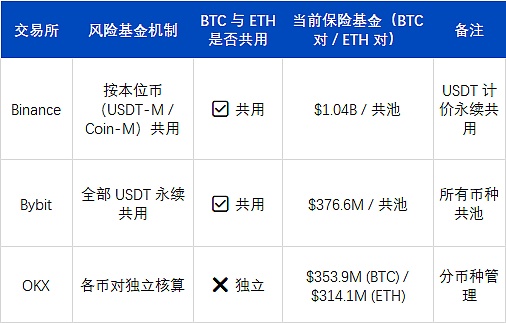

TL;DR: Brief depegging, quick recovery: On October 11, 2025, USDe briefly fell to $0.65 on the Binance spot market, but this only lasted a few minutes. The depegging lasted approximately 90 minutes (between $0.75 and $0.98), with over 780 million USDe traded. The price fully stabilized to around $0.99 by 06:45 Beijing Time. Localized Liquidity Misalignment: Fluctuations were primarily concentrated on Binance. Price deviations on other major exchanges and DEXs (Bybit, Curve, and Uniswap) were all within 0.3%, indicating a single point of liquidity imbalance rather than a systemic issue. Not the trigger for the market crash: BTC, ETH, and SOL first declined at 04:45 Beijing Time, triggering a chain reaction of liquidations. USDe's price deviation was more likely a secondary liquidity release than a triggering event for the decline. Proven Protocol Robustness: Ethena successfully processed over $2 billion in redemptions within 24 hours without downtime or delays. The Aave oracle price remained in the $0.99–$1.00 range, and the system showed no signs of forced liquidation, defaults, or liquidity runs. Systemic Risk is Manageable: The three major exchanges (Binance, Bybit, and OKX) hold a combined risk fund of approximately $2 billion. Under similar market conditions, they can theoretically withstand a liquidation shock of approximately $200 billion, significantly reducing the risk of triggering automatic deleveraging (ADL). On October 11, 2025, USDe briefly depegged to $0.65 on Binance, but this lasted only a few minutes. The depegging lasted approximately 90 minutes (between $0.75 and $0.98), with trading volume exceeding 780 million tokens. During the same period, prices on other major exchanges and on-chain markets remained largely within the $0.99–$1.00 range, with limited volatility. Overall, this was a localized liquidity mismatch rather than a mechanism-based risk event—the liquidation chain triggered by the sharp drop in BTC was amplified in localized, shallow trading venues. The Ethena protocol maintained a stable hedging structure, smooth redemption paths, and robust oracle system despite high volatility, successfully withstanding real-world stress testing and demonstrating the resilience and self-healing capabilities of its stability mechanism. Ethena's USDe stability mechanism has been battle-tested. USDe's Brief Price Dislocation on Binance: On October 11, 2025, USDe briefly decoupled from its peg on Binance, hitting a low of $0.65 for approximately 90 minutes and trading volume exceeding 780 million tokens. During the same period, Bybit, the second-largest spot market exchange, also experienced a slight deviation in its USDe/USDT trading pair, but the magnitude was limited, trading volume was low, and the impact on the overall market was negligible. Overall, the USDE depegging on Binance lasted approximately 45 minutes, with the maximum depegging amplitude reaching approximately −35% (instantaneously). During this period, total trading volume exceeded 780M USD. This incident is more akin to a liquidity flash crash than a structural risk in the protocol.

USDE's unpegging and re-pegging process on Binance spot (USDE/USDT)

USDE/USDT price chart on Binance

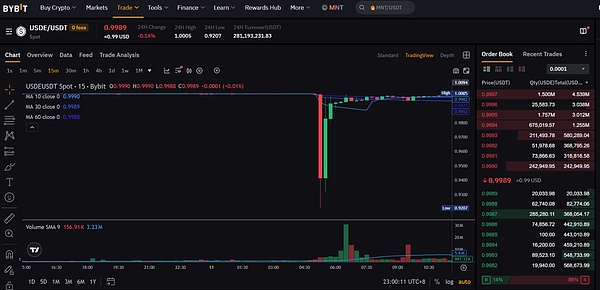

USDE/USDT price chart on Bybit Exchange

USDE has not shown any systematic deviation on the DEX side (Uniswap / Curve)

Compared to Binance's deep depegging, on-chain DEXs (such as Curve and Uniswap) have only experienced slight and delayed price fluctuations, reaching a low of approximately $0.995, remaining stable overall with almost no depegging.

Uniswap’s USDe/USDT price chart

Curve’s USDe/USDC price chart

USDe on Binance: Growth Trajectory and Post-Event Adjustment

As of September 22, 2025, Binance The USDe Rewards Program has officially launched, offering users up to 12% annualized returns. The platform records users' minimum USDe holdings across spot, fund, and margin accounts (including collateral) through a random daily snapshot. Rewards are calculated annually and distributed to spot accounts every Monday. The program runs from September 22 to October 22, 2025. Users holding at least 0.01 USDe for at least 24 hours are eligible to participate. As a result of this incentive program, the USDe balance on Binance briefly exceeded $5 billion. Currently, USDe's lending and contract staking functions on Binance are suspected to be temporarily disabled, with verification unavailable on the front-end. Related leverage and lending data is also unavailable. Based on subsequent announcements and parameter adjustments, it is speculated that Binance may have directly used the USDe price index as its core price feed during the depegging event, with its lowest transaction price being approximately $0.66. Following the October 11th incident, Binance adjusted USDe's risk control parameters to enhance system robustness. These adjustments included incorporating the redemption price into the price index, setting a minimum transaction price limit, and increasing the frequency of parameter reviews to mitigate potential market volatility.

In addition, according to Binance’s latest announcement, the platform has launched a compensation plan of approximately US$283 million for users affected by this incident (including USDe, BNSOL and WBETH depegging-related assets).

Binance's USDE index price

The USDe lending market on Aave remains stable, with no chain liquidations.

When analyzing Aave's related markets, focus primarily on the USDe lending pool and sUSDe. Although other USDe-related assets (such as pt-sUSDe) exist on Aave, their prices are highly correlated with USDe itself, which is why the Pendle protocol's USDe principal funds... Currently, USDe lending pools are primarily distributed across the Ethereum (approximately $1.1 billion) and Plasma (approximately $750 million). Meanwhile, sUSDe deposits on Ethereum are approximately $1 billion. Due to the on-chain circular lending model, some users use USDe and sUSDe as collateral to borrow other stablecoins, then redeem the proceeds and pledge them back for USDe and sUSDe, thereby leveraging USDe's returns. Aave's USDe and sUSDe revolving loan process Aave's USDe and sUSDe revolving loan process Judging from Aave's price feed data, USDe's oracle price on the platform has always remained around $1, or even slightly above $1. The sUSDe price feed has remained around 1.2, which means that USDe and sUSDe borrowers on Aave have not been actually affected by the depegging of Binance's USDe spot price.

Note: This analysis focuses on the lending cycle and stability performance of USDe and sUSDe. Other liquidation behaviors using mainstream assets such as BTC and ETH as collateral are not within the scope of discussion.

Aave Ethereum’s USDe price feed

Aave Plasma’s USDe price feed

Aave Ethereum’s sUSDe price feed

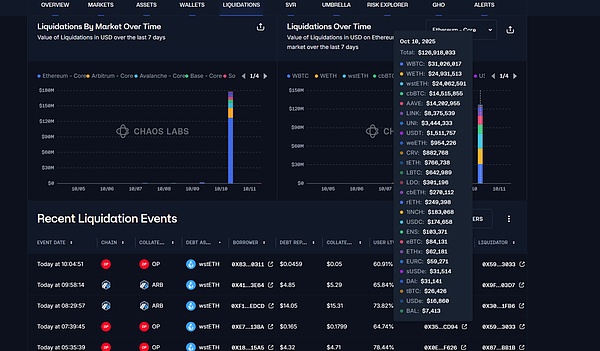

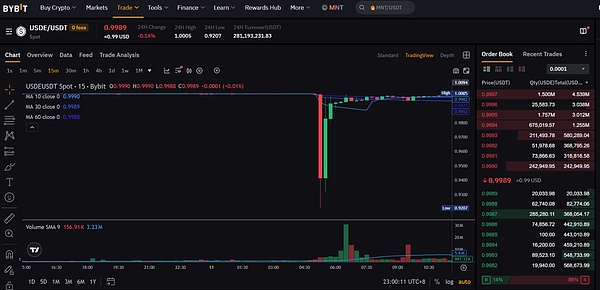

In the monitoring data of Chaos Labs, another risk analysis platform, Aave's liquidation activities can also be seen, but there are no liquidation records directly related to USDe and sUSDe.

Aave liquidation data provided by Chaos Labs

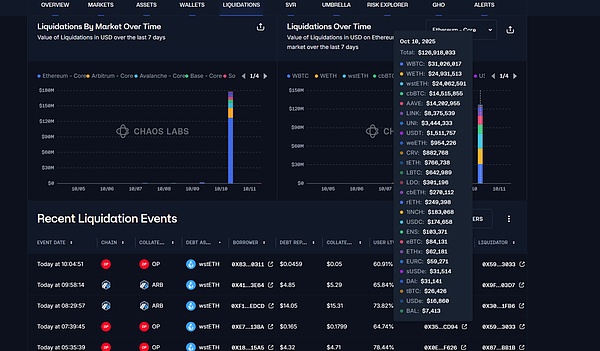

Aave's oracle pricing and price feed logic for USDe

Aave's pricing for USDe is not fixed at $1, but uses a combined oracle mechanism:

USDe price = Chainlink USDe/USD feed price × sUSDe/USDe internal exchange rate × CAPO (price adapter) adjustment factor

Thanks to this mechanism, USDe pricing on Aave can effectively reflect its fair value of the entire market, thereby avoiding price deviations due to short-term fluctuations or liquidity imbalances on individual exchanges.

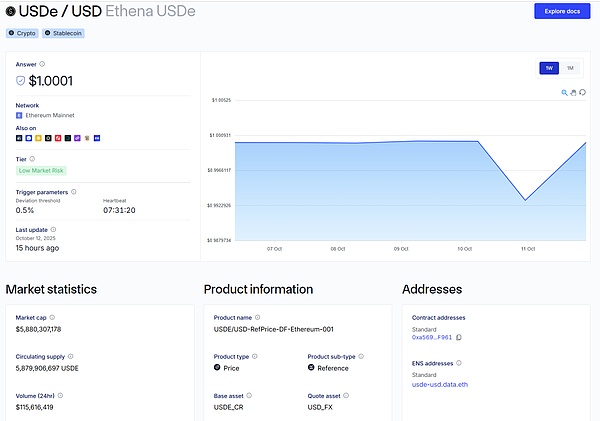

Chainlink's USDe price feed

During the unpegging period, no abnormal USDe fund flows occurred on Binance

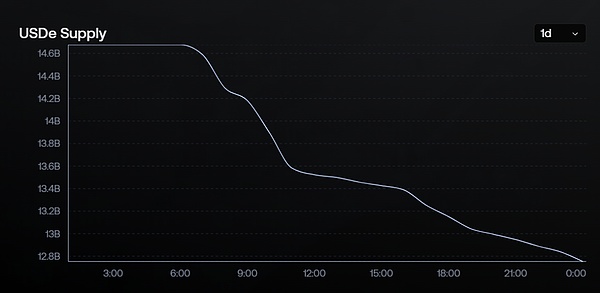

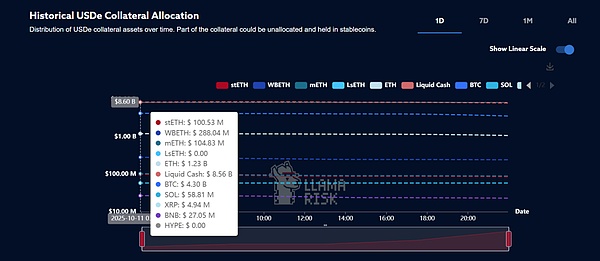

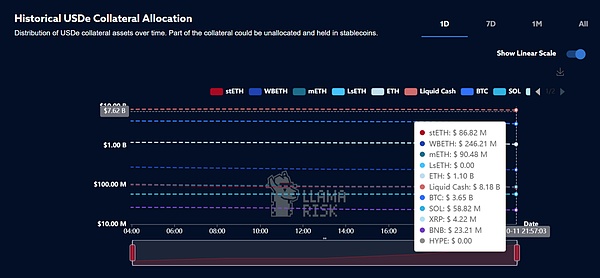

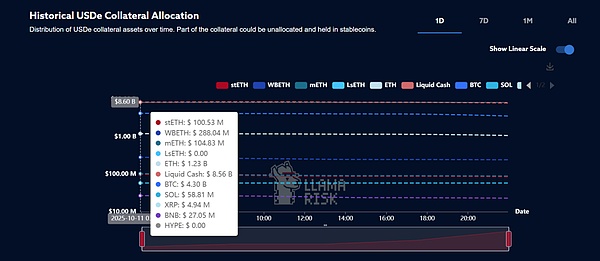

No significant abnormal fund inflows were observed. Binance's USDe balance is approximately $4.7 billion, a significant decrease of approximately $500 million from the previous $5.2 billion after the incident. This change is consistent with the overall trend of USDe's total supply decreasing from $14.6 billion to $12.8 billion. Regarding the collateral structure, BTC positions decreased by approximately $650 million, ETH by approximately $130 million, and stablecoin assets by approximately $400 million. Overall, the decline in USDe issuance is primarily due to long position liquidations and shrinking liquidity in the derivatives market, rather than a stability attack or run on a single exchange.

Arkm’s Binance assets

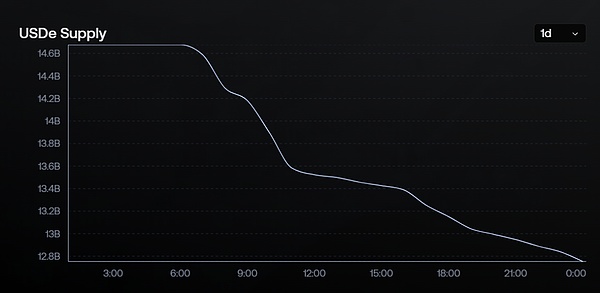

USDe supply changes

Changes in the underlying assets of USDe

Changes in USDe's Underlying Assets

The Sequential Relationship Between the Overall Market Decline and USDe's Depeg

In fact, BTC began to fall at 4:45, and major assets such as ETH and SOL also experienced pullbacks during the same period. The market experienced a spike at 5:15, but at this time, USDe had not yet shown any significant depegment. Therefore, it can be inferred that USDe's depegging was not directly triggered by the overall market decline, but more likely stemmed from Binance users holding revolving lending positions selling USDe in response to margin pressure, triggering a short-term liquidity run and price depegging. It remains unclear whether any market makers are using USDe as collateral to provide market liquidity. Based on actual testing, Binance currently only allows USDe to be deposited in margin accounts and has not yet enabled it to be used as collateral for futures contracts, thus potentially limiting its market-making use.

BTC price drop icon

Analysis of ENA systemic risk and USDe stability

ENA system anti-risk structure

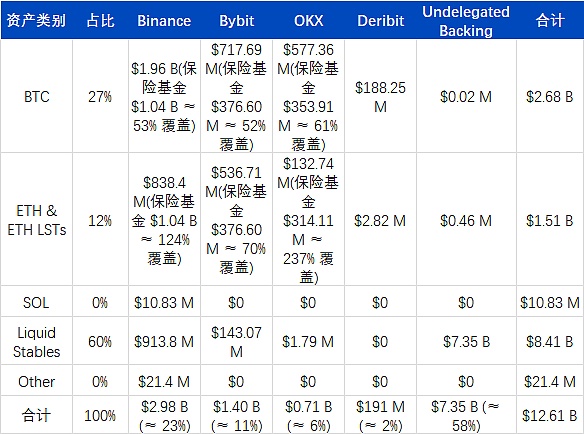

The total issuance of USDe under the current ENA ecosystem is estimated at US$14 billion.

Among them:

About 60% (≈ US$8.4 billion) is the "liquidity stablecoin" part, which is mainly used for internal deployment of the protocol and revolving mortgage;

About 40% (≈ US$5.6 billion) is the stablecoin liability formed by the hedging structure,

Of which:

BTC spot + short positions account for about ETH spot + short positions account for approximately 11% (corresponding to approximately 1.54 billion USDe issuance). This means that the stability of BTC and ETH hedging positions directly determines the risk resistance of the entire system.

Core Systemic Risk

The main systemic risk of USDe lies in the effectiveness and sustainability of its short hedge:

If the BTC/ETH short position is forcibly liquidated due to sharp market fluctuations or the triggering of ADL (Automatic Deleveraging), the ENA protocol will lose its corresponding neutral hedging structure.

At this time, the protocol will no longer hold a hedge portfolio, but will instead hold approximately $3.9 billion in BTC long exposure.

If the market declines further by 10%–20%, USDe's assets will suffer actual losses, and the stablecoin will face real pressure to depeg. Furthermore, shrinking funding rates and delayed liquidations in extreme market conditions may also lead to greater losses on the asset side, as evidenced by the declining share of BTC in this incident.

Possibility of further depegging and key points for monitoring

USDE's market anchor is primarily determined by the exchange's order book, so if a large sell-off occurs (such as concentrated selling by whales), even if the asset side remains healthy, it may cause a short-term depegging.

The following indicators need to be monitored continuously:

Potential impact on overall liquidity

If USDe actually depegs, the market impact may be close to a local liquidity crisis:

BTC hedging positions at the protocol layer become invalid → Risk exposure on the asset side is exposed;

LP of the stablecoin pool Lenders and lenders will prioritize divestment → accelerated outflow of stablecoins;

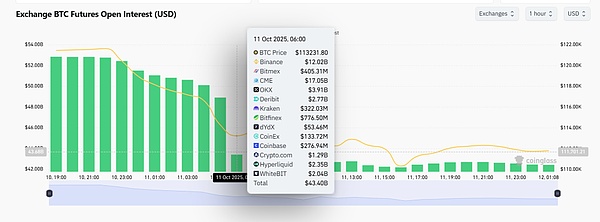

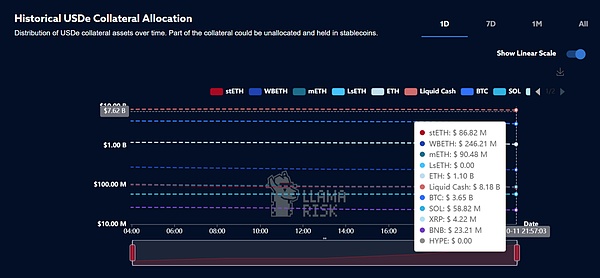

BTC contract OI data

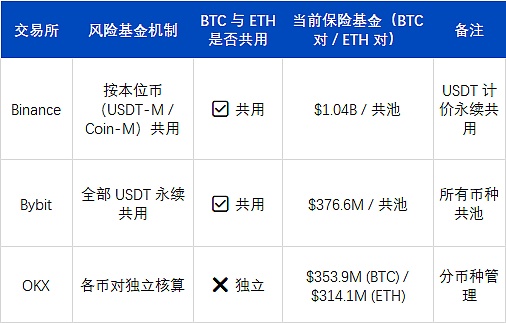

Ethena's response mechanism to ADL and exchange risks

The Ethena team's response to potential Pre-emptive measures for ADL (Automatic Deleveraging) and exchange systemic risks are already in place and clearly outlined in official documentation. This section primarily addresses two scenarios: Auto Deleveraging risk; and Exchange Failure Risk (Exchange downtime or bankruptcy risk). The Auto Deleveraging (ADL) mechanism is the "last line of defense" used by major derivatives exchanges to prevent systemic risk in extreme circumstances. When the insurance fund is depleted and unable to cover losses from margin calls, the exchange will forcibly liquidate the profitable positions to eliminate risk exposure. Ethena's documentation states that while ADL could theoretically lead to the forced liquidation of some hedge positions, the probability of its triggering is extremely low on current mainstream exchanges (Binance, Bybit, OKX, etc.) for the following reasons: The insurance fund is sufficiently large; the clearing system has multiple layers of risk buffers and self-healing mechanisms; and when the market fluctuates, the exchange prioritizes internal matching and position-by-position risk sharing to mitigate risk. Even if ADL is triggered in individual venues, Ethena can quickly restore market neutrality by instantly rebuilding hedge positions and actively realizing open profits and losses (PnL). Overall, the impact of ADL on Ethena is limited to a short-term position interruption risk and does not pose a systemic threat to the USDE price anchor or asset security.

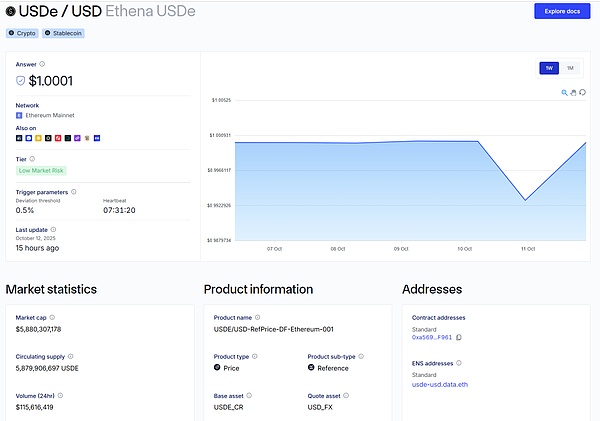

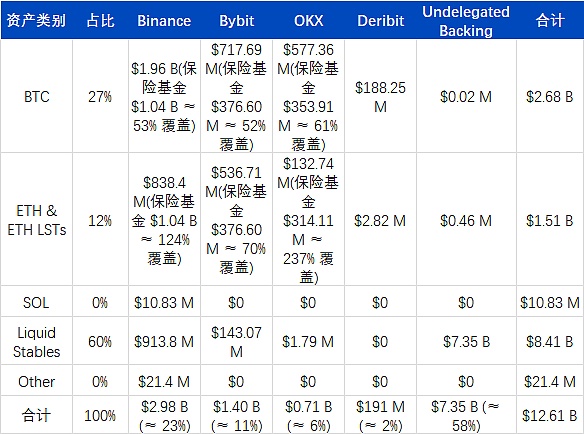

Multi-Exchange Risk Fund Carrying Capacity Assessment

Based on the distribution of Ethena's hedging positions and the scale of risk reserves of major exchanges, the following calculation can be made:

As of October 11, 2025, the total daily clearing volume in the entire market is approximately US$20 billion.

Among them, the risk fund balance officially disclosed by Binance dropped by approximately US$200 million, and it is estimated that its risk absorption rate under extreme market conditions is approximately 10%.

If calculated based on the current size of Binance's venture fund of approximately US$1 billion, its theoretical maximum liquidation capacity under similar market conditions is approximately:

≈ US$100 billion in daily liquidation volume (corresponding to a 10% risk absorption rate)

Ethena's hedging positions are distributed across multiple mainstream exchanges (Binance, Bybit, OKX, etc.), providing a significant risk diversification effect.

Estimated based on public data:

Binance: approximately US$1.04 billion

Bybit: approximately US$380 million

OKX: approximately US$320 million

A total of approximately US$2 billion

Under the same assumptions (approximately 10% risk absorption rate), the total risk fund size of the three major platforms can theoretically support approximately 2,000 This result demonstrates that Ethena's multi-exchange hedging strategy has sufficient flexibility and defensive depth in its risk profile, ensuring that even during periods of extreme volatility, the risk of systematic liquidation (ADL) remains manageable.

Reference links

https://app.ethena.fi/dashboards/transparency

https://www.binance.com/en/trade/USDE_USDT?type=spot

https://www.bybit.com/en/trade/spot/USDE/USDT

https://aavescan.com/ethereum-v3/usde

https://dune.com/KARTOD/AAVE-Liquidations

https://community.chaoslabs.xyz/aave/risk/liquidations

https://intel.arkm.com/explorer/entity/binance

https://portal.llamarisk.com/ethena/overview

https://www.binance.com/en/futures/funding-history/perpetual/insurance-fund-history

https://www.bybit.com/en/announcement-info/insurance-fund/

https://www.okx.com/zh-hans/trade-market/risk/swap

https://help.defisaver.com/protocols/aave/ethena-liquid-leveraging-on-aave-in-one-transaction

https://governance.aave.com/t/arfc-susde-and-usde-price-feed-update/20495

https://data.chain.link/feeds/ethereum/mainnet/usde-usd

https://www.binance.com/zh-CN/support/announcement/detail/9eb104f497044e259ad9bd8f259f265c?utm_source=chatgpt.com

https://www.binance.com/zh-CN/support/announcement/detail/f3d5d97ed12c4f639019419bd891705e?utm_source=chatgpt.com

https://www.binance.com/zh-CN/support/announcement/detail/0989d6c7f32545bfb019e3249eaabc3f

https://www.binance.com/en/margin/interest-history

https://www.coinglass.com/BitcoinOpenInterest

XingChi

XingChi