Source: AiYing Compliance

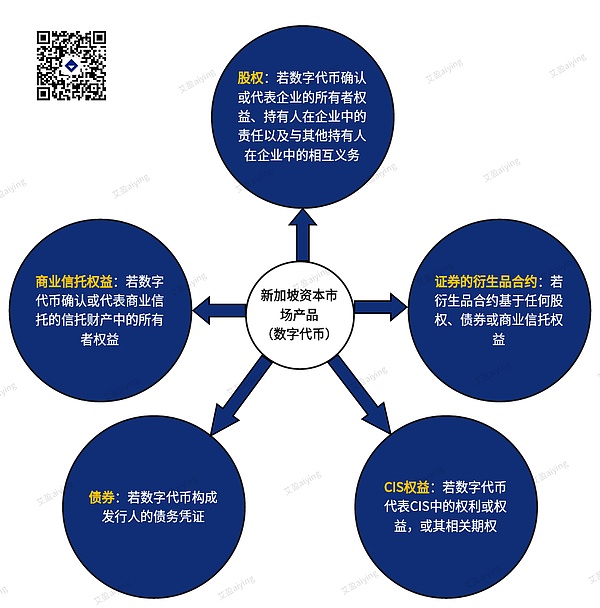

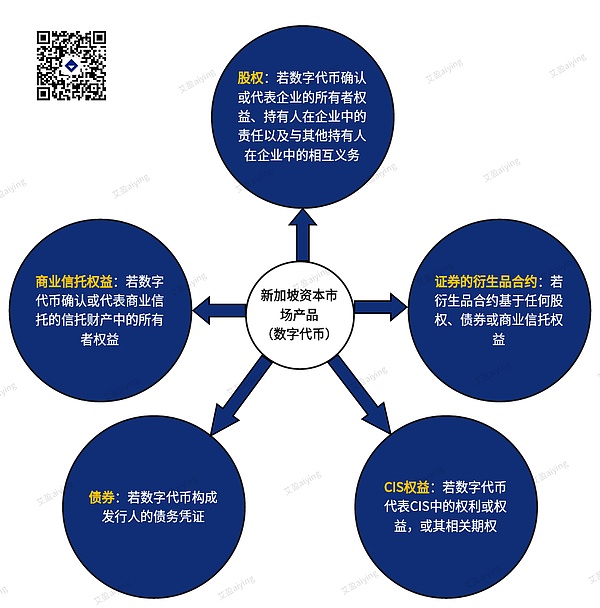

Following the previous article"Overview of Singapore's capital market regulatory policies and fund management licenses for 24 years (virtual assets)" Regulatory requirements for virtual assets in Singapore's capital services market It can be seen that if virtual assets are classified as capital market products as defined by the Monetary Authority of Singapore, then they will be regulated by capital markets regulations. Specific licenses may be required to engage in service activities related to these virtual assets. In addition, the issuance of these virtual assets also needs to comply with the registered prospectus requirements prescribed by the Monetary Authority of Singapore (MAS), unless exemptions are met. Then this article will explain two scenarios of crypto funds in Singapore:

1. Licensed Fund Management Company LFMC

Licensed fund management company LFMC (Licensed FMC) refers to a fund management company that has obtained a CMS license. The following are the main types and requirements:

Generally speaking, fund management in Singapore Activities should hold a capital market services license. For virtual assets "fund management" that involves the management or operation of Collective Investment Scheme tokens the issuance of the following token projects and market services, they are required to comply with the Securities and Futures (Licensing and Operation) Regulations" and need to obtain authorization and operating license from MAS.

Among LFMC, A/I LFMC qualified investor licensed fund company is a common application type for crypto funds, mainly because its threshold is relatively low. The following areApplication for LicenseFund Management Company (LFMC)—A/I LFMC (Qualified Investor LFMC) Requirements:

< strong>1. Basic requirements for application

①The company is an entity registered in Singapore;

②The registered capital is not less than S$250,000;

③ CEOs and executive directors with more than 5 years of relevant industry experience, among whom the executive directors need to be Singapore residents and be responsible for the company’s daily operations full-time;

④ At least 2 full-time local Singaporeans with 5 years of relevant experience Employees with more than 20 years of relevant experience;

⑤At least 2 Singapore resident representatives.

Note: The above three requirements for directors, representatives and relevant professionals are not mutually exclusive. Because the same two people (3 retail investors) can meet these three requirements at the same time as long as they have the necessary experience and quality.

2. Requirements for investors and asset management

A/I LFMC can only serve qualified investors, but there is no limit on the number of investors and the maximum size of assets under management. If the total amount of assets under management reaches SGD 1 billion, an independent company needs to be established in Singapore and a dedicated compliance department.

3. Risk capital management

Financial resources must be at least 120% of operational risk requirements.

< h3>

4. Minimum compliance arrangementsWhen assets under management (AUM) are less than S$1 billion or A/I LFMCs are only conducting research and consultancy, adopt the same The same standards for RFMC; when the AUM is S$1 billion or above, the standards for A/I LFMCs and Retail LFMCs are the same.

5. Risk management structure

Must comply with the principles set out in the "Risk Management Practice Guidelines" and at least cover:

① Management, independence and competent risk management functions;

②Identification and measurement related to client assets Risks;

③ Timely monitoring and reporting management;

④ Record risk management policies, procedures and reports.

6. Audit requirements

① Quarterly report (unaudited, submitted within 14 days);

② Annual report (audited , submitted within 5 months).

7. Professional Indemnity Insurance

It is not mandatory but highly encouraged and such arrangements, or lack thereof, should be disclosed to all clients.

8. Letter of Responsibility

If applicable, the Monetary Authority of Singapore may require that such letters be procured from the parent company of the licensed fund management company.

9. Information disclosure

Ensure sufficient disclosure to clients of the assets or accounts under its management, including at least investment strategies, valuation policies, leverage, Custodians, trustees, administrators, auditors, conditions for closing accounts, etc.

10. Anti-money laundering requirements

Comply with anti-money laundering requirements to identify, assess, and address money laundering and terrorist financing risks.

11. Notification/Application for Permission

For specific transactions and changes in your own circumstances (such as the appointment of a new director/CEO), you need to notify MAS or Apply for permission.

12. Company annual fee

① Fixed fee;

② Starting from January 1 of the calendar year, Variable fee calculated at S$5 per representative starting from the 101st representative.

2. Exemption from licensing

For those who manage cryptocurrency funds, Singapore has some special requirements Rules allow them to do so without applying for official permission if certain conditions are met. In short, if the funds they manage do not involve specific security token products (which are governed bytheSecurities and Futures (Licensing and Carrying on) Regulations A range of products and services, introduced at the beginning of the article), and their investors are all “qualified investors” with certain qualifications, they can enjoy this special exemption.

The concept of security token products is a bit broad, including products other than mainstream cryptocurrencies like Bitcoin and Ethereum. For example, if a non-fungible token (NFT) represents a certain type of share, or has the characteristics of a security, it may be considered a security token product. Therefore, for cryptocurrency derivatives and certain special NFTs, we need to judge based on their specific properties.

The term "accredited investor" includes professional investors and institutional investors alike, and if a cryptocurrency fund is open only to such investors, it will be subject to less regulation. This means thatcryptocurrency funds designed specifically for experienced investors can operate more freely.

Even though these fund managers do not need to hold specific licenses under the Securities and Futures Act (SFA), they are still considered financial institutions and are required to comply with the requirements of the Monetary Authority of Singapore (MAS), which includes anti-money laundering and risk management requirements In particular, when investors use cryptocurrencies (rather than traditional fiat currencies) to pay for investments, fund managers need to pay special attention to the process and ensure they comply with all relevant legal obligations.

In addition, cryptocurrency fund management activities may be considered digital payment token (DPT) services that require a license under Singapore’s Payment Services Act. However, if these payments are merely an ancillary or necessary part of the fund's management activities, the fund manager may be able to benefit from certain licensing exemptions. This gives cryptocurrency fund managers more flexibility to focus more on managing their funds.

3. Cryptocurrency Fund Structure

There are two mainstream ways to set up a cryptocurrency fund in Singapore. First, funds can choose not to apply for a license, invest directly in non-security cryptocurrencies, and use specific exemptions to avoid becoming a licensed manager. Secondly, the fund can also adopt a traditional private equity fund structure, created by a fund manager registered or authorized by the Monetary Authority of Singapore (MAS), and adopt the organizational form of a Singapore Variable Capital Company (VCC). In practice, since institutional investors usually have higher requirements for supervision and compliance, the credibility of the license is of course higher.

For more information about the establishment form, regulatory framework and fund manager qualifications of private equity funds in Singapore, please pay attention to our next issue.

Joy

Joy