Author: BeWater.xyz, Source: Author's Twitter @BeWaterOfficial

1. USDe definition: fully collateralized semi-centralized stablecoin

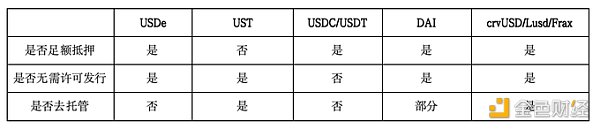

Stablecoins can be classified in many ways, such as:

(1) fully collateralized and non-fully collateralized

(2) centralized custody and decentralized custody

(3) on-chain issuance and centralized institution issuance

(4) permission required and permissionless

There will be some overlaps and changes. For example, in the past, we believed that algorithmic stablecoins such as AMPL and UST were stablecoins whose supply and circulation were completely regulated by algorithms. According to this definition, most stablecoins are non-fully collateralized stablecoins, but there are exceptions, such as Lumiterra's LUAUSD. Although its minting and destruction prices are regulated by algorithms, the protocol vault provides collateral (USDT & USDC) of no less than the LUAUSD anchor value. LUAUSD has both the attributes of algorithmic stablecoins and fully collateralized stablecoins.

Another example is DAI. When DAI's collateral is 100% of the on-chain assets, DAI is a decentralized custodial stablecoin. However, after the introduction of RWA, part of the collateral is actually controlled by real entities, and DAI has become a centralized and decentralized hybrid custodial stablecoin.

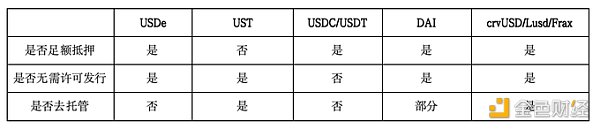

Based on this, we can strip off the overly complex classification and abstract it into three core indicators: whether it is fully collateralized, whether it is issued without permission, and whether it is de-custodial. In comparison, USDe and other common stablecoins have some differences in these three attributes. If we believe that [decentralization] needs to meet both [permission-free issuance] and [de-custody] conditions, then USDe does not meet the requirements, so it is appropriate to classify it as a [fully collateralized semi-centralized stablecoin].

2. Collateral Value Analysis

The first question is whether USDe has sufficient collateral. The answer is obviously yes. As stated in the project document, USDe's collateral is a synthetic asset of crypto assets and corresponding short futures positions as collateral.

Synthetic asset value = spot value + short futures position value

In the initial state, spot value = X, futures position value = 0, assuming the basis is Y

Collateral value = X + 0

Assuming that after a certain period of time, the spot price rises by a US dollar, and the futures position value rises by b US dollars (a and b can be negative), the position value = X + a -b = X + (a-b), and the basis becomes Y + ΔY, where ΔY = (a-b)

It can be seen that if ΔY remains unchanged, the intrinsic value of the position will not change. If ΔY is a positive number, the intrinsic value of the position will increase, otherwise it will decrease. In addition, for delivery contracts, the basis is generally negative in the initial state, and the basis will gradually become 0 on the delivery date (excluding transaction friction), which means that ΔY must be positive. Therefore, if the basis is Y when synthesized, the value of the synthetic position on the delivery date will be higher than the initial state.

The asset portfolio of holding spot and shorting futures is also called "spot-futures arbitrage". This arbitrage structure itself is risk-free (but has external risks). According to current data, constructing this investment portfolio can obtain a low-risk annualized return of about 18%.

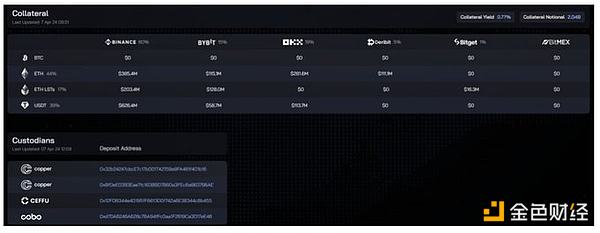

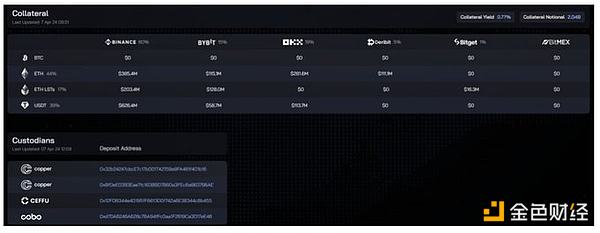

Let's go back to Ethena. I didn't find an accurate definition on the official website about whether to use delivery contracts or perpetual contracts (considering the issue of transaction depth, the probability of perpetual contracts is relatively high), but the on-chain address and CEX distribution of the collateral were announced.

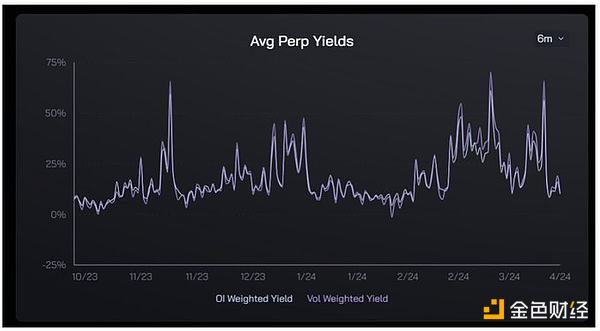

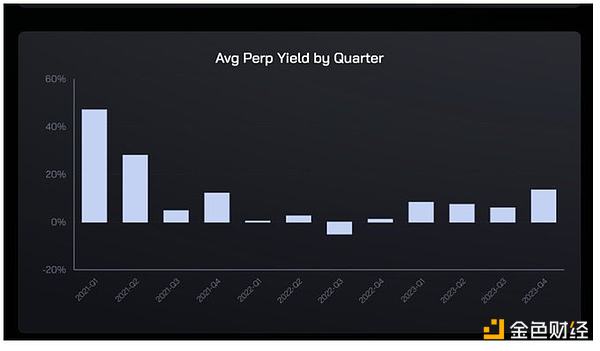

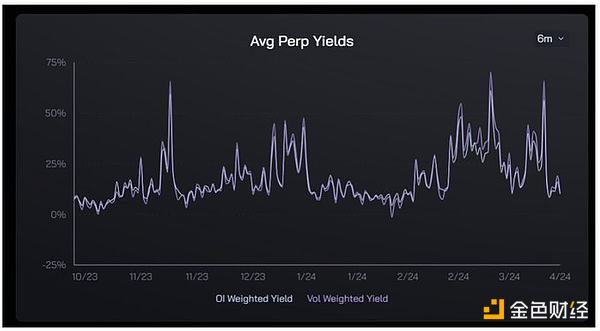

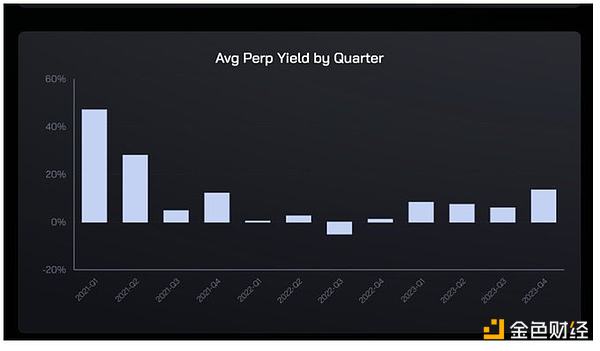

In the short term, there will be some differences between the two methods. Delivery contracts will provide a more "stable and predictable" rate of return, and the maturity return is always positive. Perpetual contracts are a product with fluctuating interest rates, and the daily interest rate may also be negative under certain circumstances. But from experience, the historical arbitrage returns of perpetual contracts are slightly higher than those of delivery contracts, and both are positive:

1) Delta-neutral futures airdrops are essentially lending funds, and lending funds cannot maintain 0 interest rates or negative interest rates for a long time, and this position stacks USDT risks and centralized exchange risks, so the required rate of return is greater than the risk-free rate of the US dollar.

2) Perpetual contracts need to bear variable yields to maturity and need to pay additional risk premiums.

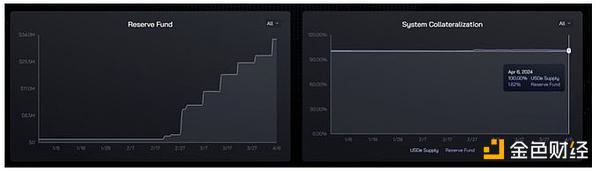

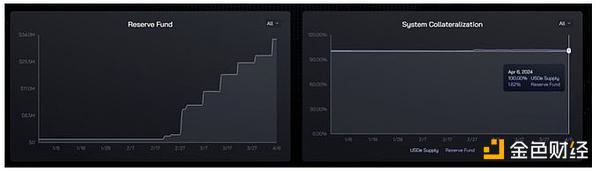

Based on this, it is completely wrong to worry about "USDe" being insolvent or to compare USDe to UST. According to the collateral risk assessment framework introduced at the beginning of the article, USDe's current core/narrow collateral coefficient is 101.62%. After taking into account ENA's $1.57 billion market value, the broad collateral coefficient can reach about 178%.

[Potential negative rates will lead to shrinkage of USDe collateral] is not a big problem. According to the law of large numbers, as long as the time is long enough, the frequency will inevitably converge to the probability, and the USDe collateral will maintain a growth rate that converges to the average funding rate in the long run.

To put it in a more popular way: you can draw one card from the poker cards indefinitely. If you draw a big or small joker, you will lose $1, and if you draw the other 52 cards, you can earn $1. With a principal of $100, do you need to worry about going bankrupt because of drawing too many big or small jokers? It is more intuitive to look at the data directly. In the past 6 months, the average contract rate was only below 0% twice, and the historical winning rate of spot-futures arbitrage is much higher than that of drawing poker cards.

3. Where are the real risks?

1. Market capacity risk

Now that we have made it clear that collateral risk is not worth worrying about. But this does not mean that there are no other risks. The most noteworthy is the potential limitation of contract market capacity on Ethena.

The first risk is liquidity risk. At present, the issuance volume of USDe is about 2.04 billion US dollars, of which ETH and LST total about 1.24 billion US dollars, which means that a short position of 1.24 billion US dollars needs to be opened in the case of full hedging, and the required position size is proportional to the size of USDe.

The current size of Binance's ETH perpetual contract holdings is approximately US$3 billion. 78% of Ethena's USDT reserves are deposited in Binance. Assuming that the funds are used evenly, this means that Ethena needs to open a short position with a nominal value of 2.04 billion*61%*78%=970 million on Binance, which already accounts for 32.3% of the holdings.

If Ethena's holdings account for too high a proportion in Binance or other derivatives exchanges, there will be many negative effects, including:

1) It may lead to greater trading friction

2) It is unable to cope with large-scale redemptions in a short period of time

3) USDe pushes up the supply of short positions, resulting in a decrease in fees and affecting yields

Although some mechanism-based designs may be able to mitigate risks, such as setting time-based casting/destruction caps and dynamic fees (LUNA has introduced this mechanism), it is better not to put yourself in danger.

According to these data, the market capacity that the combination of Binance + ETH trading pairs can provide to Ethena is very close to the limit. But this limit can be broken by introducing multiple currencies and multiple exchanges. According to Tokeninsight data, Binance accounts for 50.1% of the derivatives trading market. According to Coinglass data, except for ETH, the total contract positions of the top 10 currencies on Binance are about three times that of ETH. According to these two data, it is estimated that:

The theoretical upper limit of USDe market capacity = 20.4 (628/800)*60%/4/50.1% = 12.8 billion US dollars

The bad news is that USDe has a capacity limit, but the good news is that there is still 500% room for growth from the upper limit.

Based on these two upper limits, we can divide the growth of USDe into three stages:

(1) 0-2 billion: achieve this scale through the ETH market on Binance

(2) 2 billion-12.8 billion: need to expand collateral to mainstream currencies with deep market depth + make full use of the market capacity of other exchanges

(3) More than 12.8 billion: need to rely on the growth of the Crypto market itself + introduce additional collateral management methods (such as RWA, lending market positions)

It should be noted that if USDe hopes to truly flip the centralized stablecoin, it must at least surpass USDC to become the second largest stablecoin. The latter currently has a total issuance of approximately US$34.6 billion, which is 2.7 times the potential capacity limit of USDe's second phase, which will be a relatively large challenge.

2. Custody risk

Another controversial point about Ethena is that the funds of the agreement are held by a third-party institution. This is a compromise based on the current market environment. Coinglass data shows that the total BTC contract position of dydx is 119 million US dollars, which is only 1.48% of Binance and 2.4% of Bybit. Therefore, it is inevitable for Ethena to manage positions through centralized exchanges.

However, it should be pointed out that Ethena adopts the "Off-Exchange Settlement" custody method. Simply put, the funds managed in this way will not actually enter the exchange, but will be transferred to a special address for management, usually managed by the principal (ie Ethena), the custodian (third-party custodian) and the exchange. At the same time, the exchange generates a corresponding quota in the exchange based on the scale of the custodial funds. These funds can only be used for transactions and cannot be transferred; settlement is made afterwards based on the profit and loss situation.

The biggest advantage of this mechanism is precisely [eliminating the single point risk of centralized exchanges], because the exchange has never really controlled the funds, and at least two of the three parties need to sign before they can be transferred. Under the premise that the custodian is trustworthy, this mechanism can effectively avoid exchange Rug (such as FTX) and project party Rug. In addition to Copper, Ceffu, and Cobo listed by Ethena, Sinohope and Fireblocks also provide similar services.

Of course, there is a theoretical possibility that the custodian will do evil, but based on the current background that CEX still occupies an absolute dominant position + frequent security incidents on the chain, this semi-centralization is a local optimal solution, not a final form, but after all, APY is not free. The key lies in whether these risks should be taken for the purpose of improving returns and efficiency.

3. Interest rate sustainability risk

USDe needs to be pledged to obtain returns. Since the pledge rate will not be 100%, the yield of sUSDe will be higher than the derivative rate. At present, the USDe pledged in the contract is about 470 million US dollars, and the pledge rate is only about 23%. The 37.1% nominal APY corresponds to the underlying asset APY of about 8.5%.

The current ETH pledge yield is about 3%, while the average funding rate in the past three years was about 6-7%. The 8.5% APY of the underlying assets is completely sustainable, and whether the 37.1% sUSDe APY can be sustained will also depend on whether there are enough applications that commonly carry USDe to reduce the pledge rate and bring higher returns.

4. Other risks

Including contract risks, liquidation and ADL risks, operational risks, exchange risks, etc. Ethena and Chaos Labs gave more detailed explanations.

JinseFinance

JinseFinance