Looking solely at market trends makes it difficult to explain the differences in returns among exchange users in 2025. What truly determines returns is the operational methods at the account level, not just market fluctuations themselves.

OKX's annual statement shows that mainstream cryptocurrencies remain the core of capital turnover and returns, supporting trading and strategy execution; emerging cryptocurrencies are more used to amplify volatility and provide short-term opportunities, but are not stable, long-term sources of returns. What truly contributes to sustained returns is a portfolio of products used long-term with controllable risks. Taking 2025 as an example, stablecoin investments consistently ranked high in both usage frequency and return contribution, becoming the most stable underlying source of returns for exchange accounts, effectively boosting overall returns during periods of volatility and pullbacks.

This report will analyze the real choices of exchange users in 2025 from data dimensions such as OKX exchange strategy products, earning products, trading currencies, and actual return performance, revealing which operations are effective in the long term and which are merely "seemingly profitable." ...>

6 Best Annual Strategies

In 2025, the strategies with the largest user base almost all point to the same core demand: **fewer mistakes, predictability, and low drawdowns**. The reason why OKX BTC large-range spot grid has become the most popular strategy is logically consistent with BTC dollar-cost averaging and annual low-drawdown spot grids—they do not require users to judge the direction, nor do they rely on timing ability. Instead, they reduce the risk of human decision-making errors through decentralized execution and automation mechanisms. The value of these strategies lies not in their high short-term returns, but in their ability to cover most market phases, making them suitable for long-term, continuous use by ordinary users. Strategies that truly maximize returns are concentrated in scenarios involving high-volatility assets like ETH, SOL, and DOGE combined with contract grids. The high returns here don't come from "smarter judgment," but rather from the combined effect of volatility and amplification mechanisms. In bull markets or trending markets, these strategies can rapidly amplify profits, but simultaneously, the risks are also amplified, with returns highly concentrated among a small number of users who can withstand volatility and understand ranges and leverage boundaries. Therefore, they can be called "most profitable," but not "most widely used" strategies. From a long-term perspective, stable excess returns more often occur when the strategy combination and timeframe are well-matched. The combination of BTC and ETH dollar-cost averaging achieved a 100% return in less than two years, essentially due to the synergistic effect of the stability of core assets and the volatility of volatile assets within a suitable timeframe. Meanwhile, the DCA strategy favored by smaller, larger investors reflects the same idea—as capital grows, the goal shifts from pursuing maximum returns to improving capital efficiency and controlling drawdowns. Ultimately, what determines the difference in returns is not the individual strategy itself, but whether or not one understands and respects its applicable boundaries.

The most classic3major strategy types and parameters

BTClarge range spot grid (40,000–400,000, approximately200dense grid)

This is currently the most verified and longest-used type of OKX grid setting.

Real user preferences show that the core of BTC grid trading is not "predicting direction," but rather using an ultra-wide price range to ensure long-term survival. The 40,000–400,000 range essentially covers the main oscillation zones of multiple bull and bear markets. Combined with a dense grid of approximately 200 grid cells, it can continuously capture BTC's structural fluctuations without frequent shutdowns or repeated reopenings. The 200-grid number is not arbitrary: too few grid cells would waste oscillations, while too many would be eroded by transaction fees; this density achieves the optimal balance between trading frequency and cost. For most users, this strategy addresses a very real pain point—being able to participate in BTC's fluctuations long-term without timing the market. In trending markets, users' demands for grids shift from "stability" to "amplification," which is why coin-margined contract grids are most prevalent. Cryptocurrency-margined grid trading, exemplified by SOLUSD, essentially amplifies bull market beta: rising prices not only generate grid spread profits, but the position itself also continuously appreciates in cryptocurrency terms. Real-world usage data shows that this strategy is more commonly used for short-term market movements than year-round; consistently profitable accounts typically only activate it after a clear trend emerges, keeping leverage low to avoid forced liquidation during periods of volatility. It doesn't address "stable cash flow," but rather the most pressing concern for users in a bull market: how to maximize trend gains without frequent manual intervention. However, it's important to note that cryptocurrency-margined grid trading is still a leveraged strategy, highly sensitive to market direction and volatility. In cases of misjudgment of the trend or severe market fluctuations, leverage and position size must be carefully managed to control risk. AI Parameter Recommendations (Automatic Matching of Three Strategies) The reason AI parameter recommendations have become the default choice for many users is not because they are "more aggressive," but because they are less prone to making basic mistakes. OKX's strategy system automatically provides users with three grid strategies—long-term stable, medium-term range-bound, and short-term volatile—based on the current volatility, trend structure, and historical range of the currency pair. Its core value lies in helping users complete the most difficult step: setting the appropriate range and grid density. In reality, most grid losses are not due to market conditions, but rather because the parameters are ineffective from the start: the range is too narrow, the grid is too sparse, or it is frequently broken through. AI recommendations do not guarantee the highest returns, but they significantly reduce the probability of strategy failures such as "starting and stopping immediately, or repeatedly resetting," which directly addresses the core pain point for ordinary users.

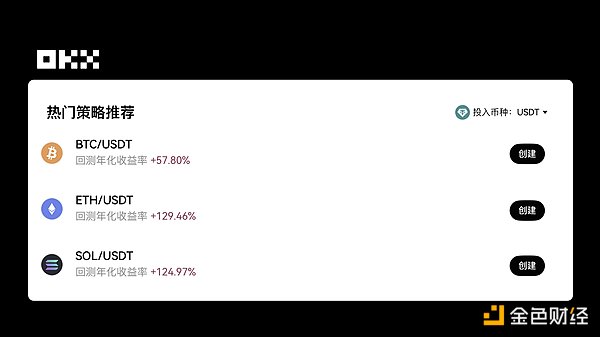

BTC Spot DCA Strategy Backtesting Annualized Return Exceeds 50%ETH Over 120%

OKX Spot Martingale Strategy essentially lowers the average cost by incrementally increasing investment during price pullbacks and taking profits when the trend rebounds. Compared to traditional equal-amount DCA, it captures rebound gains better, but it also carries higher risk, especially in a one-sided downtrend where multi-layered positions can quickly deplete capital. Its core value lies in combining market volatility and trend structure to achieve high-frequency cyclical arbitrage, while overcoming the risk of missing rebound opportunities by simply holding coins.

Taking BTC as an example, a typical spot Martingale strategy uses the following parameters: a 0.96% drop triggers a position increase, a position increase factor of 1.05, a maximum of 7 position increases, and a profit target of 0.5%. Backtesting shows that the annualized return can exceed 50%. This strategy can quickly capture profits from long-term trend rebounds in BTC, while using multi-level position increases to reduce costs in volatile markets. However, there is still a risk of running out of funds in a continuously falling or sideways market environment. Taking ETH as an example, due to its higher volatility, a Martingale strategy with a 1.42% drop trigger, a position increase factor of 1.05, and a profit target of 2.8% can achieve an annualized return exceeding 120% in backtesting. The most successful example of continuous doubling shows that with an initial position of 1000 USDT, after triggering 7 consecutive position increases, a 2-3 times return can be achieved during a trend rebound cycle. Compared to BTC, ETH's high-frequency volatility makes it easier for the Martingale strategy to achieve multiple rounds of position building and profit-taking within a short period. However, money management and profit-taking settings remain crucial to the strategy's success.

Conclusion: Diversification and Risk Control Become the Mainstream Choice

By analyzing the trading behavior throughout the year, it can be seen that most accounts that achieved positive returns did not rely on aggressive single-point speculation, but rather accumulated returns continuously under the premise of controllable risk through the combined use of trading, strategy products, and earning tools.

Users with different capital sizes and trading styles may employ different execution methods, but their underlying logic remains highly consistent: proactively reducing reliance on single market judgments and instead choosing more replicable, scalable, and controllable profit paths. This trend not only reflects the maturity of users' trading philosophies but also demonstrates the market's genuine demand for professional and systematic tools. As a provider of trading infrastructure and products, OKX will continue to iterate its product capabilities around real-world usage scenarios, improving the overall synergy from trade execution and strategy management to profit tools, helping users manage risk and seize opportunities more efficiently in an ever-changing market environment. In the future, we also look forward to exploring more robust and sustainable trading methods with more users, creating deterministic value in the long run.

Alex

Alex

Alex

Alex Alex

Alex Weatherly

Weatherly Weatherly

Weatherly Weatherly

Weatherly Anais

Anais Weatherly

Weatherly Weatherly

Weatherly Alex

Alex Alex

Alex