Author: Aylo, author of alpha please; Compiled by: Golden Finance xiaozou

Botanix is an equivalent to Bitcoin L2 EVM. They currently have a fully working product released on testnet, which I think will be one of the most exciting Bitcoin-related releases this year.

I chatted with Botanix Labs founder Willem Schroe to better understand his BTC L2 perspective.

Botanix background introduction

Botanix Labs is on Bitcoin Building the first fully decentralized EVM equivalent, L2, combining the ease of use and versatility of EVM with the decentralization and security of Bitcoin.

Using Bitcoin's Proof of Work (PoW) as the underlying settlement and decentralized L1, Botanix will use a proof-of-stake consensus model in which stake (represented by (for Bitcoin) are securely stored on Spiderchain, a decentralized multi-signature distributed network protected by a group of random participants. You will be able to stake Bitcoin on the Bitcoin network.

1, tell us about yourself and how did you come up with the idea of developing Botanix?

I grew up in Belgium and later became Belgium’s national mathematics champion. Then I completed my bachelor's and master's degrees in electrical engineering. Belgium actually has a great reputation in cryptography, so my master's degree was actually in cryptography. My ultimate research direction was authentication encryption, and I even managed to break some encryption algorithms. At the time, I did not realize that cryptography would enter my career again.

After graduation, I worked in the chemical industry for six years and moved to Saudi Arabia for two years. When seeing hyperinflation in the Middle East, especially in Lebanon, I completely understand the importance of cryptocurrencies. So I applied to Harvard Business School, which was my gateway to the United States.

At Harvard, I developed a Botanix perspective that has remained unchanged since. A year and a half ago, I was trying to understand where crypto infrastructure was heading. Interestingly, 15 years later, theories about infrastructure are still changing. However, the idea is simple. We believe that Bitcoin is a purely decentralized, secure form of money with almost no utility based on it. So you have a huge pool of dormant capital waiting for some development and construction to be done on it.

However, developing on the Bitcoin network is notoriously difficult, and everyone knows this. Meanwhile, outside of Bitcoin, there are a plethora of utilities and applications, many of which form product-market fit and create significant value.

I realize that these are built on so-called virtual machines. A virtual machine is essentially a software layer that follows the same software technology principles. I realized that EVM (Ethereum Virtual Machine) is the most prominent and widely distributed of all virtual machines. In software technology competition, distribution is the most important. If you look back at Windows in the 1980s, you know it wasn't the best technology, nor was it the most secure, but its distribution was by far the largest.

Distribution has always been the key to competition in software technology. So while Bitcoin may win as a form of currency, the EVM is the winning virtual machine. This led to the idea of building L2 on Bitcoin, which differentiates us from others. The idea was formed a year and a half ago, and we first spent six months delving back into cryptography and then developing a fully decentralized L2 on Bitcoin that we called Spiderchain. Spiderchain is the technology that enables this L2 to be built.

p>

We have received positive feedback and comments from many people in the Bitcoin community. We started official development in September, launched our public testnet in November, and are now preparing to launch the mainnet. I believe we are the only one that has truly launched a fully end-to-end product that is ready to go.

2. Can you introduce us to the working principle of Botanix?

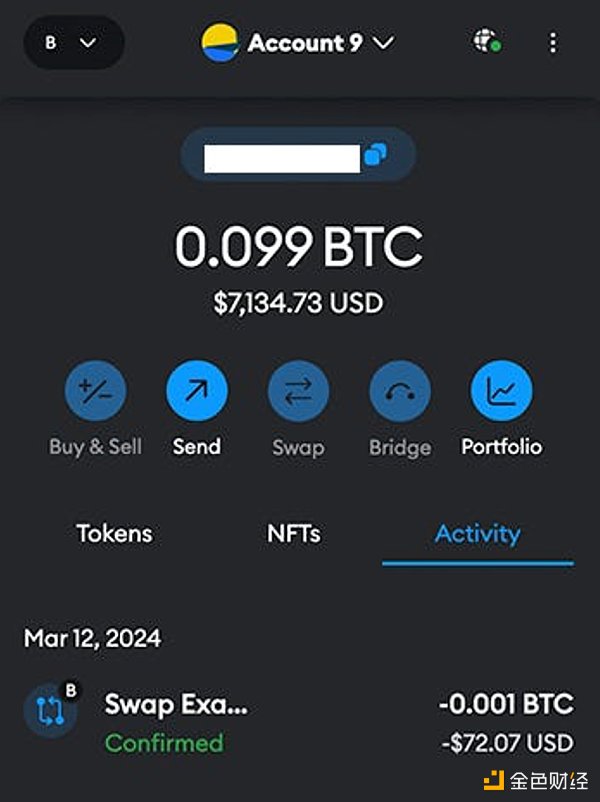

We are fully equivalent to the EVM, so anything that works on the EVM, you can just copy and paste it and make it work on Botanix, and the whole process is Do it on Bitcoin. Once you connect to MetaMask, a Bitcoin deposit address will be generated. This looks like a normal Bitcoin address, but in fact, it is a special type of address that in Taproot we encode into your EVM address.

This means that from now on, this Bitcoin address is uniquely connected to the EVM address we obtained from your MetaMask. We did this because we saw what Stacks and Rootstock did and saw where they went wrong. We want to make it as easy as possible for people to log into Bitcoin's second layer, so when doing a Bitcoin to Botanix bridge, it feels as easy as an Ethereum to L2 bridge like Arbitrum.

Basically, using this address, you can now send Bitcoin directly from Coinbase, Kraken, or any exchange to this Bitcoin deposit address in your MetaMask There will be Bitcoin. After this, you will feel like you are on Ethereum, except you are using Bitcoin.

3. Which users do you think Botanix will attract? Ethereum L2User or native Bitcoin user?

I think the answer is both. In the crypto space, Bitcoin and Ethereum are often compared, with people divided along ideological lines. Some people prefer Bitcoin because it represents a fully decentralized currency, which is the most important thing to them. Others lean towards Ethereum, valuing utility above all else. However, I believe there will eventually be Botanix users in both camps.

I know that many Bitcoin holders want to use their Bitcoin to earn income. But nothing allows them to do that. I know a lot of people want to use their Bitcoin for perps decentralized exchanges and the like, but there is no native way to access that on Bitcoin. So, this basically allows any application that achieves product market fit on Ethereum to also achieve product market fit on Bitcoin. I have always believed that even Bitcoin holders are human beings and behave much like everyone else. So any product that has achieved product market fit on Ethereum can also achieve product market fit on Bitcoin, there just isn't the infrastructure to actually do it.

I think ordinals and BRC-20 show that many Bitcoin enthusiasts also want to engage in various activities, but currently, nothing is suitable for them. What I've observed is that over the past few months, we've been doing massive business development, and from a developer's perspective, if you're an Ethereum dApp, you choose to deploy on Arbitrum or Ethereum, You will face huge competition for the same users and funding. In addition, deploying on Botanix gives you the opportunity to become a pioneer in the entire Bitcoin market, attracting all Bitcoin enthusiasts who want to do something with Bitcoin.

I think 70% of the people or capital will actually come from native Bitcoin, and all the dormant capital waiting to be put to use on Bitcoin will come from There, other capital will come from Ethereum.

4. Will developers also be interested in developing native applications on Botanix?

p>

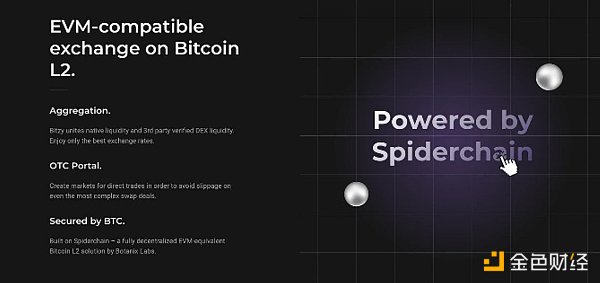

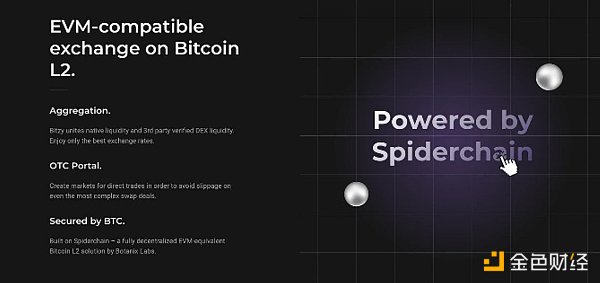

The Bitzy team is building a very novel DEX that uses the V2 front-end, but the back-end uses the V3 aggregator, which is logically similar to the Ethereum DEX. The Vertex team is developing a new generation of applications that improve existing proof models. Other well-known Perps decentralized exchanges are also considering related deployments.

Palladium will announce a stablecoin backed by Bitcoin, which is a huge application in itself. Many people have tried to create a stablecoin based on Bitcoin, but it has not happened yet. However, the largest wrapped Bitcoin application on Ethereum is essentially a stablecoin that has wrapped Bitcoin backing, like MakerDAO with DAI, but having native decentralization on Bitcoin makes more sense. So the Palladium team is entering this space: having a Bitcoin-backed stablecoin on Bitcoin.

Then, there are many different lending agreements. The most obvious use cases for Bitcoin are those that have demonstrated product-market fit on Ethereum. Some are considering venturing into unique areas of Bitcoin (such as mining hashrate). There are also those interested in building a commodities DEX, which may be more in line with Bitcoin enthusiasts and their interest in macroeconomics. But most people want to bring applications with product-market fit on Ethereum to Bitcoin.

5 Can people use BRC-20 on Botanix ?

As you may already know, the current user experience of BRC-20 is very bad. Essentially, what you are able to do is move from the main layer of Bitcoin to the second layer of Botanix through a cross-chain bridge, and then you can start doing block transactions and trading protocols on the DEX, which basically you can access The entire ERC-20 DeFi ecosystem.

6 Do you want to compete with high-throughput chains? Or do you want to carve out your own niche?

This is a very good question. The answer is no. I think the game changer is us providing the infrastructure on Bitcoin. In fact, Spiderchain is designed more like Ethereum. We are able to support 10,000 to 100,000 different full nodes, and anyone can join the network, stake Bitcoin, and run a full node. Therefore, this is also more attractive to Bitcoin enthusiasts, who prefer decentralization.

p>

This is a game changer. The blockchain trilemma shows that if you pursue high throughput at scale, you will limit your decentralized nature. In the second layer of Botanix, we basically follow the Ethereum vision, requiring more hardware, but still running on 9-10 second blocks and a very high degree of decentralization. This vision favors decentralization rather than high throughput at scale. We believe this is one of the main reasons why we have received so much support from the Bitcoin community. Our strong stance on decentralization is widely recognized by the Bitcoin community.

What are the charges for 7 and Botanix?

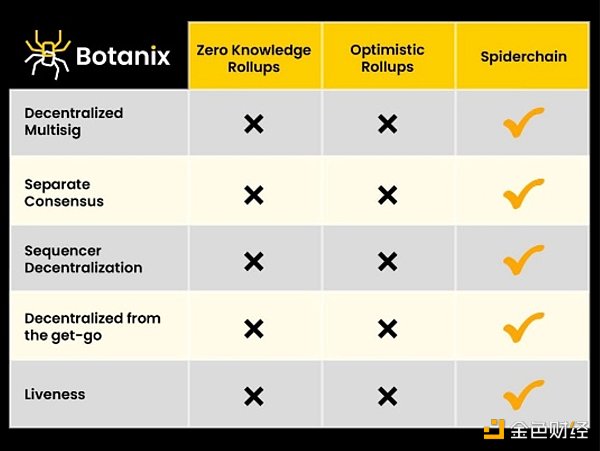

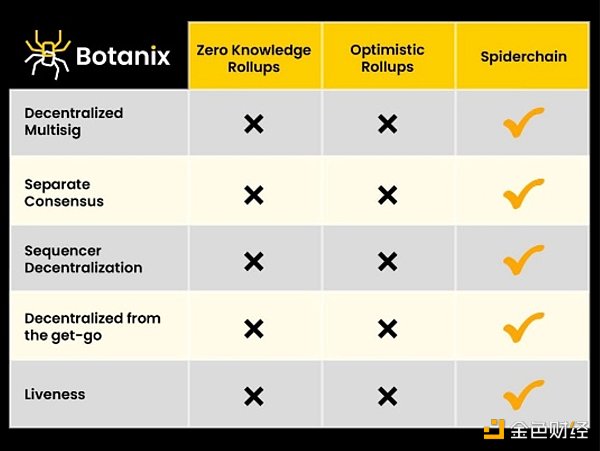

The cost is very low. Current rollups are highly centralized in nature, which leads to various issues and higher fees. In order to be censorship-resistant, have liveness and the ability to unilaterally exit, they need to pull data back to layer 1, increasing the cost of layer 2. In contrast, we are fully decentralized and anyone can run a full node and solve these problems. Therefore, our L2 fees will be very low because we do not need to publish data back to the Bitcoin main layer, which is very expensive.

8How is the speed?

Botanix is optimized like Ethereum. In terms of the blockchain trilemma and rapidity, we are essentially like an Ethereum. However, it is possible to build an L3 or even L2.5 layer that connects directly to Bitcoin as the base layer and achieve massive speeds. The EVM will then act as a data availability layer. Spiderchain is essentially how you decentralize Bitcoin at the base layer. It's similar to EigenLayer's design, but on Bitcoin, so we can ensure very fast rollup. This is a long-term vision. After that, you can achieve very fast rollups on Bitcoin.

9. What do you think of the "Sleeping Capital"How big is it?

The basic idea is that Bitcoin's total market cap is three or four times that of Ethereum. Initial statistics show that in fact, ordinarys and BRC-20 are also more or less three times larger than the NFT market when it first exploded on Ethereum.

We also believe that the DeFi market size on Bitcoin will also triple. I think out of a trillion dollar market cap, taking into account ETFs, all the Bitcoin in the wallets of long-term holders, and about 20% of the extreme Bitcoin Maxis (who don't want to do anything with their Bitcoin), there will be About 30% of the Bitcoin supply is opened. When you consider that Bitcoin is a trillion-dollar asset, the DeFi market could easily reach $100 billion.

JinseFinance

JinseFinance