Author: JAY JO & YOON LEE; Compiler: TechFlow

Key Points

Bitcoin ETF approval surges in job postings: After the U.S. Securities and Exchange Commission (SEC) approved the Bitcoin ETF in January 2024, the number of global Web3 job postings rose sharply, up about 20% year-on-year in the first half of 2024.

Increase in Asian job postings: Job postings in Asia have risen, further narrowing the gap with Europe. Singapore, India, and Hong Kong are particularly active in recruitment activities.

Mainnet job postings in Asia: Although mainnet job postings in Asia have decreased since 2023, more and more global mainnets are expanding their recruitment in the region, highlighting Asia's growing importance in the Web3 field.

1. Introduction

A company's job openings reflect 1) the execution of the company's strategy and 2) the needs of a specific industry, which can be used to predict future market activity. In this report, we analyze the trends of global Web3 job openings to provide an overall insight into the Web3 market. This section of the report focuses on the status of Web3 job openings in the first half of 2024. The data mainly comes from Web3Jobs, a website that provides job listings in the Web3 field.

2. Trends in global Web3 job openings in the first half of 2024

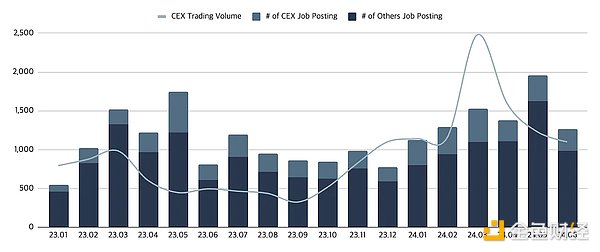

Global Web3 job openings in the first half of 2024, source: Web3Jobs, Tiger Research

2.1. Changes in job openings since the approval of Bitcoin ETF

After the U.S. Securities and Exchange Commission (SEC) approved the Bitcoin spot ETF in January 2024, job openings in the global Web3 market began to increase significantly. As expectations for market recovery rise, recruitment activities have become relatively active. In the first half of 2024, the number of job openings increased by about 20% year-on-year, reflecting a significant increase in overall industry expectations compared to last year.

However, the current level of job openings is still lower than the peak in 2021/2022. This is mainly due to multiple factors such as market environment and technological innovation. First, the approval of the Bitcoin ETF has a greater impact on the crypto trading and investment sector than on the broader Web3 ecosystem. The increase in job openings mainly comes from crypto ETF management companies and exchanges, rather than Web3 projects.

For example, job openings for crypto ETF management companies such as Grayscale increased to 28 in the first half of 2024, a four-fold increase from 7 in the first half of the year. Although job openings for crypto exchanges also increased, the change was not significant as these companies maintained stable demand.

Second, the recent market recovery was driven by speculation, not technological innovation. The market is currently more inclined towards speculative trading like meme coins than new technological trends. As we mentioned in our previous report, multiple meme coin projects with a market value of over $1 billion have emerged and attracted market attention. This trend shows that there is a lack of innovative progress to drive the industry forward. Given this short-term speculative trading culture, the actual adoption demand in the Web3 industry is relatively limited.

2.2. June marks a return to a downward trend in job postings

Since June 2024, we have observed a sharp decline in the number of job postings in the Web3 industry. This can be interpreted from two perspectives.

First, the market environment may have deteriorated. Due to the pressure on the sale of Bitcoin by Mt. Gox and the German government, the decline in cryptocurrency prices, coupled with the subsequent decrease in trading volume, may have suppressed market sentiment.

Second, this may also be a seasonal factor. Many companies usually temporarily suspend recruitment activities in June during the summer vacation season.

Therefore, the decline in job postings may be caused by a combination of an overall industry downturn and seasonal factors. We need to pay close attention to future job posting trends to analyze this situation more accurately.

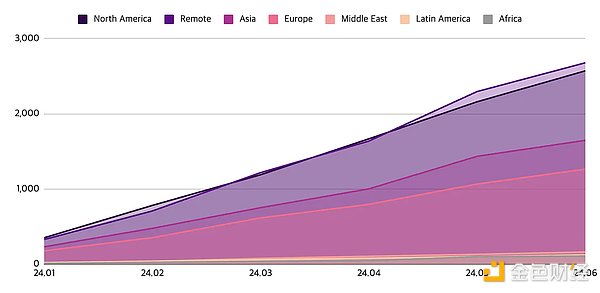

3. Web3 job openings by continent in the first half of 2024 (accumulated monthly)

Web3 job openings accumulated by continent in the first half of 2024, source: Web3Jobs, Tiger Research

Analyzing the job opening trends of the Web3 industry by region in the first half of 2024, the ranking of job openings is as follows: 1) remote work, 2) North America, 3) Asia, 4) Europe, 5) Middle East. It is worth noting that remote job openings are beginning to exceed those in North America. This change shows that remote work is rapidly gaining popularity in the Web3 industry, reflecting its location-independent nature and indicating that work arrangements are becoming increasingly flexible.

Another notable change is the widening gap in the number of job postings between the Asian and European markets. Starting in the first half of 2023, Asia began to surpass Europe, and the gap continued to widen in the first half of 2024. As of the first half of 2024, Asia accounted for approximately 20% of the total job postings, while Europe accounted for approximately 15%. This trend clearly shows that interest and activity in the Web3 industry is shifting towards Asia.

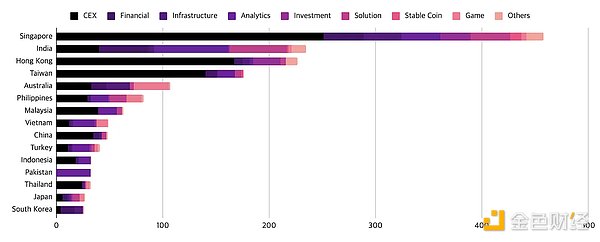

4. Web3 recruitment positions in Asia by industry in the first half of 2024

Web3 recruitment positions in Asia by industry in the first half of 2024, source: Web3Jobs, Tiger Research

As of the first half of 2024, Web3 recruitment positions in the Asian market are most active in the following regions: 1) Singapore, 2) India, 3) Hong Kong.

Singapore is still the region with the largest number of recruits, an increase of about 23% compared with the second half of 2023. This growth was aided by Singapore’s clear regulatory framework and crypto-friendly business environment, making it an attractive market.

Hong Kong opened its Web3 market in June 2023, and initially saw an increase in hiring as more Web3 companies entered the market. Many companies prepared to do business in Hong Kong by obtaining crypto licenses. However, the situation began to reverse when the Hong Kong Securities and Futures Commission (SFC) imposed a ban on mainland services for license applicants. In response, global exchanges such as Binance, OKX, and HTX withdrew their license applications, resulting in a decline in overall hiring. As a result, hiring in the Hong Kong market fell nearly 40% from the first half of the year, slipping to third place after India.

5. Web3 job postings in Asia by industry in the first half of 2024

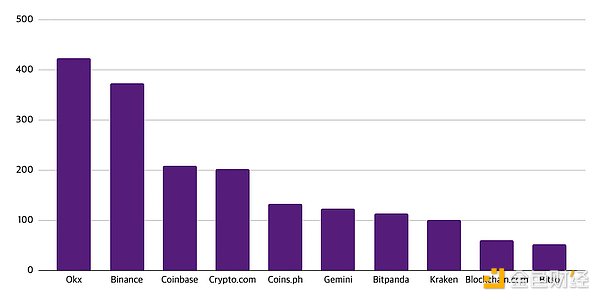

In the first half of 2024, the number of job postings in cryptocurrency exchanges increased by about 45.6% compared with the second half of 2023. This increase may be due to the rise in Bitcoin prices and the significant increase in cryptocurrency trading volume, which has enhanced the profitability of the industry.

The recruitment trends of most crypto exchanges in 2023 remained consistent, with the main exchanges being 1) OKX and 2) Binance. Previously, Binance had been more active in hiring, but this trend changed after the U.S. Attorney's Office filed charges against it in June 2023. In addition, Binance's failed attempts to obtain licenses in several countries, such as Abu Dhabi and the Netherlands, may also have led to a slight decline in its global hiring activities.

Interestingly, while OKX's hiring level was similar to the second half of last year, Coinbase's hiring increased significantly, from 39 in the second half of last year to 209 in the first half of this year. This surge may be related to the approval of the Bitcoin ETF by the U.S. Securities and Exchange Commission (SEC). According to previous reports by Kaiko, the approval of the Bitcoin ETF has led to an increase in trading volume and liquidity on regulated exchanges in the United States. Coinbase seems to have benefited from this, resulting in a significant increase in recruitment positions.

6. Trends in mainnet recruitment positions in the first half of 2024

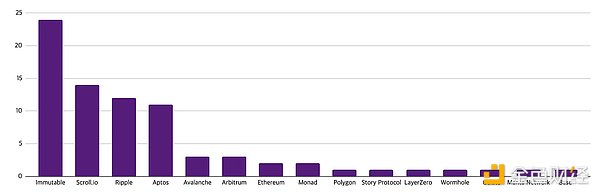

Web3 recruitment positions in Asia by mainnet in the first half of 2024, source: Web3Jobs, Tiger Research

In the first half of 2024, the number of mainnet recruitments in Asia decreased slightly compared with the second half of last year. However, it is worth noting that more mainnets have increased their recruitment activities in Asia compared with last year, with Scroll.io targeting the region for 14 of its 20 recruitment positions in the first half of 2024.

Immutable, an Australian-based Web3 gaming mainnet, has the highest absolute number of recruits in Asia. Other major non-Asian mainnets such as Ripple, Aptos, and Avalanche also continue to show recruitment needs in Asia. Although the absolute number of recruits is not high, it is clear that mainnet participants recognize the business opportunities and potential of the Asian market.

7. Other notable recruitment trends

Source: Story Protocol

In the first half of 2024, several notable recruitment trends emerged. Story Protocol has attracted a lot of attention by announcing plans to launch a Layer 1 blockchain for the tokenization of intellectual property. They began actively recruiting at the beginning of the year, making 16 hires in total.

While Story Protocol is based in the United States, recent news indicates that they are also hiring a head of Korean operations. This indicates that Story Protocol plans to expand into the Korean market.

Source: Mocaverse

Animoca Brands is also hiring like crazy. After hiring only four people in the second half of 2023, they increased to nearly 40 people in the first half of 2024. Animoca Brands is hiring for multiple projects, including NFT project Mocaverse and Web3 chess game Anichess, and is also actively hiring for its investment business.

8. Conclusion

In the first half of 2024, the number of job postings in the Web3 market increased compared to the same period last year, but it is still lower than the hiring levels in 2021 and 2022. As the industry develops and the market grows, it is a natural trend for job postings to increase. However, despite the large scale of growth in the Web3 industry, the number of job postings has not met industry expectations.

This discrepancy is partly due to the Web3 industry's preference for short-term consumer trends, such as meme coin trading and airdrop activities, rather than cultivating a sustainable ecosystem. In order to achieve sustainable growth, the industry needs a fundamental shift in discussion and the emergence of new technology trends. If this change fails to occur in the second half of 2024, the risk of stagnant industry growth will increase.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Brian

Brian Alex

Alex JinseFinance

JinseFinance Hui Xin

Hui Xin Hui Xin

Hui Xin Davin

Davin Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph