Author: Qorban Ferrell, Messari Researcher; Translator: 0xjs@Golden Finance

The rotation of cryptocurrency is ruthless, but those who catch it have the power to reshape their destiny. A protocol heralds the arrival of the next major shift - the product of the fusion of DeFAI and AI agents.

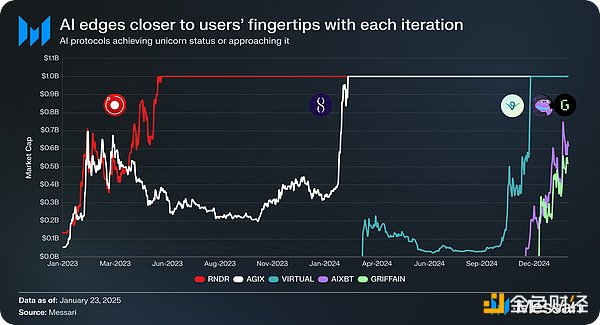

The development of AI super trading has been tortuous and non-linear. But each iteration drives the market towards a common goal: bringing AI directly to the fingertips of end users.

Following NVIDIA's historic rise and the launch of ChatGPT in 2022, market participants quickly began to build and invest in crypto counterparts:

AI trading initially focused on raw computing and resources. For example, the market capitalization of Render (RNDR), the first decentralized GPU rendering network, reached $151 million in December 2022. Just one year later, it reached $2 billion - a 13-fold increase and continuing to climb.

After a break in the crypto AI space, a new wave of AI projects emerged in the second half of 2024. The pivotal moment was the launch of GOAT, an AI agent on Twitter that was trained in the dark corners of the internet. It went viral as an ideal consumer-facing tool, posting and replying to tweets 24/7.

Today, the crypto AI space is evolving into two distinct sub-fields.

The first field includes agents like AIXBT that post research content, answer questions, and even show personality through humorous quips.

The second field is known as DeFAI. DeFAI projects such as Griffain and ANON enable users to enter natural language prompts and execute them on-chain as DeFi actions, effectively acting as an AI chat interface for blockchains.

I believe these two areas will converge into personal AI trading agents. These trading agents will combine the research capabilities of AIXBT and the trading capabilities of DeFAI, and more importantly, they will be tailored to individual needs - such as risk tolerance and industry interests.

This convergence is encapsulated in a framework called Waveform. Waveform is building a platformwhere users can do the following:

Autonomous trading - Utilize the Waveform trading agent framework to execute real-time decisions driven by data insights.

Personalized agents - Develop customized trading agents to fit specific strategies, preferences, and signal requirements.

Integrate social signals - Integrate information from platforms such as Twitter and Telegram to quickly respond to market movements.

Waveform is similar to Virtuals Protocol, but its agents have built-in trading capabilities and can process personalized social information immediately.

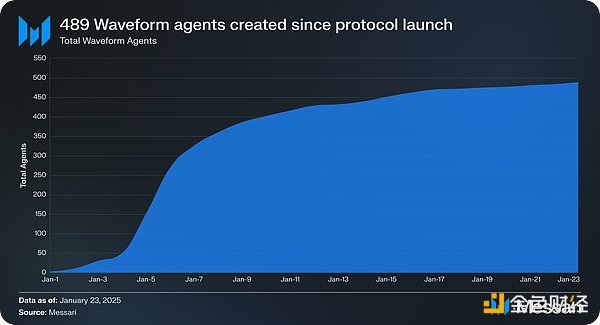

Since launch, Waveform users have created 489 trading agents. While the project is still in beta and most agents are in paper trading mode, early adopters have been given access to on-chain trading. Just yesterday, an agent with on-chain trading capabilities made $4,400 by buying $SLICE early.

Kikyo

Kikyo

Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Brian

Brian Hui Xin

Hui Xin Alex

Alex Kikyo

Kikyo Alex

Alex Brian

Brian Alex

Alex