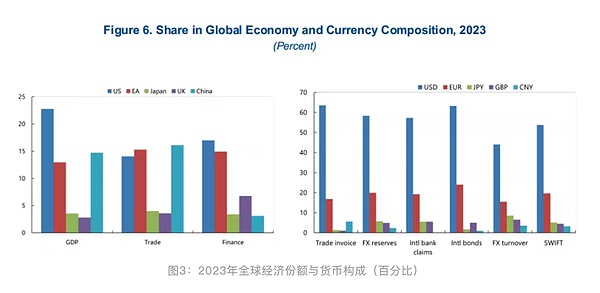

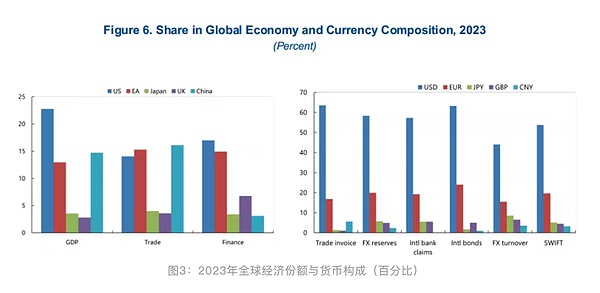

In December 2025, the IMF published an article titled "Understanding Stablecoins," which systematically reviewed the current development status, operating mechanisms, potential returns and risks of stablecoins, as well as the evolving international regulatory framework. Stablecoins, as crypto assets denominated in fiat currency and backed by financial assets, are primarily used for crypto transactions and are gradually expanding into areas such as cross-border payments, possessing the potential to improve payment efficiency, reduce costs, and promote financial inclusion. However, in the absence of adequate regulation and security mechanisms, stablecoins may bring risks such as macroeconomic financial stability, currency substitution, capital flow volatility, fragmentation of the payment system, and financial integrity and legal certainty, especially in countries with weaker macroeconomic foundations and institutions. The current international regulatory framework remains fragmented, with differences among economies in terms of issuing entities, custody and segregation requirements, and systemic importance regulation, potentially leading to regulatory arbitrage. Central bank-issued currency is the most fundamental, liquid, and resilient form of money and should continue to play its role. The Financial Technology Research Institute of Renmin University of China has compiled the core parts of the research. Introduction In recent years, stablecoins have developed rapidly due to their settlement function in crypto asset transactions and their potential to generate returns within the crypto ecosystem. Their issuance has grown significantly in the past two years, prompting countries to accelerate the development of relevant laws and regulatory frameworks. The attention surrounding stablecoins has also further promoted the development of asset tokenization, namely, the recording and transfer of assets through distributed ledger technology. This study aims to systematically introduce the basic concepts and economic characteristics of stablecoins, outline their main operating models, market development and application scenarios, analyze their potential returns and risks, and summarize the latest progress of international organizations and major economies in the construction of stablecoin regulatory and policy frameworks, providing a foundational analysis for understanding the role of stablecoins in the global financial system and their policy implications. Definition and Conceptual Framework Stablecoins are a type of on-chain crypto asset issued by private entities, denominated in fiat currency, and maintained in value by relying on secure and highly liquid reserve assets. They aim to serve as a relatively stable payment tool and store of value. Unlike unbacked crypto assets such as Bitcoin, this article focuses on "fiat-backed stablecoins." These stablecoins constitute the main body of the current market, their issuance, circulation, and pricing rely on the blockchain ecosystem, and their price is maintained through secondary market arbitrage mechanisms. Stablecoins are an important component of the asset and currency tokenization trend, possessing potential in payment efficiency and financial innovation. Functionally, they share similarities and complementarities with bank deposits, electronic money, money market funds, and central bank digital currencies. However, due to their lack of full inclusion in deposit insurance, central bank liquidity support, and a complete regulatory and resolution framework, stablecoins still present new policy challenges in terms of financial stability, legal certainty, and regulatory coordination, and are gradually being incorporated into the regulatory systems of various countries. Against this backdrop, CBDCs and stablecoins may compete with each other or complement each other, depending on their differences in issuing entities, risk attributes, legal status, technological architecture, and application scenarios. Recent Developments, Current Use Cases, and Potential Demands In recent years, the issuance scale of stablecoins has grown rapidly, nearly doubling since 2024 and reaching approximately $300 billion in 2025. However, it still accounts for only a small proportion (approximately 7%) of the overall crypto asset market, and an even smaller proportion in the traditional financial system. Despite the “crypto winter” of 2022-2023 and numerous risk events, the stablecoin market has shown strong resilience. The current market is highly concentrated, with USD-denominated stablecoins accounting for approximately 97% of the total issuance. Among them, USDT and USDC together account for approximately 90% of the market share, reflecting the strong correlation between the development of stablecoins and the international dominance of the US dollar. Figure 1: Stablecoin and Cryptocurrency Market Size Although stablecoins have briefly decoupled from their anchor during extreme events (such as the TerraUSD crash or the collapse of Silicon Valley Bank), the deviations are generally short-lived, demonstrating a degree of market self-correction. While stablecoins still have a smaller market capitalization than unbacked crypto assets, their cross-border flows surpassed the latter in 2022 and continue to expand. Cross-border payments using stablecoins are particularly important in emerging markets and developing economies, especially in Africa, the Middle East, Latin America, and the Caribbean, where their usage intensity relative to GDP is higher. Overall, stablecoin funds primarily flow from North America to other regions, reflecting both their role in cross-border payments and their demand as a store of value. This pattern contrasts sharply with the traditional SWIFT cross-border payment system, which is mainly used for transactions between developed economies. The future demand for stablecoins depends on multiple factors, the most crucial being the international attractiveness of their pricing currency (especially the US dollar) and the clarity of their legal and regulatory framework. The US dollar's dominance in global trade, reserves, finance, and payments provides a solid foundation for the continued expansion of dollar-denominated stablecoins; in economies with high inflation or unstable currencies, stablecoins may also be seen as hedging tools. In the future, the use cases for stablecoins may expand from crypto transactions and cross-border payments to the settlement of tokenized financial assets and domestic retail payments, but this largely depends on the integration of payment infrastructure, regulatory safeguards, and user confidence. Different institutions have widely varying forecasts for the stablecoin market size in 2030, indicating significant potential but also considerable uncertainty.

Potential Benefits

First, a major potential benefit of stablecoins lies in improving payment efficiency and reducing costs, especially in the area of cross-border payments and remittances. By providing a shared, immutable ledger through blockchain, stablecoins help reduce the costs and time delays caused by repeated verification, reconciliation, and multiple intermediaries in traditional payment systems, thereby speeding up settlement.

Risks and Systemic Impacts

While stablecoins are not yet widely used in key financial functions of the real economy, such as large-scale retail payments, their adoption is accelerating and could impact several policy objectives, including macro-financial stability, the efficiency of the financial system, financial integrity, and legal certainty. Some risks, such as currency substitution and capital flow volatility, are particularly prominent in emerging markets and developing economies. The systemic risks posed by stablecoins depend heavily on the scale of their adoption and their interconnectedness with the traditional financial system; even with the gradual development of existing regulatory frameworks, these risks may become more apparent as they scale.

1. Macro-financial Stability

Stablecoins face value volatility stemming from reserve asset market risk, liquidity risk, and credit risk, and are also affected by operational and governance deficiencies.

When stablecoins are considered "money-like", their price deviation from the pegged value may weaken the singularity of the currency. During periods of stress, stablecoins may exhibit bank-like behavior, especially if issuers do not offer unconditional redemption rights to all holders. The lack of clear bankruptcy resolution rules and uncertainty regarding the disposal of reserve assets may exacerbate panic selling and force issuers to liquidate reserve assets through "fire sales", thereby further impacting the value of stablecoins. 2. Impairment of Reserve Asset Market Function

(1) Bank Disintermediation and Interconnection of the Financial System

Stablecoins may, to some extent, replace bank deposits, increase banks' liability costs, and affect credit supply. The specific impact depends on whether stablecoins provide indirect benefits, banks' competitive response, and the storage structure of reserve assets. At the same time, the two-way risk exposure between banks and stablecoin issuers may amplify systemic risks: on the one hand, issuers may concentrate deposits in a few banks; on the other hand, pressure on bank balance sheets may also be transmitted back to the stablecoin system. As banks and other financial institutions become more deeply involved in the stablecoin ecosystem in areas such as payment, custody, and investment, the channels for risk contagion within the financial system may further expand.

(2) Currency Substitution and Capital Flow Reshaping

The widespread use of stablecoins may weaken a country's monetary sovereignty, especially in economies with high inflation, weak institutions, or insufficient local currency credit. Stablecoins denominated in foreign currencies have characteristics such as 24/7 operation, cross-border transferability, and low cost, which may accelerate the substitution of local currencies and weaken the transmission of monetary policy and seigniorage revenue. At the same time, by reducing cross-border transaction frictions, stablecoins may change capital flow patterns, amplify capital flows and exchange rate fluctuations in some cases, and may be used to circumvent capital flow management measures, increasing the difficulty of policy implementation. Figure 4: Relationship between Stablecoin Holding and Deposits 3. Security, Financial Integrity, and Legal Certainty Stablecoins face risks at the operational level, including technical failures, cybersecurity, governance inefficiencies, and smart contract vulnerabilities. Furthermore, the irreversibility of blockchain transactions increases the difficulty of error correction. Regarding financial integrity, insufficient regulation could lead to the use of stablecoins for money laundering, terrorist financing, sanctions evasion, and other illegal activities. Their anonymity and cross-border nature further complicate law enforcement. From a legal perspective, the legal attributes of stablecoins are still unclear. They may be classified as different asset classes under private law and financial law, leading to uncertainty regarding holder rights, bankruptcy proceedings, and cross-border claims arrangements. With the expansion of new technologies and cross-border applications, these legal uncertainties may further amplify systemic risks. The International Monetary Fund (IMF) collaborates closely with international standard-setting bodies such as the Financial Stability Board (FSB), the International Organization of Securities Commissions (IOSCO), the Basel Committee on Banking Supervision (BCBS), the Financial Action Task Force (FATF), and the Committee on Payments and Market Infrastructures (CPMI) to promote systemic policy responses to stablecoin risks. Two key documents released by the IMF in 2023 provided countries with a comprehensive policy framework covering macro-financial stability, financial regulation, and legal issues. These documents build upon the FSB's advanced regulatory recommendations on global stablecoin arrangements and integrate existing principles from multilateral standard-setting bodies. The IMF recommends that countries prioritize mitigating macro-financial risks associated with stablecoins, particularly maintaining monetary sovereignty, strengthening monetary policy frameworks, and preventing excessive capital flow volatility. The documents explicitly state that crypto-assets should not be granted fiat or official currency status, and caution should be exercised regarding the potential for stablecoins to undermine the effectiveness of capital flow management measures (CFMs). The FSB's global stablecoin regulatory recommendations emphasize strict prudential supervision of stablecoin issuers, including requirements for high-quality, highly liquid, and unburdened reserve assets, and attention to dimensions such as duration, credit risk, liquidity, and concentration. The documents note that there are currently no unified international guidelines explicitly addressing whether systemic stablecoins can be included in central bank financial safety nets. If the size of stablecoins becomes large enough to influence market operations, central banks may be forced to intervene in extreme circumstances to prevent the dumping of reserve assets and the threat to financial stability. However, providing central bank liquidity to under-regulated stablecoin issuers could also create moral hazard. The FATF has incorporated stablecoins into its Anti-Money Laundering, Counter-Terrorist Financing, and Non-Proliferation Financing (AML/CFT/CPF) standards framework, requiring relevant entities to fulfill obligations regarding customer due diligence, transaction monitoring, and suspicious transaction reporting. Stablecoins have developed rapidly in recent years. Although they still account for a small percentage of the overall size of crypto assets, they already possess both potential benefits and significant risks, involving macro-financial stability, financial integrity, legal certainty, and security and efficiency. To this end, the IMF and FSB jointly developed global policy recommendations and regulatory standards covering stablecoins, incorporating them into a broader policy framework for crypto-assets. This framework addresses macroeconomic issues such as monetary policy, fiscal policy, and capital flow management, providing systematic policy guidance for regulatory authorities in various countries. While progress has been made in implementing regulatory frameworks, global regulation remains highly fragmented. The EU's MiCA leads in comprehensiveness, while the US, Japan, and the UK have adopted different approaches, differentiating their regulations on issuers, reserve requirements, custody, and payment functions. The cross-border nature of stablecoins further complicates regulatory coordination; different practices may weaken regulatory effectiveness and induce regulatory arbitrage. Foreign currency-denominated stablecoins in cross-border environments may also trigger currency substitution and weaken monetary sovereignty. Therefore, in addition to stablecoin regulation itself, sound macroeconomic policies, a robust institutional foundation, and international coordination remain crucial for managing risks. Finally, the development of stablecoins may accelerate the adoption of distributed ledger technology in the financial system, driving changes in asset tokenization, clearing and settlement, and payment infrastructure. The IMF and BIS are actively exploring frameworks for blockchain applications in the public and private sectors and continuously monitoring the impact of stablecoins on the international monetary system. Through analysis, research, policy recommendations, capacity building, and international coordination, the IMF supports member countries in striking a balance between innovation and risk management, and promotes a more consistent and effective global regulatory environment.

Brian

Brian