Long-term "whales" continue to hold their positions, and the number of Bitcoins held for more than 5 years continues to rise.

The sell-off is primarily concentrated among mid-term holders, rather than the earliest holding wallet addresses. The futures market appears to have bottomed out, with funding rates and open interest both at oversold levels. Bitcoin (BTC) Investors Feel Panic Bitcoin (BTC) Investors Feel Panic

Data Source: Glassnode, as of November 13, 2025.

ETP Outflows Cause Early Market Weakness

The price action over the past 30 days has been particularly unfavorable for Bitcoin holders, with the price falling by 13% due to significant selling pressure.

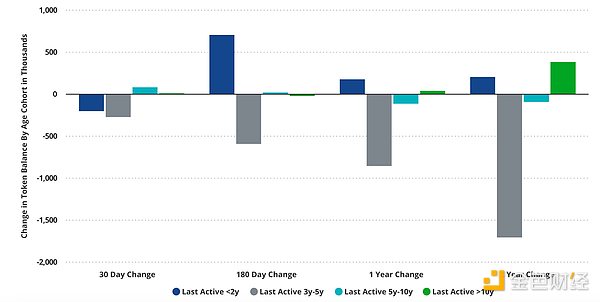

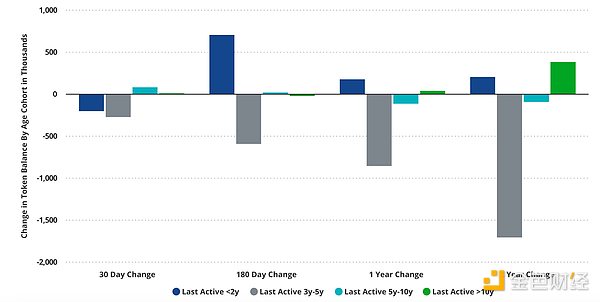

Data source: Glassnode, as of November 13, 2025. Mid-term holders are the real sellers. However, analyzing "whale data" solely by holding size doesn't provide complete information. This view overlooks the process by which experienced, long-term whales transfer tokens to new investors. To deepen our understanding, we examined the "last active transfer" time of Bitcoin balances, representing the time elapsed since the last transfer. Transfers mean these tokens were likely sold to different holders. Over the past 30 days, selling pressure has been primarily concentrated among Bitcoin investors holding for less than 5 years, while longer-term holders have mostly maintained or increased their holdings. Notably, over the past 6 months, the ownership structure has shifted from a 3-5 year holding group to a 6-month-2 year holding group, indicating a trend of shifting from mid-term holders to new holders. Among longer-term holders (those holding coins for more than 5 years), the circulating supply remains relatively low compared to other groups. In contrast, the largest trading group consists of Bitcoin holders whose last transaction occurred 3-5 years ago, and the circulating supply in this segment has consistently declined across each research period. Over the past two years, the supply in this segment has decreased by 32% due to a large amount of Bitcoin being transferred to new addresses. Given that these Bitcoins were likely accumulated during the downturn of the previous cycle, their holders appear to be more inclined towards cyclical trading than long-term investment. Meanwhile, the number of Bitcoins held for more than 5 years has increased by a net 278,000 compared to two years ago. This increase reflects newer Bitcoins gradually entering a holding period of 5 years or more, rather than a new round of accumulation, but it still indicates that long-term holders remain confident. While a more detailed analysis may provide further insights, the overall trend remains encouraging: long-term holders continue to accumulate and hold. Bitcoin futures basis falls to its lowest level since fall 2023. [Image of Bitcoin futures basis] Data source: Glassnode, as of November 13, 2025. Futures market speculation activity is resetting. One of the best indicators for measuring speculative activity is the annualized basis cost paid by traders willing to go long on Bitcoin perpetual futures (perp). Because perpetual futures never settle, their price is aligned with the spot price by charging interest to the counterparty. If the perpetual contract price is higher than the spot price, the long position holder must pay interest to the short position holder proportional to the spot/perpetual contract price difference. Due to the asymmetric upside potential of cryptocurrencies, the basis of perpetual futures contracts is almost always positive. The basis decreases significantly when demand for cryptocurrencies like Bitcoin is low. Recently, we have seen a sharp decline in open interest in Bitcoin futures, down 20% in Bitcoin terms and 32% in USD terms since October 9, 2025. This partly explains the significant drop in funding rates. Of course, funding rates can rise rapidly if people are bullish on Bitcoin. Historically, prolonged declines in Bitcoin prices have often been accompanied by speculative frenzies, with funding rates for perpetual contracts averaging as high as 40% on some days. We haven't seen such a rapid increase in funding rates since March 2024. However, it's worth noting that projects like Ethena, along with some seasoned traders, have accumulated substantial long positions in spot cryptocurrencies and short positions in perpetual contracts. Ethena alone saw its total value locked (TVL) reach $14 billion in October 2025, but has since plummeted to $8.3 billion. These massive basis trades could artificially depress funding rates, rendering them ineffective. It's important to note that funding rate crashes of this scale that we've just witnessed are typically associated with oversold conditions. This is especially true when we see such a sharp drop in perpetual futures open interest simultaneously. Furthermore, the unrealized profit/loss ratio (NUPL) has reached tactically oversold levels, comparable to those during the Spring 2025 tariff crisis and the August 2024 yen depreciation. We believe that with this data in hand, investors can adopt a more aggressive, tactical bullish strategy after a month of sharp sell-offs.

Anais

Anais