Author: Jsquare Research

Since the creation of the Bitcoin genesis block in 2009, the cryptocurrency funding ecosystem has evolved rapidly. As blockchain projects explore new ways to raise capital, a variety of token issuance mechanisms have emerged, each shaped by market conditions, technological advances, and regulatory adaptations.

From ICO to STO: A Timeline of Token Issuance Mechanisms

Initial Coin Offerings (ICOs)

The first wave was the initial coin offering (ICO), which exploded between 2016 and 2018. One of the earliest and most successful examples was Ethereum, which raised approximately $18 million in a public sale at $0.35 per ETH in 2014. ICOs peaked in 2018, raising more than $6 billion in total. However, investor protection is weak, the fraud rate is over 80%, and only about 44% of ICO projects remain active three months after issuance.

Source: https://icobench.com/stats/ico-statistics/

Initial Exchange Offering (IEO)

In response to the chaos of ICOs, Initial Exchange Offerings (IEOs) emerged around 2019, introducing a more standardized structure through centralized exchanges such as Binance Launchpad. These platforms conduct token audits and compliance checks, which have increased project survival rates to around 70-80% and significantly reduced scam rates to around 5-10%. However, listing fees, KYC requirements, and centralized control present limitations.

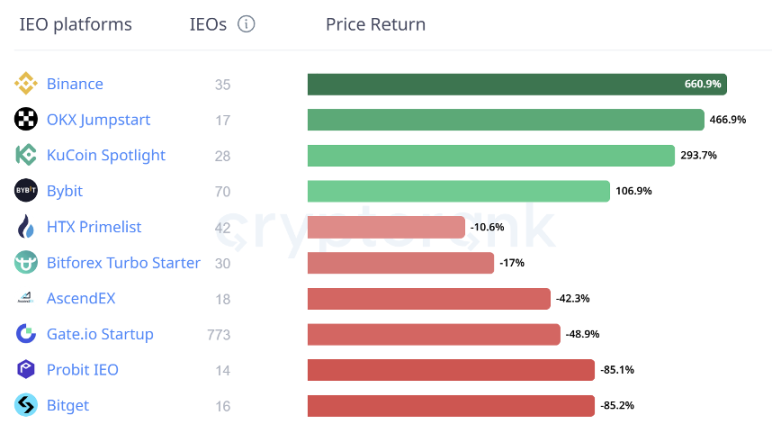

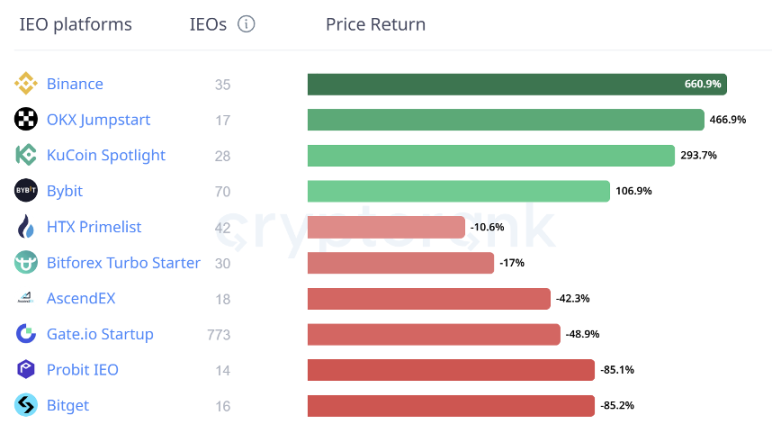

The following is an analysis of the average return on investment (ROI) of IEO projects since issuance by exchange from 2009 to 2025:

Source: https://cryptorank.io/ieo-platforms-roi

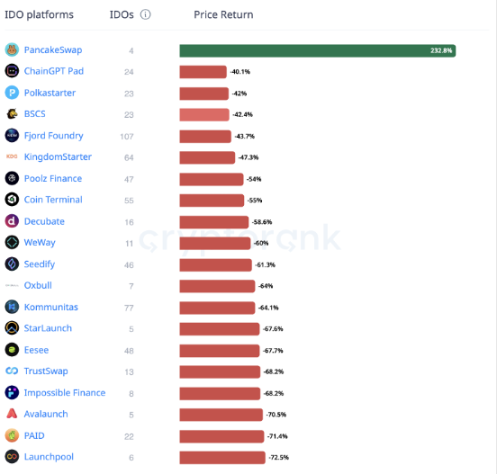

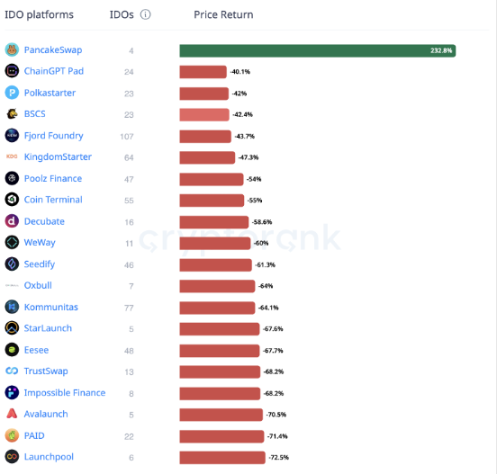

The following is an analysis of the average return on investment (ROI) of IDO projects since their issuance:

Source: https://cryptorank.io/ido-platforms-roi

Platforms that promote IDO

IEO vs. IDO: A Collision of Two Worlds

IEO and IDO offer projects very different financing pathways, each with its own unique advantages and challenges. IEOs provide a structured environment through exchange oversight, boosting investor confidence, but at a higher cost and with limited participation. Exchange due diligence leads to more efficient pricing and reduced investment risk. In contrast, the lack of formal regulation and large number of IDOs leads to less efficient markets and increased volatility.

The Road Ahead: Hybrid Issuance Models and Regulatory Shift

Issuance mechanisms are not just technical tools, they shape capital allocation, investor engagement, and narrative formation. The future lies in hybrid models that combine on-chain liquidity and off-chain regulatory compliance.

New platforms like Hyperliquid use Dutch auction mechanisms to achieve price discovery while remaining structured. Pump.fun simplifies memecoin issuance, riding the wave of virality, but with market saturation risks. Both models reflect the market’s thirst for experimentation.

Meanwhile, policies in the US and EU are creating clearer frameworks for token issuance. In the US, the upcoming stablecoin framework and broader regulatory clarity under the Trump administration could impact the compliance of IDO platforms. In the EU, MiCA (Markets in Crypto-Assets Regulation) sets a precedent for crypto-asset licensing, potentially pushing projects toward regulation-friendly structures.

Conclusion: Efficiency, Compliance, and Community

In 2025, IDOs are likely to remain the preferred choice for small, community-driven issuances, while IEOs and STOs will serve more institutional projects. What we are witnessing is not a competition of funding forms, but an evolution toward issuance strategies that balance accessibility, compliance, and investor protection. As platforms mature and regulation solidifies, hybrid issuance frameworks will define the next era of crypto capital formation.

Weiliang

Weiliang