Abstract

On April 3, the United States introduced reciprocal tariffs with a base rate of 10%.Among major economies, Vietnam 46%, China 34%, Taiwan Province of China 32%, Switzerland 31%, South Africa 30%, India 26%, South Korea 25%, Japan 24%, the European Union 20%, the United Kingdom 10%, Brazil 10%, and Australia 10%. This time, the IEEPA of 1977 was still used to impose tariffs, and a national emergency was declared to impose tariffs.

►Increased uncertainty in the United States may bring tariff variables

The Federal Reserve is facing a stagflationary environment, and there is more uncertainty in interest rate decisions.On the surface, the price increase caused by tariffs is a one-time shock, but the accompanying changes in corporate pricing behavior may affect inflation expectations and have a lasting impact on subsequent inflation trends. Recent tariffs have led to rising expectations of recession, and the market has begun to price in four interest rate cuts this year. However, in an environment of rising inflation + slowing economic growth, coupled with pressure from the US government, the uncertainty in the Federal Reserve's decision-making is high.

In the short term, the United States may announce the postponement of tariffs of more than 10% on some economies when the tariffs are implemented on April 9 to appease the market. In the medium term, in the next 1-2 quarters, the impact of tariffs on the US economy will become apparent, which may force Trump to return to common sense and expand the exemption list to reduce tariff rates.

►Estimation of the impact on China under the 54% tariff scenario

The tariff rate on US imports from China is called 54% by US Treasury Secretary Bensonte, which is the equivalent tariff rate of 34% plus the 20% levied in February and March this year. Referring to the fact that my country's exports to the United States account for about 14.5% (20% in 2018), the short-term drag effect (12 months) on overall exports is about 5 percentage points, and the medium-term effect is about 7 percentage points. For GDP, only the direct effect is considered. If exports fall by 5 percentage points, the direct drag on current price GDP is about 0.9%. If the impact of the input-output table on upstream and downstream is considered, it may reach more than 1 percentage point.

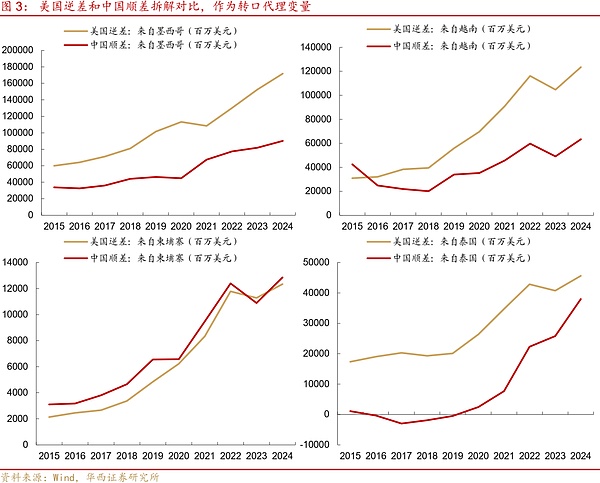

The United States' imposition of tariffs on major trading partners may also affect re-export trade. Based on the changes in trade volume in 2023-2024 relative to 2015-2017, it is estimated that re-export trade will be about 360 billion yuan, equivalent to 1.4% of the total export volume and about 0.3% of GDP.

►Tariffs will affect domestic asset pricing in two stages

After the implementation of US tariffs, the impact on stocks and bonds can be divided into two stages: the first stage is the impact of tariffs on market sentiment, the market risk appetite is reduced, and bonds perform relatively well; the second stage is internal policy hedging, and risk appetite may rise again, which is beneficial to risky assets. In terms of domestic policies, loose money may take the lead. Every round of stable growth policy is implemented with loose money first.

Risk warning: Domestic fiscal and monetary policies exceed expectations. US tariffs and other policies exceed expectations.

On April 3, the United States introduced reciprocal tariffs with a base rate of 10%. Among major economies, Vietnam 46%, China 34%, Taiwan Province of China 32%, Switzerland 31%, South Africa 30%, India 26%, South Korea 25%, Japan 24%, the European Union 20%, the United Kingdom 10%, Brazil 10%, and Australia 10%. This time, the IEEPA of 1977 was still used to impose tariffs, and a national emergency was declared to impose tariffs. How do you view its impact?

The United States itself has increased uncertainty, which may bring tariff changes

Tariffs will push up US inflation. Assuming that the US import volume remains unchanged, the weighted tariff rate is 20%, and the tariff rate in 2024 is only about 2.4%, the reference import volume accounts for about 16.5% of US consumption. If the 20% tariff is borne entirely by the importer, the pull effect on price increases is about 2.9 percentage points. If the importer and exporter each bear half, the price increase will be about 1.4 percentage points. Considering that some imported products such as clothing, shoes, toys, etc. have low profit margins, most tariffs will be borne by consumers. Moreover, the above estimates do not take into account the second-order effects, such as the possibility that domestic US companies may take the opportunity to increase prices, which will actually have a greater impact on inflation. Tariffs bring income distribution effects. Trump hopes that tariffs will bring in additional fiscal revenue to offset the revenue and expenditure gap caused by tax cuts. Imposing a 10-20% tariff is equivalent to transferring part of consumers' income to the government (if all is borne by consumers, the corresponding transfer is 320-640 billion US dollars, accounting for 1.5-3.0% of residents' disposable income), which means that residents' disposable income will decline, leading to a decline in consumption. Since tariffs are regressive (the higher the income, the lower the tax burden as a proportion of income), and the US tax cuts are mainly aimed at companies and wealthy groups, this wealth transfer effect will aggravate the gap between the rich and the poor in the United States and further weaken the growth prospects of consumption. Trump hopes to drive the return of manufacturing by imposing tariffs and create jobs for middle- and low-income groups. If these jobs have higher salaries, it seems that they can offset the impact of tariffs. However, the imposition of tariffs is a fast variable, while the return of manufacturing is a slow variable, and there is uncertainty as to whether it can return. Therefore, the short-term impact of the imposition of tariffs on the United States is a decline in residents' disposable income, slowing consumption, and thus slowing growth.

The Federal Reserve is facing a stagflationary environment, and there is more uncertainty in interest rate decisions. On the surface, the price increase caused by tariffs is a one-time shock, but the accompanying changes in corporate pricing behavior may affect inflation expectations and have a lasting impact on subsequent inflation trends. Recent tariffs have led to rising expectations of a recession, and the market has begun to price in four interest rate cuts this year. However, in an environment of rising inflation + slowing economic growth, and facing pressure from the US government, the uncertainty in the Federal Reserve's interest rate decision is high.

1.1 Short-term deduction: or postponement of more than 10% tariffs on some economies

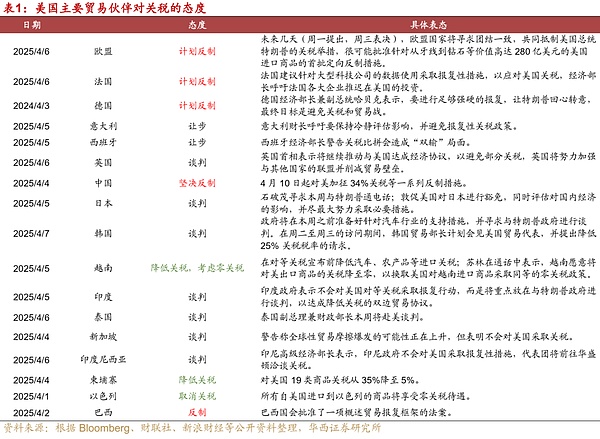

Tariff short-term deduction: the United States may announce the postponement of more than 10% tariffs on some economies when the tariffs are implemented on April 9 to appease the market. After April 9, the key lies in the EU's negotiations and countermeasures.

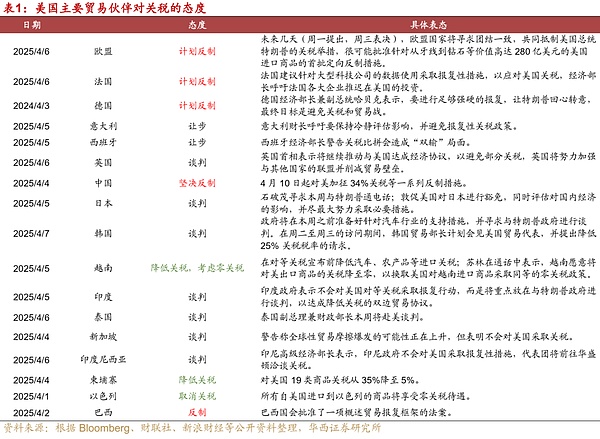

Specifically,

1) Vietnam, India, Thailand, Singapore and others tried to reach an agreement with the United States by reducing tariffs and negotiating. Referring to the US tariff negotiations against Canada and Mexico, the tariffs on these economies may be postponed for 1-2 months.

2) In addition to my country's resolute countermeasures against the United States, the European Union, Brazil and other countries are also considering countermeasures against the United States. The European Union has internal differences on whether to retaliate. Germany and France have expressed relatively tough positions, while Italy and Spain tend to make concessions. The EU's countermeasures to be implemented are mainly aimed at the previous steel, aluminum and automobile tariffs, and the countermeasures of the 20% equivalent tariff have not yet been clarified. For this part of the tariff, whether the EU negotiates or retaliates has a greater impact on overseas market sentiment. In addition, the Brazilian Congress approved a retaliation framework bill.

Even if the tariff rate is lowered, the United States may retain the 10% base tariff and tariffs on specific products such as steel, aluminum and automobiles in the short term to raise funds for subsequent tax cuts. Most of the high tariffs are used as bargaining chips and may be canceled or partially canceled through negotiations. China and the United States may also conduct trade negotiations, but the United States needs to recognize the negative impact of tariffs and show sincerity.

1.2 Mid-term deduction: Return to common sense

Three estimates of the impact on China under the 54% tariff scenario

2.1 The short- and medium-term impact of tariffs on domestic exports

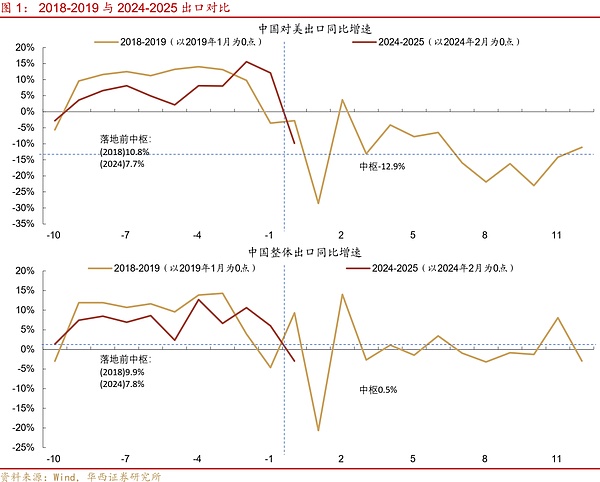

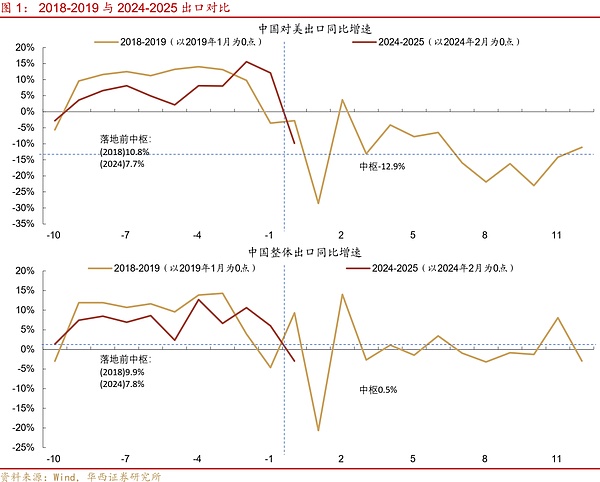

The US Treasury Secretary Bensonte said the tax rate on US imports from China is 54%, which is the equivalent rate of 34% plus the 20% levied in February and March this year, but not the tariffs imposed in the 2008-2009 Section 301 investigation (the weighted rate is about 12%). How to evaluate the impact of this tariff, the export data from 2018 to 2019 provides us with a perspective.

After the tariffs were imposed in 2018-2019, around January 2019, US imports from China fell from 10.8% in 2018 to -13.6% in 2019, a short-term decline of about 24 percentage points (12 months after the main tariffs were implemented). However, not all goods were subject to tariffs at that time. Therefore, when we break down the tariff rates of different lists, there are mainly three categories for reference for short-term effects: 1) A 25% tariff on a list of US$34 billion worth of goods took effect on July 7, 2018, and the rate of decrease in 2019 compared with 2018 was 24.9%; 2) A 25% tariff on a list of US$16 billion worth of goods took effect on August 23, 2018, and the rate of decrease in 2019 compared with 2018 was 40.5%; 3) The 10% tariff on the $200 billion goods catalogue took effect on September 24, 2018, and the tariff rate was further increased to 25% on May 10, 2019, with a decrease of 33.8% in 2019 compared with 2018; The medium-term effect mainly refers to the change in the average import volume in 2023-2024 compared with 2018. The decreases in the $34 billion, $16 billion, and $200 billion goods catalogues were 21.1%, 42.9%, and 52.3%, respectively. In addition to these three catalogues, the United States began to impose a 15% tariff on part of the $300 billion goods (about $100 billion) from September 1, 2019, and the tariff rate was reduced to 7.5% on January 22, 2020. The average import value of this part in 2023-2024 will decrease by 24.6% compared with 2018. Compared with the untaxed catalog, the average import value in 2023-2024 will increase by about 7.9% compared with 2018.

To summarize the last round of tariffs,the corresponding categories brought about by the 25% tariff increase in 2019 relative to 2018 fell by 24.9%-40.5%, with a weighted decline of about 33.1%. The decline in 2023-24 relative to 2018 is between 21.1% and 52.3%, with a weighted decline of about 47.5%. The subsequent 7.5% tariff increase also saw a decline of 24.6%, which shows that the impact of tariffs on import value is not linear.

In this round, the weighted tariff rate for US imports from China will be about 12.4% in 2024, and the tariff rate will be raised to 54%, corresponding to a rise of nearly 42%. Its impact may be greater than the impact of the 25% tariff imposed in 2018-2019. The data from 2018-2019 can be used as a reference value for the estimated lower limit. The short-term decline in exports to the US (12 months) may be around 33%. Affected by the "export rush", the first six months may be slightly larger than this (4-6 percentage points in 2018-19 data); and the medium-term impact is about 48%. Referring to the fact that my country's exports to the US account for about 14.5% (20% in 2018), the short-term drag effect on overall exports (12 months) is about 5 percentage points, and the medium-term effect is about 7 percentage points. For 2025, the short-term effect can be used as a reference. The premise of the medium-term effect is that global trade frictions will continue for several years, which is a scenario with a relatively low probability.

For GDP, only the direct effect is considered. For example, if exports fall by 5 percentage points, the direct drag on current price GDP is about 0.9%. If the impact of the input-output table on upstream and downstream is considered, it may reach more than 1 percentage point. It is worth noting that the decline in export growth in 2019 was about 9 percentage points, and the drag on exports to the United States can only explain about half of it. The rest is also affected by the superposition of the downward trend of the global trade cycle. For this year, subsequent global trade may also face downside risks due to the imposition of tariffs by the United States.

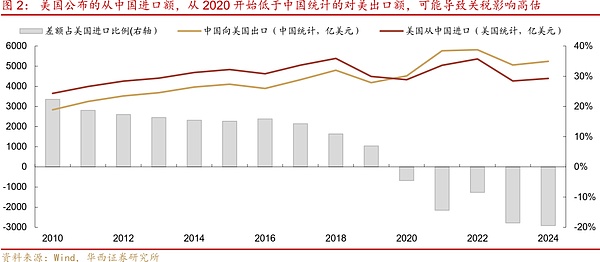

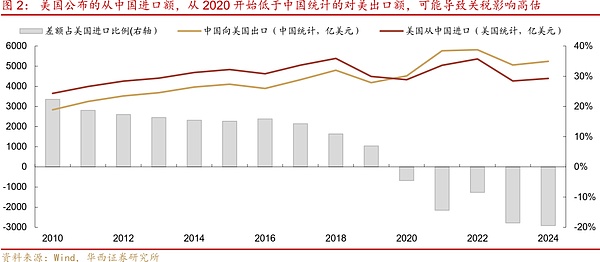

However, the underreporting of import prices by US importers may also make the above estimates overestimated. If we compare the export volume to the United States as reported by China Customs and the import volume from China as reported by the United States Customs, we can find that before 2020, the former was lower than the latter, mainly because the importing countries had to trace back to the final source and include some re-exports in the statistics. But since 2020, the former has been higher than the latter, with an average of 15% higher in 2021-2024. This abnormal performance indicates that US importers may be suppressing import customs declaration prices to pay less tariffs. This makes our aforementioned estimates of a short-term decline of 33% and a medium-term decline of 48%, which may be overestimated by the impact of lowering import quotations. Therefore, the short-term drag of tariffs on exports may be less than 5%, and perhaps the lower limit is only about 3%, and the direct drag effect on current price GDP may be around 0.5%.

2.2 Possible impact of tariffs on re-exports

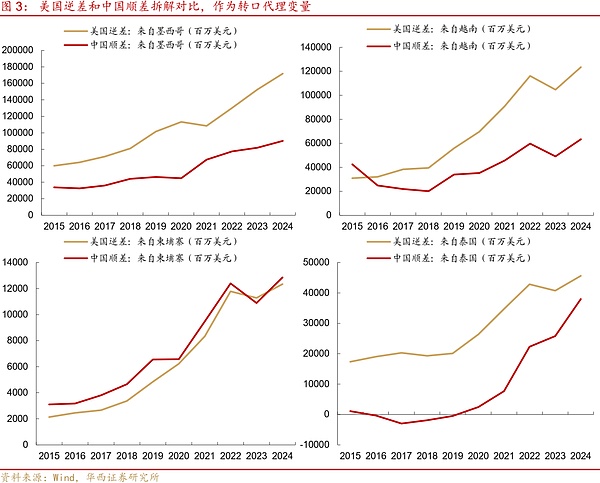

The United States' imposition of tariffs on major trading partners may also affect re-export trade. For re-export data, due to the lack of effective direct tracking methods, it is difficult to estimate. We measure it indirectly by decomposing the US deficit and China's surplus. Calculate the average US deficit in 2023-2024 by source country (major trading partners), relative to the change in 2015-2017. Similarly, calculate the average China's surplus in 2023-2024 by source country, relative to the change in 2015-2017.

Specifically, among the deficits counted by the United States, the surplus from China decreased by 20.8%, a decrease of US$75.7 billion per year, and the surplus from the European Union, Mexico, Vietnam, South Korea, Canada, India, Thailand, Cambodia, etc. increased by US$365.1 billion per year. China's surplus with these economies is also growing rapidly, with an increase of about US$249.5 billion per year. The increase in China's surplus is equivalent to 68% of the US deficit from these countries. Of course, this does not mean that China is re-exporting to the United States through these economies. It is only used as a reference value for re-export estimation. Assuming that about 20% of the $249.5 billion is re-export (the rest is mainly investment by overseas enterprises, etc.), the corresponding number of affected re-exports is $49.9 billion, about 360 billion yuan, equivalent to 1.4% of the total export volume, or about 0.3% of GDP. It is worth noting that the United States may maintain a 10% base tariff on all imports (or expand the exemption list on this basis). In this scenario, China's finished manufacturing products are still a good and cheap choice for American consumers after re-export or export.

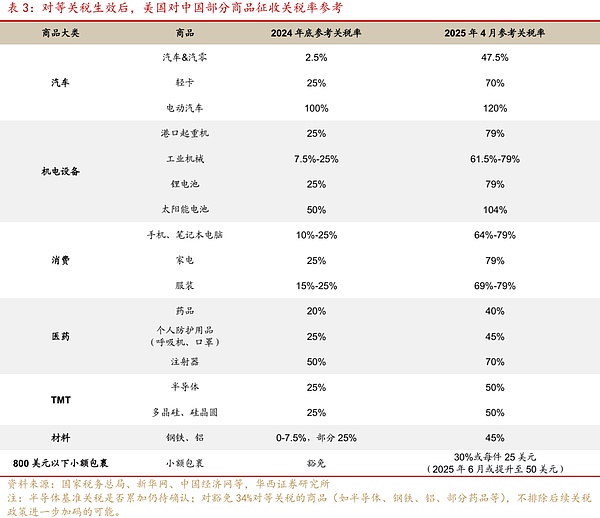

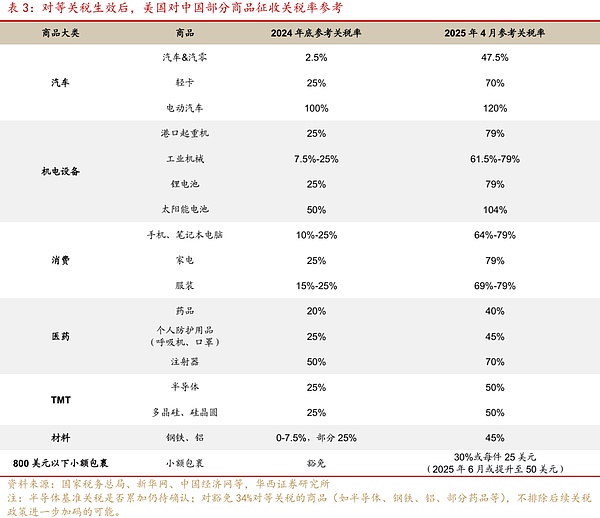

2.3 Structural impact of tariffs on the industry

After the imposition of tariffs, the export of consumer goods (such as consumer electronics and home appliances) and electromechanical equipment (such as cranes, industrial machinery, solar cells, etc.) may be impacted. On the one hand, these commodities are key export commodities of my country. Judging from the export situation from January to February 2025, the export value of electromechanical products (including mobile phones, home appliances, etc.) reached 323.7 billion US dollars, accounting for nearly 60% of the exports from January to February, and the scope of impact in the trade friction since 2025 is relatively large. On the other hand, most of these goods were subject to additional tariffs of 10%, 10% and 34% in February, March and April, respectively, which are the directions subject to more tariffs in this round of trade frictions. In addition, the tariff on small packages below $800 has been increased from exemption to 30% or $25 per piece, and the fixed tariff may even be increased to $50 per piece in June, which may also have an impact on consumer goods such as cross-border e-commerce, toys, and electronic products.

For the automotive industry, the direct impact of the additional 25% tariff imposed by the United States may be limited. In fact, the United States is not a major exporter of automobiles in my country. According to the data from the Automobile Mobility Association, the top five countries to which my country's complete vehicle exports will be in 2024 are Russia, Mexico, the United Arab Emirates, Belgium and Saudi Arabia, while the United States is not among the top ten. For the auto parts industry, Chinese parts factories in Mexico can meet the duty-free conditions of the USMCA by increasing the proportion of US supporting value to 75%, and may also set up factories in the United States to reduce the impact of tariffs.

In addition, it is worth noting thatsome semiconductors, steel, pharmaceuticals and other commodities are exempted from reciprocal tariffs, which means that Trump may impose additional tariffs on these industries through other means, and the potential impact may still exist.

Tariffs have impacted domestic asset pricing in two stages

After the implementation of US tariffs, the impact on stocks and bonds can be divided into two stages: the first stage is the impact of tariffs on market sentiment, the market risk appetite is reduced, and bonds perform relatively well. The overseas macro narrative switches to "the end of the free trade era." But whether it ends is a posteriori. At present, we can only say that US President Trump's tariff policy has brought an impact on free trade. The US government's tariff policy violates basic economic laws, and the "backlash" effect caused will appear in the next few quarters. When the American people realize that tariffs are a "plunder" of their income, the probability of the Republican Party's failure in the 2026 mid-term congressional elections will increase significantly. This means that the policies in the second half of Trump's term will be difficult to sustain, and there may not be enough time to complete the package of the "Mar-a-Lago Agreement". Therefore, the grand narrative of "the end of the free trade era" is a judgment rather than logic. Risk aversion may have a short-term impact on global market sentiment, but it will not dominate the medium-term market trend. For the domestic market, whether the United States will continue to impose tariffs or turn to negotiations will have a greater impact on risk appetite. In the short term, the former may prevail, but there is a possibility of switching to the latter in May and June.

The second stage is internal policy hedging. In the past two days, bonds have been strong and stocks have been weak. The emotional impact of the first stage is being priced by the market. If the domestic hedging policy is implemented in the second stage, risk appetite may rise again, which is beneficial to risky assets. In terms of domestic policy hedging, loose money may take the lead. Every round of stabilizing growth policies is implemented first. Considering that the reserve requirement ratio cut is relatively more flexible, it can not only supplement long-term liquidity for banks, but also boost expectations. When the United States imposed the first round of tariffs in 2018-2019, the central bank also cut the reserve requirement ratio in April 2018. In addition, the central bank may lower structural tools such as the re-lending rate to provide targeted support to the economy. The conditions for a comprehensive interest rate cut are relatively high, and it may take 1-2 months of data to evaluate.

In terms of finance, it may mainly focus on accelerating the implementation of existing policies, such as accelerating the issuance of special treasury bonds and local government bonds. Policies such as birth subsidies mentioned during the two sessions may also be accelerated. The Politburo meeting in late April may further study the reserve increment policy to boost domestic demand and offset the downward trend in external demand.

Alex

Alex