, security, and scalability of its blockchain oracle network. The RED Token will serve as the basis for incentivizing participants, strengthening economic security, and expanding RedStone’s infrastructure, especially for applications in new blockchain ecosystems.

RED Token Economic Key Highlights:

• Maximum Supply: 1 billion RED (an ERC-20 token based on Ethereum, supporting scalability to multiple chains via Wormhole)

• Initial Circulating Supply at TGE: 30%

• Staking Feature: Integration with EigenLayer AVS allows data providers and token holders to stake RED to secure the oracle network while earning rewards in ETH, BTC, SOL and USDC.

• Supply Unlock Plan: 70% of tokens are locked, and unlocking will be carried out gradually over 4 years.

Strategic Positioning

Fastest Growing Oracle: 130+ clients on 70+ chains including Berachain, Story, TON, Monad, and MegaETH.

Economic Sustainability: The first stake-based blockchain oracle with scalable value accumulation capabilities.

DeFi Infrastructure Backbone:RedStone's modular architecture enables secure and efficient cross-chain data transfer.

RED is not yet live.

Hybrid Pull-Push Architecture

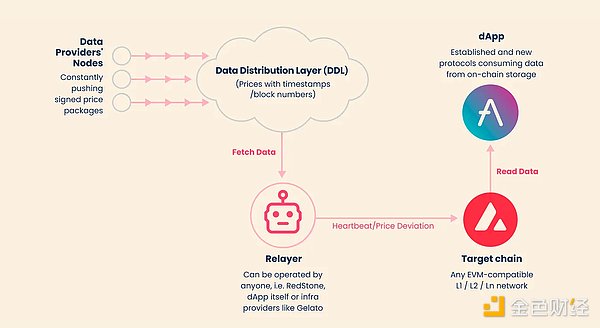

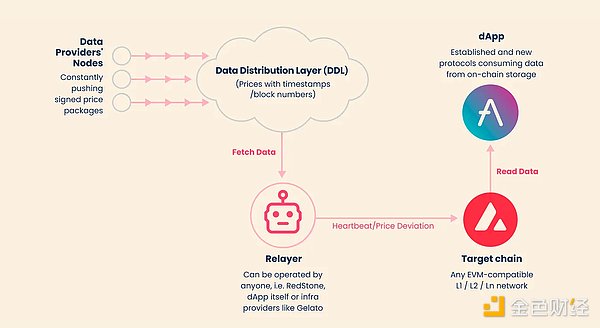

RedStone introduces an innovative hybrid oracle model that combines a modular pull design with optional push functionality. The architecture improves efficiency by enabling decentralized applications (dApps) to retrieve off-chain data on demand while retaining the push mechanism for protocols that require continuous updates.

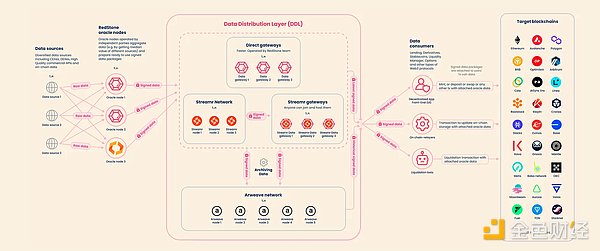

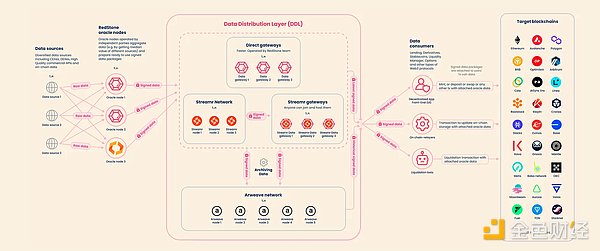

Data Distribution Layer (DDL): RedStone nodes aggregate data from multiple sources, including centralized exchanges (CEX) and decentralized exchanges (DEX), as well as other financial data providers. Data is signed and stored off-chain, significantly reducing gas costs by ensuring on-chain retrieval is only done when necessary.

Multi-layer storage mechanism: Historical price data is archived on Arweave, ensuring the immutability and verifiability of past information records for enhanced transparency and auditability.

Cross-chain compatibility: Unlike Chainlink and Pyth, RedStone natively supports over 70 blockchain networks without relying on centralized cross-chain bridges, making it one of the most versatile oracle solutions.

Cryptoeconomic Security and Re-staking

RedStone aims to build an advanced security framework through staking and cryptoeconomic incentives:

Staking and Slashing via RED Tokens: The upcoming RED Token will enable a staking-based security model where data providers must stake RED tokens and are subject to slashing in case of false or fraudulent reporting.

Re-staking Mechanism: RedStone integrates EigenLayer and Symbiotic re-staking, allowing security to scale without increasing the burden on liquidity providers. This approach enhances trust minimization and capital efficiency, surpassing traditional staking-based oracles such as Chainlink and Pyth.

Dispute Resolution Protocol: An on-chain arbitration system allows users to challenge inaccurate data submissions, and fraudulent providers face hefty fines to compensate affected parties.

RedStone's Pull Oracle Model

In January 2022, RedStone pioneered the Pull Oracle Model to address the inherent inefficiencies of traditional push oracles. Unlike push oracles that continuously publish data on-chain regardless of demand, pull oracles allow dApps to retrieve off-chain data only when needed. This model significantly optimizes cost-effectiveness by reducing unnecessary gas expenditures and on-chain congestion.

While Chainlink and Pyth later introduced pull oracle capabilities (Chainlink in October 2023 and Pyth in December 2022), RedStone maintained its first-mover advantage and expanded its coverage to over 60 blockchain networks - significantly exceeding Chainlink's limited coverage of five chains in this category.

RedStone's modular oracle design allows for seamless customization of a variety of blockchain applications. The architecture operates under two main models:

The pull model integrates data into transactions only when necessary, maximizing flexibility and cost efficiency. Key components include:

Diverse Data Sources: RedStone aggregates pricing data from CEXs (e.g. Binance, Coinbase, Bybit), DEXs (e.g. Uniswap, Trader Joe, Sushiswap), and aggregators (e.g. CoinGecko, CoinMarketCap).

Oracle Nodes: These nodes obtain, aggregate, and verify data using methods such as Time Weighted Average Price (TWAP) and Liquidity Weighted Average Price (LWAP), and sign the data for verification.

Data Distribution Layer (DDL): This off-chain data availability layer distributes signed price information through RedStone’s open source gateway or Streamr’s decentralized infrastructure, while Arweave archives historical data for auditing.

RedStone Push Model

For protocols that require continuous data updates, RedStone supports a push model based on its pull architecture. This approach allows permissionless relay nodes to obtain and periodically submit verified data to the chain, ensuring real-time availability without introducing additional trust assumptions.

RedStone's Role in the Future of Decentralized Oracles

RedStone's modular architecture and pull-based design make it a leading oracle solution in the modern blockchain ecosystem. Its flexible off-chain data access capabilities enable seamless deployment on a variety of networks, including EVM-compatible chains and non-EVM platforms such as Starknet, Fuel Network, NEAR, TON, Tron, Casper, and Stacks. With a ranking of third in Total Value Security (TVS), behind only Chainlink and Pyth, RedStone has quickly gained acceptance among DeFi protocols such as Pendle, Morpho, Lombard, EtherFi, and Renzo.

Towards Full Decentralization

Despite rapid adoption, RedStone’s current architecture still retains some centralized elements, relying on five authorized oracle nodes and not yet implementing instant penalties for inaccurate data submissions. However, future development plans are aimed at enhancing decentralization, including:

• The launch of the RED Token: The token will facilitate oracle payments, staking rewards, and governance mechanisms to resolve disputes.

• Introduction of RedStone AVS: By leveraging EigenLayer’s crypto-economic security model, RedStone AVS will strengthen decentralization and minimize trust assumptions.

• Permissionless Oracle Nodes: Plans to introduce a permissionless node structure to further decentralize data verification responsibilities and cover a wider network.

With these advances, RedStone will redefine the oracle space, balancing scalability, efficiency, and decentralization while providing the industry’s most capital-efficient security model.

Conclusion

As blockchain applications continue to expand, oracle networks are evolving from basic data feeds to providing more complex decentralized services. Innovations such as fully homomorphic encryption (FHE) to protect privacy computing, AI-driven oracles for predictive analytics, and multi-layer governance frameworks are shaping the next generation of decentralized oracles. With their increasing integration in the global financial infrastructure, oracles are becoming indispensable, becoming a bridge between blockchain systems and the broader economy, consolidating their role in future verifiable networks.

Catherine

Catherine