Author: Tanay Ved Source: Coin Metrics Translation: Shan Ouba, Jinse Finance

Key Takeaways

As long-term holders gradually reduce their holdings and new participants take over the supply, the supply turnover rate of Bitcoin is gradually slowing down, and the ownership transition is becoming more stable.

Since the beginning of 2024, spot Bitcoin ETFs and digital asset pool strategies have absorbed approximately 57% of the incremental supply from short-term holders, currently accounting for nearly a quarter of all active Bitcoin over the past year.

The continued stabilization of actual volatility indicates a maturing market structure, characterized by institutional demand dominance and longer cycle rhythms.

Introduction

After hitting an all-time high earlier this year, Bitcoin has largely been in a consolidation phase, briefly dipping below the $100,000 mark for the first time since June.

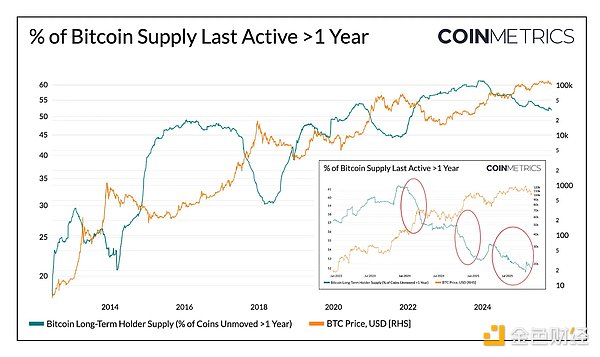

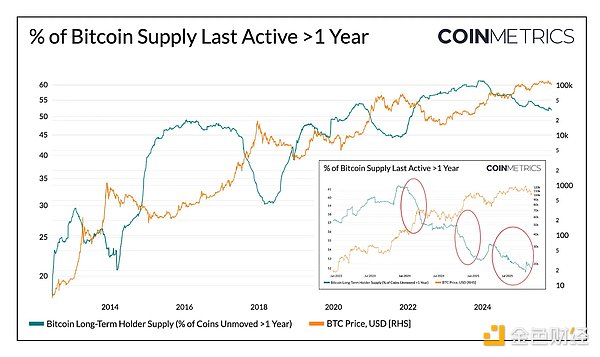

Macroeconomic headwinds, a weak stock market, and one of the largest liquidations in cryptocurrency history have collectively dampened market sentiment and slowed capital inflows, raising questions about the sustainability of the Bitcoin bull market. Furthermore, growing concerns about large holders (i.e., “early whales”) transferring or selling their early holdings are putting pressure on Bitcoin and the entire cryptocurrency market – with the total market capitalization approaching $3.6 trillion after the recent decline. Beyond the surface phenomena, Bitcoin’s on-chain data provides crucial context. This article will explore how changes in Bitcoin holder behavior and core demand drivers influence market sentiment and define the rhythm of this cycle. By analyzing changes in active supply and demand channels, we will investigate whether recent market volatility reflects profit-taking at the end of the cycle or a structural shift in the foundation of Bitcoin ownership. Supply Distribution and Institutional Acquisition Active Supply First, let’s look at Bitcoin’s active supply – divided according to the length of time since the token’s last on-chain movement, it directly reflects the activity of tokens held for different durations. This metric helps us understand the distribution of supply between inactive (dormant) tokens and recently moved tokens (also known as “holding waves”). The chart below separately lists the percentage of Bitcoin supply that hasn't moved in over a year, which can serve as a proxy for long-term holder (LTH) supply. Historically, this percentage increases during bear markets (tokens concentrate in long-term holders) and decreases during bull markets as long-term holders begin transferring tokens, realizing profits, and reducing their holdings when the market strengthens.

(Source: Coin Metrics Network Data Pro)

Currently, of the 19.94 million circulating Bitcoins, approximately 52% of the tokens have not moved for over a year, down from approximately 61% at the beginning of 2024. Both the increases during the bear market and the decreases during the bull market have noticeably moderated—phased reductions occurred in Q1 2024, Q3 2024, and recently in 2025. This indicates that long-term holders are reducing their holdings in a more sustained manner, reflecting a lengthening ownership transition cycle.

ETFs and DAT as Demand Drivers

In contrast, since 2024, the supply from short-term holders (tokens active over the past year) has steadily increased as previously dormant tokens re-entered circulation. Simultaneously, the launch of spot Bitcoin ETFs and the accelerated accumulation of Digital Asset Collections (DATs) have created new channels of sustained demand, absorbing the released supply.

As of November 2025, the number of active Bitcoins over the past year was 7.83 million, an increase of approximately 34% from 5.86 million at the beginning of 2024, primarily due to the re-entry of dormant tokens into the market. During the same period, Treasury holdings in spot Bitcoin ETFs and strategy products increased from approximately 600,000 to 1.9 million, absorbing nearly 57% of the net increase in supply from short-term holders. Currently, these instruments collectively account for approximately 23% of all short-term holder supply.

Despite a slowdown in inflows in recent weeks, the overall trend shows that supply is gradually shifting towards more stable, long-term holding channels – a unique characteristic of the market structure in this cycle. (Source: Coin Metrics Network Data Pro & Bitbo Treasuries. Note: ETF supply excludes Fidelity FBTC, DAT supply includes strategy products.) Short-Term and Long-Term Holder Behavior Actual profit trends further confirm the easing pattern of Bitcoin supply dynamics. The Spent Output Profit Ratio (SOPR) measures whether holders sell tokens at a profit or loss, helping us observe the behavioral differences among different holder groups during market cycles. In the past, long-term and short-term holders tended to realize profits or incur losses during periods of sharp, synchronized volatility. Recently, however, this relationship has diverged. Long-term holders' SOPR remains slightly above 1, indicating they are steadily realizing profits and moderately reducing their holdings when the market strengthens. (Source: Coin Metrics Network Data Pro) Short-term holders' SOPR hovers near the break-even point, which explains the recent cautious market sentiment – many short-term holders' positions are close to their cost price. The divergence in behavior between the two types of holders reflects a more moderate market phase: institutional demand has absorbed the released supply, rather than a repeat of past sharp rises and falls. If the SOPR for short-term holders continues to break through 1, it may indicate that market momentum will strengthen. While a full-blown correction will still compress the profitability of all holder groups, the overall pattern shows a more balanced market structure, with supply turnover and profit realization gradually unfolding, and the cycle rhythm of Bitcoin being lengthened. This structural easing is also reflected in the volatility trend of Bitcoin—its volatility has shown a long-term downward trend. Bitcoin's 30-day, 60-day, 180-day, and 360-day realized volatility has stabilized at around 45%-50%, whereas in the past its volatility was much more volatile, leading to large market fluctuations. Now, Bitcoin's volatility characteristics are increasingly similar to those of large-cap tech stocks, indicating its increased maturity as an asset, reflecting improved liquidity and a more institutionalized investor base. For asset allocators, declining volatility could enhance Bitcoin's appeal in portfolios, especially given its dynamic correlation with macro assets like stocks and gold. (Source: Coin Metrics Market Data Pro) Conclusion: Bitcoin's on-chain trends indicate that this cycle is unfolding in a more moderate and prolonged phase, without the frenzied rallies of previous bull markets. Supply reductions are occurring in batches, with the majority being absorbed by more stable demand channels (ETFs, DAT, and broader institutional holdings). This shift signifies a maturing market structure, with decreased volatility and turnover, and a longer cycle. Despite this, market momentum still depends on the sustainability of demand. Factors such as flattening ETF inflows, pressure on some DAT tokens, recent market-wide liquidations, and short-term holders' SOPR nearing the break-even point all highlight that the market is in a correction phase. A continued increase in long-term holder supply (tokens that haven't moved in over a year), SOPR breaking through 1, and renewed inflows into spot Bitcoin ETFs and stablecoins could all be key signals of a market recovery. Looking ahead, easing macroeconomic uncertainty, improved liquidity, and regulatory progress related to market structure could help accelerate capital inflows again and extend the bull market cycle. Despite cooling market sentiment, the recent deleveraging adjustment, supported by expanded institutional channels and the widespread adoption of on-chain infrastructure, has resulted in a healthier market foundation.

Weatherly

Weatherly