1. Cryptocurrency Circle Earthquake and USDe DepeggingOn October 11, 2025, the cryptocurrency market once again experienced severe fluctuations. It was reported that the entire crypto market value evaporated significantly, and altcoins were particularly hit. During this crash, USDe, the world's third-largest stablecoin (a "yield-based stablecoin" issued by Ethena Labs), was severely depegged, with its price falling to approximately US$0.65 at one point, thus losing its anchoring function as a stablecoin in a short period of time.

II. Risk identification from a legal and regulatory perspective

1. Classification and attributes of stablecoins

The original design intention of stablecoins is to maintain a stable peg to a certain fiat currency. In essence, they are tokens anchored to the value of the US dollar or other assets, but different design paths bring about completely different legal attributes.

(

1)Fiat currency-backed (such asUSDT,USDC): A centralized version of trust

This type of stablecoin is issued by an institution, and its reserve assets include cash, short-term government bonds, etc. From a legal perspective, it is closer to electronic money or a payment tool, with relatively clear regulations. Its risks primarily lie in custody and transparency, such as the actual existence of reserves and their immediate redemption.

(2)Crypto-collateralized (such asDAI): A self-consistent model of on-chain credit

users useETH

(3) derivatives and algorithmic (such as left;">USDe

2. The stabilization mechanism of USDe and USDTWhen the market plummeted on October 11, the price of USDT remained at around The price of USDe

fell from USD 1 to around USD 0.65 at one point, almost repeating the “de-dollarization” collapse of Terra/UST in 2022. This is because, in most exchanges and market environments, USDT and USDC, thanks to their scale, liquidity, and market trust, retain strong support during extreme market crashes. Compared to mainstream fiat-reserve stablecoins like USDT and USDC, USDe has a more complex mechanism and relies more heavily on market hedging structures, making it a high-risk target during a major market crash. The comparison of the stabilization mechanisms of USDe and USDT is as follows: The high structural risk of USDe makes it more prone to problems in extreme market conditions. In the USDT model, users give US dollars to Tether, which holds real fiat currency reserves (cash/treasury bonds). Users can redeem them at 1:1, and the peg is stable. In the USDe model, users deposit crypto assets (ETH, etc.) into Ethena contracts. The system hedges against fluctuations by establishing short positions, generates "synthetic dollar exposure", and ultimately issues USDe tokens. In short, USDT has physical reserves, and its stability comes from the "money in the dollar account." Meanwhile, USDe relies on market hedging and derivatives contracts, and its stability comes from the "mathematical balance of hedge positions." Therefore, during extreme market fluctuations, the mathematical model may temporarily fail, while the bank account will not. 3. USDe's decoupling chain

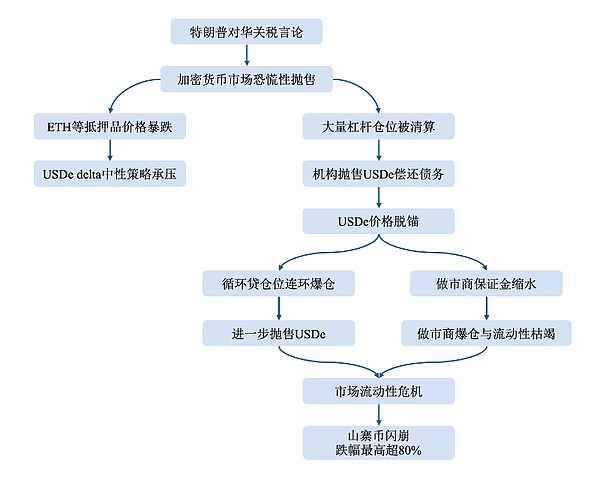

This time, USDe's decoupling was the result of the combined effect of multiple factors, and the chain reaction it triggered also had an impact on the entire market. The transmission path of the USDe de-anchoring event is as follows: There are two main key mechanisms leading to this event:

One is the “Delta neutral hedging” strategy run by USDe - and Unlike stablecoins such as USDT and USDC that rely on fiat currency reserves, USDe is a "synthetic dollar" that uses a "Delta neutral hedging" strategy (that is, building a portfolio of spot long and futures short positions to make its overall net Delta This strategy maintains stability by maintaining a stable price (with a value equal to or close to zero): going long on the spot side (holding spot assets such as ETH) and shorting on the derivatives side (simultaneously shorting an equivalent amount of ETH perpetual swaps on derivatives exchanges). The core profit of this strategy comes from the funding rate in the perpetual swap market. Typically in bull markets, funding rates are positive, meaning long traders need to pay short traders. Due to Ethena's large short position, it can continuously receive this funding rate income from the market and distribute it as profit to USDe holders. However, when the market enters a bear market or an extreme market crash, funding rate risk (perpetual swaps' funding rates turn negative, eroding the protocol's reserve fund and turning the strategy from a money-maker into a cash-burner), counterparty risk, collateral liquidation risk, and bank runs can all trigger major crises and even negative feedback loops. This is exactly what happened to USDe during the market crash on October 11, 2024: deeply negative funding rates hit the strategy's most vulnerable "Achilles' heel."

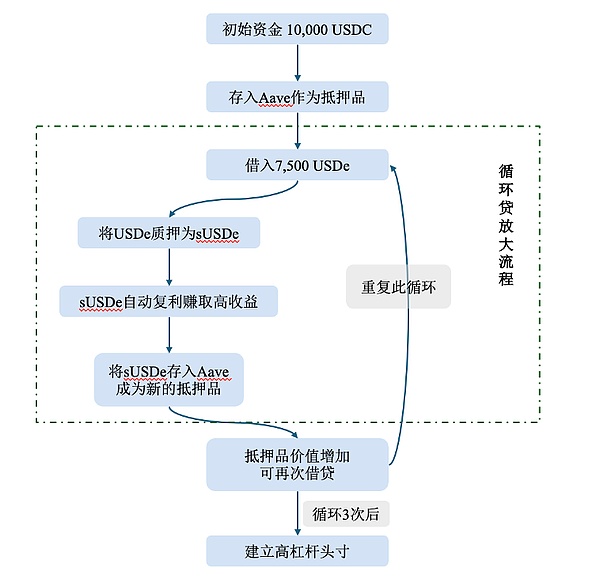

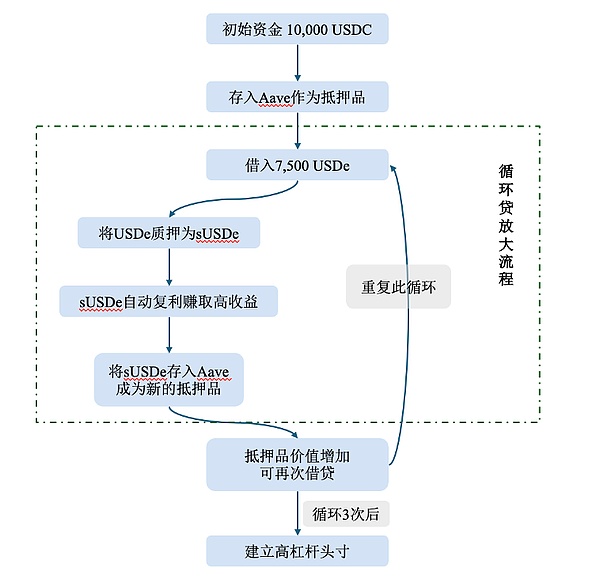

The second is the boost from highly leveraged "revolving loans" - before the incident, a model of obtaining high returns through revolving loans was prevalent. Investors leveraged their principal and returns through repeated mortgages, borrowing, and re-depositingUSDe, with an annualized rate of return even reaching50%.

Example:

Initial capital: 10,000 USDC

Lending agreement:Aave

Number of cycles:3times

Mortgage rate:75%(You can use $100 of collateral to lend $75 of assets)

After the cycle in the above picture, the user finally used $10,000 of principal to establish a USDe/sUSDe risk position with a total value of tens of thousands of dollars. The system's true yield is calculated based on a magnified total asset value, resulting in an astonishing apparent APY (Annual Percentage Yield). This revolving loan model attracted a massive influx of capital, but it also made the entire system extremely leveraged and extremely fragile. The USDe's unpegging not only triggered market panic but also raised a fundamental question: when a complex combination of algorithms and derivatives forms the core of a "stablecoin," who can guarantee its so-called "stability"? This crisis is both a stress test of financial engineering and a realistic examination of the legal boundaries of stablecoins.

III. The Trust Anchor of Stablecoins: From Algorithms to Law

In the DeFi world, when the market is booming, everything can operate under the narrative of "decentralization"; however, when external shocks are strong enough, the "trust" in the algorithm will collapse. This crisis has fully exposed the gray areas and potential risks in the DeFi field under the current legal framework. The USDe depegging incident has reawakened in the market the importance of stablecoin stability: it's not just a technical or market issue, but also a question of law and trust. During this liquidity crisis triggered by an imbalance in derivatives funding rates, USDe's algorithms and models operated according to established logic, yet price deviations were unavoidable. This demonstrates that technological certainty cannot replace legal certainty. A stabilization mechanism must be based on legal verifiability and traceable accountability. 1. The Limits of Algorithmic Trust and the Return of Legal Trust The "re-hypothecation + hedging" model represented by USDe attempts to achieve "synthetic stability" of the dollar's value through financial engineering. This model, based on algorithmic logic, inherently relies on a series of market assumptions: sufficient liquidity, effective derivative hedging, and returns covering costs. However, these conditions often fail to hold in extreme market conditions. Therefore, the trust fostered by algorithms is "conditional trust" rather than "institutional trust."

In contrast to USDe, there are centralized stablecoins such as USDT and USDC, which are centered on "fiat currency reserves + compliant custody". Their "trust anchor" is built on legal responsibility and audit systems, such as:

Clear legal entity: issued by regulated companies (such asTether,Circle), and assumes redemption obligations

Fiat currency or government bond reserves: reserve assets can be audited and traced

Operating within a regulatory framework: complying withFinCEN

Therefore, even if the market fluctuates violently, USDT 、 The price of USDC remains around $1. This stability is not a product of algorithms, but the result of legal constraints and a transparent system. 2. Construction of Trust Anchor The de-anchoring of USDe proves that even with highly complex algorithms, it may still fail in extreme circumstances; and the true stability of stablecoins must come from the combination of “legal trust + technical transparency”. This means:

(1)Algorithm design must have legal boundaries. For example, the stabilization mechanism should clearly define the responsible party, redemption rights and risk disclosure obligations; hedging or re-pledge models should disclose the strategy logic and source of funds; investors should be clearly aware of the type of risk they are involved in (whether it constitutes a derivative, investment contract, etc.).

(2)The regulatory framework needs to adapt to technological innovation and implement a three-level review of “disclosure—monitoring—reserve verification” for algorithmic stablecoins, while incorporating smart contract transparency into regulatory technical standards.

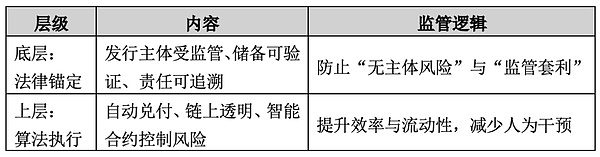

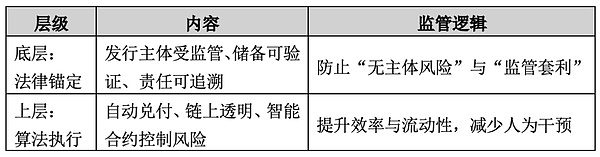

(3) Stablecoins should build a "trust hierarchy system", with the bottom layer based on fiat currency reserves and compliance audits, and the upper layer using on-chain algorithms and automated hedging to improve operational efficiency, so as to form a structural balance of "institutional stability + algorithmic flexibility".

At present, the global regulatory trend has gradually pushed the trust structure of stablecoins from "algorithm single layer" to "legal

-algorithm double layer":

Under this structure, algorithms no longer replace the law, but become an enforcement tool under the legal framework. This is also the core direction proposed by the U.S. "Clarity for Payment Stablecoins Act" and the "GENIUS Act" - requiring stablecoins to be issued by "regulated institutions or qualified custodians", reserves limited to highly liquid assets (such as Treasury bonds, cash, repurchase agreements), and prohibiting purely algorithmic stablecoins from being sold to U.S. citizens without registration. Furthermore, according to the EU's MiCA Regulation, any asset-backed token (including stablecoins) publicly offered to EU residents or listed on an EU trading platform must be established and authorized in the EU by the issuer. The issuer must also disclose its reserve asset structure, custody, and audit information in a white paper, and establish a redemption and orderly liquidation plan. Clearly, these laws share the common goal of bringing the risks of algorithmic stablecoins back into the "trust radius" of financial regulation. 3. The True Meaning of Stability The depegging of the USDe was not accidental but the inevitable outbreak of an "algorithmic trust crisis." Code can define rules, but not responsibilities. The ultimate value of a stablecoin lies not in the sophistication of its algorithms but in the sustainability of trust. The future of stablecoins is destined to be a union of law and algorithms—technology provides enforcement, law sets the boundaries of trust; algorithms maintain balance, and law ensures stability. Only when law and code are aligned can stablecoins truly achieve stability.

Joy

Joy